The Delta SkyMiles® Gold American Express Card and Citi/AAdvantage Platinum Select credit cards are popular choices among frequent travelers, each offering unique benefits tailored to their respective airlines. Let's compare them side by side:

General Comparison

Both cards charge similar annual fees, don't charge foreign transaction fees, and offer benefits tailored for each airline company. Here's a side-by-side comparison of the card's main features:

|

| |

|---|---|---|

Delta SkyMiles® Gold | Citi/ AAdvantage Platinum Select | |

Annual Fee | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months)

|

Rewards | 2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases. | Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus | 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months | 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0. See Rates and Fees. | $0 |

Purchase APR | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

Read Review | Read Review |

Airline Miles Rewards Analysis: Which Card Is Better?

When we analyze the number of points cardholders can get for each card for the same spend, we can see no significant difference between the cards:

|

| |

|---|---|---|

Spend Per Category | Delta SkyMiles® Gold | Citi/ AAdvantage Platinum Select |

$10,000 – U.S Supermarkets | 20,000 miles | 10,000 miles |

$4,000 – Restaurants

| 8,000 miles | 8,000 miles |

$5,000 – Airline | 10,000 miles | 10,000 miles |

$4,000 – Hotels | 4,000 miles | 4,000 miles |

$4,000 – Gas | 4,000 miles | 8,000 miles |

Total Points | 46,000 miles | 40,000 miles |

Redemption Value (Estimated) | 1 mile = ~1.3 cents

| 1 mile = ~1.5 cents |

Estimated Annual Value | $598 | $600 |

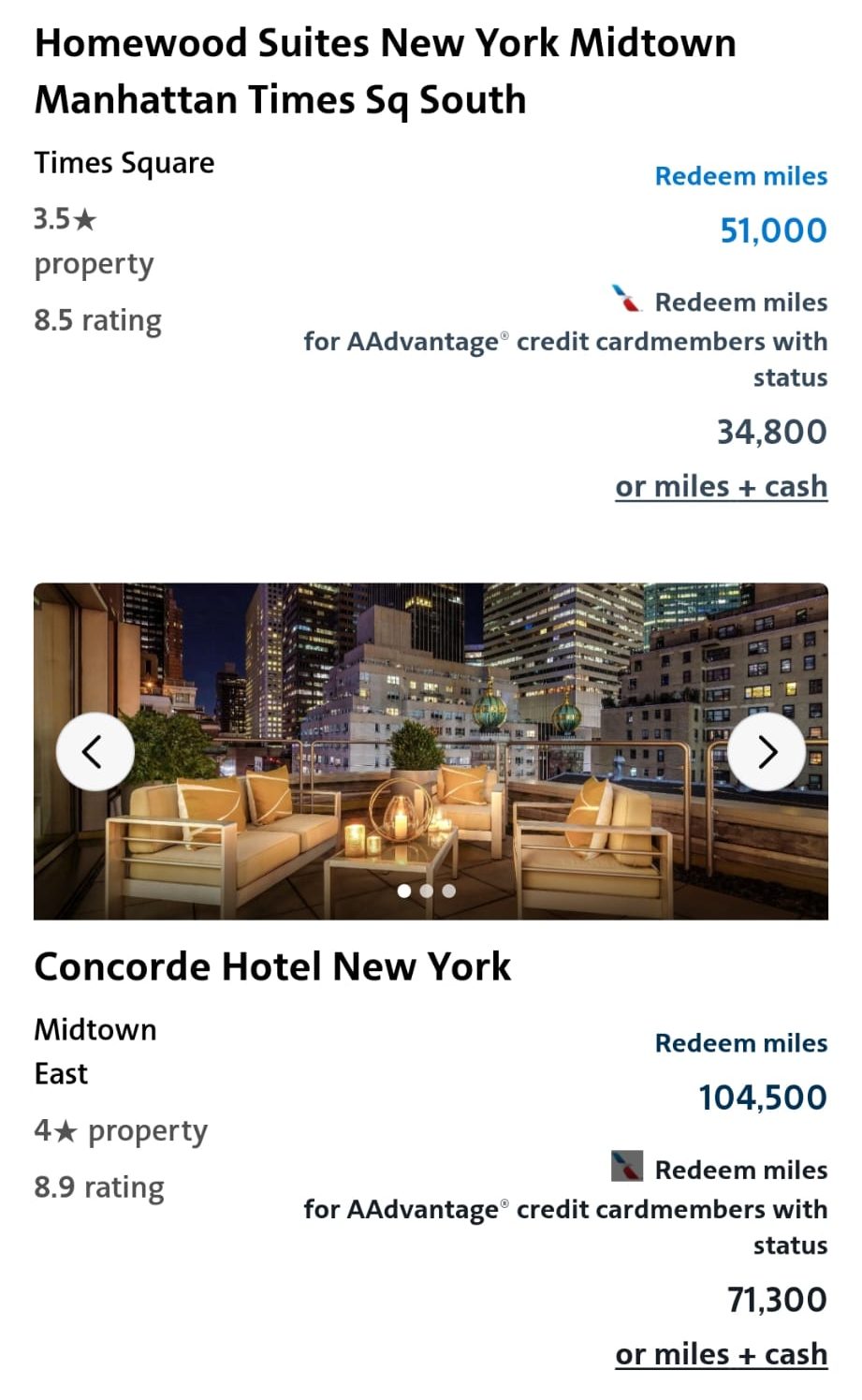

The advantage Platinum Select Card offers simple and flexible redemption options for miles earned. You can use your miles for travel-related expenses like flights and hotels or even get cash back.

Also, you can redeem miles for a variety of experiences on AA website:

The Delta SkyMiles card offers various ways to redeem your points for travel perks. You can book flights with Delta and its partners, covering destinations worldwide.

Additionally, use points for seat upgrades, hotel stays, car rentals, and even experiences. If travel isn't your thing, opt for merchandise, gift cards, or statement credits.

Top Offers

Top Offers From Our Partners

Top Offers

Airline And Travel Benefits: Comparison

When it comes to extra travel and airline perks, the Delta SkyMiles Gold card is the winner, mainly due to the broader protections and travel insurance it provides:

Delta SkyMiles Gold

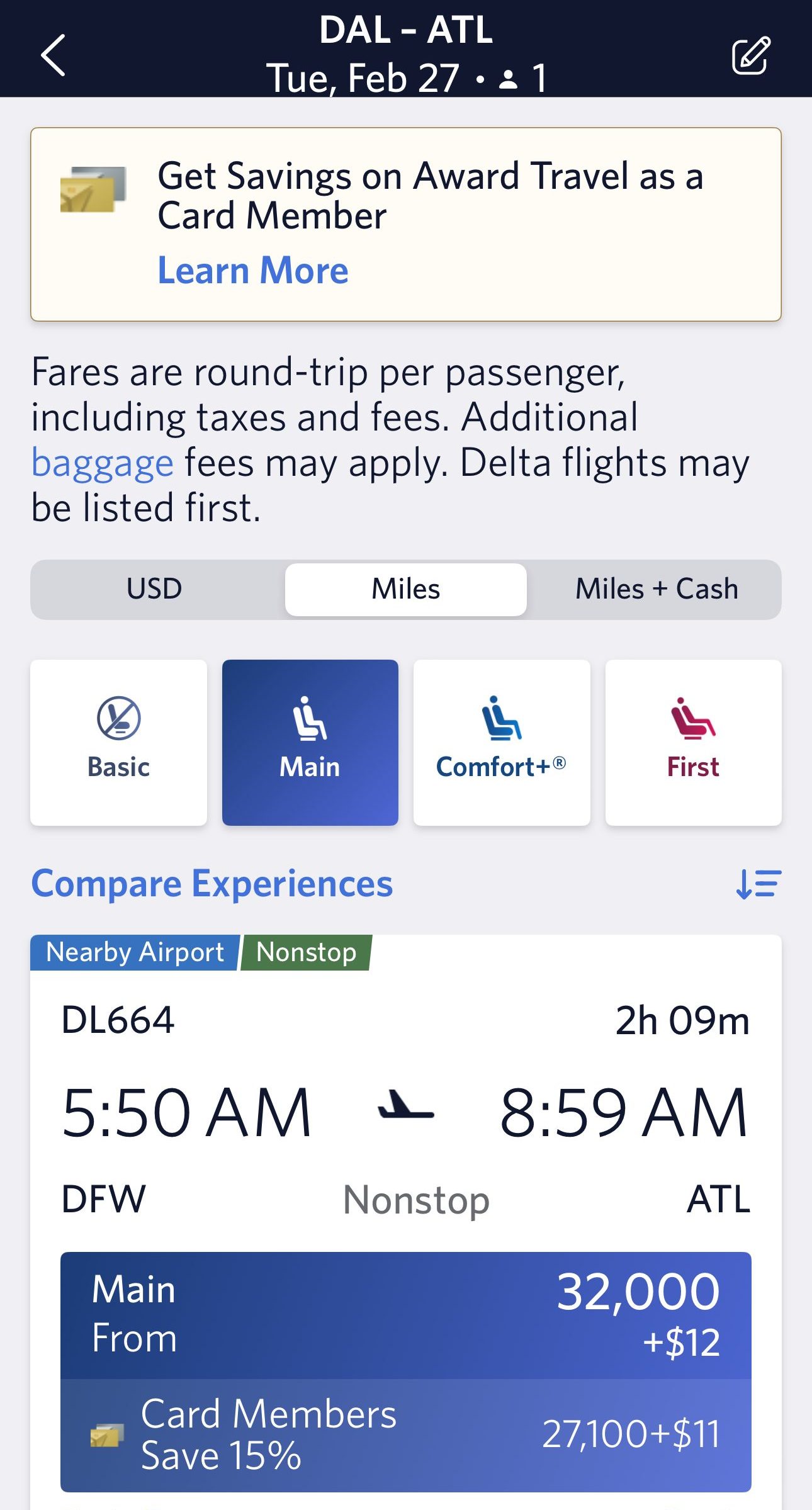

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

$100 Delta Stays Credit: Members of the Delta SkyMiles® Gold American Express Card are eligible to receive an annual rebate of up to $100 on qualifying prepaid Delta Stays bookings made on delta.com.

$200 Delta Flight Credit: Upon reaching $10,000 in annual purchases, cardholders can enjoy a $200 Delta Flight Credit, applicable towards upcoming travel expenses.

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

- Pay with Miles Discount: You can receive up to $50 off the cost of your Delta flight for every 5,000 miles you redeem.

- 20% Back on In–flight Purchases: Receive a 20% statement credit on eligible Delta in-flight purchases of food and beverages.

- ShopRunner: Enjoy free 2-day shipping at 100+ online stores when you enroll in complimentary ShopRunner membership with your Delta Platinum card.

Terms apply to American Express benefits and offers.

Citi/ AAdvantage Platinum Select

First Checked Bag Complimentary: Travelers holding the Citi® / AAdvantage® Platinum Select® card are entitled to the benefit of a complimentary first checked bag on domestic American Airlines itineraries for themselves and up to four companions sharing the same reservation.

- $125 American Airlines Flight Discount: Those who spend $20,000 or more in purchases throughout the cardmembership year and choose to renew the card are eligible for a $125 American Airlines Flight Discount.

- Priority Boarding: Additionally, cardholders enjoy priority boarding privileges on American Airlines flights, affording them the convenience of saving time and increasing efficiency during the boarding process.

- 25% Discount on Inflight Food and Beverage: Utilizing the card during American Airlines flights grants users a 25% discount on purchases of inflight food and beverages, presenting an opportunity for added savings while in the air.

When You Might Prefer The AAdvantage Platinum Select?

You might prefer the Citi/ AAdvantage Platinum Select card in the following situations:

You're Loyal To American Airlines: Choose the Citi/AAdvantage Platinum Select if you frequently fly with American Airlines or prefer their extensive route network, maximizing the benefits such as free checked bags and priority boarding.

You Prefer The Oneworld Alliance: If you often fly with airlines within the Oneworld Alliance, to which American Airlines belongs, the Citi/AAdvantage Platinum Select card becomes advantageous. It allows you to earn and redeem miles across a broader network of partner airlines, providing greater flexibility in travel options.

You're Near American Airlines Hub Proximity: If you live near or frequently travel through an American Airlines hub, such as Dallas/Fort Worth (DFW) or Charlotte (CLT), the Citi/AAdvantage Platinum Select card may be preferable. This card could offer more convenient flight options and better align with your primary airline.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Delta SkyMiles Gold?

You might prefer the Delta SkyMiles Gold card in the following situations:

Dedicated Delta and SkyTeam Traveler: If you frequently fly with Delta Air Lines or other carriers within the SkyTeam alliance, the Delta SkyMiles Gold card is a better choice. It aligns with the perks and benefits of this specific alliance, optimizing your travel experience within its network.

- You Want Broader Protections And Travel Insurance: If you are looking to get broader coverage, the Delta Gold card may be a better option.

- You're Near Delta Hub Proximity: Opt for the Delta SkyMiles Gold if you live near or frequently travel through a Delta hub like Atlanta or Boston. Choosing a card aligned with the dominant airline in your region can provide more convenient flight options and increased accessibility.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

|

|  | |

|---|---|---|---|

The JetBlue Plus Card | Southwest Rapid Rewards® Premier Credit Card | United Explorer Card | |

Annual Fee | $99 | $99 | $95 ($0 first year) |

Rewards | 1X – 6X

6X points on JetBlue purchases, 2X points at restaurants and grocery stores and 1X points on all other purchases

| 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

Welcome bonus | 50,000 points

50,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days

| 50,000 Points

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 21.24% – 29.99% variable | 21.49%–28.49% variable

| 21.99% – 28.99% variable |

Compare AAdvantage Platinum Select

We think that for most consumers, the no-annual-fee AAdvantage MileUp card may be a better option. When you may consider the Platinum Select?

Paying an annual fee with higher rewards rate & benefits, or getting a no annual fee card with access to Amex membership?

Here's our analysis: Delta SkyMiles Blue vs AAdvantage Platinum Select

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

The Citi/AAdvantage Executive offers better cashback value and perks than the Platinum Select, but usually it doesn't worth the annual fee.

Citi/AAdvantage Executive World Elite vs. Citi/AAdvantage Platinum Select

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

While the Citi/AAdvantage Platinum Select wins at cashback value, the Aviator Red World card offers better airline perks.

AAdvantage Aviator Red World Elite Mastercard vs AAdvantage Platinum Select

While the airline perks are quite comparable, the JetBlue Plus Card emerges as the preferred choice thanks to higher cashback rates

Citi/ AAdvantage Platinum Select vs JetBlue Plus Card: Side By Side Comparison

Compare Delta SkyMiles Gold Card

The Delta SkyMiles Gold offers higher annual cashback and better perks than the Delta Blue card. But is it worth the annual fee? It depends.

Delta SkyMiles Blue vs Delta SkyMiles Gold: How They Compare?

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you're looking for airline travel rewards, there is a clear winner. But what about other premium travel benefits? Here's our comparison.

Delta SkyMiles Gold vs Southwest Rapid Rewards Priority: Which Gives You More?

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

While Alaska Visa Signature card offers higher miles rewards ratio on airline, the Delta SkyMiles Gold is our winner. Here's why.

Alaska Visa Signature vs Delta SkyMiles Gold: Side By Side Comparison

Both Hawaiian and Delta SkyMiles Gold have similar annual cashback values and diverse airline benefits, so there is no clear winner.

Hawaiian World Elite Mastercard vs. Delta SkyMiles Gold: Side By Side Comparison