Table Of Content

The Platinum Card® from American Express, also known as the Amex Platinum, is well known for its travel rewards and range of other cardholder benefits. It is no introductory credit card though, requiring a good to excellent credit score and a hefty $695 annual fee (See rates & fees).

Amex is well known for keeping their requirements to themselves, however, they also rely on data about their existing customers and will offer more prestigious cards, like the Platinum, to customers with good payment histories. Below we explore some of the details you need to know about one of the world’s most premium travel credit cards.

What Credit Score Is Required For An Amex Platinum Card?

According to our research, you can get the Amex platinum card if you have 680+, the higher your score, the higher your chances to get approved.

American Express does not disclose exact requirements for its cards, therefore the ranges above are based on past applicants. If you’re an existing Amex customer they will also rely on their internal data about your payment history, which may enable you to apply with a lower credit score than non-customers.

Below are some real approvals in 2022:

- Approved with credit score of 780 and utilization (portion of maximum credit used) of 15%. Amex did “hard” inquiries using Experian and TransUnion.

- Approved with 749 Experian credit score. Customer had existing relationship with Amex, holding both Hilton Honors and Everyday Card with $1,000 limits.

- Approved with 736 Experian credit score with a personal bankruptcy in 2016.

- Approved with 645 Experian after rebuilding credit following a divorce. This applicant was originally told more information was needed before being approved.

Credit scores range from 300 to 850, with higher scores showing a strong ability to pay back debts on time. If you don’t know your score, you can request it for free at annualcreditreport.com.

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

Additional Requirements to Get the Amex Platinum Card

Based on previously successful applicants, there are several recommendations outside of what Amex strictly requires that will boost your chances of acquiring the Platinum card:

- A clean credit history for at least 2 years. This is similar to Chase’s 24/5 policy in which they automatically deny applicants who have opened 5 credit cards in the past 24 months. A “clean” history doesn’t mean no cards opened, it does however mean no non- or late payments.

- Steady income of above $50,000. As we describe below, your financial resources are a major factor and although Amex doesn’t stipulate a cut-off salary it’s still best to have income of at least $50,000 for the past few years.

Lastly, are you an active-duty service member? Amex waives the annual fee of $695 if you are active and your military status may help your application.

Which Documents Should I Provide When Applying?

American Express says you will need the following to apply for a credit card:

- Personal information: including your current address – this means government-issued identification, passport or SSN that you can acquire by applying online or at your local DMV

- The current e-mail address and phone number

- Financial information: including current annual income, employment details (with work contract phone number) and other income sources. Ask your HR department for a letter outlining your length of employment, current title and salary, plus any bonus programs you are eligible for.

Remember that Amex needs to assess if you are going to pay your debt on time. This is the purpose of the credit inquiries (from Experian and other bureaus) that Amex will request based on your personal information.

If you are near or slightly below the Amex Platinum card’s unofficial credit score cut-off of 700, make sure you are prepared to show information on any:

- Recent raise

- Newly-acquired part-time or “gig economy” work

- Rental or other types of incomes

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Is The Credit Score Needed For An Amex Platinum Card Higher Than The Capital One Venture X?

No, Capital One Venture X requires a higher score of 720+ versus 700+ for the Platinum card from Amex. Both are considered premium travel cards packing serious benefits to those wanting to make the skies their home.

Capital One prefers not to issue more than one personal credit card to customers. It also pulls your credit history from all 3 providers (Equifax, TransUnion, and Experian) – issues at any one of these may derail your chances of being approved.

Is The Credit Score Needed For An Chase Reserve Card Higher Than The Amex Platinum?

Yes, although it is tricky to know exactly what score each company requires, the general rule for Chase’s Sapphire Reserve card is a credit score of 740+ versus a score of 700+ for the Amex Platinum.

There will always be exceptions to these ranges when applicants can clearly show their ability to pay is better than their credit score shows.

Chase has an additional policy, called the 5/24 rule, which automatically denies applicants who have opened 5 credit cards in the past 24 months. Although “New Credit” (number of credit accounts you've recently opened) is already a component in Experian’s credit score, Chase likely felt it needed an extra letter of protection from customers unable to juggle their cards.

Have excellent credit and can’t decide between the two? Amex’s Platinum is geared more toward luxury travel while Chase boasts better flexibility in travel.

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X | |

Annual Fee | $695 | $550 | $395 |

Rewards | 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

1X – 10X

|

Welcome bonus | 80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Which Amex Cards You Can Get With A 650 Credit Score?

Most Amex cards require good credit of 670+ but there are exceptions to this. Since there are differences in score depending on the provider, the 650 should be using the FICO Score 8 model by Experian as this is the one Amex uses.

- Delta SkyMiles Gold – One option is to apply for a co-branded card like the Delta SkyMiles Gold which comes with lower requirements and an annual fee is $150, $0 intro first year.

- Green Card – The Green card is another popular option that has been approved for applications with credit scores from Experian as low as 659.

- Gold Card – Approvals show the Gold card has been approved for applicants with scores just above 650, especially if other factors are strong, and sometimes for even lower scores.

While all three of these cards have been approved for applicants with credit scores of around (or even less than) 650, there are usually other factors boosting their chances of success, including: an existing relationship with Amex, rebuilding trend in credit history over past few years or high income level.

What Other Factors Amex Consider?

A high credit score is not the only factor in successfully applying for an Amex card. Providers know that your ability to pay off the card is boosted by any of the following:

- Recent move to a better-paid job

- Promotion with higher salary

- Paid off debt

Since it can take time for the above to be reflected in your credit score, one approach to being approved is simply to wait while your score catches up to your new real

Card | Rewards | Bonus | Annual Fee |

| 1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

| $250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

| $95 ($0 intro for the first year) |

|---|---|---|---|---|

| 1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

| 10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

| $0 | |

| 1.5%

unlimited 1.5 percent cash back on all purchases

| $150

$150 statement credit for spending $1,000 in the first 3 months of account opening

| $0 | |

| 1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| 40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

| $150, $0 intro first year | |

| 3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 70,000 points

70,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 |

Things to Know Before Getting The Amex Platinum Card

Here are a few key considerations before you go ahead and apply for the Amex Platinum card:

- Annual fee – First of all, will you earn enough benefits to justify the $695 annual fee? You can do some rough calculations based on your past expenditure and the card’s points rewards to find the answer. Remember, the sign-up bonus is a one-time benefit and should not be included in this calculation.

- Welcome bonus – Next, do you spend enough to earn the welcome bonus? If you will have to significantly change your spending to do so, it’s worth considering other options or waiting until you have a large expense in your near future.

- Travel habits – The Platinum card is targeted at frequent travelers who want access to hotel, airport lounge and airline benefits. You should look at not only whether you fly often enough but also whether you will fulfill the particular conditions, such as a two-night stay minimum at hotels pre-paid using your card.

- Shopping habits – You will reap the most benefits from the Platinum card if you already use or plan to use the perks on offer. These include Walmart+ (includes Paramount+ for streaming), the digital streaming package (includes Disney, ESPN+), Saks Fifth Avenue and Uber Eats. If these are inconvenient or undesirable, you should make sure the other, mainly travel benefits, make up for it.

- Protection services – The Platinum goes beyond the usual insurance benefits common to most credit cards by offering extended warranty (subject to exclusions) and cell phone repair or replacement, for example. Consider your current insurance coverage and whether additional coverage from your new card is a true benefit to you.

Why My Application Was Rejected And What Can I Do?

One reason why applicants are rejected by Amex is due to having a large credit limit on an existing Amex credit card.

This can be mystifying to applicants at first, but from Amex’s perspective it makes sense to limit their total exposure to a single customer – this is simple diversification on their part. The solution, according to rejected candidates, is to call in and offer to reduce the credit limit on another card.

Amex asks that you call if your application was rejected so the decision can be reviewed over the phone. There is no guarantee of being approved as a result, however, it will help you understand how to proceed in the future. They also insist you wait at least 30 days before re-applying.

Top Offers

Top Offers From Our Partners

Top Offers

FAQs

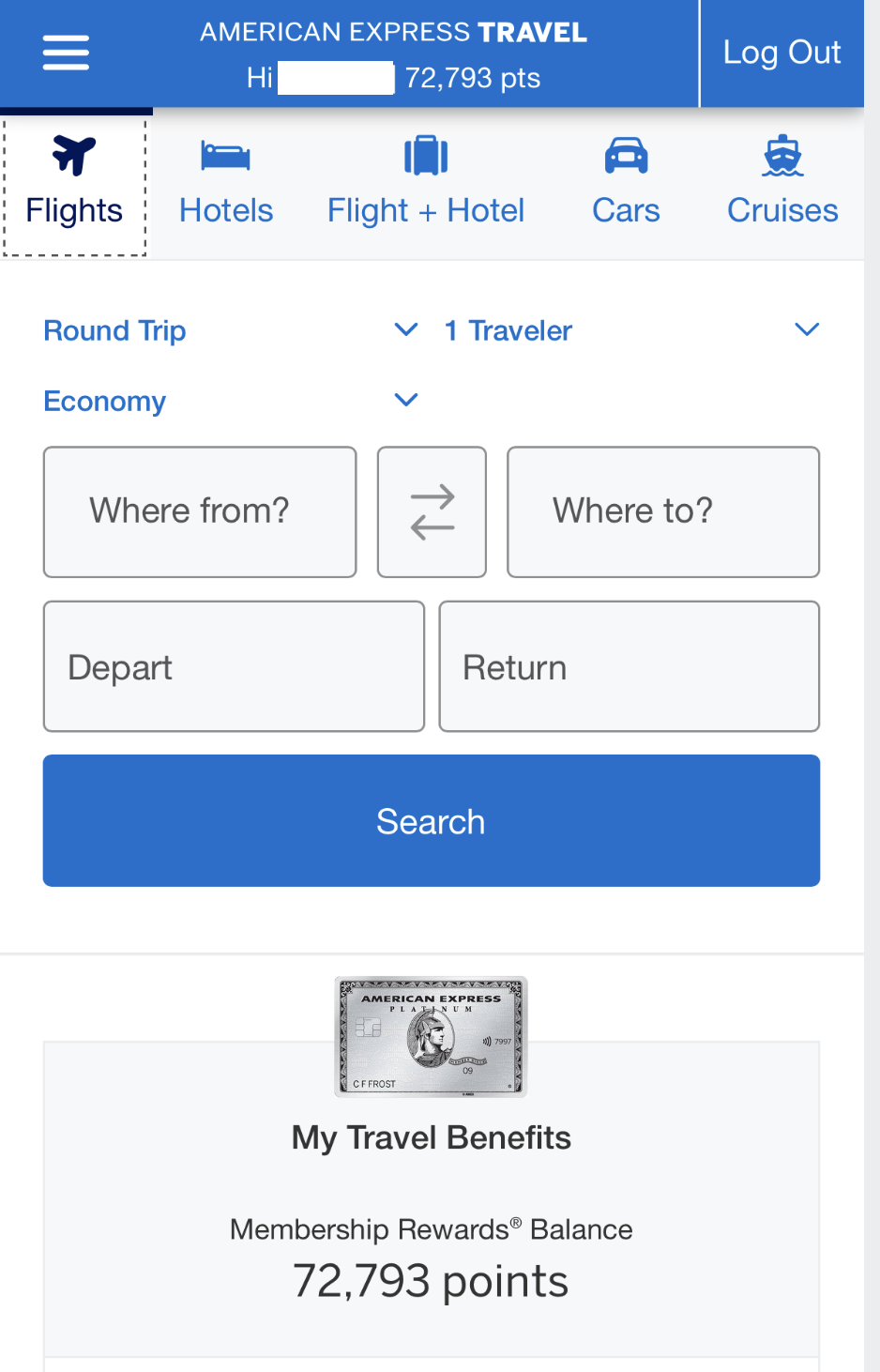

Yes, pre-approval for the Platinum card is possible. Pre-approval letters are sometimes mailed out to people likely to be approved –but remember pre-approval is not a guarantee– and Amex may offer it to existing customers.

Yes, Amex offers two options for checking your credit. First, for non-members, you can enroll in MyCredit Guide here and find your score provided by VantageScore® 3.0 by TransUnion.

Card members have access to Experian data and the FICO Score 8 model. Both are free with the major difference being that Amex uses Experian in making credit decisions, not TransUnion.

For existing customers, Amex uses the information they have on file to conditionally approve you.

Only once you are approved do they perform a “hard” credit inquiry to make sure nothing has changed. If you a new customer, Amex will need a hard inquiry to process your application.

MyCredit Guide is available on phone and tablet over the Amex app, allowing you access to your free VantageScore® 3.0 credit score and alerts when a change occurs.

It also includes a Simulator, where you can see the impact of your financial actions on your score before you make them, and Goals to help you improve your score over time.

Short term, yes. The “hard” inquiry required for a credit card application will negatively impact your credit score temporarily, for up to a year.

That said, some people will see no impact from the inquiry. You can limit the impact by only applying for one card at a time.

There is no denying the Amex Platinum comes with a steep annual charge. $695 annual fee (See rates & fees) is the second highest fee between Amex cards.

Nevertheless, for frequent travellers especially, the card’s credits and other perks can more than cover this cost.

Very likely, yes. The updated Amex Platinum allows members free Walmart+ membership and this comes with $0.10 off (per gallon of gas) at Walmart, Murphy USA, Murphy Express, Sam's Club, Exxon, and Mobil gas stations (enrollment required). With gas prices as high as they are, this translates to a 2.5% discount.

All information about American Express Everyday® Card and American Express Cash Magnet® has been collected independently by The Smart Investor. American Express Everyday® Card and American Express Cash Magnet® are no longer available through The Smart Investor.