The Hilton Honors American Express and the Marriott Bonvoy Bold are two popular no annual fee hotel credit cards, offering various perks and rewards within their respective hotel loyalty programs.

Each card is affiliated with a major hotel brand, providing cardholders with unique benefits. The Hilton honors card is an Amex card, while the Marriot Bold is a Chase card.

Comparison :Hilton Honors Amex vs. Marriott Bold

Both cards provide opportunities for earning points, enjoying elite status benefits, don't charge an annual fee and enhancing the overall travel experience within their respective hotel networks.

Hilton and Marriott both have extensive global footprints, so we think that choosing a card may depend on which hotel chain aligns better with the individual's travel patterns.

Here's a side-by-side comparison:

|

| |

|---|---|---|

Hilton Honors American Express | Marriott Bonvoy Bold | |

Annual Fee | $0 ( See Rates and Fees. ) | $0 |

Rewards | 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases . | 3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases. |

Welcome bonus | 70,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership | 1 Free Night Award (valued up to 50,000 points) after you spend $1,000 on purchases in your first 3 months from your account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0. ( See Rates and Fees.) | $0 |

Purchase APR | 20.99%-29.99% Variable

| 21.49%–28.49% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Hilton Amex vs. Marriot Bold: Point Rewards Comparison

In our comparison of points rewards between the two cards, the Amex Hilton card is a clear winner. It offers a significantly higher rewards ratio and earns more points in every category.

Despite each Hilton point being valued at approximately a lower redemption value than Marriot, the overall estimated redemption value is much higher according to our analysis.

|

| |

|---|---|---|

Spend Per Category | Hilton Honors Amex | Marriott Bonvoy Bold |

$10,000 – U.S Supermarkets | 50,000 points | 10,000 points |

$4,000 – Restaurants

| 20,000 points | 4,000 points |

$4,000 – Airline | 12,000 points | 8,000 points |

$5,000 – Hotels | 35,000 points | 15,000 points |

$4,000 – Gas | 20,000 points | 4,000 points |

Total Points | 137,000 points | 41,000 points |

Redemption Value (Estimated) | 1 point = ~0.6 cent | 1 point = ~0.8 cent |

Estimated Annual Value | $822 | $328 |

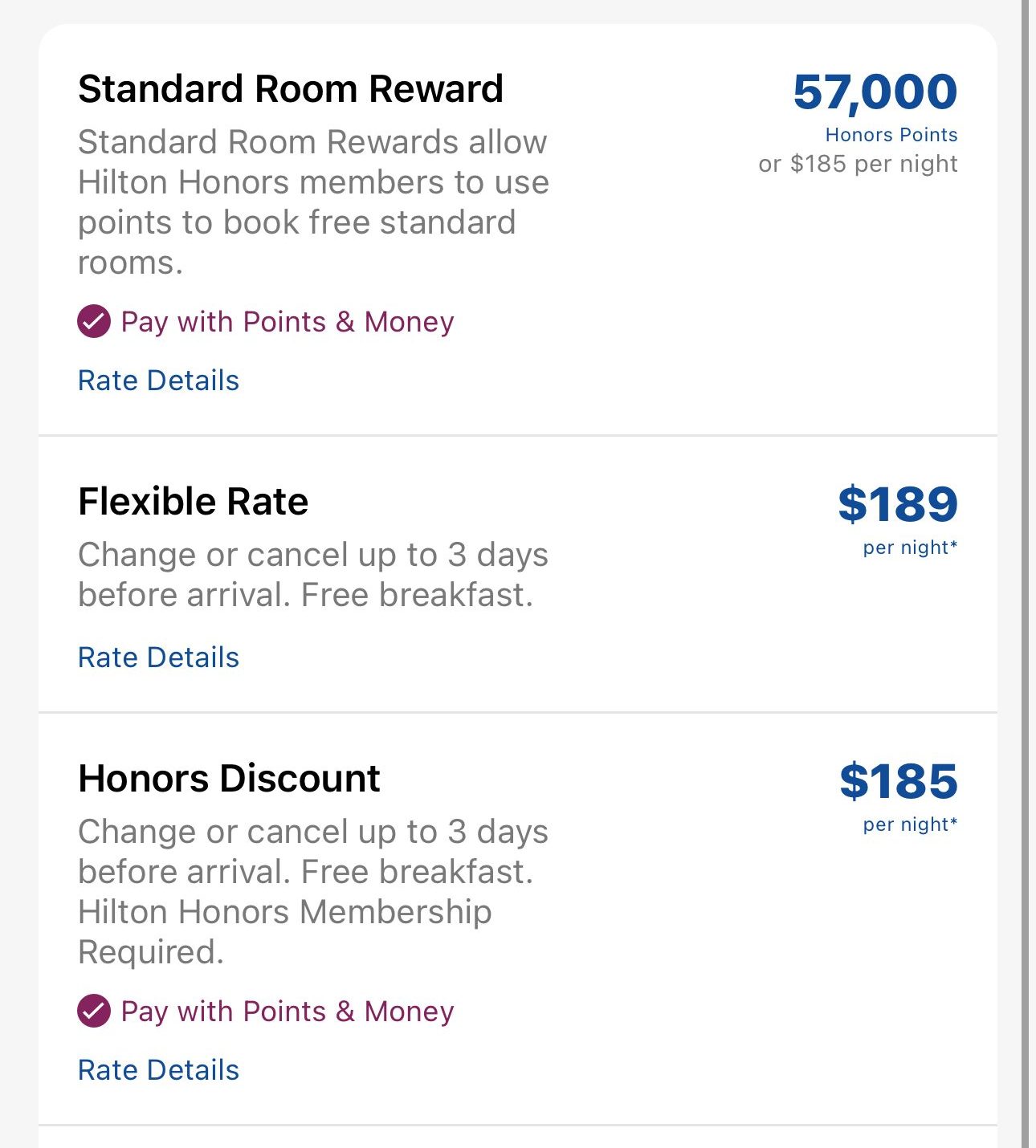

The Hilton Honors Amex credit card lets you earn points on purchases, which you can redeem for hotel stays, upgrades, and experiences. Use points for free nights at Hilton properties worldwide, or indulge in shopping, dining, and entertainment.

Marriott Bonvoy Bold Card has flexible redemption options, from budget-friendly accommodations to luxurious resorts. Cardholders can use points for room upgrades, or even transfer them to airline miles.

Which Benefits You'll Get With Each Card?

The Marriott Bonvoy Bold card stands out as the top choice for additional benefits. While both cards offer automatic Silver Elite status, the Marriot card provides superior travel protections, including lost luggage reimbursement, trip delay reimbursement, and baggage delay insurance.

Hilton Honors American Express

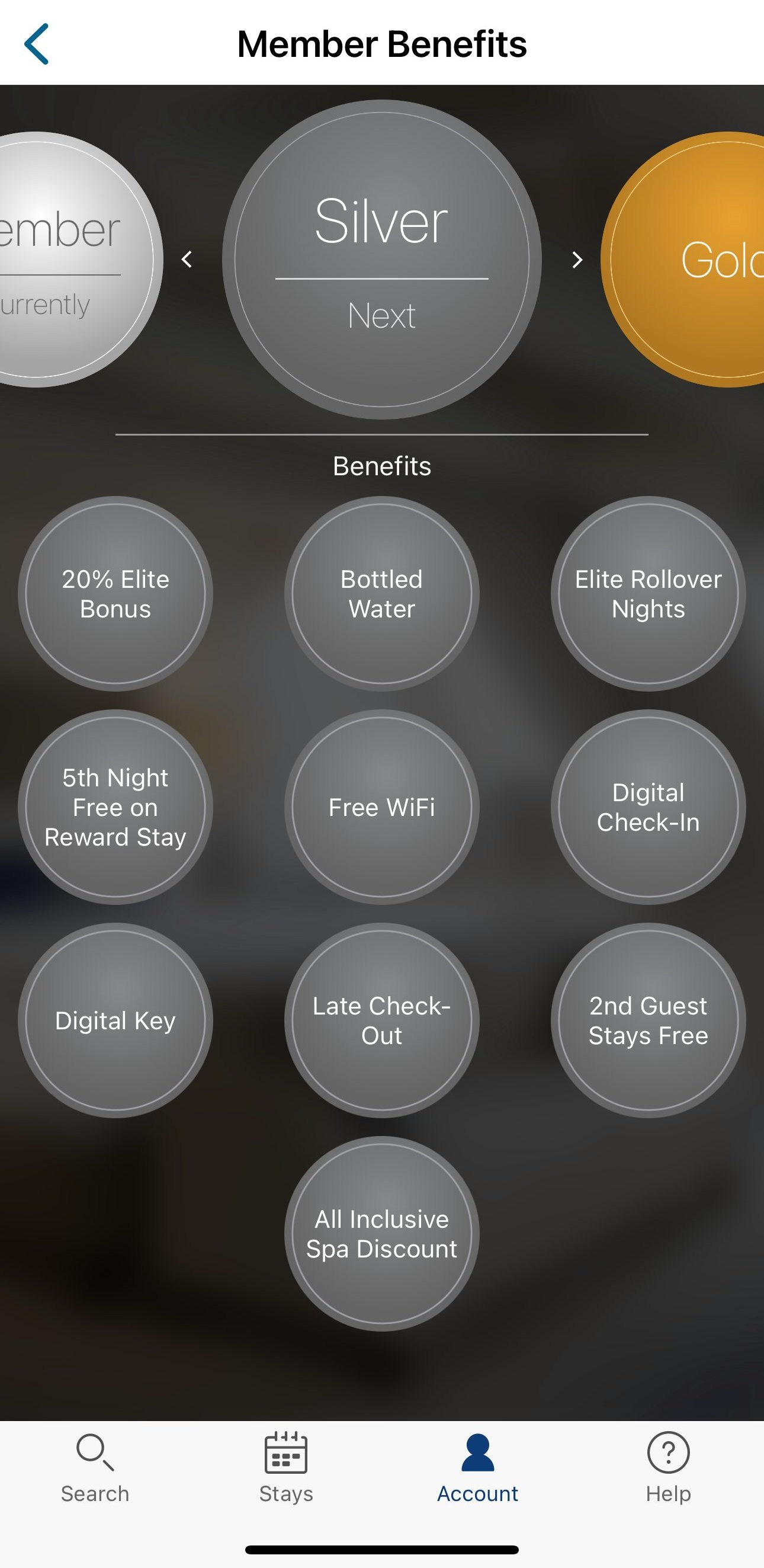

- Hilton Honors Silver Status: Enjoy a 20% bonus on Base Points, expediting your journey to free nights. Spend $20,000 on eligible Card purchases in a calendar year to upgrade to Hilton Honors Gold status through the following calendar year.

- Car Rental Loss and Damage Insurance: When reserving and paying for a rental vehicle with your eligible Card, and declining the collision damage waiver, you're covered for damage or theft in a covered territory. Exclusions apply, and the coverage is secondary without liability coverage.

- Global Assist® Hotline: Access the Global Assist® Hotline for travel assistance over 100 miles from home, offering services like lost passport replacement, translation, missing luggage, and emergency legal and medical referrals. Costs from third-party service providers are the Card Member's responsibility.

- Dispute Resolution: American Express collaborates with you and the merchant to promptly resolve unrecognized charges or billing issues.

- Purchase Protection: Covered Purchases made with your Eligible Card are protected for up to 90 days from the purchase date, covering theft or accidental damage.

- ShopRunner: Enjoy complimentary membership with ShopRunner, providing free 2-day shipping on eligible items from a network of 100+ online stores. Enroll with your eligible Card at shoprunner.com/americanexpress.

Marriott Bonvoy Bold

- Silver Elite status: Receive 15 Elite Night Credits annually, qualifying for Silver Elite status.

- Baggage Delay Insurance: Get reimbursed for essential purchases (up to $100 a day for 5 days) in the event of baggage delays over 6 hours by a passenger carrier.

- Lost Luggage Reimbursement: Receive coverage up to $3,000 per passenger if checked or carry-on luggage is damaged or lost by the carrier, covering you and immediate family members.

- Trip Delay Reimbursement: If your common carrier travel is delayed over 12 hours or requires an overnight stay, enjoy coverage for unreimbursed expenses, like meals and lodging, up to $500 per ticket.

- Purchase Protection: Your new purchases are covered for 120 days against damage or theft, with reimbursement up to $500 per claim and $50,000 per account.

- Visa Concierge: Access complimentary Visa Signature Concierge Service 24/7 for assistance with finding tickets to events, making dinner reservations, and more.

- DoorDash: Receive a one-year complimentary DashPass membership for DoorDash and Caviar, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders. After the first year, automatic enrollment in DashPass at the current monthly rate, if activated by 12/31/24.

When You Might Want The Hilton Honors Card?

You Might Prefer the Hilton Honors Amex over the Marriott Bonvoy Bold if:

Hilton Loyalty and Preferences: If you have a strong loyalty to Hilton hotels or prefer their properties, the Hilton Honors Card is the better choice, offering exclusive perks, bonus points, and a pathway to elite status within the Hilton Honors program.

You Want Better Rewards Ratio: According to our analysis, the estimated value cardholders can get with the Hilton card is higher than Marriot. So in terms of rewards, the Hilton card may be a better option.

You Want Flexible Redemption Options: Opt for the Hilton Honors Card if you value flexible redemption options. The Hilton Honors program allows for a variety of ways to use points, including not just hotel stays but also experiences, shopping, and more, providing versatility in how you choose to use your rewards.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want The Marriott Bonvoy Bold Card?

You Might Prefer the Marriott Bonvoy Bold over the Hilton Amex if:

Marriott Presence Fits Your Needs: Opt for the Bonvoy Bold if you frequently travel internationally or in areas where Marriott has a stronger presence. Its widespread global network ensures consistent access to Marriott properties, making it a reliable choice for diverse travel destinations.

You Want Better Travel Protections: The Marriott Bonvoy Bold® Credit Card offers baggage delay insurance, lost luggage reimbursement, and trip delay reimbursement coverage, while the Hilton Honors American Express Card only offers car rental loss and damage insurance. These travel insurance benefits can provide peace of mind and financial protection in case of unexpected events during your travels.

Compare The Alternatives

If you're in search of a travel credit card offering hotel rewards, there are several compelling alternatives worth exploring:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Hilton Honors American Express Card

If you're looking for an hotel card, a good one can provide exclusive benefits. Which card offers more perks and what are the differences?

Amex Hilton Honors vs World of Hyatt: Which Hotel Card Wins?

The Surpass card boasts a notably higher annual fee, justified by its superior rewards ratio and benefits compared to the Hilton Honors card.

Both Hilton Honors Amex and Wyndham Rewards Earner cards offer a decent point rewards ratio and basic extra hotel perks.

Hilton Honors American Express vs. IHG One Rewards Traveler: Side By Side Comparison