Table Of Content

LendingClub, a renowned online lending platform, offers not only loan services but also an opportunity to open a savings account. This article serves as a concise guide, outlining the simple steps involved in opening a savings account with LendingClub.

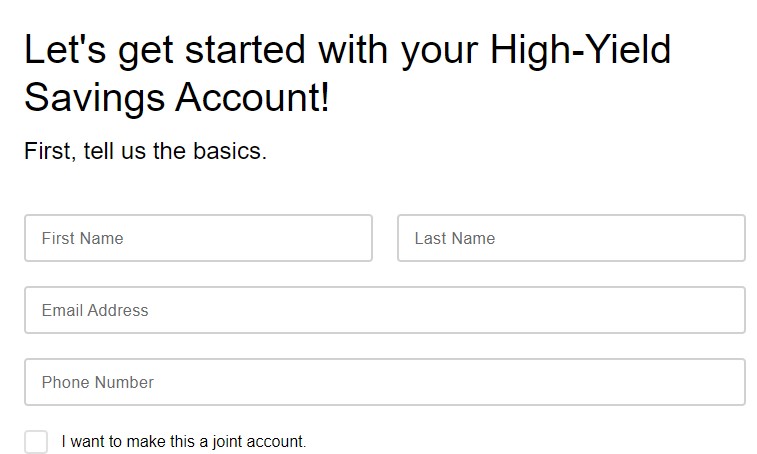

1. Start Application And Fill Basic Personal Details

Start your application on LendingClub website. The first thing you'll need to do is to share some basic personal information about you and the account you would like to open.

This step involves providing LendingClub with the basic information required to initiate the process of opening a High-Yield Savings Account. The information includes:

Full Name: Your legal first and last name is used for identification purposes.

Email Address: Your valid email address serves as a means of communication and account verification.

Phone Number: Your active phone number is used for account-related communication and security purposes.

Additionally, there is an option to indicate whether you want to make the savings account a joint account. A joint account allows you to share ownership and access to the account with another person, typically a spouse, partner, or family member.

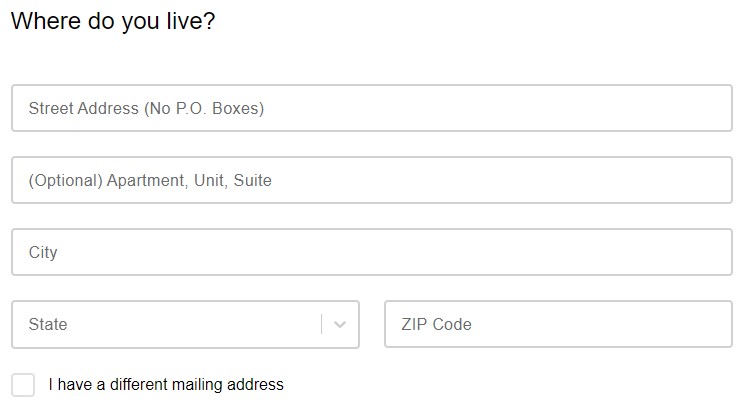

2. Fill Contact Information

The step is a request for your residential address information. It requires you to provide your complete physical address, excluding P.O. Boxes, for the purpose of verifying your identity and ensuring accurate communication.

Suppose you have a different mailing address than your residential address. In that case, you should provide that information separately, as it may be used for sending important documents or correspondence related to your savings account.

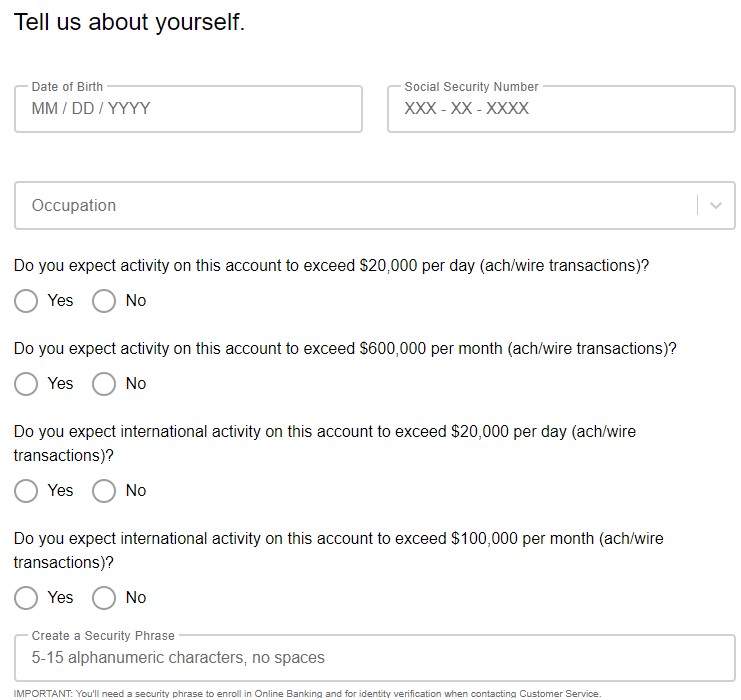

3. Verify Details And Answer General Questions

In this step, you will provide certain personal information and answer specific questions related to your account activity. Here's an explanation of each item:

Social Security Number: LendingClub requires your SSN as part of their identity verification process.

Occupation: LendingClub asks for your occupation to gather information about your employment status. This helps them understand your financial background and tailor their services accordingly.

Activity exceeding $20,000 per day: LendingClub inquires whether you expect any single-day activity on your account to exceed $20,000 through ACH or wire transactions. This information helps them understand the potential transaction volume and enables them to monitor and prevent any unusual or suspicious activity.

Activity exceeding $600,000 per month: LendingClub asks if you anticipate monthly account activity to exceed $600,000 through ACH or wire transactions.

International activity exceeding $20,000 per day: LendingClub wants to know if you expect any international transactions through ACH or wire transfers to exceed $20,000 in a single day.

International activity exceeding $100,000 per month: This question pertains to your anticipated monthly international transaction volume.

Create a Security Phrase: This step involves creating a unique security phrase or password for your LendingClub account. This phrase acts as an additional layer of security, ensuring that only you can access and manage your account.

4. Taxpayer Certification And E-Sign Consent

When you come across the “Taxpayer Certification” step while opening a savings account with LendingClub, it's essential to understand its significance. By checking the box, you are personally certifying the following points:

- The taxpayer identification number you provided is correct.

- You are not subject to backup withholding.

- You are a U.S. citizen or a U.S. person.

Remember, if you are subject to backup withholding, you won't be able to open a LendingClub Bank account through online account origination.

Moving on to the “E-Sign Consent” step, this is where you give your consent to receive electronic communications and disclosures regarding your accounts and services.

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

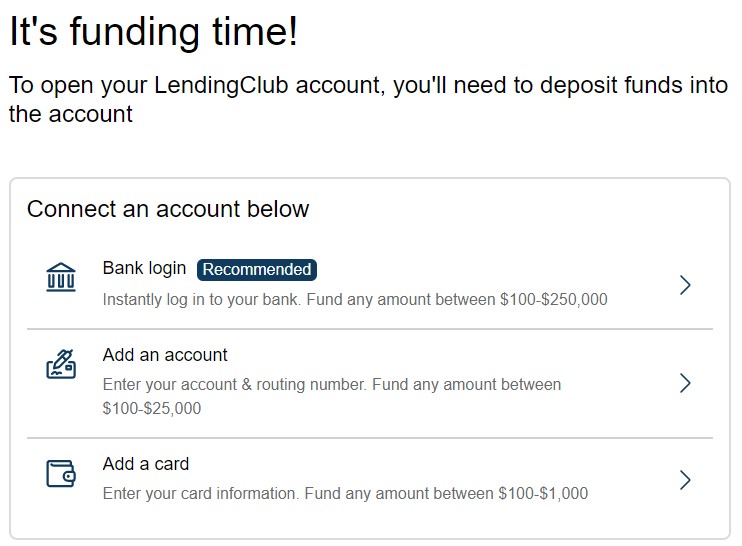

5. Funding Time

Now it's time to fund your new LendingClub account, and you have different options to choose from. You'll need to deposit at least $100, a bit higher than other banks' minimum deposit. Here are the three options available:

Bank Login: This option allows you to instantly log in to your bank account through LendingClub's secure system. This method offers convenience and speed, as the funds will be transferred directly from your bank account to your LendingClub account.

Add a Bank Account: With this option, you manually enter your bank account and routing number into LendingClub's platform. While this method requires you to input the account details manually, it still provides a straightforward way to transfer funds from your bank account to your LendingClub account.

Add a Credit Card: If you prefer to use a credit or debit card to fund your LendingClub account, you can choose the “Add a Card” option. Simply enter your card information securely, and you'll be able to fund your account with any amount between $100 and $1,000, a lower amount compared to other options.

Remember, each option provides flexibility in terms of the amount you can fund, allowing you to choose the option that best suits your needs and preferences.

6. Review Agreement And Submit Application

The “Review Agreement and Submit Application” step is the final stage in the process of opening a LendingClub account. At this point, you will be presented with the agreement that outlines the terms and conditions of your account.

Overall, Lending Club doesn't charge a fee on savings accounts and other activities, but it is crucial to carefully review this agreement to understand the rights and responsibilities associated with your LendingClub account.

Once you have thoroughly reviewed the agreement and are comfortable with its terms, you can proceed with submitting your application. By doing so, you are formally expressing your intention to open a LendingClub account and agreeing to abide by the terms set forth in the agreement.

It's important to note that submitting the application does not guarantee immediate approval. LendingClub will review your application and may conduct additional verification processes to ensure compliance with their policies and regulatory requirements.

Does LendingClub Offer Competitive Savings Rates?

LendingClub aims to offer competitive interest rates to investors, allowing investors to earn attractive returns. Here's a comparison of some of the highest savings accounts:

Bank/Institution | Savings APY |

|---|---|

American Express | 4.25% |

Capital One | 4.25% |

Upgrade | 5.21% |

Marcus | 4.40% |

Discover Bank |

4.25%

|

Lending Club | 5.00% |

Quontic | 4.50% |

Axos Bank | Up to 5.25% |

Alliant Credit Union | 3.06% – 3.10% |

Ally Bank | 4.20% |

SoFi | up to 4.60% |

FAQs

Can I open the savings account and fund it later?

To complete the account opening process, a minimum opening deposit of $100 is required. However, you can add additional funds to your account later by signing into Online Banking and setting up a funds transfer.

Does LendingClub perform a credit check?

LendingClub does not pull credit during the account opening process. However, they do obtain information from a credit bureau to validate your personal details. This request for information does not impact your credit score.

Can I apply over the phone?

Currently, LendingClub only accepts online applications. Phone applications are not available at this time. This is also relevant for the LendingClub checking account.

How long does it take for my funds to become available for use?

During the account setup process, you will initially see a $0 balance. However, you can enroll in Online Banking and download the LendingClub mobile app. Once your initial deposit is reflected in your account, it takes approximately 3-5 business days to verify the availability of the deposited funds, and then you can start using your account.

How can I add more funds to my account after opening?

After opening your account, you have multiple options to add funds. Using Online Banking or the LendingClub mobile app, you can initiate one-time or recurring transfers (direct ACH) or set up another Plaid-like connection. Additionally, you can work with your external financial institution to initiate a wire transfer into your LendingClub Bank account.

Can I deposit cash into my savings account?

You can deposit cash at any MoneyPass Deposit Taking ATMs.