The Citi/AAdvantage Executive World Elite and Citi/AAdvantage Platinum Select are two credit cards offered by Citibank, both affiliated with American Airlines' AAdvantage program. While they share the same airline partnership, they cater to different consumer needs and financial profiles.

General Comparison

The Executive World Elite card is designed for frequent travelers who value premium perks. With a higher annual fee, it offers higher points rewards ratio on travel categories, Admirals Club membership, statement credits and many other travel perks.

In contrast, the Platinum Select card targets a broader audience, particularly those seeking a balance between benefits and cost. It features a lower annual fee and offers advantages such as free checked bags and preferred boarding.

Here's a side by side comparison of the card's main features:

|

| |

|---|---|---|

Citi/AAdvantage Executive World Elite | Citi/AAdvantage Platinum Select | |

Annual Fee | $525 | $99 (waived for the first 12 months)

|

Rewards | 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

| Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases. |

Welcome bonus | 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 in purchases within the first 3 months of account opening | 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.24% – 29.99% (Variable) | 21.24% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Point Rewards: Which Card Wins?

Based on our analysis, the Citi/AAdvantage Executive World Elite is a clear winner, especially if you mainly use your card for travel purchases such as flights and hotels:

|

| |

|---|---|---|

Spend Per Category | AAdvantage Executive World Elite | AAdvantage Platinum Select |

$10,000 – U.S Supermarkets | 10,000 miles | 10,000 miles |

$5,000 – Restaurants | 5,000 miles | 10,000 miles |

$4,000 – Hotels | 40,000 miles | 4,000 miles |

$5,000 – Airline

| 20,000 miles | 10,000 miles |

$4,000 – Gas | 4,000 miles | 8,000 miles |

Total Points | 79,000 miles | 42,000 miles |

Estimated Redemption Value | 1 mile ~1.5 cents | 1 mile ~1.5 cents |

Estimated Annual Value | $1,185 | $630 |

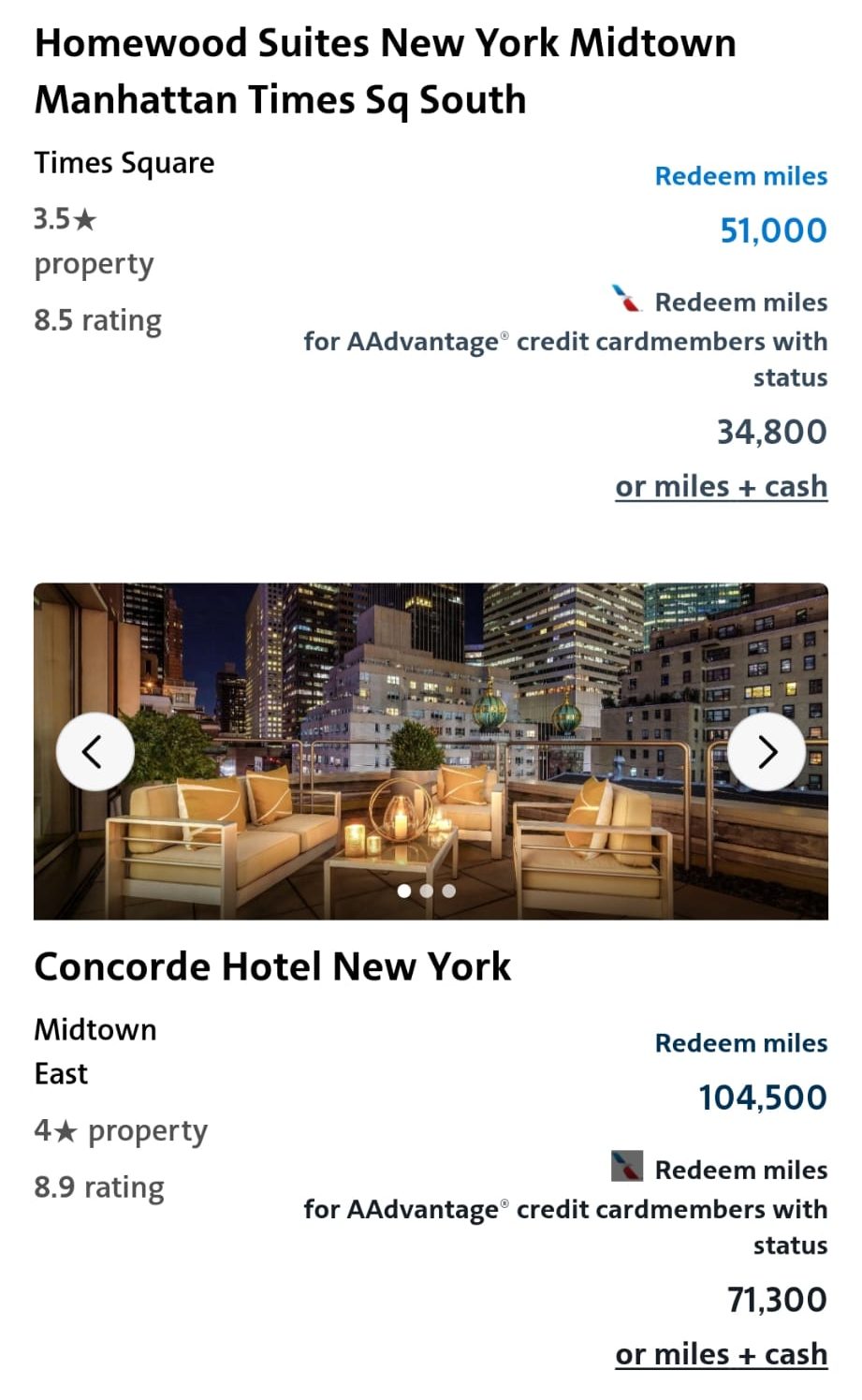

With the both Cards, you can redeem your points for a variety of options. This includes cash back, travel rewards, gift cards, and merchandise. Whether you prefer getting money back, planning a getaway, or treating yourself with gift cards or items, the card provides flexible and straightforward redemption choices.

Which Benefits Of You'll Get On Both Cards?

There are some additional types of perks that you will see with both of these cards:

- First Checked Bag Free: Travelers with the AAdvantage cards enjoy the benefit of a first checked bag free on domestic American Airlines itineraries for themselves and up to four companions on the same reservation.

- Preferred Boarding: Cardholders also receive preferred boarding on American Airlines flights, allowing them to save time and enhance productivity during the boarding process.

- 25% Savings on Inflight Food and Beverage: When using the card on American Airlines flights, users receive a 25% discount on purchases of inflight food and beverages, providing additional savings during air travel.

- $0 Liability On Unauthorized Charges: ensuring you are not held responsible for charges you did not authorize.

Citi/AAdvantage Platinum Select Unique Benefits

The AAdvantage Platinum Select offers this benefit for cardholders:

- $125 American Airlines Flight Discount: By spending $20,000 or more in purchases during the cardmembership year and renewing the card, users can earn a $125 American Airlines Flight Discount, adding a valuable incentive for cardholders who meet the specified spending threshold.

Citi/AAdvantage Executive World Elite Unique Benefits

The Citi/AAdvantage Executive World Elite provides many unique, premium airline and travel benefits, including:

- Enhanced Airport Experience: Receive priority check-in, screening, and boarding privileges for you and up to eight travel companions on the same reservation, enhancing your overall airport experience.

- Admirals Club® Membership: Gain access to nearly 100 Admirals Club® and partner lounges worldwide, with the flexibility to bring immediate family or up to 2 guests.

- Dedicated Concierge: Access a dedicated concierge service for expert assistance with foreign and domestic travel, shopping, dining, household, and entertainment needs.

- TSA PreCheck® or Global Entry Application Fee Credit: Get a statement credit, up to $100 every 4 years, as reimbursement for your application fee for Global Entry or TSA PreCheck®.

- Up to $120 in Lyft Credits: Earn a $10 Lyft credit after taking 3 eligible rides in a calendar month, for a total of up to $120 Lyft credits annually.

- Up to $120 Back on Eligible Avis® and Budget Car Rentals: Earn $1 statement credit per $1 spent on eligible Avis® and Budget car rental purchases, up to $120 every calendar year.

- Up to $120 Back on Eligible Grubhub Purchases: Earn a statement credit of up to $10 per monthly billing statement on eligible Grubhub purchases, totaling up to $120 every 12 billing statements.

- Loyalty Points Bonuses: Earn a 10,000 Loyalty Points bonus after reaching 50,000 Loyalty Points in a status qualification year, and an additional 10,000 Loyalty Points bonus after reaching 90,000 Loyalty Points in the same status qualification year.

Top Offers

Top Offers From Our Partners

Top Offers

Citi/AAdvantage Executive World Elite Protections

In addition to unique travel perks, the Citi/AAdvantage Executive World Elite provides travel insurance and protections:

Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations

Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

Trip Cancellation and Interruption Insurance: Buying a round-trip with your Card can assist in the event of trip cancellation or interruption, following the specified terms and conditions.

When You Might Want The Citi/AAdvantage Executive?

You might prefer the Citi/AAdvantage Executive card over the AAdvantage Platinum Select card in the following situations:

You Want a Card With a Reasonable Annual Fee: The Citi/AAdvantage Platinum Select is a better choice for those who prioritize cost-effectiveness. With a lower annual fee compared to the Executive World Elite, it provides valuable travel perks, such as free checked bags and preferred boarding, without a substantial financial commitment.

You're An Occasional Traveler: If you travel infrequently, the Platinum Select may be more suitable. Its lower annual fee makes it a more budget-friendly option for individuals who don't require the premium benefits associated with the Executive World Elite but still want to earn AAdvantage miles for occasional travel.

You're Focus On Dining And Gas Spending: If you spend a lot on dining and gas, the Platinum Select card's 2x miles earning rate on these categories can help you earn more miles than the Executive card.

When You Might Want The AAdvantage Platinum Select?

You might prefer the Citi/AAdvantage Executive card over the AAdvantage Platinum Select card in the following situations:

You Want Better Point Rewards Ratio On Travel: When it comes to flights and hotels, the Executive card offers significantly higher points rewards ratio, so if you plan to spend a high amount on these categories -this card may be a better option.

You Want Premium Travel Perks: If you prioritize luxury and premium travel amenities, the Executive World Elite is the better choice. The exclusive access to Admirals Club lounges provides a tranquil and well-appointed space for relaxation, making it suitable for individuals who value an elevated travel experience.

You Want Travel Insurance And Protections: The Citi/AAdvantage Executive World Elite offers protections and travel insurance options that are not included in the Platinum Select card.

Compare The Alternatives

If you're looking for an airline miles credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

United Club Infinite Card

| The Platinum Card® from American Express | Delta SkyMiles® Reserve American Express | |

Annual Fee | $525 | $695. See Rates & Fees | $650. See Rates & Fees |

Rewards | Up to 4x miles

4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases

|

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus | 90,000 miles

80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening

|

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

| 60,000 miles

Earn 60,000 bonus miles after you spend $5,000 in purchases on your new card in your first six months

|

Foreign Transaction Fee | $0 | $0. See Rates & Fees | $0

|

Purchase APR | 21.99% – 28.99% variable | 21.24% – 29.24% APR Variable | 20.99%-29.99% Variable |

Compare AAdvantage Platinum Select

We think that for most consumers, the no-annual-fee AAdvantage MileUp card may be a better option. When you may consider the Platinum Select?

Paying an annual fee with higher rewards rate & benefits, or getting a no annual fee card with access to Amex membership?

Here's our analysis: Delta SkyMiles Blue vs AAdvantage Platinum Select

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

While the Citi/AAdvantage Platinum Select wins at cashback value, the Aviator Red World card offers better airline perks.

AAdvantage Aviator Red World Elite Mastercard vs AAdvantage Platinum Select

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While the airline perks are quite comparable, the JetBlue Plus Card emerges as the preferred choice thanks to higher cashback rates

Citi/ AAdvantage Platinum Select vs JetBlue Plus Card: Side By Side Comparison

Compare Citi/AAdvantage Executive World Elite

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two?

Here's our analysis: United Club Infinite vs AAdvantage Executive Elite Mastercard

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card: Compare Cards

The AAdvantage Executive is a clear winner when it comes to cashback value. But the Delta SkyMiles Reserve wins at premium airline perks.

Citi/AAdvantage Executive World Elite vs. Delta SkyMiles Reserve: Compare Cards

Both Citi/AAdvantage Executive and Chase Sapphire Reserve offer great cashback value, but the latter is our winner. Here's why.

Citi/AAdvantage Executive World Elite vs. Chase Sapphire Reserve: Compare Cards