While the Costco Anywhere Visa Card targets a specific consumer base, the Chase Freedom Unlimited offers flexibility and simplicity for a broader audience.

Let's compare them side by side to see which is a better fit for your needs.

General Comparison

The Costco Anywhere Visa® Card by Citi is a solid choice for Costco shoppers looking to maximize their cash back earnings on gas and grocery purchases made at the warehouse club. The Chase Freedom Unlimited® stands out for its travel benefits, offering high cash back rate on travel and dining.

The Chase card has some additional benefits – it has no annual fee (Costco card requires a Costco membership, which is $60), it offers a welcome bonus and also 0% intro APR, makes it a good candidate for a avriety of customer types.

|

| |

|---|---|---|

Costco Anywhere Visa Card | Chase Freedom Unlimited | |

Annual Fee | $0 ($60 Costco membership fee required) | $0 |

Rewards | 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases | 5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases. |

Welcome bonus | None | Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. |

0% Intro APR | N/A | 15 months on purchases and balance transfers , then 20.24%–28.99% variable APR |

Foreign Transaction Fee | $0 | 3% |

Purchase APR | 20.49% (Variable)

| 20.24%–28.99% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Cashback Analysis: Which Card Gives More?

Assuming all supermarket and gas purchases are made via Costco and travel purchases are made with Chase Travel – there is no significant difference between the cashback on both cards. Both cards offer nice cash-back rewards on different categories, so your spending habits matters here.

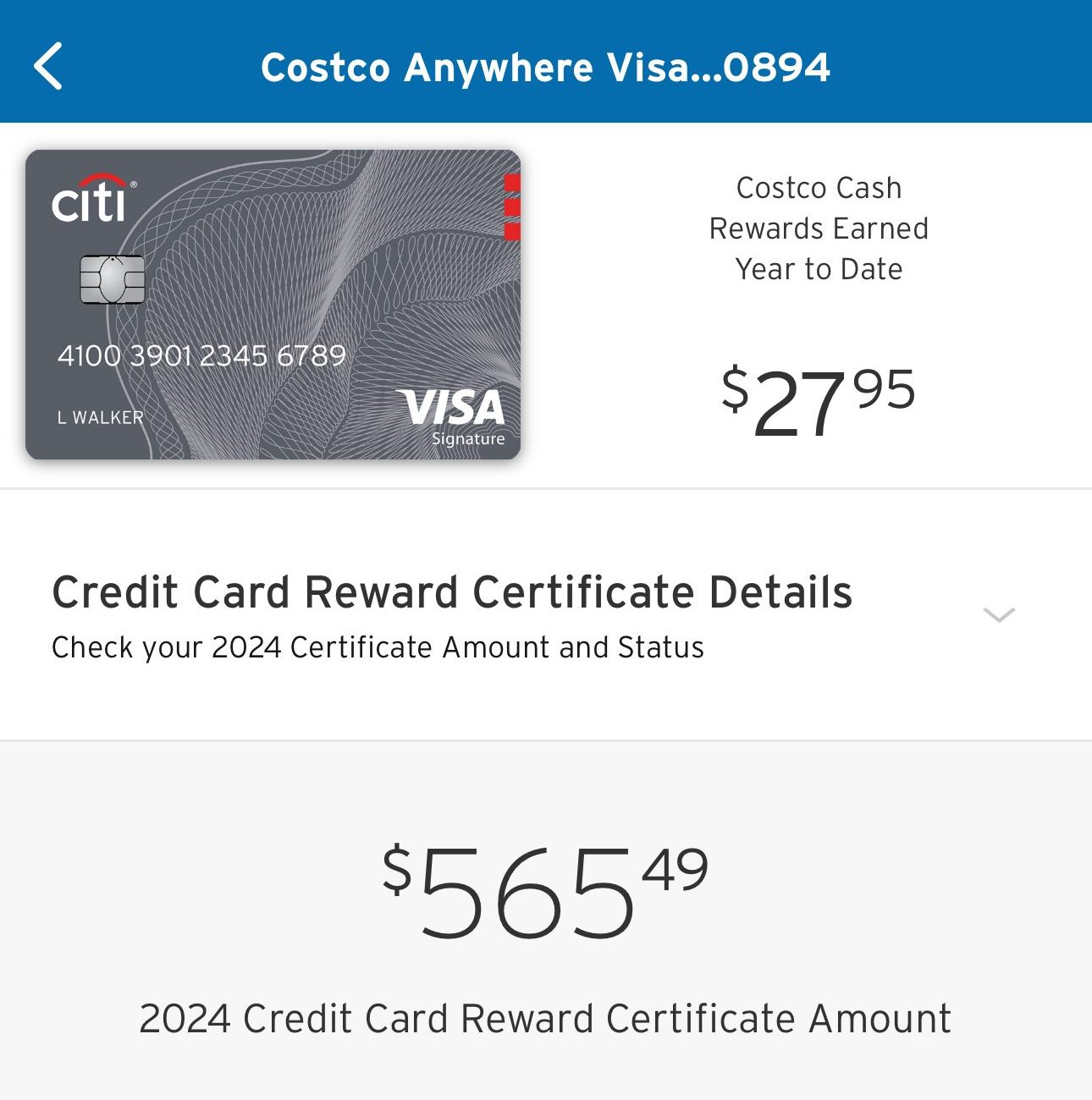

Another thing to remember is that the Costco cash back will be issued as an annual credit card reward certificate, accessible once your February billing statement concludes. This is less comfortable compared to may other cash back cards, including the Chase Unlimited card.

|

| |

|---|---|---|

Spend Per Category | Costco Anywhere Visa Card | Chase Freedom Unlimited |

$15,000 – U.S Supermarkets | $300 | $225 |

$5,000 – Restaurants | $150 | $150 |

$3,000 – Hotels

| $60 | $150 |

$3,000 – Airline

| $60 | $150 |

$4,000 – Gas | $160 | $60 |

Estimated Annual Cashback | $730 | $735 |

* Assuming all supermarkets/gas purchases made via Costco ** Assuming all travel purchases made via Chase Travel

Additional Benefits: Comparison

When it comes to extra benefits, the Freedom Unlimited card is the winner – it offers unique travel protections such as auto rental car insurance, trip delay/cancellation insurance, and cell phone protection.

Costco Anywhere Visa Card

- Damage & Theft Purchase Protection: Costco's Citi card offers coverage for damaged or stolen purchases, providing potential repairs or refunds within 120 days of acquisition, offering peace of mind for cardholders.

- Travel & Emergency Assistance: Costco cardholders benefit from 24/7 services, ensuring assistance with emergency travel arrangements, travel issues, medical and legal referrals, and more, enhancing their travel experience.

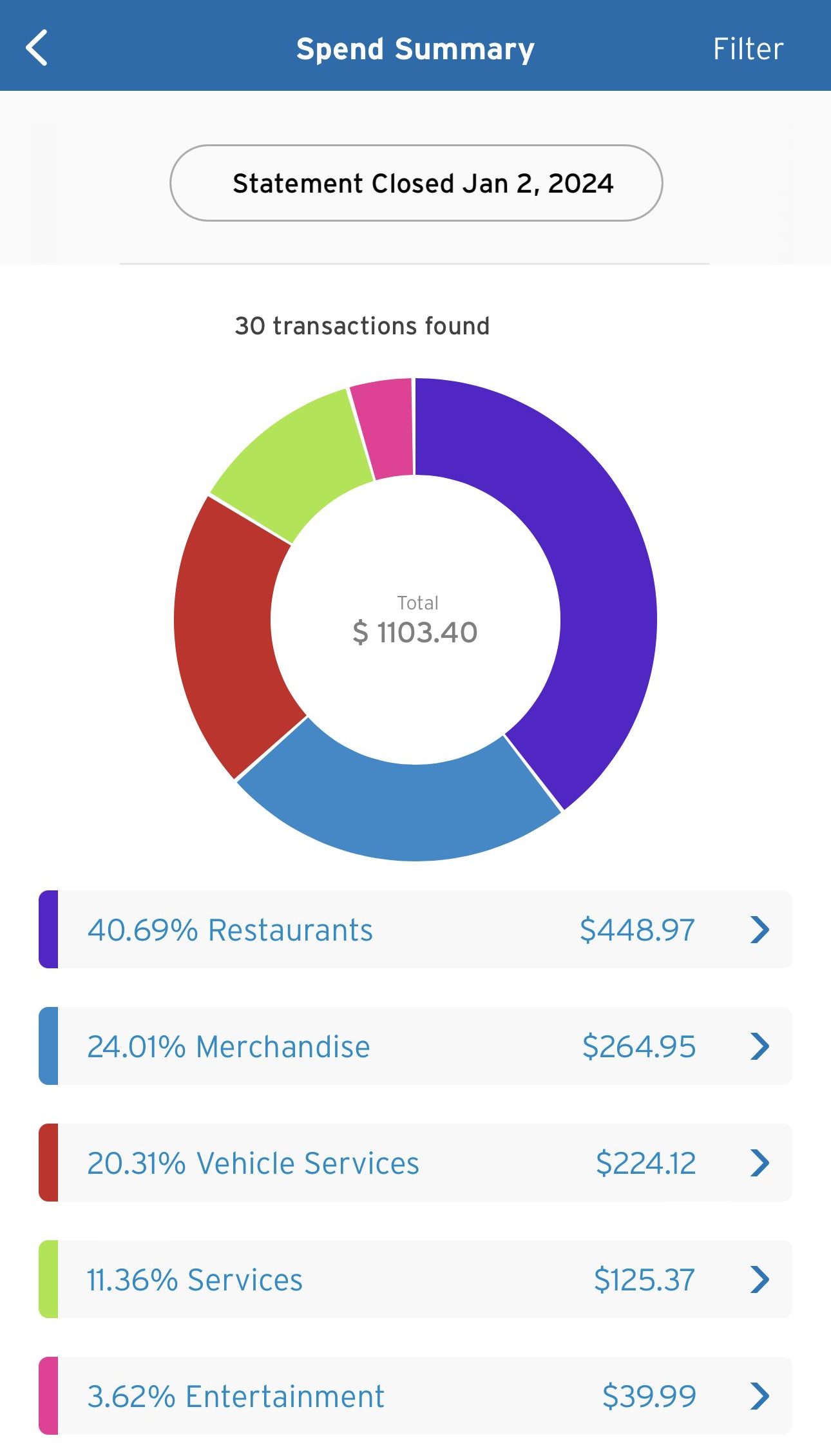

- Purchases Analysis and Tools: The Costco card offers a variety of spending tools and statistics on your purchases and rewards.

- Roadside Assistance Dispatch Service: With coverage across the U.S. and territories, Costco's Citi card provides a Roadside Assistance Dispatch Service, ensuring prompt help for cardholders facing car troubles during their journeys.

- Citi Entertainment℠: Elevating experiences, Citi Entertainment provides exclusive access to presale tickets and special events, enhancing the entertainment options available to Costco cardholders.

- $0 Liability on Unauthorized Charges: Costco's consumer card ensures complete protection against unauthorized charges, relieving cardholders of responsibility for any unauthorized online or other charges.

Chase Freedom Unlimited

- Auto Rental Collision Damage Waiver: Drive with confidence as you get coverage against theft and collision damage. Simply decline the rental company's insurance and charge the entire rental cost to your card. This coverage is applicable to most cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: Experience flexibility in your travel plans with reimbursement for pre-paid, non-refundable passenger fares. It covers up to $1,500 per person and $6,000 per trip in case your trip is canceled or interrupted due to covered situations.

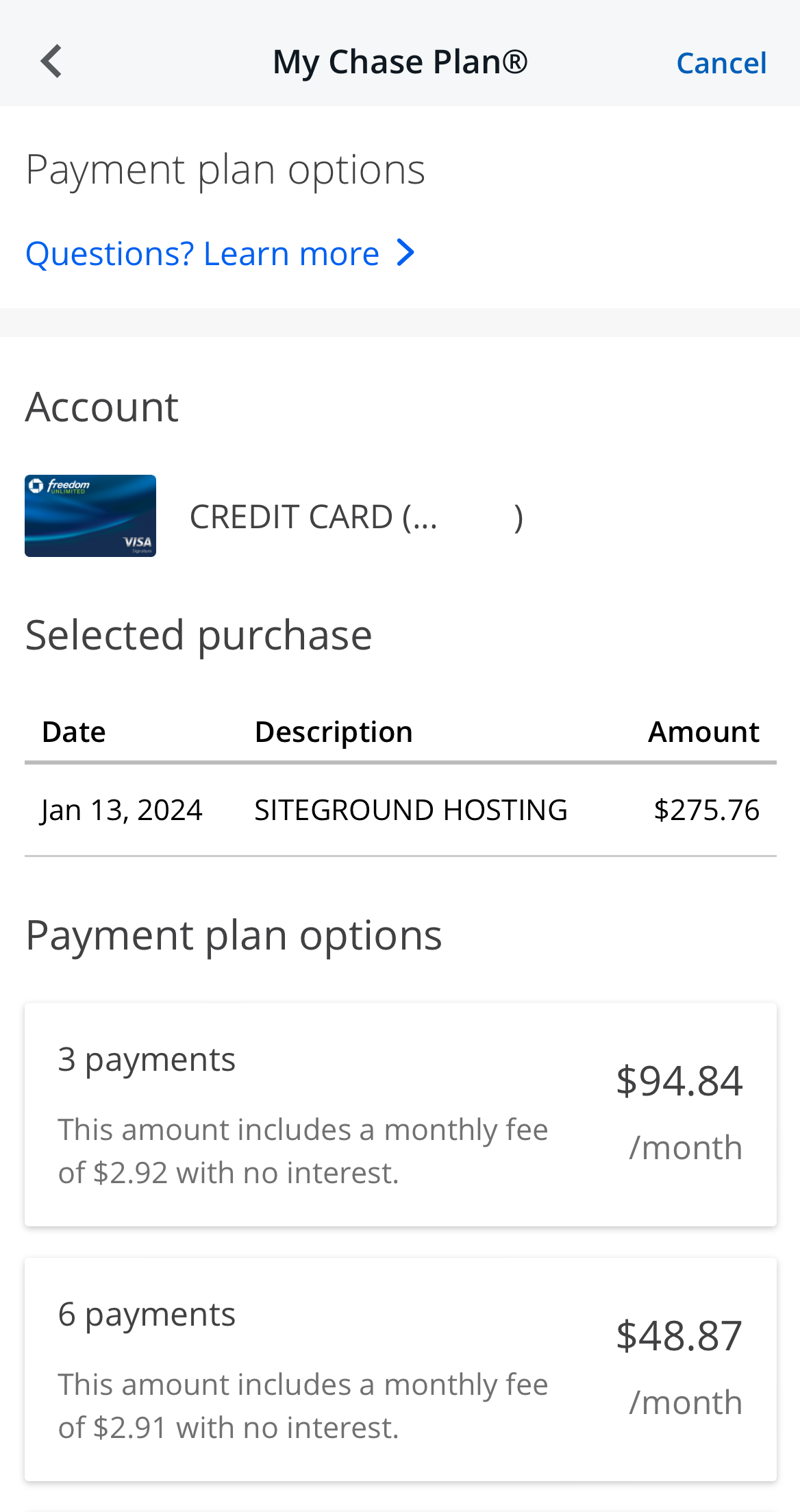

- My Chase Plan: Enjoy financial flexibility with My Chase Plan on the Unlimited card. Easily pay off eligible purchases of $100 or more in equal monthly payments with no interest, only a fixed monthly fee.

- Instacart+ Benefit: Enjoy a complimentary 3-month Instacart+ membership with bthe Freedom Unlimited, granting you unlimited deliveries at $0 delivery fees and reduced service fees on eligible orders.

- 5% Cash Back/5x Points on Lyft Rides: Elevate your Lyft experience with enhanced rewards on the card through March 31, 2025, providing 5% cash back or 5x points on all Lyft ride purchases.

- Cellular Telephone Protection: The Unlimited card ensures peace of mind with up to $600 in cell phone protection. Simply pay your monthly cell phone bill with the card, and enjoy coverage, subject to a $25 deductible.

- Purchase Protection: The card extends a safety net to your new purchases, offering 120 days of coverage against damage or theft. Benefit from up to $500 per claim and $50,000 per account.

- Extended Warranty Protection: Amplify your warranty with the Unlimited card, extending the U.S. manufacturer's warranty by an additional year on eligible warranties of three years or less.

When You Might Prefer The Costco Credit Card?

Here are scenarios where you might prefer the Costco Anywhere Visa Card over the Chase Freedom Unlimited:

- Frequent Costco Shopper: If you are a regular Costco member and a significant portion of your spending occurs at Costco, the Costco Anywhere Visa Card is tailored to reward your loyalty with higher cashback percentages on Costco purchases.

- You Spend A Lot On Gas. The Costco Anywhere Visa Card offers 3% cash back on gas, which is tied for the highest gas cash back rate among major credit cards. The Chase Freedom Unlimited does not offer any bonus cash back on gas.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Chase Freedom Unlimited?

You might prefer the Chase Freedom Unlimited if:

- You Are Looking For A Travel Rewards Card. The Chase Freedom Unlimited offers 5% cash back on travel purchased through Chase Ultimate Rewards®, which can be used to book flights, hotels, and car rentals. The Costco Anywhere Visa Card does not offer any bonus cash back on travel.

- You Prefer A Wider Range Of Redemption Options: The Chase Freedom Unlimited is part of the Chase Ultimate Rewards program, offering versatile redemption options. You can redeem cash back as a statement credit, for gift cards, or even for travel through the Chase Ultimate Rewards portal. If you value flexibility in how you use your rewards, this could be a key consideration.

- You Need 0% Intro APR: If you're looking for a credit card with a 0% introductory APR for balance transfers or new purchases, the Chase Freedom Unlimited might be a better choice compared to the Apple Card, as it often offers such promotional periods.

Compare The Alternatives

If you're looking for a store credit card with great rewards for online shopping – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Target Red Card | Apple Credit Card | Amazon Prime Rewards Visa Signature Card | |

Annual Fee | $0 | $0

| $0 ($139 Amazon Prime subscription required)

|

Rewards | 1% – 5%

5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

|

1-5%

5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases

|

Welcome bonus | None | N/A |

$100

$100 Amazon gift card upon approval

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 29.95% (Variable) | 15.99% – 26.99% Variable

| 19.49% – 27.49% Variable

|

Compare Chase Freedom Unlimited

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

While both cards offer decent cash back rewards with no annual fee, there is a clear winner between the two. And here's why we think so.

American Express Everyday® Card vs Chase Freedom Unlimited®: Which Card Wins?

While both cards offer great cash back rewards and considered among the best Chase cards, there are some major differences. Which is better?

Chase Freedom Flex vs Chase Freedom Unlimited: Which Card Is Best?

The flat rate cash back on Citi Double Cash Card is higher – but usually, it may not be the best option. Here's The Smart Investor analysis.

Citi Double Cash Card vs Chase Freedom Unlimited: Which Card Wins?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Blue Cash Everyday is the winner if you need gas and grocery purchases, while the Freedom Unlimited offers better travel rewards

Amex Blue Cash Everyday vs. Chase Freedom Unlimited: Which Card Wins?

When it comes to cashback potential, the Chase Freedom Unlimited wins, especially for those who frequently engage in travel-related expenses.

Chase Freedom Unlimited vs. Citi Custom Cash Card: Which Card Wins?

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR.

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited: Which Card Wins?

The Active Cash card offers flat-rate cashback, while the Unlimited card is the winner for travel. Here's a side-by-side comparison

Wells Fargo Active Cash vs. Chase Freedom Unlimited: Which Card Wins?

The Apple Card offers competitive cashback rewards on Apple purchases and services – but if you travel frequently, the Unlimited card wins.

Compare Costco Anywhere Visa Card by Citi

Both can be a perfect choice if you're looking for a store card. What are the main things you should know before applying, and how much can you save? Here's our analysis.

Costco Anywhere Visa vs Capital One Walmart Rewards Card: Which Card Is Best?

The Costco card stands out with substantial cashback rewards on gas, dining, and Costco shopping. In which cases the Apple card may be better?

Costco Anywhere Visa Card by Citi vs Apple Card: Which Card Is Best?

Costco is a clear winner when it comes to rewards for everyday spending, but the Best Buy Card wins for gadget lovers. Here's our comparison.

My Best Buy Visa vs Costco Anywhere Visa Card: How They Compare?

The Amazon Prime Visa card offers high cashback for avid online shoppers. However, Costco is the winner when it comes to everyday spending.

In the realm of wholesale clubs, Sam's Club and Costco stand as titans. Which of them offers a better branded credit card? Here's our verdict.

Sam's Club Mastercard vs Costco Anywhere Visa Card: Which Card Is Best?

BJ's One+ Mastercard our winner when it comes to cashback, but Costco card offers flexibility and many categories with higher cashback ratio.

BJ's One+ Mastercard vs Costco Anywhere Visa Card: How They Compare?

If you focus on groceries – the Target RedCard wins, but if you focus on travel or gas – you may want the Costco credit card.

Target Red Card vs. Costco Anywhere Visa Card: How They Compare?