The Blue Cash Preferred® Card from American Express and the Chase Sapphire Preferred Card are two of the most popular credit cards in the United States, and for good reason. Both cards offer excellent rewards programs, but they have different strengths and weaknesses.

In this comparison, we will delve into the key features, rewards, fees, and perks of both cards to help you determine which one aligns better with your spending patterns and financial goals.

General Comparison: Amex Preferred vs. Chase Preferred

If your main focus is earning cashback rewards for your day-to-day spending, especially at U.S. Supermarkets and gas stations, then the Blue Cash Preferred might be the more suitable choice.

The American Express Blue Cash Preferred is renowned for its generous cashback rewards, especially in categories like groceries and gas. On the other hand, the Chase Sapphire Preferred is celebrated for its travel benefits and versatile points system that can be transferred to various airline and hotel partners.

|

| |

|---|---|---|

Amex Blue Cash Preferred | Chase Sapphire Preferred® Card | |

Annual Fee | $95 ($0 intro for the first year). See Rates & Fees. | $95

|

Rewards | 6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

.Terms Apply. | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus | $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

0% Intro APR | 12 months on purchases and balance transfers

, then 19.24% – 29.99% Variable APR | N/A

|

Foreign Transaction Fee | 2.70%. See Rates & Fees. | $0 |

Purchase APR | 19.24% – 29.99% Variable | 21.24%–28.24% variable APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: A Side-by-Side Analysis

If your primary spending revolves around categories such as U.S. supermarkets or gas, you're likely to earn more substantial rewards with the Amex Blue Cash Preferred when compared to the Chase Sapphire Preferred Card.

Conversely, if your spending patterns are predominantly focused on travel-related purchases, not only will the Chase Sapphire Preferred Card yield more rewards, but also the access to its ultimate rewards portal can significantly amplify the travel benefits you can enjoy.

|

| |

|---|---|---|

Spend Per Category | Amex Blue Cash Preferred | Chase Sapphire Preferred® Card |

$15,000 – U.S Supermarkets | $450 | 45,000 points |

$5,000 – Restaurants

| $50 | 15,000 points |

$4,000 – Airline | $40 | 20,000 points |

$3,000 – Hotels | $30 | 15,000 points |

$4,000 – Gas | $120 | 4,000 points |

Total Cashback/Points | $690 | 99,000 points |

Estimated Redemption Value | N/A | 1 point ~ 1 – 1.5 cent |

Estimated Annual Value | $690 | $990 – $1,565 |

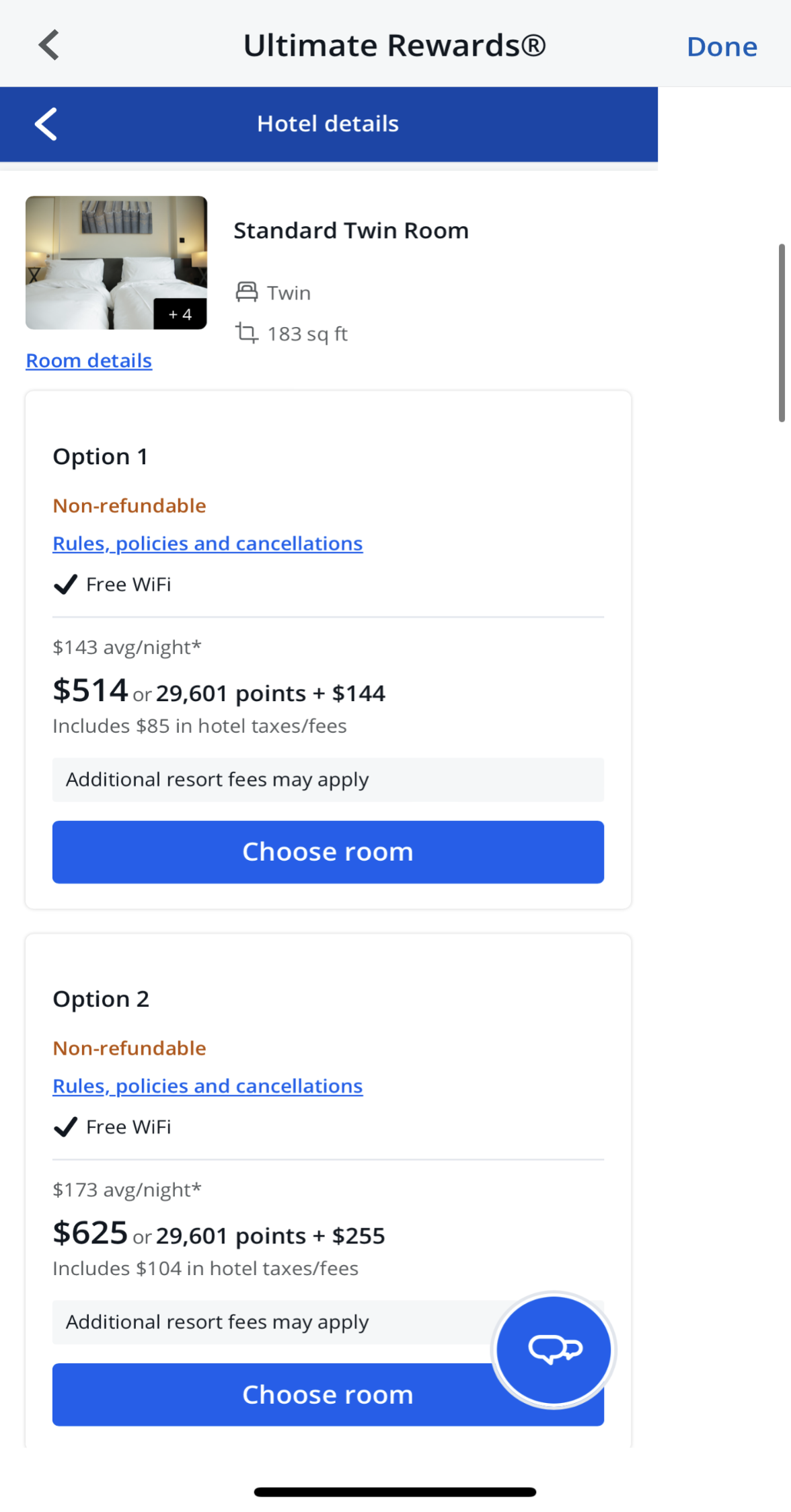

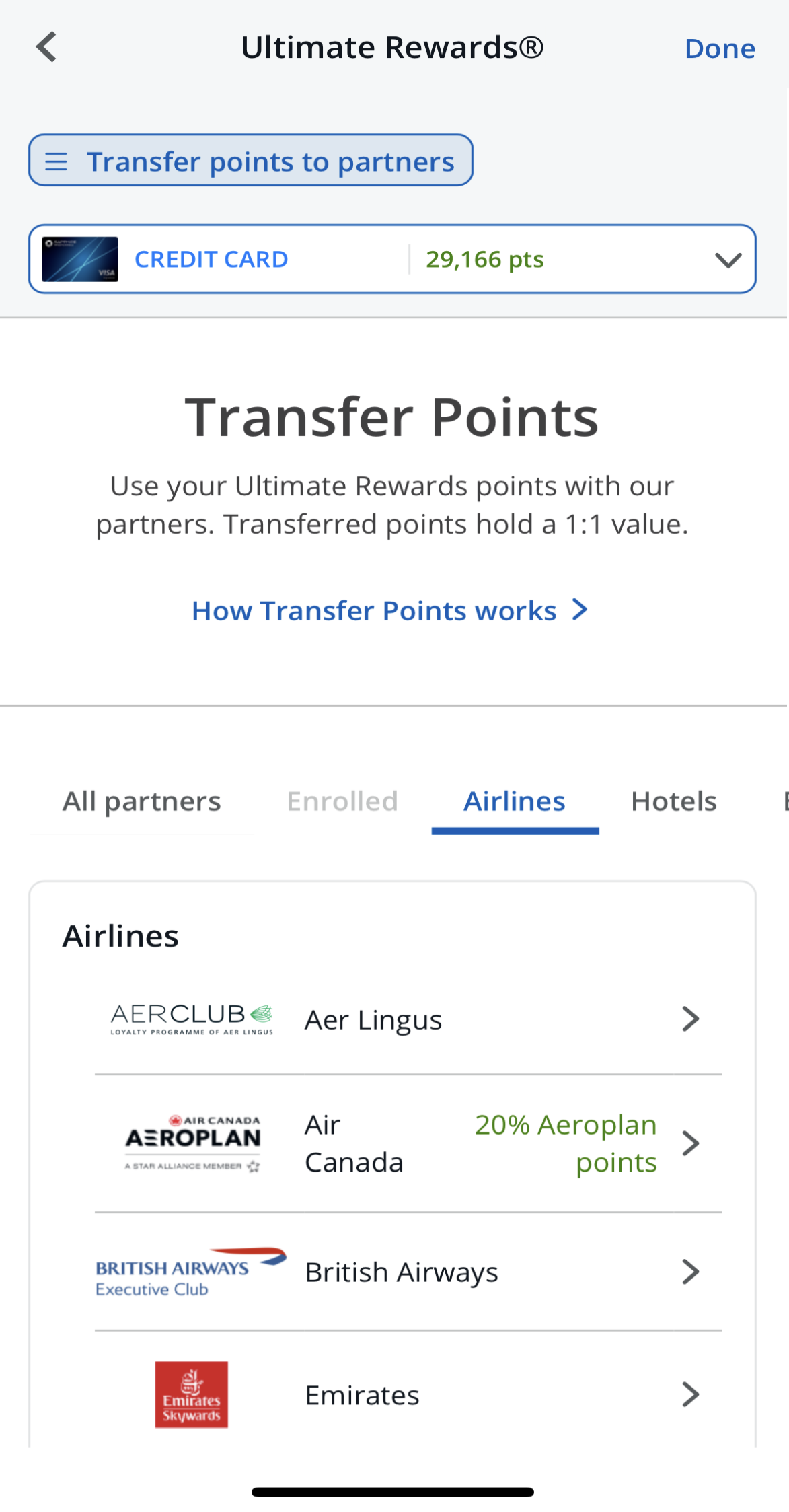

Chase Sapphire Preferred® points offer more than just cash back. Explore thrilling possibilities by booking flights, hotels, or car rentals through the Chase Ultimate Rewards portal. Additionally, consider transferring points to airline and hotel partners for added flexibility.

Beyond travel, you can opt for non-travel alternatives like redeeming points for statement credits, gift cards, or unique experiences through Chase Ultimate Rewards.

The Amex Blue Cash Preferred® Card provides versatile options for redeeming Reward Dollars to suit various preferences. Opt for straightforward Statement Credits. Alternatively, indulge in flexibility by redeeming for Gift Cards from diverse brands.

While not its primary strength, the card allows the use of Reward Dollars for certain Travel expenses, including airline tickets, hotels, and car rentals through American Express Travel, albeit with a slightly lower redemption rate than specialized travel cards.

Which Extra Benefits You'll Get With Each Card?

There are some additional types of perks that you will see with both of these cards. Both cards offer statement credits and protections. However, there are no premium benefits with any of these cards.

Amex Blue Cash Preferred

- $120 Equinox+ Credit: When you use your Blue Cash Preferred credit card to pay for your Equinox+, you’ll receive $10 a month in statement credit. Terms Apply.

- Additional Car Rental Insurance: When you use your Blue Cash Preferred card to reserve and pay for your car rental, you’ll receive additional car rental loss, damage, and theft insurance.

- Purchase Return Protection: You can enjoy return protection on eligible items with up to $300 per item and a cap of $1,000 per year. You must make your purchases with your card and negotiate with the seller first.

- Exclusive Ticket Presale Access: Via American Express Experiences, you can obtain exclusive access to card member only events and ticket presales for concerts, sporting events, shows, and family events. Terms Apply.

- $84 Disney Bundle Credit: Earn an $84 Disney Bundle Credit by receiving a monthly $7 statement credit when you use your enrolled Blue Cash Preferred® Card to make monthly subscription payments of $9.99 or more.

Chase Sapphire Preferred® Card

- $50 Anniversary Statement Credit: Every year on your card anniversary, you have the opportunity to earn up to $50 in statement credits for hotel stays made through the Chase Ultimate Rewards portal.

- %25 Travel Bonus: When you redeem your reward points for travel through the Chase Ultimate Rewards portal, you'll receive a 25% bonus, enhancing the value of your points.

- %10 Anniversary Bonus: Chase offers a 10% bonus on your total purchases from the previous year as an anniversary gift. For example, if you earned 20,000 points in the first year, you'll receive a 2,000-point bonus in the second year.

- DoorDash Perks: Upon registration, you'll receive a one-year DoorDash subscription, DashPass, which offers reduced service fees and $0 delivery fees for orders over $12.

- Lyft Rides: During the promotional period, you'll earn extra points on Lyft rides, currently available until March 2025.

- Instacart+ Subscription: Linking your card to Instacart grants you a six-month Instacart+ subscription for free. As a member, you can earn up to $15 in statement credits per quarter until July 2024.

Auto Rental Collision Damage Waiver: Offers primary coverage for theft and collision damage for most rental cars in the U.S. and abroad when you decline the rental company's insurance, with reimbursement up to the actual cash value of the vehicle.

Purchase Protection: Offers coverage for new purchases against damage or theft.

Chase Offer Better Travel Insurance And Protections

The Chase Preferred card offer better travel insurance with different types of coverage that are relevant for travelers:

- Extended Warranty Protection: Extends the U.S. manufacturer's warranty by an additional year for eligible warranties of three years or less.

- Cell Phone Protection: Pay your cell phone bill with your ard to get reimbursed up to $800 if your phone is stolen or damaged (certain terms and conditions apply).

- Baggage Delay Insurance: Reimburses essential purchases like toiletries and clothing for baggage delays over 6 hours by a passenger carrier, up to $100 a day for a maximum of 5 days.

- Trip Delay Reimbursement: Covers unreimbursed expenses, such as meals and lodging, up to $500 per ticket, if your common carrier travel is delayed more than 12 hours or requires an overnight stay.

- Travel and Emergency Assistance Services: Provides access to legal and medical referrals and other emergency assistance services when encountering problems away from home, though you are responsible for the costs of goods or services obtained.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Chase Sapphire Preferred?

You might prefer the Chase Sapphire Preferred card over the Amex Blue Cash Preferred in the following situations:

- You Spend More On Travel: If you frequently travel, especially internationally, and want to maximize your travel-related benefits, the Chase Sapphire Preferred is an excellent choice. It offers travel rewards and features such as transferable points to airline and hotel partners, travel insurance, and no foreign transaction fees.

- No Foreign Transaction Fees: If you frequently travel abroad, the absence of foreign transaction fees with the Chase Sapphire Preferred can save you money on international purchases.

- You Want Travel Benefits: The Chase Sapphire Preferred® Card offers a flexible rewards program with valuable travel benefits, such as a $50 annual statement credit for travel purchased through Chase Ultimate Rewards®, primary rental car insurance, and trip cancellation/interruption insurance.

When You Might Prefer the Blue Cash Preferred?

You might prefer the Amex Blue Cash Preferred card over the Chase Sapphire Preferred in the following scenarios:

- Cashback Focus: If you prefer the simplicity of cashback rewards over travel points, the Amex Blue Cash Preferred is a strong contender. It provides cashback directly to your account, making it easy to use for any expenses or savings goals.

- You Spend More On Groceries And Gas Than On Travel: If a significant portion of your monthly expenses goes toward U.S. supermarket purchases and gas, the Amex Blue Cash Preferred offers higher cashback rewards in these categories. It's an excellent choice for individuals and families who want to maximize savings on everyday essentials.

- You Need A Balance Transfer: The Blue Cash Preferred card offers a 0% intro APR on 12 months on purchases and balance transfers , then 19.24% – 29.99% Variable APR, something you won't get with the Chase preferred card.

Compare The Alternatives

Several other noteworthy travel cards deserve mention, and here are some of our top picks for premium travel credit cards:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Amex Blue Cash Preferred

In terms of cashback rates, the Blue Cash Preferred is a clear winner. But is it still apply if you're a high spender?

Here's our analysis: Amex Blue Cash Preferred vs Chase Freedom Unlimited

Cash back or Amex membership rewards? Annual fee with higher rewards or no annual fee? Here's our full analysis – which is better for you?

Amex Everyday® Card vs Blue Cash Preferred® Card from American Express

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

Amex Blue Cash Preferred vs. Amex Gold: Which One Gives You More?

The Citi Custom cash offers high cashback on your preferred category, but it's very limited in rewards compared to the Blue Cash Preferred.

If you can maximize supermarket benefits, the Amex Blue Cash Preferred may be more suitable than the Everyday card despite the annual fee.

American Express Blue Cash Everyday vs. Preferred: Side By Side Comparison

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison