There is a natural tendency for people to put off investing or totally stay away from it just because of fear. There are a lot of things a prospective investor might worry about. You might not be able to buy the right instrument and end up with the wrong investment.

You might miss the right timing and not be able to buy or sell when you should. And there’s also the worry that the economy might take a downturn and cause your investment to crash to the ground. They are valid concerns, but they should not stop you from making your money work for you.

Investing could be simple and not complicated. But it is important to start early and stay disciplined. Saving and investing early in your life is wonderful because the longer you can use compound interest to work to your advantage, the better returns you will get.

Let’s make it clear: we are not giving you advice or tips on how to improve your investment strategies. These simple tips are for beginners who would like to get on board but are apprehensive to start their investing journey. So, to help the fence-sitters or those who are clueless where and how to start, here are a few things to remember.

A report by Gallup shows that a majority of Americans consider real estate as their best long-term investment from a pool of several investment options. Real estate leads the list of preferred long-term investments by 35%, against stocks at 21%, gold at 16%, and Savings accounts at 17%.

Tip #1 – Understand Which Type of Investor You Are

Are you comfortable taking risks? Do you see yourself able to actively participate in the market several times each day? If so, you could adopt an active investing style. Active investing means you focus more on the present-day scenario rather than the long-term horizon.

Active investors keep an eye out for certain specific stocks and use good market timing to try to outperform the market to gain short-term profits. It requires an investor to constantly monitor the market and his position in the market.

If you’re a passive investor, you know you’re there for the long haul. Passive investors minimize the amount of buying and selling within their portfolios, ensuring cost-effectiveness in their method of investing. This practice is basically a buy-and-hold strategy. It often requires resisting the urge to react or anticipate the stock market’s constant movements.

The best example of a passive approach is by investing in an index fund that follows one of the major indices in the industry such as the S&P 500 or Dow Jones.

Basically, you’ll be owning tiny portions of thousands of different stocks and you earn your returns as a participant when the corporate profits of these stocks go up over time in the overall stock market. Many conservative investors believe the value of money decrease and therefore prefer to invest in gold.

Successful passive investors are the ones who have learned to fix their gaze on the prize at the end of the course and ignore short-term losses and sharp downturns.

Tip #2 – Optimize Your Cost

Mutual funds, index funds, and ETF portfolios take care of your concerns about asset diversification. The great thing about it is you can ask your bank for an auto-deposit service so you can keep pouring in money to your investment accounts automatically.

Just remember that nothing is ever free and you may have to pay some fees. This may not be such a big thing but many beginners often fail to account for the fees in their financial projections.

If you invest in a mutual fund, you also get the expertise of professional fund managers who look after the fund day in and day out.

Of course, you need to pay for that kind of brainpower. Mutual funds often levy a fee of 2% or more per year. You might say that 2% won’t really make a dent in your finances, but when you’re talking about paying it for 5, 10 or 20 years, that’s quite a sum.

So, when evaluating any fund, avoid focusing on just the colorful line graph that shows how much it made for the past few years or the number of good reviews. Instead, look into these other items they don’t highlight:

- Expense ratio. Basically, this tells you the operating costs such as the fee they pay to the manager, taxes, legal expenses, and others.

- Turnover. You will see how often they trade the funds. The rule is, the more times they trade, the higher the turnover rate. The higher the turnover, the higher the transaction costs that they charge the investors.

- Load fee. What the fund charges to the investor when you buy or sell shares of a fund.

What you want is a fund where these factors register low or below average. There are dedicated calculator for mutual fund expenses.

Comparatively, index funds charge much lower fees. The catch is, you’ll have to manage your own portfolio or pay a higher fee if you want a professionally-managed portfolio.

Tip #3 – Get Into It As Early As Possible

Sometimes, when you see the value of certain stocks reach unimaginable heights, you wish that you’ve bought even one share so you can participate in the elation of winning. Or maybe you have friends who tried their luck with Bitcoin and enjoyed a crazy windfall after a few months. The temptation can become more intense the more that you hear about these instant millionaire stories.

There’s no denying that. But you should remember that before these people got their rewards, they took risks. And when you’re a newbie, it’s not a good idea to go all in. Hindsight is totally different from foresight although many people mix them up. Do you find ETFs and index funds boring? They could be – but experience tells us that they are likely to outperform the market.

If you’re debating with yourself daily whether to buy or sell with a small amount of money, you won’t get anywhere.

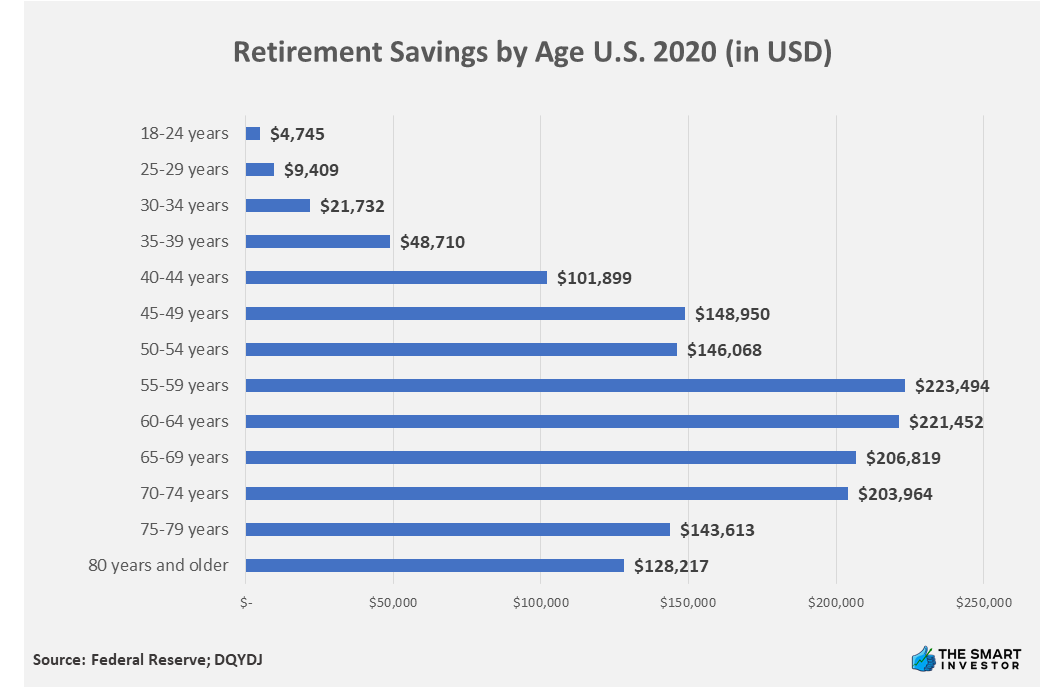

Based on this chart from DQYDJ, retirement savings in the United States increase with age, starting from when young adults join the workforce. Young adults in age 18 to 24 have the lowest savings at $4,745, and the savings increase with age until the 55 to 59 age bracket when the savings peak at $223, 494. Between age 50 and 60, there is a spike in the amount of retirement savings by $77, 426 as retirement savers make catch-up contributions as they approach retirement.

As we’ve said, looking at the boring stocks is like watching the grass grow. They normally move in just one direction but very slowly. However, the exponential power of compounding interest is what will blow you away. Look at the following illustration. If you have $5,000 now and invest it in an index fund that grows six percent per annum, you’ll end up with $50,000 in 40 years.

Chalk up another argument for the adage that says time is money. In investing, every year that you lose in the market can substantially lessen your return in the future. This is why those who invest early have no trouble retiring early. Those who invest later may have to work longer before they can comfortably transition to retirement.

Tip #4 -Don’t Panic When You Lose

Investors who lose sleep over the recent drop in stock prices should realign their portfolios by reducing the ratio of stocks. If you see signs that it’s turning into a bear market (when the price decline is reaching 20% or more), you better act fast if your risk tolerance is low.

You’ll be better off if you lower your stock allocation immediately. You can protect your investment big time by simply adjusting your stock-to-bond ratio by 10% to 20% rather than buying or selling everything of any asset class. If you don’t invest a portion of your portfolio in stocks or any similar growth instrument, you would have to save more money or work longer to get enough retirement stash.

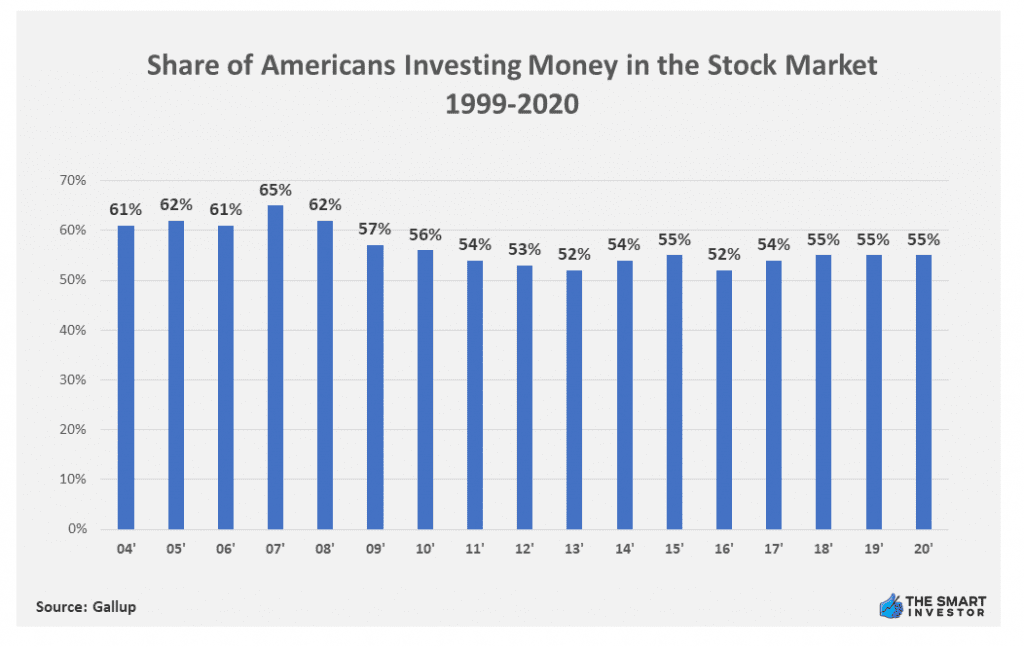

The percentage of Americans investing in stocks has remained steady since 1999, according to a report by

Drastic moves to your investment portfolio – like liquidating everything immediately – may appear to be a safe decision for the moment. But deciding at the height of emotions is never good for you when it comes to investing (or in any other area of life for that matter).

You must have a long-term investment plan that you can follow through the inescapable rollercoaster move of the market. If you follow your emotions, you’ll probably end up buying stocks near market peaks and selling them as they reach the market bottom.

Buy Gold and Silver Online

- Leader in the Precious Metals industry

- Over 1 million customers

- Authorized Purchaser of the US Mint

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Tip #5 – Market Expectations is Part of Investing

In reality, it is not the performance that dictates the price of an asset or a stock but the prevailing investors’ perceptions of how it will do. You must have heard of rags-to-riches stories in stock investing where a virtual unkown company hits it big and subsequently makes all of its stockholders rich.

Did you see the first qualification? The company was unheard of or little known. So many investors do not understand that the market’s expectations for a given asset make up the asset’s price.

Therefore, it is not enough to find an asset with above-average potential.

You need to look for an asset that will grow at a rate higher than the market’s expectation. In the case of stocks, it would involve you doing an exhaustive analysis of a company’s future growth rate better than what all the industry experts can come out with. It is equally formidable and inconceivable, if not totally impossible.

Tip #6 – Investing is Not Trading

You have to set your sights on transforming yourself to become a true-blue investor so don’t panic if your stocks are correcting and prices are going down. Look at it as an opportunity to bring in more shares to your portfolio. You need the patience to be an investor. It is always probable to go through tough times of recession. Impatient investors make bad decisions and lose money.

Patient investors wait and collect dividends.

Patient investors bide their time until a good moment to add more stocks to their portfolio and later get higher ROI. Both investing and trading follow the same golden rule of money management: to make more money, you need to reinvest your profits.

Tip #7 – Evaluate Your Risk Tolerance

Risk tolerance basically refers to how much variability you are willing to bear when it comes to your investments. Genes primarily determine your tolerance level but education, income and wealth positively influence it as time goes by.

As they increase, it appears that your tolerance level also increases. On the other hand, your risk tolerance goes down as you age. Your risk tolerance summarizes how you feel about risk and shows you the degree of worry you feel when you perceive that risk is present on your investments.

When you understand your risk tolerance, you can steer clear of investments that are likely to make you nervous. A good rule to follow is never to put your money in an asset that would make you lose sleep. Worry often leads to fear and can trigger emotional impulses instead of logical responses to the situation.

In times of financial uncertainty, the investor who can remain calm and follow the analytical decision-making process ultimately has more success.

Tip #8 – Learn How To Control Your Emotions

Some investors fail because of their inability to make logical decisions because they get carried away by their emotions. You could probably say that the current prices of assets if a reflection of the collective emotions of the investment community participants. When the majority of investors worry about an asset, they tend to bring down its price. When the majority feel positive about the company’s future, the price usually goes up.

So, it’s normal for investors to feel some anxiety and insecurity when asset prices do not move according to their expectations. If that happened to you, you would probably be asking yourself these questions: Should I sell my position and minimize my losses? Should I hold on to it and hope that the price will rebound? Will it be okay if I buy more?

But observe that even when things are going as you hope them to, you still ask some questions: Should I take this opportunity now before the price goes down? Should I stay because the prices will still go higher? These thoughts may flood your mind especially if you are always watching the price of a security.

Eventually, you will reach a point where the urge becomes so strong that it will force you to take action. And since your decision depended primarily on how you feel, the probability of making a mistake is very high.

Remember that when you buy a certain asset, you should already settle the question of why you are buying that particular asset and not another.

Therefore, you should have an expectation of what the price will do (if your reason is valid). At the same time, you should already make up your mind when to liquidate your holdings, especially if your reason proves to be false or if the asset does not react as you have projected. In short, have an exit strategy ready beforehand. Then, when the time comes, execute that strategy no matter how you feel.

Tip #9 – Consider Automating Your Investments

Dividing your money into four accounts (containers) may seem like a goofy idea but it’s actually a good approach. It’s also quite easy and there’s even a way to automate everything.

This is how it works. Start with your first container and fill it up. Once you fill up your first container, set up automatic instructions with your bank to transfer money from your checking account directly to your investment accounts. This way, you won’t have to do it yourself regularly – it’s a “set it and forget it” model. You can do this online or through your local bank.

You can find plenty of investing platforms that can automate your investments by seamlessly drawing money out of your bank account.

You simply input the frequency and amount that you want, their system will do the actual process. It works to your advantage to have an automated system take the money for your investments or savings when you get your paycheck. It lessens or removes the opportunity for you to spend it before you’ve set aside money for the future.

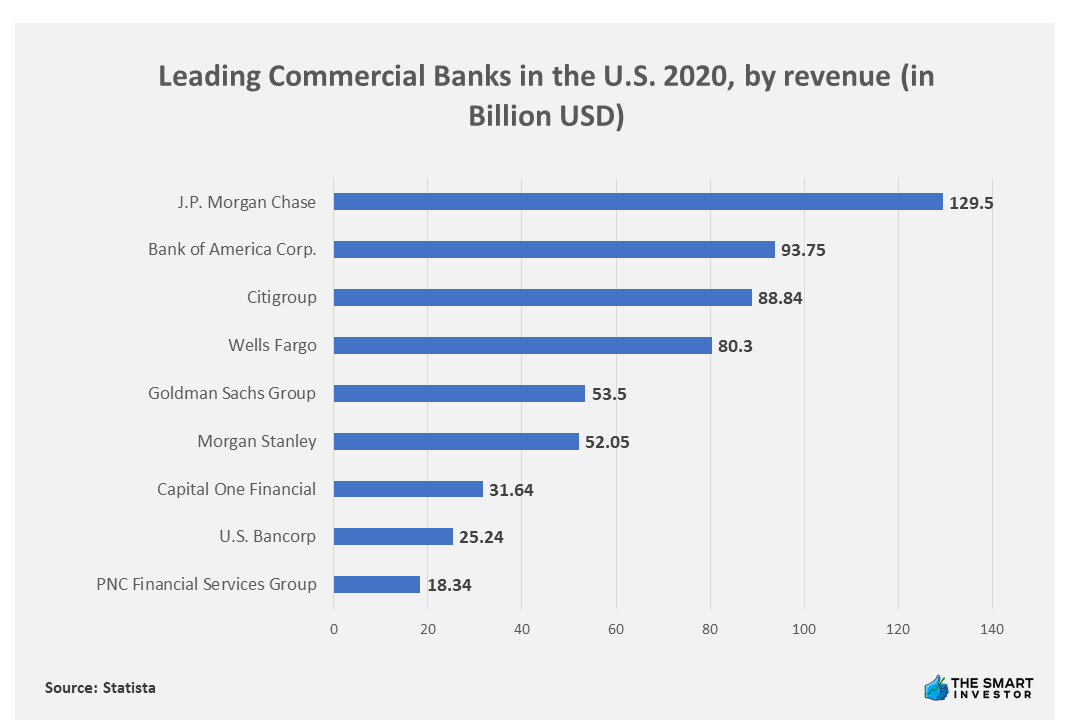

Data compiled by Statista in 2020 of the top 10 largest banks in the United States by revenue ranked JPMorgan Chase in the first position with $129.5 billion. Bank of America Corp took the second position with $93.75 billion, a notable 38.13% short of JPMorgan’s. From the bottom-up, PNC Finance Service Group took 10th place with $18.34 billion in revenue.

Tip #10 – Keep Investing in Yourself

You’ve read all the way here, so it shows you’re off to a good start. Remember that there’s plenty of information out there and this (relevant) information is valuable. Never say that you’re too old to learn something new.

You might need to filter the sources for your investing news and financial markets. Choose the ones from credible sources or those that are not afraid to recommend what’s the best for you. You have access to the Internet at any time and all the time. A single click could open millions of investment guides and tools for your benefit.

Keep in mind that investing in yourself will also reap dividends. But it may cover many different areas. Maybe it’s your knowledge of the stock market that’s developing. Or perhaps you’re learning from the experiences of other great investors who have walked the beaten path. You might also be investing in yourself by becoming more mature and level-headed in your decision-making. The big idea is to keep yourself growing by learning things.

Tip #11 – Don’t Skip on an Extensive Research

It’s surprising how many investors just go ahead and part with their hard-earned money without even spending sufficient time to probe the investment opportunities. They do a short cut by just relying on what “the experts say”, sometimes not even checking who these ‘experts’ are. It may work at first for a couple of times. But if you really want to make sure you’re making good choices, you have to do some groundwork.

The saying “Knowledge is power” is true even in the arena of investing. However, the financial market has its own set of confusing jargons, terminologies, abbreviations, acrostics, and initials that tends to confuse and flood the greenhorn. Try investing in a few financial literacy books that can give you more details about the principles involved in investing or on the stock markets. There are plenty of best-selling business books that can give you a crash course in investing that you may not have received before.

The other benefit is that good research into an investment gives you more confidence in your investment and lessens the anxiety that normally comes with any investment. Be sure you have a full grasp of what you’re venturing into with your money. If you don’t understand something, don’t buy it.

Ask questions, compare brokers and benefits, then ask more questions until you’re satisfied that you know everything you need to know about it. Never purchase an investment because the advertising materials look convincing or the salesperson recommended it to you.

Tip #12 – Make Sure to Diversify

One great way to protect yourself against the unpredictability of the market is to see to it that you have money in more than just one type of investment. Assemble a portfolio made up of bonds as well as stocks, and a mix of stocks in small and big companies in the U.S. and other countries. The fastest way to set up a mix of investments is by buying a mutual fund with a diverse portfolio. It lets you own a small portion of many stocks and/or bonds altogether.

- Diversify with asset types. Create a mix of assets like stocks, corporate bonds, government bonds, real estate, gold shares, and more.

- Diversify with sectors. Spread your investments to cover different sectors so that if one sector takes a big hit, the other sectors can stand. If all your assets are in real estate and real estate companies, a slump in the real estate market can considerably cripple you financially.

- Diversify with geography. Get assets from all over the place. If you own a mix of stocks, bonds, real estate, and other assets but they are all based in Japan, what would happen to your investment when the Japanese economy takes a downturn? Your investments will do the same.

You can consult a financial planner to arrive at the right asset allocation for you. A professional would be able to do this by taking into account your age, goals, and risk tolerance. Or, you may DIY by using an online calculator (like the one from Vanguard) to get a good picture. If you’re more of a hands-off type, you may try a target-date fund. It will automatically allocate your investments and make the necessary adjustments according to your timeline.

Tip #13 – Have Enough Cash on Hand

What we really want to happen is for you to reach your personal goals through investing. You can get the maximum benefit when you let your investment grow until their maturity dates. When you dip into them for major life events or emergencies, you lessen their value and effectively push your progress and timeline backward. So, before you start putting your money into investment assets, be sure that you have cash set aside for emergencies or at least an ample amount in your savings account. This is to prevent you from touching your investment funds or going into credit card debt when unforeseen events happen.

We’re following a rule of thumb of having an accessible emergency fund equivalent to three times your monthly expenses. If you don’t have one right now, make it a top priority to build up a rainy-day fund because you don’t know when a sudden expense will come up like house repairs or hospital bills. Once you’ve taken care of this, you can build up your investments without financial interruption because you have a fund to cover emergencies that may come up.

Tip #14 – Set Long Term Goals

Before you even start scouting for investment opportunities, you have to assess your present situation and look forward to where you want to go down the road.

If you think you can’t be in the market for the long haul, then don’t even bother getting started. The real value in investments comes in the long term so forget about those “get rich quick” investment schemes.

Here are the questions to ask yourself:

- Where do I want to be financially in the next five years? The next 20 years?

- How much do I have now that I can invest?

- How much do I expect to earn over time?

- How long should I keep on investing?

- What do I expect as contributions over time?

- Which investment options are ideal to start with that fit both my long-term goals and my current finances?

- Once I’m in gear, what adjustments should I make over time so that I can stay on track towards my goals?

A major benefit of investing is how it systematically sets up your money to grow it efficiently until you reach your goals. For example, you may desire to retire at 60 or buy a new home within the next 10 years, or just spend a year off from work to take a world tour.

Whatever it is, you’ll want to time your investments so that their fulfillment coincides with the time that you’ll need access to your money.

Tip #15 – Take Advantage of Your Employee Benefits

Often, large companies offer avenues for you to invest conveniently through direct payroll deduction that sometimes come with tax benefits and discounts. Some companies even allow their employees to buy company stock at reduced prices or easy terms.

When it comes to retirement savings plans, 55% of American adults save their money using a regular saving account, according to T. Rowe Price. 401(k) plan closely follows by a margin of 54% of the respondents.

Usually, the most valuable benefit you can get is a retirement savings plan such as a 401(k) which permits you to make a contribution and enjoy current income tax benefits.

And after you have put in the money into your account, it can compound and grow over the years tax-free. If your employer offers to match your contribution, contribute enough to reach the maximum or try to work your way up towards it.

Supposing that a 401(k) is not feasible, or you’re already enjoying a match, check if you can get a Roth IRA. Unlike a traditional IRA or a 401(k), it won’t let you avail of a tax break on contributions although is offers something that could eventually be of more value. When you take your money out during retirement, the federal government won’t tax you anymore. You read right – your contributions and earnings grow tax-free.

If you are self-employed, you really need to establish and use a retirement plan. Set aside time to learn about what is the best investment option in your situation. Then, go ahead and take it.