Table Of Content

This article will guide you through the simple and straightforward process of opening an Amex savings account. Discover the key steps and requirements to embark on your journey toward a rewarding banking relationship with American Express.

1. Prepare Documents

When opening an Amex savings account, American Express will ask for certain information to comply with legal requirements and ensure the security of your account. The information they request includes:

Taxpayer Identification Number (TIN): Amex obtains a correct TIN for each account. This can be your Social Security Number (SSN) if eligible, issued by the Social Security Administration. Alternatively, if you are not eligible for an SSN, you would need to provide your Individual Taxpayer Identification Number (ITIN).

- Employment Information: When opening an Amex savings account, you will need to provide employment information, which consists of details such as your employer's name, your job title or position, the duration of your employment, your income from employment (annual or monthly), the industry in which your employer operates, and the business address of your employer's location. Additionally, you will be asked for contact information related to your employer, including their phone number or email address.

Personal Details: full name, birth date, address email address are also required. Amex requires your email address to communicate updates on your application status, as well as important account updates and exclusive offers.

By gathering this information, Amex fulfills legal obligations, ensures compliance with regulatory standards, and provides essential communication channels to enhance the security and functionality of your bank account.

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

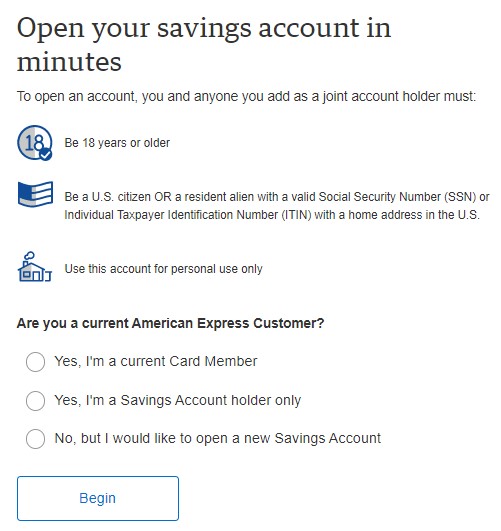

2. Apply On Amex Website

Find the “Apply Now” button: Go to the Home page or the High Yield Savings Account (HYSA) page and look for the “Apply Now” button. Click on it to begin the account opening process.

During the application process, you will be asked if you want to open a joint account. If you choose this option, it means you want to share ownership of the account with another person. It's important to note that once the account is opened, this selection cannot be changed.

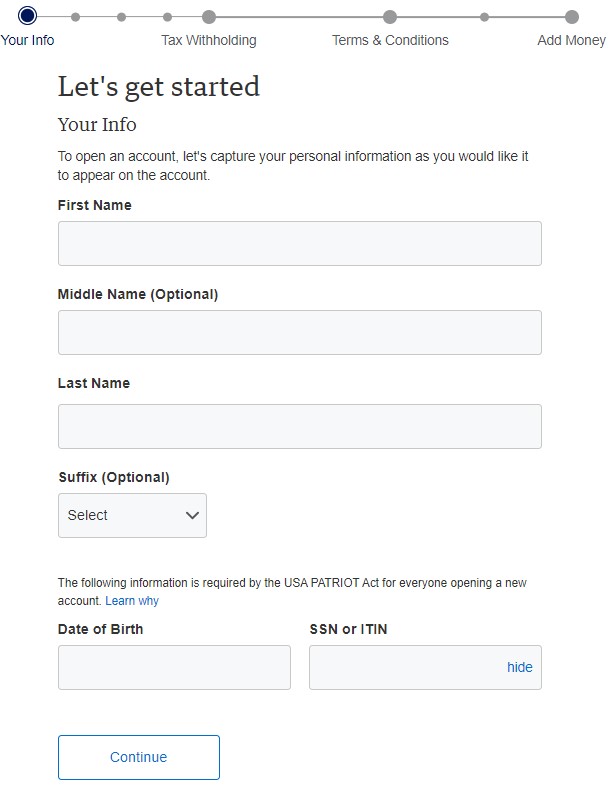

3. Add Personal Details

This section will require you to provide your personal information, such as your full name, date of birth, Social Security Number (or other identification number), and contact details as described above.

This step is necessary to establish your identity and set up the account in your name.

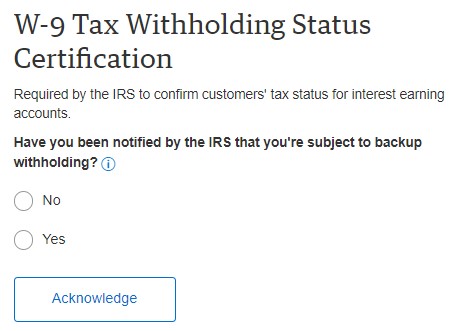

4. W-9 Tax Withholding Status Certification

During the account opening process, American Express will ask you whether you have been notified by the IRS that you are subject to backup withholding. Backup withholding is a process where the IRS requires the withholding of a portion of your interest income to fulfill your tax obligations.

If you have received a notification from the IRS stating that you are subject to backup withholding, you should indicate this during the application process. It is important to provide accurate information to comply with IRS regulations and ensure the appropriate withholding measures are taken.

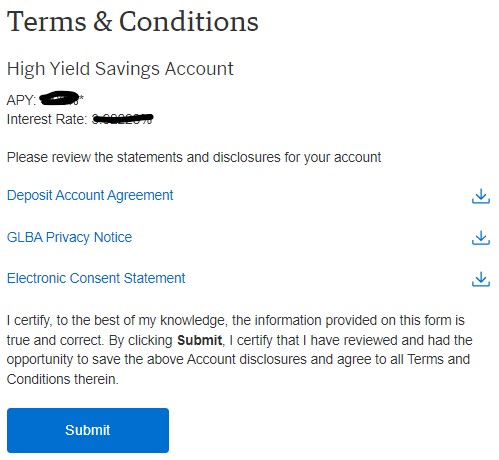

5. Review Terms And Conditions

To proceed with opening the account, you will need to review the statements and disclosures associated with your account. These typically include:

Deposit Account Agreement: This document outlines the terms and conditions, account features, fees, and other important details related to your High Yield Savings Account.

GLBA Privacy Notice: This notice explains how Amex collects, uses, and protects your personal information in accordance with the Gramm-Leach-Bliley Act (GLBA).

Electronic Consent Statement: This statement confirms your agreement to receive electronic communications, such as statements and notices, regarding your account. It may also include information on how to access and manage your account electronically.

6. Fund Your Account

To electronically fund your American Express Savings Account, you'll need to transfer money from another bank account that is in your name. During the application process, you will be asked to provide the Routing Number and Account Number of your other bank account. You can find these numbers on a check associated with that account.

Once you've entered the funding amount and successfully linked your external bank account to your new American Express Savings Account, the transfer will be processed automatically. However, it's important to note that it may take a day for the transfer to appear in your account online.

To make a deposit via paper check by mail to your American Express Savings Account, follow these steps:

Write the Check: If you have an account with another bank and want to deposit funds into your American Express Savings Account, write the check payable to “American Express National Bank.” On the memo line of the check, write your Savings account number.

Endorse the Check: If you receive a check made payable to you, endorse it on the back with your signature. Below your signature, write “For Deposit Only in Account” followed by your Savings account number.

Mail the Check: Once the check is properly filled out and endorsed, mail it to the following address:

American Express National Bank P.O. Box 30384 Salt Lake City, Utah 84130

Why Can’t I Open a Amex Savings Account

There could be several reasons why you may not be able to open an Amex bank account. Some possible reasons include:

Eligibility Requirements: Amex may have specific eligibility criteria that you need to meet in order to open an account. This could include factors such as age, residency status, or creditworthiness. If you do not meet these requirements, you may be ineligible to open an account.

Prior Account Issues: If you have had previous issues with Amex or other financial institutions, such as a history of account closures, fraudulent activity, or unpaid debts, it could impact your ability to open a new account.

Negative ChexSystems Report: ChexSystems is a consumer reporting agency that tracks banking history, including account closures, bounced checks, and unpaid fees. If you have a negative report in ChexSystems, it may affect your ability to open a new account with Amex or other banks.

Compliance and Regulatory Requirements: Financial institutions, including Amex, are subject to various compliance and regulatory obligations. If you are unable to fulfill the necessary identification or verification requirements, it may prevent you from opening an account.

FAQs

Can I make payments for my Amex Card bill using Amex savings?

Yes, after opening an American Express Savings account, you have the option to pay your American Express Card bill using funds from your High Yield Savings Account.

What is the timeframe for making an initial deposit?

It is required that you fund your High Yield account within 60 days after receiving approval of your application. If you fail to make the initial deposit within this timeframe, your account will be closed.

Do I need to maintain a minimum balance in the account?

Yes, accounts that maintain a balance of zero for 180 days will be closed automatically.

How can I get in touch with American Express National Bank?

You can contact American Express Savings at any time as they are available 24 hours a day, 7 days a week. To reach them, you call 1-800-446-6307.