Table Of Content

If you're looking to begin your savings journey, opening a Capital One savings account is a simple and hassle-free process.

This guide will walk you through the necessary steps, including providing personal and employment details, as well as choosing the appropriate account type and product.

By following these steps, you'll be well on your way to kickstarting your savings with Capital One.

1. Launch Your Application Process On Capital One Website

To begin the account opening process with Capital One, you'll need to access their website, as they primarily operate as an online bank, similar to Discover, Amex or CIT Bank.

Unlike traditional methods, such as in-person visits to a branch or phone calls, the entire process is conducted digitally. Capital One may contact you if they require any additional information.

To get started, simply visit the Capital One website and and get started by clicking “Open Account”

2. Add Personal Details

In this step, you will need to provide your personal information to proceed with the Capital One savings account application. The following details should be filled in:

Name: Enter your full legal name (first name and last name) as it appears on your official identification documents. Please avoid using nicknames.

Email Address: Provide the email address where you would like to receive important account-related information from Capital One.

Phone Number: Enter your mobile phone number. Capital One may use this number to send you text messages containing vital account updates and to assist with identity verification.

Residential Address: Input your home address (street address, apartment/suite number, city, state, and ZIP code). Please note that for security reasons, P.O. Box addresses cannot be accepted.

Country of Citizenship: Indicate your primary citizenship by specifying the country you hold citizenship in.

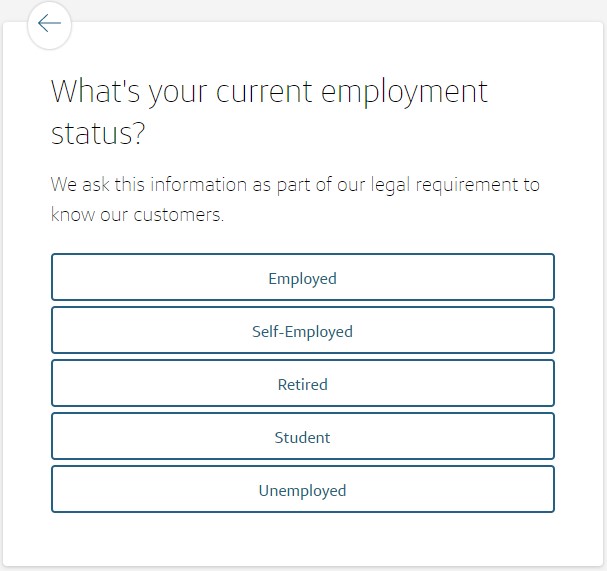

3. Add Employment Details

Due to legal requirements, Capital One asks for your employment details during the savings account application process. This information is necessary for Capital One to comply with regulations and better understand its customers. Here's a summary of the steps involved in providing your employment details:

Current Employment Status: Indicate your current employment status from the following options: Employed, Self-Employed, Retired, Student, or Unemployed. This information helps Capital One gain insight into your current professional situation.

Job Title: You'll need to clarify your job title.

Annual Income: Capital One requires information about your annual income to fulfill legal requirements and better understand your financial situation. You'll need to select the appropriate income range from the following options: No Income, $1 – $50,000, $50,000 – $100,000, $100,000 – $150,000, $150,000 – $250,000, or Over $250,000.

By providing these details, you help Capital One meet its regulatory obligations and develop a comprehensive understanding of its customers.

4. Identity Verification

This step ensures that your identity is securely confirmed to comply with regulatory requirements. Here's a summary of the identity verification process based on the provided details:

Birthday: Capital One will ask you to provide your date of birth. This information is used to verify your age and identity.

Social Security Number: You will be required to enter your Social Security Number (SSN). This is a unique identification number issued by the government and is used to confirm your identity and comply with legal regulations.

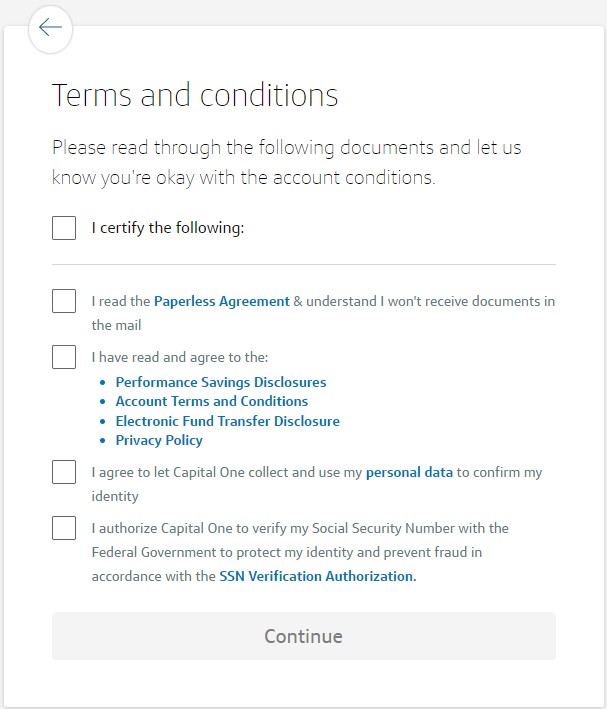

5. Terms And Conditions

Before proceeding, it's important to review and acknowledge the terms and conditions associated with opening a Capital One savings account. We have summarized the key points below in clear and everyday language for your convenience:

Paperless Agreement: By selecting this option, you acknowledge that you have read and understood the terms of the Paperless Agreement. This means you will not receive account-related documents through traditional mail and instead, they will be available to you electronically.

Performance Savings Disclosures: It is necessary to review and agree to the Performance Savings Disclosures. These documents outline important information regarding the features, benefits, and conditions of the savings account you are opening.

Account Terms and Conditions: You are required to read and accept the Account Terms and Conditions. These terms specify the rights, responsibilities, and obligations associated with maintaining a Capital One savings account.

Electronic Fund Transfer Disclosure: The Electronic Fund Transfer Disclosure explains the rules and regulations governing electronic transfers and transactions related to your savings account. By agreeing to this disclosure, you understand and accept these terms.

Privacy Policy: Capital One's Privacy Policy details how your personal information is collected, used, and protected. By agreeing to the Privacy Policy, you authorize Capital One to collect and utilize your personal data to verify your identity.

Social Security Number (SSN) Verification Authorization: To safeguard your identity and prevent fraud, you authorize Capital One to verify your Social Security Number with the Federal Government. This verification process helps ensure the security of your account and personal information.

By confirming your agreement to these terms and conditions, you demonstrate your understanding of the account conditions and provide consent for Capital One to collect and utilize your personal data as described.

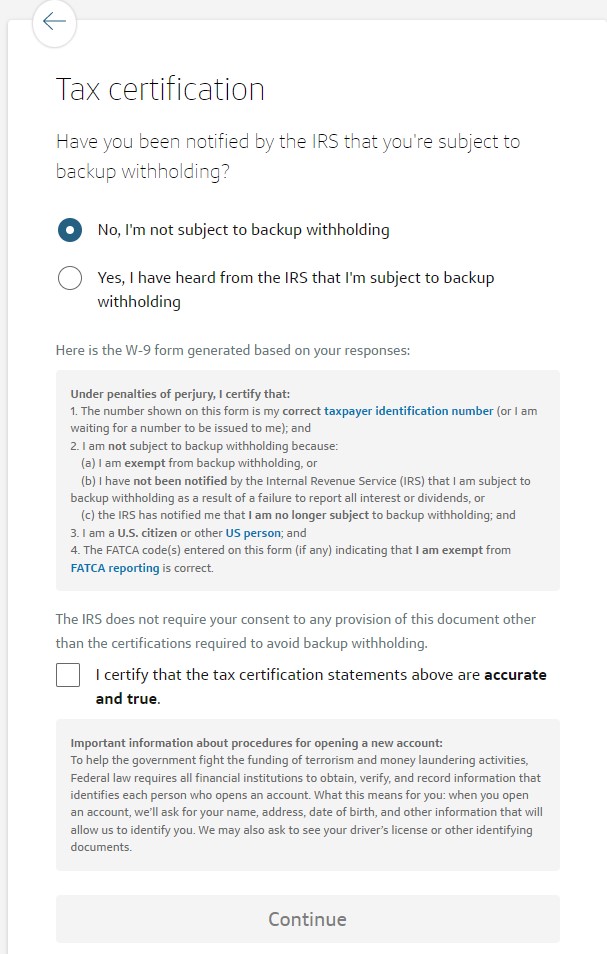

6. Complete Tax Certification

As part of the account opening process with Capital One, it is necessary to verify your tax information. This step involves confirming whether you have received any communication from the IRS regarding backup withholding.

Backup withholding is a process where a portion of your income is held back for tax purposes. Based on your response, Capital One will generate a form called W-9.

This form includes statements where you certify your taxpayer identification number, exemption from backup withholding, and U.S. citizenship. It is important to provide accurate information.

7. Make Your First Deposit

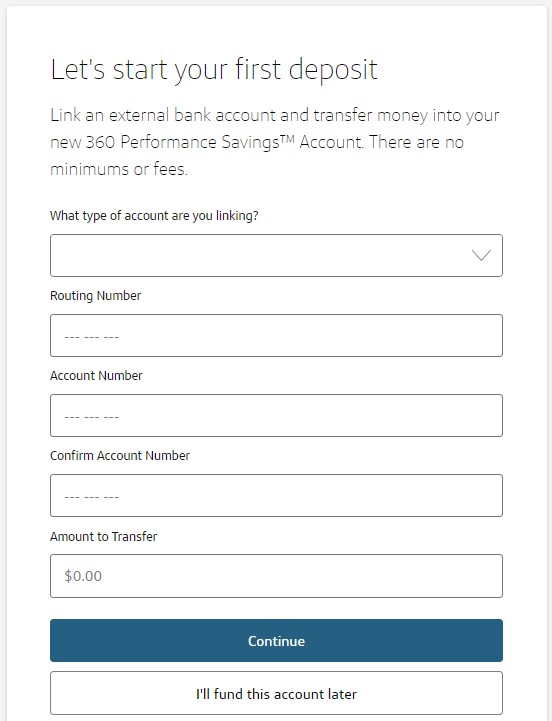

To begin depositing funds into your new 360 Performance Savings™ Account at Capital One, you will need to link an external bank account and transfer money. Here's a summary of the depositing step:

Linking an External Bank Account: You will need to provide the details of the external bank account you wish to link. This includes the account type, routing number, and account number. Please ensure that you provide accurate information.

Amount to Transfer: Specify the amount of money you wish to transfer from your linked external bank account into your new 360 Performance Savings™ Account. Capital One does not impose any minimums or fees for this transfer.

Continue: Once you have filled in the necessary information, click on the “Continue” button to proceed with the deposit.

Alternatively, if you are not ready to make a deposit at this time, you can choose the option “I'll fund this account later.”

Can I Make A Deposit In More Ways?

Yes. Capital One offers a variety of easy ways to make a deposit into your savings account. Here's a summary of the options available:

Direct Deposit: Get access to your funds up to 2 days earlier than your payday through early paycheck deposit.

Zelle®: Enroll with Zelle® to send and receive money quickly and free of charge.

ATM and Branch Deposits: Visit a nearby Capital One location to deposit money directly into your account.

Mobile Deposit: Use mobile deposit to conveniently deposit checks into your account anytime and from almost anywhere.

Money Transfer: Transfer funds between your Capital One accounts or link external accounts to your 360 Savings.

With these various options, you can choose the most convenient method to make a deposit into your Capital One account

FAQs

Is the interest rate on Capital One savings accounts competitive?

Yes. As of September 2024, Capital One 360 Performance Savings offers a highly competitive Annual Percentage Yield (APY) of 4.25%. This APY is comparable to or even surpasses the rates offered by other banks and credit unions.

Can I set savings goals within my Capital One savings account?

Capital One provides a goal-setting feature within their savings accounts. You can define savings goals, track your progress, and stay motivated as you work towards achieving your financial targets

Does Capital One offer customer support for savings accounts?

Yes, Capital One provides customer support for their savings accounts. You can reach out to their dedicated support team through phone at 1-888-464-7868.

Can I set up automatic transfers to my Capital One savings account?

Absolutely! Capital One allows you to set up automatic transfers from your linked checking account to your savings account. This feature makes it easy to regularly contribute to your savings without manual effort.

Does Capital One provide tools or resources to help me track my savings progress?

Yes, Capital One offers helpful tools and resources to assist you in tracking your savings progress. Their online banking platform provides features such as transaction history, statements, and savings goal tracking

Are there any monthly fees for a Capital One savings account?

Capital One does not charge monthly fees for their savings accounts.