Table Of Content

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

The Platinum Card® from American Express is the pinnacle of travel reward credit cards. This card is often lauded as one of the best rewards credit cards and many aspire to qualify for it.

While it has a hefty annual fee , this card does have a comprehensive benefits package, which should offset the cost for the right account holder.

So, here we’ll explore the Amex Platinum Card benefits in more detail to help you decide if it is a good choice for you.

1. Earn Point Rewards For Amex Membership

The main benefit of the Amex Platinum card is the ability to earn rewards and redeem them for flights, hotels, experiences, gift cards and many more options.

Here are the main point reward benefits

-

Tiered Reward Structure

The most obvious benefit of this card is that it has a tiered reward structure offering 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases.

-

Welcome Bonus

There is also a generous point bonus for new cardholders – 80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership.

The points will be added your Amex membership account as soon as you reach the relevant threshold.

-

Additional Gold Card

You can add an additional Gold card to your account with no annual fee, allowing you to earn Membership Rewards points on eligible purchases made by your additional card members.

-

Incircle Points

With a Platinum card, you can earn Incircle points, and for every 10,000 points you accumulate, you’ll receive a $100 Incircle Point card, which you can use towards purchases at Bergdorf Goodman, Horchow, Last Call and Neiman Marcus.

-

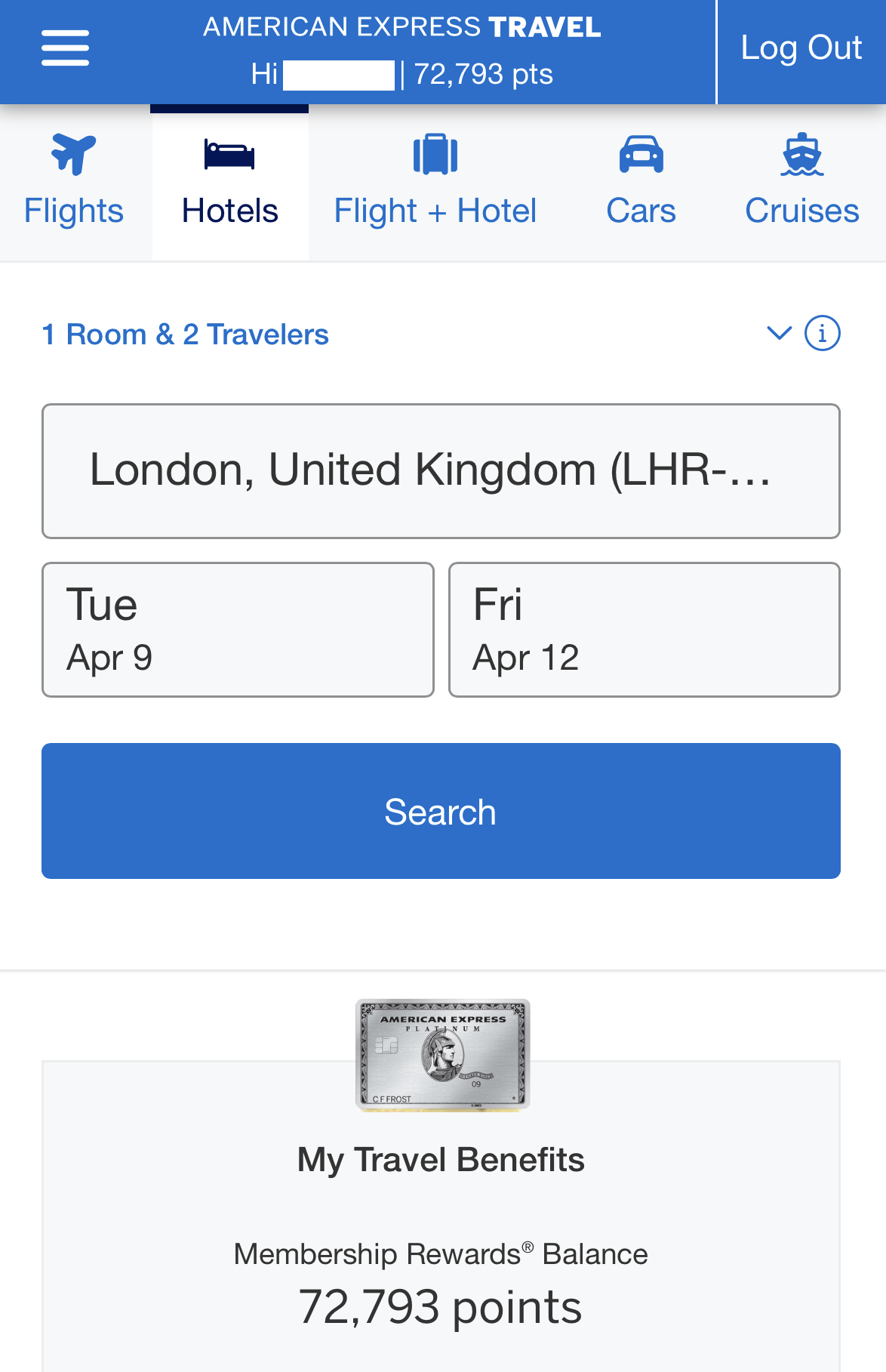

How To Redeem Point Rewards Benefits

If you want to redeem your accumulated card rewards, Amex makes it very easy. You can log into your account to check your points balance at any point and browse the available rewards via the membership rewards site:

Statement credits: You can use your points to cover eligible purchases on your credit card statement.

Flights And Hotels: You can use your points to book travel through Amex's travel portal or transfer them to partner airlines and hotels.

Gift cards: You can redeem your points for gift cards to popular retailers and restaurants. .

Merchandise: You can use your points to purchase a variety of products, including electronics, home goods, and more. The value of the redemption varies widely and is often lower than other options.

Shopping and entertainment: You can use your points to purchase tickets to concerts, sporting events, and other experiences. The value of the redemption varies widely depending on the event or experience.

Charity donations: You can use your points to donate to a variety of charities. The redemption value per point is typically low, but it can be a great way to support a cause you care about.

2. Dining And Travel Credits

The Amex Platinum card offers a bunch of credits:

-

Airline Fee Credit

When you nominate one qualifying airline, you can receive up to $200 of statement credit each year to reimburse you for incidental fees such as in flight purchases and checked bag fees when you pay with your Platinum card.

-

Walmart+ Credit

If you use your card to pay for your Walmart+ monthly membership cost, you’ll receive a statement credit of up to $12.95 per month.

-

Hotel Credit

You’ll receive up to $200 in statement credit as reimbursement for prepaid bookings made via The Hotel Collection or the Fine Hotels and Resorts collection, when you pay with your card (2 night minimum stay required).

There is also up to $100 credit that you can use to cover select activities such as spa treatments or dining, depending on the specific property.

-

CLEAR® Plus Credit

Clear membership allows you to move faster through select airport security nationwide using digital identity verification.

When you pay for the Clear membership cost with your Platinum card, American Express will reimburse you for up to $189 per year in the form of statement credit.

-

Global Entry or TSA PreCheck Credit

You can receive a statement credit of $100 for Global Entry or a credit of up to $85 for TSA PreCheck after applying through an Authorized Enrollment Provider.

However, only one credit can be given per 4-year period for Global Entry or 4.5-year period for TSA PreCheck.

-

Uber Cash Credit

When you link your Uber account to your Platinum card, you’ll receive $15 of Uber Cash per month to spend on eligible orders with Uber rides and Uber Eats.

There is also a $20 bonus each December. You will also receive Uber VIP status automatically without needing to meet the minimum ride requirements.

-

Equinox/SoulCycle Credit

When you use your card to pay for Equinox+ or any Equinox club membership, you can receive up to $300 of statement credits per year against your purchases. However, you do need to enroll via the Platinum website to qualify.

You can also receive up to $300 of statement credit when you use your card to purchase a SoulCycle at home bike.

-

Saks Statement Credit

When you pay for purchases at saks.com or at Saks Fifth Avenue with your card, you’ll receive up to $100 of statement credit annually as partial reimbursement for your charges.

-

Digital Entertainment Credit

You can receive up to $20 of statement credits per month when you use your card for eligible digital entertainment purchases such as Disney+, Hulu and Peacock.

-

How To Redeem Annual Credit Benefits

If the benefit is statement credit for purchases or charges, these should be automatically applied to your account.

If you’ve had a charge on your account, which should qualify for statement credit and it has not appeared on the following statement, you can call the customer support line, who will advise you if the statement credit has been processed.

Top Offers

Top Offers From Our Partners

Top Offers

3. Travel Benefits

The variety of the travel benefits it offers, makes this card as one of the top cards for travelers. Here are the main travel perks it offers:

-

Access to the Global Lounge

The American Express Global Lounge network has over 1,400 lounges in airports across 650 cities and 140 plus countries.

Your Amex Platinum card provides access to these lounges when you travel, so you can rest, relax or even work before your flight.

-

International Airline Program

You’ll have access to the International Airline Program through American Express Travel to enjoy savings on First, Business and Premium Economy international seats for up to eight tickets per booking.

This service is available on 20 plus airlines but your travel needs to originate in and return to the U.S to qualify.

-

No Foreign Transaction Fees

You can use your Platinum card when you’re traveling, even if you’re outside of the U.S without incurring any foreign transaction fees.

While the standard foreign transaction fee is typically around 3% (See rates & fees), this can quickly add up when you’re on vacation or traveling for business.

-

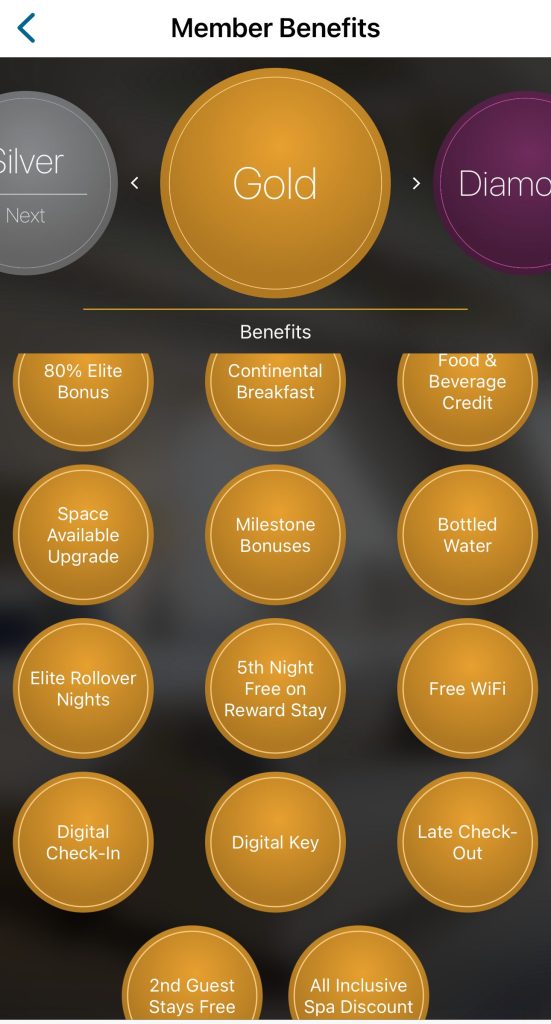

Hilton Honors Gold Status

As an Amex Platinum cardholder, you’ll have eligibility to enroll in the Hilton Honors program with complimentary Gold status.

-

Marriott Bonvoy Gold Elite Status

You’ll also receive complimentary Gold Elite status with the Marriott Bonvoy program to receive upgrades and enhanced rooms where available when you check into Marriott Bonvoy locations.

-

Exclusive Dining and Experiences

You can link your Platinum card to your Resy profile and unlock access to special dining experiences and exclusive reservations.

There is also Invitation Only experiences offering once in a lifetime events that are exclusively curated for Platinum card members. This varies from fine dining and art to fashion and sporting events.

You can also enjoy Preferred Access for premium seats for sporting and cultural events, but this is subject to availability.

-

Premium Status for Car Rental Programs

As a Platinum card member, you’ll be eligible to receive complimentary premium status for participating car rental programs.

This provides access to discounts and additional benefits. The participating programs include Avis Preferred, National Car Rental Emerald Club and Hertz President’s Circle.

You can view the specific privileges online via your Platinum card account dashboard. You’ll receive a code to enter into your booking to receive the free upgrades and any discounts.

-

Premium Assist Global Helpline

If you’re more than 100 miles away from home, you can call the helpline for assistance with legal, medical, financial or other emergencies around the clock.

The assistance is provided at no cost, but you may incur expenses charged by any third party providers.

-

Platinum Card® Concierge

The American Express Platinum Card Concierge is a complimentary service available to American Express Platinum Cardholders that offers personalized assistance with a wide range of travel, dining, and entertainment needs.

-

ShopRunner Membership

As a ShopRunner member, you can enjoy delivery of qualifying purchases in approximately two days with free shipping on your returns. This service is available at 100 plus online stores.

-

How To Redeem Travel Benefits

In most cases, all you need to do to redeem third party benefits is to link your Platinum card to the appropriate platform or account.

However, there are some benefits that require you to enroll. Be sure to read the terms of conditions for specific benefits to see which action is required

4. Travel Insurance And Protections

In addition to point rewards and annual credits, The Amex Platinum card offers a variety of travel insurance and protections:

-

Car Rental Insurance Cover

When you use your card to reserve and pay for your rental vehicle and decline the collision damage waiver at the counter, you’ll receive Damage to and Theft of coverage as a card benefit.

This is secondary coverage and it is not available for all rentals and in all territories, so you’ll need to check the terms and conditions before you book a rental vehicle.

-

Trip Delay Coverage

If you pay for your round trip with your card and you experience a delay of more than six hours due to a covered reason, you’ll receive reimbursement for additional expenses incurred up to a maximum of $500 per trip and a maximum of two claims per 12 month period.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

-

Trip Cancellation Coverage

If you purchase your round trip with your card and your trip is interrupted or canceled by a covered reason, this coverage can help to reimburse for any non refundable expenses up to $10,000 per trip and $20,000 per 12 month period.

The high amounts of coverage make this card very appealing when it comes to travel insurance.

-

Return Protection

If you wish to return an eligible item within 90 days of purchase and the merchant refuses to take it back, you may be able to receive a refund via American Express.

You must make the purchase with your card and there is a cap of $300 per item and $1,000 per calendar year. The refund will also exclude any shipping and handling charges.

-

Purchase Protection

You can also enjoy purchase protection on eligible items when you use your card. You’ll get up to 90 days of coverage against theft, loss or accidental damage. There is also an extended warranty for covered items up to five years.

-

Cell Phone Protection

If you pay your bill with your Platinum card, you will be reimbursed for any costs needed to repair or replace a stolen or damaged cell phone up to a cap of $800, with a $50 deductible.

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

How to Get an Amex Platinum Card?

Since this is a premium card, you will need to meet higher requirements to qualify. In addition to needing a good to excellent FICO score of approximately 700 or higher. However, American Express will also need to confirm that you have sufficient income to support the card requirements.

If you’re unsure if you would qualify for the Amex Platinum, you can check if you can be pre-approved on the American Express website. You can simply click the blue “Apply for Pre Approval” button on the Platinum card product page.

You’ll need to enter some basic personal information and Amex will check if you are likely to qualify without initiating a hard credit pull. Your credit will only be affected if you decide to proceed with a full application, at which time Amex will use a hard credit pull to complete your application.

You can also apply for a Platinum card if you receive a mailer. In this case, you’ll need to enter the reference code from the mailer into the website application page or call the Amex customer support line.

While it's a highly lucrative and premium card, it may not be the best option for all customers. If you feel it's not a card for your needs, you can explore other Amex cards.

Top Offers

Top Offers From Our Partners

Top Offers