The My Best Buy Visa and Costco Anywhere Visa Card are two popular credit cards that offer rewards on everyday purchases.

From rewards programs and interest rates to annual fees and exclusive benefits, we will delve into the specifics of each card, highlighting their strengths and potential drawbacks.

Best Buy or Costco Card: General Comparison

The My Best Buy Visa card appeals to prudent consumers, providing substantial cashback incentives for Best Buy purchases, an enticing welcome bonus, and competitive rates for both gas and dining expenses.

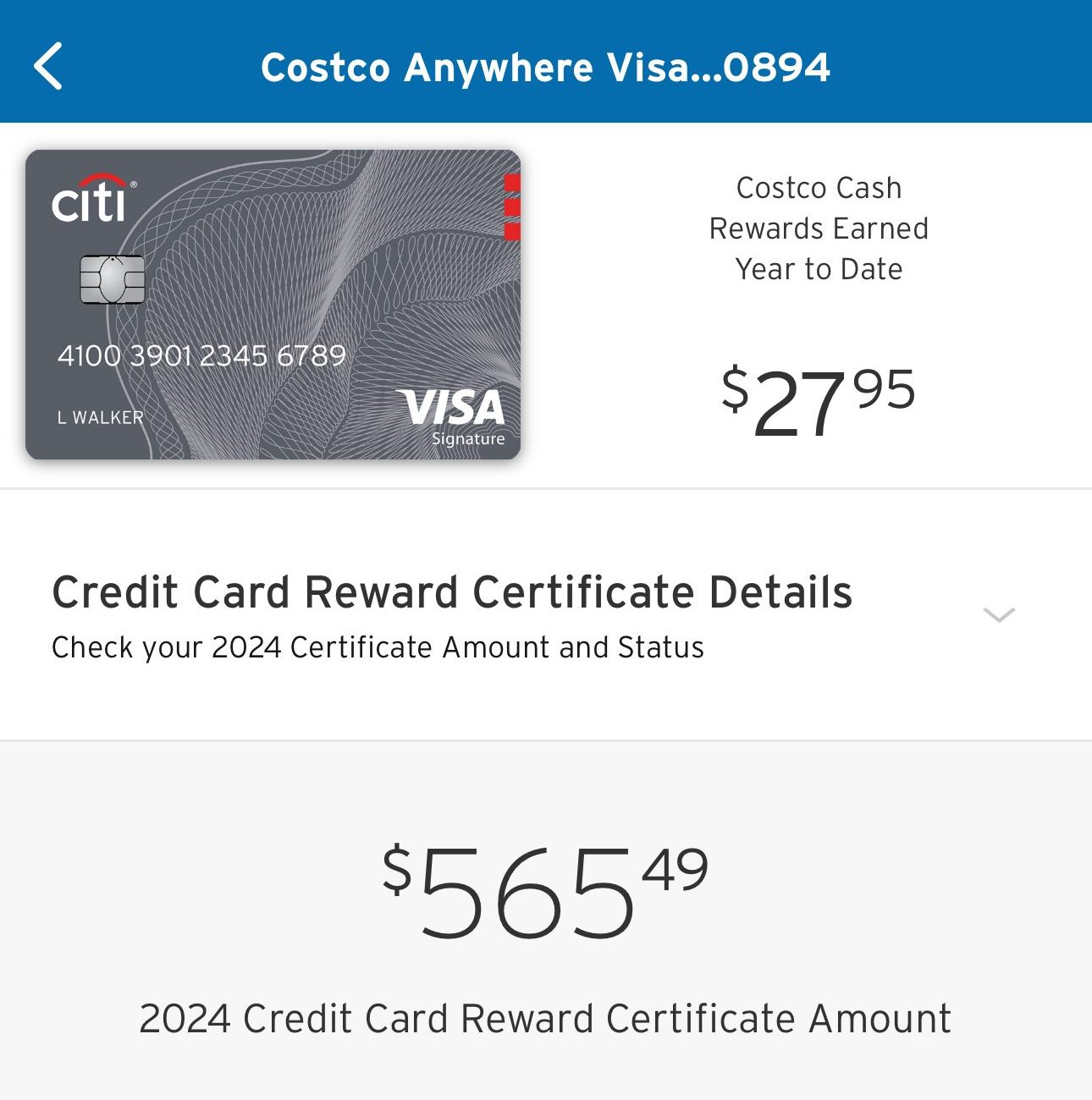

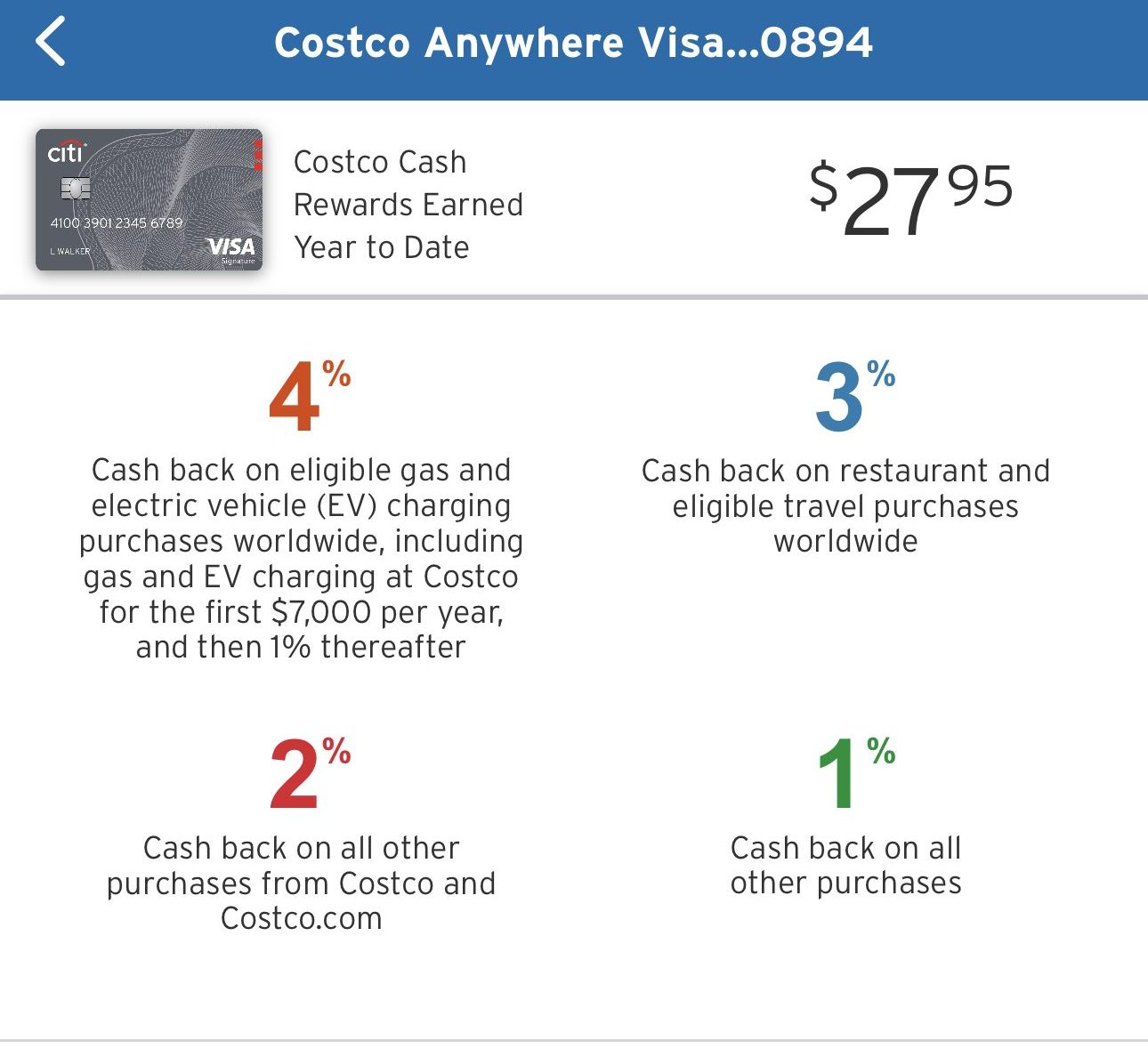

Meanwhile, the Costco Anywhere Visa, tailored for pragmatic spenders, distinguishes itself through generous cashback rewards on essential outlays like gas, dining, and Costco shopping. This alignment with the spending habits of its members positions it as the preferred choice for those in search of practical and meaningful rewards.

|  | |

|---|---|---|

Costco Anywhere Visa Card | My Best Buy Visa Card | |

Annual Fee | $0 ($60 Costco membership fee required) | $0 |

Rewards | 4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases | 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases |

Welcome bonus | None | 10% back in rewards on your first day of purchase |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | N/A |

Purchase APR | 15.99% – 31.49% variable | 15.99% – 26.99% Variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Best Buy or Costco Card: Which Card Gives More?

In the analysis, we can see there is no significant between the cards. Ultimately, the more you buy on Best Buy – the more lucrative the card is. However, if you spend on travel – the Costco card drives you more cashback.

However, unlike Best Buy – the Costco cash back will be issued in the form of an annual credit card reward certificate, accessible once your February billing statement concludes. This certificate is redeemable for either cash or merchandise at Costco Warehouses across the United States.

|  | |

|---|---|---|

Spend Per Category | Costco Anywhere Visa Card | My Best Buy Visa Card |

$15,000 – U.S Supermarkets | $300 | $300 |

$5,000 – Restaurants | $150 | $150 |

$4,000 – Best Buy Products | $40 | $200 |

$4,000 – Travel

| $120 | $40 |

$4,000 – Gas | $160 | $120 |

Estimated Annual Cashback | $760 | $810 |

* Assuming all supermarkets/gas purchases made via Costco

Additional Benefits: Comparison

When it comes to extra benefits, each card has its own unique benefits. The Costco card offers a variety of travel protections, including roadside and travel assistance protection. The Best Buy card shined in free shipping and financing options for large products.

Costco Anywhere Visa Card

- Damage & Theft Purchase Protection: Costco's Citi card offers coverage for damaged or stolen purchases, providing potential repairs or refunds within 120 days of acquisition, offering peace of mind for cardholders.

- Travel & Emergency Assistance: Costco cardholders benefit from 24/7 services, ensuring assistance with emergency travel arrangements, travel issues, medical and legal referrals, and more, enhancing their travel experience.

- Roadside Assistance Dispatch Service: With coverage across the U.S. and territories, Costco's Citi card provides a Roadside Assistance Dispatch Service, ensuring prompt help for cardholders facing car troubles during their journeys.

- Citi Entertainment℠: Elevating experiences, Citi Entertainment provides exclusive access to presale tickets and special events, enhancing the entertainment options available to Costco cardholders.

- $0 Liability on Unauthorized Charges: Costco's consumer card ensures complete protection against unauthorized charges, relieving cardholders of responsibility for any unauthorized online or other charges.

My Best Buy Visa Card

Financing Options: Instead of receiving 5% cash back rewards on Best Buy purchases, cardholders have the option to choose financing alternatives. The My Best Buy® Credit Cards offer deferred interest financing, enabling users to make purchases without incurring immediate interest charges for a specific period.

Free Shipping: Enjoy free shipping on qualifying purchases at Best Buy.

When You Might Prefer The My Best Buy Visa Card?

Opting for the Best Buy Card over the Costco Card might be preferable in certain scenarios:

You're Frequent Best Buy Shopper: If you find yourself regularly exploring Best Buy's exclusive deals and discounts, the My Best Buy Visa Card proves to be a more fitting choice. Tailored for loyal customers, it offers additional savings and rewards specifically designed for Best Buy purchases, enhancing the practicality of this credit card.

You Want Instant Cash Rewards: Unlike the Costco Credit Card's annual certificate, the My Best Buy Visa ensures immediate visibility of your Best Buy cashback on your account, eliminating the wait for a yearly payout and providing a more convenient rewards experience.

You Want Payment Flexibility: Opting for the My Best Buy Visa Card grants you the advantage of flexible payment plans. This is particularly beneficial if you prefer spreading the cost of your purchases over time, offering financial convenience, especially for larger expenditures, and enabling more effective budget management.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Costco Credit Card?

Opting for the Costco Credit Card over the Best Buy Card might be preferable in certain scenarios:

You Spend On Grocery and Gas: If a significant portion of your expenses is dedicated to grocery shopping and fuel, the Costco Anywhere Visa takes the lead. With substantial cashback rewards on gas and dining, it becomes the preferred choice for those who prioritize savings in these essential categories.

You Love Costco: For avid Costco shoppers who regularly stock up on bulk purchases, the Costco Anywhere Visa Card seamlessly integrates with the Costco membership, offering exclusive benefits and elevated cashback rewards on Costco expenditures.

You Like Travel and Dining: If your lifestyle involves frequent travel and dining out, the Costco Anywhere Visa's competitive cashback rates in these categories make it a more attractive option, providing valuable rewards for your on-the-go and culinary experiences

Compare The Alternatives

If you're looking for a store credit card with great rewards for online shopping – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Amazon Prime Rewards Visa Signature Card | Apple Credit Card | Sam's Club® Mastercard® | |

Annual Fee | $0 ($139 Amazon Prime subscription required)

| $0

| $0 ($50/$110 for Club/Plus membership – MUST)

|

Rewards |

1-5%

5% at Amazon.com, Amazon Fresh , Whole Foods Market and on Chase Travel purchases, 2% cash back on gas stations, restaurants and on local transit and commuting, 1% cash back on all other purchases

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

|

1-5%

5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases

|

Welcome bonus |

$100

$100 Amazon gift card upon approval

| N/A |

None

$30 statement credit after making $30 in Sam’s Club purchases within the first 30 days

|

Foreign Transaction Fee | $0

| $0 | N/A

|

Purchase APR | 19.49% – 27.49% Variable

| 15.99% – 26.99% Variable

| 20.40% or 28.40% Variable

|

Compare Costco Anywhere Visa Card by Citi

Both can be a perfect choice if you're looking for a store card. What are the main things you should know before applying, and how much can you save? Here's our analysis.

Costco Anywhere Visa vs Capital One Walmart Rewards Card: Which Card Is Best?

The Costco card stands out with substantial cashback rewards on gas, dining, and Costco shopping. In which cases the Apple card may be better?

Costco Anywhere Visa Card by Citi vs Apple Card: Which Card Is Best?

The Amazon Prime Visa card offers high cashback for avid online shoppers. However, Costco is the winner when it comes to everyday spending.

In the realm of wholesale clubs, Sam's Club and Costco stand as titans. Which of them offers a better branded credit card? Here's our verdict.

Sam's Club Mastercard vs Costco Anywhere Visa Card: Which Card Is Best?

The Costco Card is a great for Costco shoppers, gas and grocery purchases, while the Freedom Unlimited stands out for its travel benefits.

Costco Anywhere Visa Card vs Chase Freedom Unlimited: Comparison

BJ's One+ Mastercard our winner when it comes to cashback, but Costco card offers flexibility and many categories with higher cashback ratio.

BJ's One+ Mastercard vs Costco Anywhere Visa Card: How They Compare?

If you focus on groceries – the Target RedCard wins, but if you focus on travel or gas – you may want the Costco credit card.

Target Red Card vs. Costco Anywhere Visa Card: How They Compare?

Compare My Best Buy Visa Card

The Apple Card offers high cashback on Apple products, while the Best Buy card wins when it comes to gas and BestBuy purchases. Let's compare.

My Best Buy Visa Card is cheaper than the Amazon card, which requires a membership. But, it doesn't mean Amazon wins – here's why.