Table Of Content

Your choice of broker should be based on more than just who offers the best deal. Although price is an important factor in your broker selection, the most important factors are the services that your broker provides and how effective and efficient the broker is in providing promised services.

You may find a brokerage firm that offers all the bells and whistles at the lowest possible price, but if its systems fail during a critical trading period and you are unable to execute your trades when you need to, not being able to rely on them can result in massive losses.

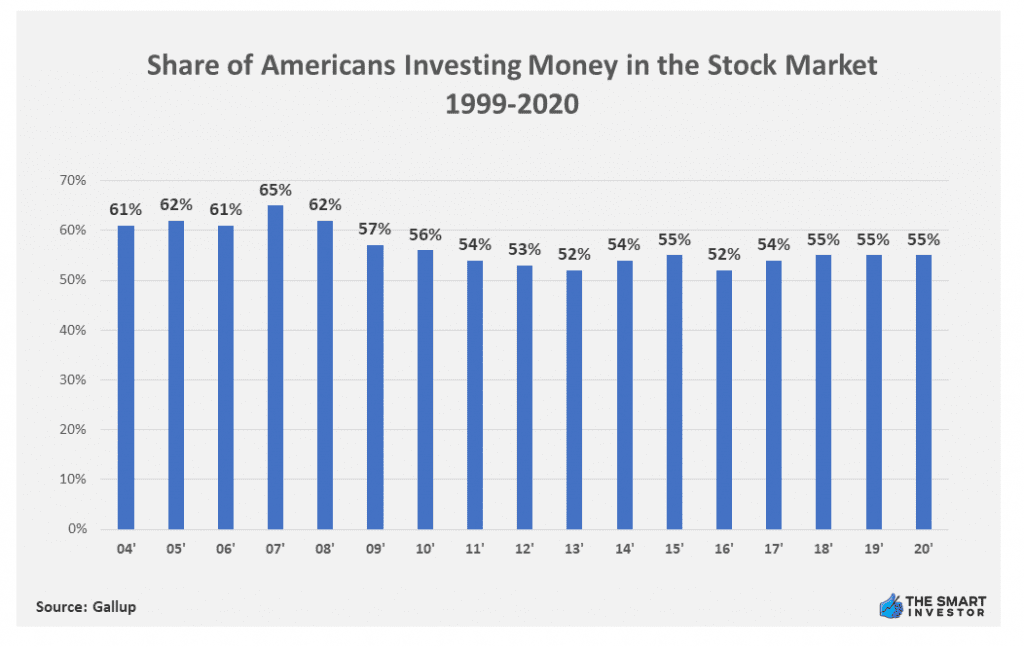

The percentage of Americans investing in stocks has remained steady since 1999, according to a report by

What is a Brokerage Account?

Let’s start from the top. What is a brokerage account?

This type of account is intended for investing, with anything you want. You can use it for stocks, bonds, exchange-traded funds, index funds, mutual funds, options, foreign currencies, real estate investment trusts, futures and practically anything else if you’re looking to make some money.

It’s important to recognize that these aren’t like standard savings accounts, however. That’s because the FDIC backs your savings account up to $250,000. Your brokerage account doesn’t have that protection. That means if your investment falls you’re going to lose money, and no one is going to give it back to you.

What’s great though is that you just set up your account and you can buy and sell just like that. Though you’ll have to choose a specific firm to work with and then base your activities on what they allow you to do.

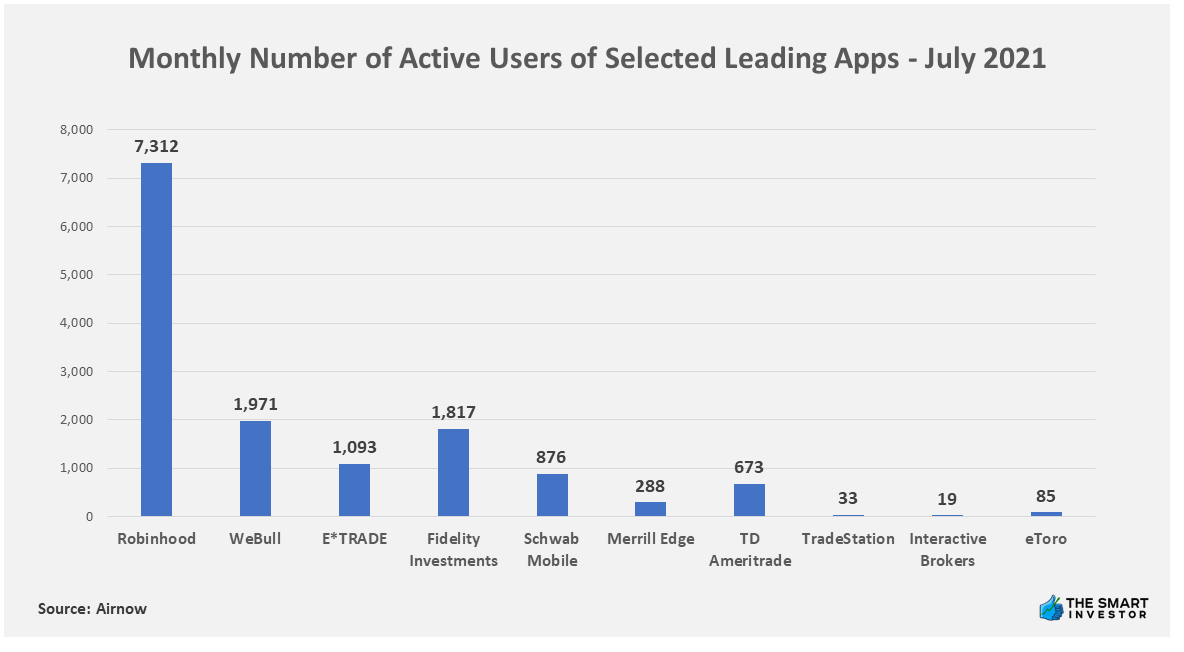

Robinhood was ranked first among the trading apps in the United States in July 2021, with an overwhelming margin of 7.312 million users, according to Airnow. WebBull and Fidelity Investment were fierce rivals at a close range, with each broker scooping 1.971 and 1.817 million users, respectively. At the bottom were Interactive brokers with 19,000, followed by TradeStation at 33,000, while eToro had 85,000 active users.

1. Know What You Need

First, look into the things that are most important to you when it comes to trading. Your specific investment knowledge and goals are going to play a role here.

Look at what you want most and just how you’re going to get it and be honest. Don’t pick something or decide something because you think it’s what you should want. Think about whether you’re looking at starting day-trading or if you want to tailor your own portfolio.

Do you want someone else to take care of everything for you? What do you want to get out of the process in the end? Why are you investing at all? What do you want to do with the money you get from the investment?

All of these questions and more are ones that your broker should be talking to you about and they’re things you want to think about more closely before you pick someone. Knowing each of these things is going to help you make the right decisions along the way.

Depending on the path you choose, you may have many more questions to answer along the way as you gain experience and refine your goals.

2. Choose Brokerage Type: Full-Service or Discount?

When you’re choosing the right brokerage account you need to think about full-service versus discount brokers. Each one has their own benefits and drawbacks, so consider them based on your needs.

Full-Service Broker

This type of broker is the one that you create a personal relationship with. You sit down with one financial adviser and get assistance with everything along the way. They’ll help you select investments and look at your financial planning.

They’ll show you tax implications and even help you feel a little better about the choices you’re making. On the other side of things you’re generally going to pay more for this type of broker. You’ll have commissions and you may have percentages of your money taken out in fees.

Discount Broker

A discount or online broker is a great idea if you’re planning on doing your own investing and handling the trading and such for yourself. You’re generally going to pay less because there’s no one handling affairs for you and you’re not going to get advice or investment help.

If you do you’re getting value advice which is likely not going to be as good of an option and won’t be as high quality as you would get with a full-service broker.

For those who want to do all their own investing you can do it yourself with a discount broker. Those who want someone to help them along will want to go with a full-service broker instead.

3. Know the Factors That Matter

Now that you know what your investment objectives are and what basic services you'll look for in your ideal brokerage, it's time to narrow down your options. While some brokerage features are more important to some investors than others, there are a few things that any reputable online brokerage should have.

With so many options available, checking on these basic necessities is a great way to quickly narrow the field. When you’re choosing someone you need to look at more than just the regular fees (though that’s an important consideration too).

If you want to become an active and successful trader and have full access to trade electronically through exchanges, you will most likely need to conduct research. You can also use the Internet to research and compare brokers. Pay attention to each of these things:

Overall Fees

There are a lot of different fees that can be wrapped up in a brokerage account. So think about how often you plan to trade and how much money you’re going to keep in the account. Also, look at the fees that each brokerage you’re thinking about will charge.

You want to know how you’ll be charged and how much you’ll be charged because you could end up losing out on some of those great returns you thought you were getting.

When it comes to the different brokerage firms out there you’ll find slightly different fees at each. Overall, however, you’re going to find some that include the ones below.

- Brokerage fee: This is the fee you pay just for the brokerage firm to keep your account active and continue doing anything with it. These are kind of like a subscription but come in the form of an annual fee. You might be paying access to the research and investing data that the firm has or to their trading platforms. You might even be paying inactivity fees if you don’t trade as much as they want you to.

- Transaction fee: Some brokerage firms charge you for every single instance where you buy or sell stock. Usually it’s going to be a flat fee, but you’ll have to check the fee schedule to find out how much it is for the firm you’re looking at.

- Management fee: This is the fee that you pay for the advisor that you’re working with. They’re the one that will do all the work for you, and they’re going to charge a percentage of your assets just for the privilege of getting their help.

- Withdrawal fee: If you want to take your money out of the account you may have to pay a fee for the privilege. That fee could vary depending on how much money is in the account and what the remaining balance will be after.

Minimum Investments

If you don’t have a lot of money because you’re just staring out that’s actually not a problem. There are plenty of places that you can get started without having to spend a lot of money. But keep in mind that some brokerages have minimum balances that could be high. Also, you may have to pay fees if you don’t meet those minimum requirements, which cuts into your profits and your ability to make anything off the account.

You should also check into whether your brokerage has checks and balance transfers available. Though most do, it’s not something that every brokerage offers. You also want to know how long it’s going to take for a deposit to transfer in and you want to know if there are fees for specific methods of deposit.

If you want your investing to be automatic you’ll want to find out how to set up the process. This should help you be more consistent about your investing and it should make sure that you’re moving forward with the amount that you want to invest as well.

If you ever plan to change your broker or your investments to another firm you want to make sure that you can transfer broker-to-broker without having to sell first.

Investment Options

There are all kinds of options that you can invest in with brokerages. These include standard securities and, in some cases, penny stocks, foreign currencies, and options.

If you’re looking to invest in something specific you’ll need to seek out a broker that will let you invest there. But make sure that you’re getting them for a reasonable fee, and that you’re not paying too much for the privilege.

The best kinds of brokerages are going to give you variety. They should have stocks, bonds, real estate investment trusts, futures, certificates of deposit, mutual funds, exchange-traded funds, options, and U.S. government treasury securities.

For those who are looking only to invest in EFT’s or only in something else specific, consider what you might want to do in the future. You could find yourself looking for more variety and you want your broker to have the options you want.

Customer Experience

The customer experience is going to be even more important when it comes to online brokers. You want to make sure you have a website that you can navigate easily and that you can use to find what you want.

Also, you may not be great at using the internet for some purposes and you want a way to get around that makes things easier for you. You may have a broker that only exists online, but you may want to keep looking for one that can give you the best of both worlds. It could be a way to make things easier on yourself.

With great customer service you should have options for how to contact someone. You should be able to email, conduct a live chat and even call if you feel more comfortable or need a quick resolution. This gives you more convenient options and makes sure that you feel comfortable about what you’re doing.

The customer service reputation that you see with your broker could be the most important factor. Plus, you can make sure the brokerage is a FINRA/SPIC member.

Trading Platform

Your trading platform is going to be important overall as well. In spite of there are great free tools for day traders, you want someone that offers the highest level and most sophisticated tools in the way of trading because this gives them even more information and allows them to make the best possible decisions.

This is even more important if you’re going to be doing your own trading and you’ll likely want to request a trial or demo before you agree to give them any money.

For those who are really good at technical analysis and who want to make their own trades, you might want to look at some different tools for this. You’ll be able to evaluate these for yourself and you should be able to get at least a trial of them before you subscribe.

If you’re just getting started on investing or you don’t know a whole lot about the research process you might want to look at the tools available. Your broker should have a range of different tools and options that you can use to make decisions and learn.

You may find reports, tutorials, and more and while you might have to pay a little more for access, the information that you gain will most definitely be worth it.

Types of Retirement Accounts

There are a number of different types of retirement accounts out there, but you’re going to want to look into what your brokerage has to offer to start. Look for someone that specializes in retirement plans and look for IRA or Roth IRA accounts to help you along. You might even be able to get cheaper options like a commission-free ETF or mutual fund. Or you might get specialty tools that will help you save for your retirement.

Look for someone that offers these IRA style options even if you’re not planning on opening one right now because you may want to look into it later. You may also want someone that can offer custodial accounts for children or 529 accounts or even robo-advising and auto-trading. Each of these are options with some brokers and they might be something you want to look at.

Just look for the option right now, even if these aren’t things that you’re concerned about or that you’re even considering. They might be a great feature at some point in the future.

Extra Bonus

There might be bonuses when you sign up for a specific type of account or just sign up with the brokerage in question. You might get specific free trades or more. Just make sure you know what’s being offered and that you’re taking advantage of the benefits. But don’t get sucked in by what sounds like a good deal but turns out to be something else.

4. Know Your Broker

The specific broker that you work with and the firm that they work for should be high on your list for investigation. Make sure you know everything you can possibly know before you open that account. You want to make sure they haven’t had disciplinary action of any kind in the past, because that gives you the best recommendation for the future.

Look also at customer reviews and complaints that have been filed against the company. They’re not likely to tell you about the hidden fees they use to make a bit of extra money on their website. Their ex-customers will though. You want to know everything you can about them, and that means the things they might be trying to hide as well (if they’re hiding anything). If you find a few complaints that’s normal, but patterns of specific things are definitely not.

Make sure contact information that you’re given are consistent with their entry in Brokercheck. If the numbers or contact info doesn’t match you could be interacting with someone who is trying to scam you. Never give out your personal information to someone you can’t verify.

What questions Should I Ask a Broker?

Before your first meeting with a potential broker, you should have a list of critical questions that will help you weigh the worth of a broker. Here are the top questions to ask your broker:

- Are you registered?

- How many years have you been a stockbroker?

- What commissions or fees will you charge to manage my investments?

- What are the brokerage’s margin requirements?

- Why is this investment suitable for me?

- What are the alternative investments that would cost less?

- What are your best trading strategies?

- Do you personally trade in the securities you recommend?

- Why should I trust you?

Bottom Line

When you’re looking for a broker you want to consider a number of different options. And you want to look at what kind of investor you are to get started.

If you’re a trader then you’re looking to make money on the short-term. You want to make a lot of trades and you want a broker that’s not going to charge you for each transaction that you make. If you aren’t careful you could end up paying out a lot of your profits.

If you’re the buy-and-hold or passive investor you’re looking for stocks that you can pick up and then keep for a long time, riding out the volatility. This could be a good idea for those who want a little bit less of the adrenaline. But it’s going to be up to you which type you are.

FAQs

What Broker Suits Your Investment Style

Beforehand, you must understand your investment style to choose the right broker for you. Generally, investments styles are grouped into the following three categories:

- The first category is the active versus passive style of investment. The portfolio manager will either be speculating in the short-term or investing in long-term securities.

- The second is growth or value investment. The portfolio includes either the most secure securities with low returns or high risks securities with potentially high returns.

- The last category is the small-cap or large-cap company investment style. The decision in this group depends on your risk tolerance. Generally, the small-cap company attracts more risks but higher rewards, while large established companies are less risky but with lower returns.

How do you know if a broker is legit?

The best way to know if a broker is legit is by checking their particulars with the FINRA broker checker. Start by going to FINRA website on finra.org/investors and navigate to the panel labeled “BrokerCheck by finra” on the right side of the screen.

Then click on the blue button to select either an individual broker or the firm option. Next, type the name or the CRD number of the broker you want to inquire about. Typically, if the broker is registered, a small popup dialogue will show up with the summary of the broker – the full name, CRD number, the current status of the broker, and an option to get the full report. To carry in-depth scrutiny, click on the get full report button.

Can brokers steal your money?

Sometimes, there is a chance that a broker can steal your investment money. Though your money is secure in a brokerage account, a broker can exploit a loophole in the management to perform fraudulent activities that contravene securities regulations and the Financial Industry Regulatory Authority (FINRA) laws.

However, you can always seek legal mitigations to sue over negligence or unauthorized trading, or outright fraud, among other types of obstructions within the legal framework that protects the investors.

Can You Trust stock brokers?

More often, you should not trust your broker because your goals relative to your broker are entirely different. The broker’s goal is to sell more and make the product sellable regardless of the product state. Therefore, before soliciting investment advice from your broker, ensure you have done your due diligence on the underlying security.

Also, remember to keep the business relationship professional, and not casual. That means keeping a distance and keeping in mind that their core objective is to hit the sales quota.