Robinhood | Webull | |

Monthly Fee | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | $0

May be charge specific fees for trading such as stock options, futures, transfers etc

|

Account Types | Brokerage, Retirement, Crypto | Brokerage, Retirement |

Savings APY | 0.01% – 5.00%

You’ll earn 0.01% Annual Percentage Yield (APY) on your uninvested brokerage cash, or 5% for Robinhood Gold members. | 5.00% |

Minimum Deposit | $0 | $0 |

Best For | Active Traders, Tech Savvy Investors | Advanced Traders, Active Investors |

Read Review | Read Review |

Webull vs Robinhood: Compare Investing Features

Robinhood is well-known for its commission-free trading of stocks, options, ETFs, and cryptocurrencies. The user-friendly app appeals particularly to active, tech-savvy traders or investors.

Webull is recognized for its comprehensive set of advanced trading tools. It provides in-depth charting capabilities, a wide range of technical indicators, and customizable screeners, making it ideal for active traders who rely on technical analysis.

Webull is better suited for experienced traders needing robust analytical tools, whereas Robinhood caters to beginners and those who prefer simplicity and ease of use.

Robinhood | Webull | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | 10,000 US stocks and ETFs. |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares | Stocks, Options, Futures, ETFs, OTC, Margin, Fractional Shares |

Financial Planning | No | No |

Automated Investing | No | Yes |

Paper Trading | Yes | Yes |

Tax Loss Harvesting | No | No |

IPO Access | Yes | Yes |

-

Self Investing And Trading Options

Robinhood is a clear winner when it comes to investing for beginners, while Webull may be a better option if you're an advanced trader.

Robinhood's self-investing platform allows users to buy and sell a variety of assets, including stocks, ETFs, options, and cryptocurrencies. Robinhood also offers options trading and access to futures and commodities.

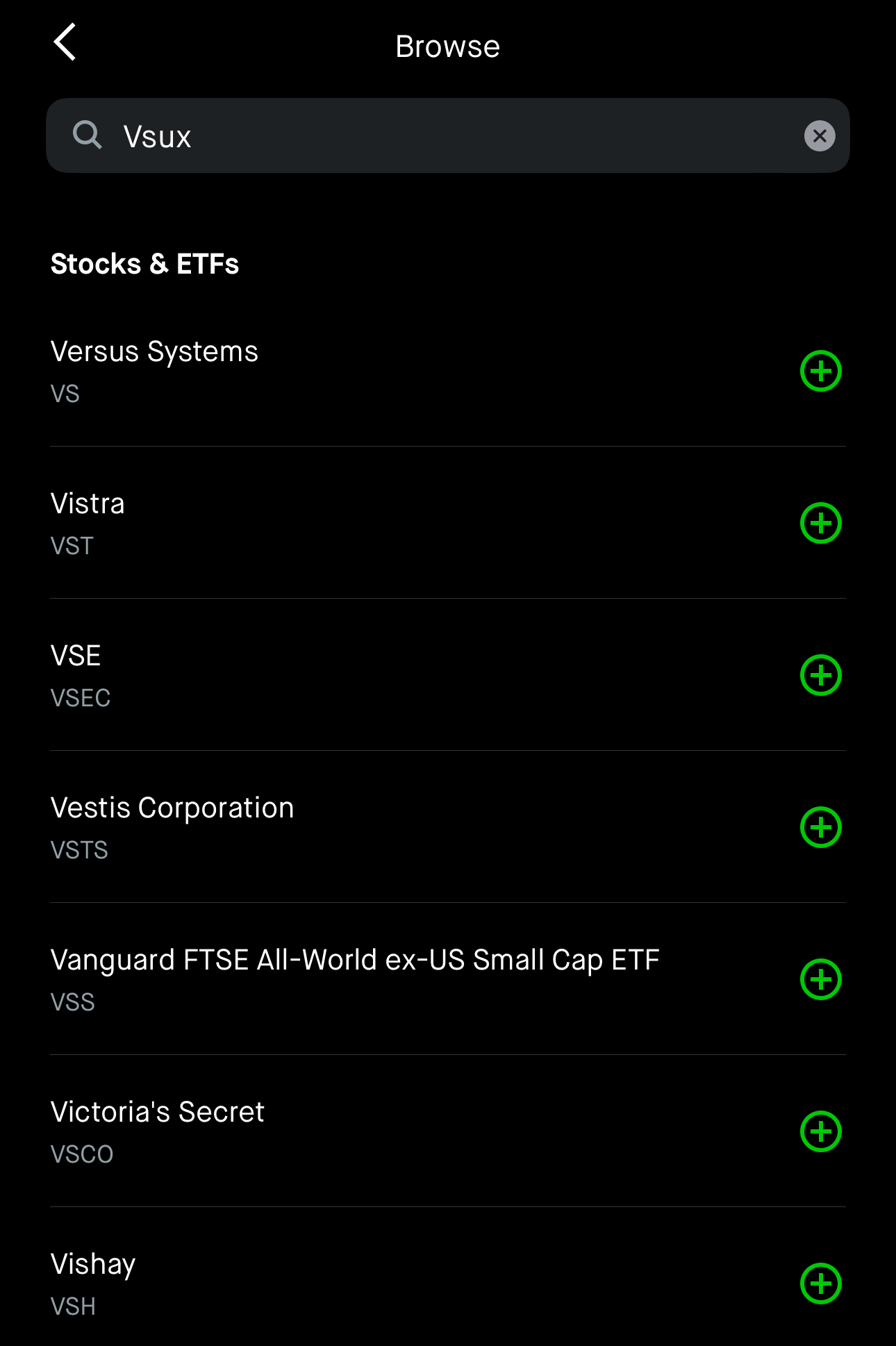

This flexible and customizable approach allows users to select investments from a pool of over 5,000 securities, including most U.S. stocks and ETFs listed on U.S. exchanges. You can browse them easily on the app:

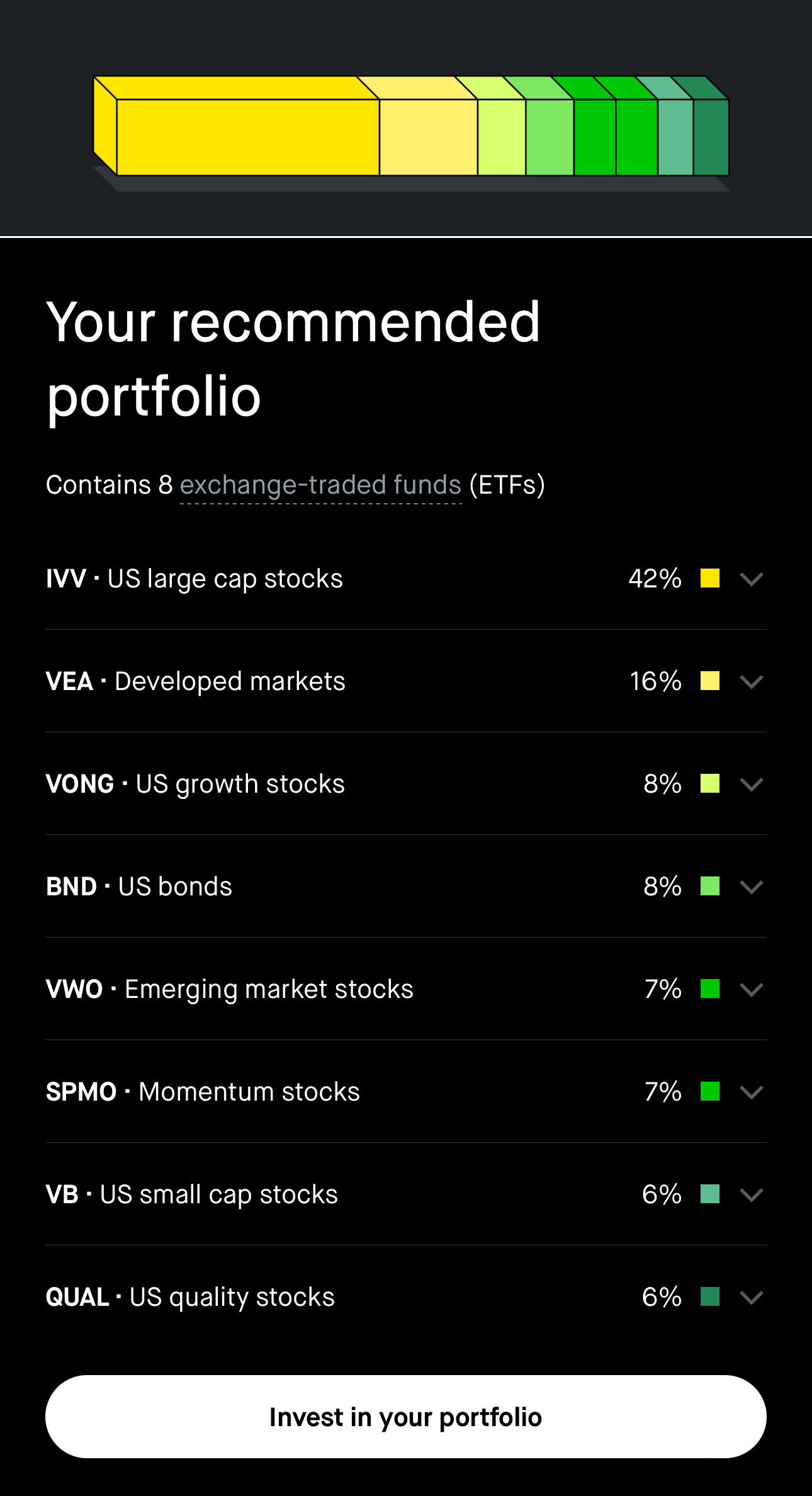

Based on your risk tolerance and goals, Robinhood can offer you a recommended portfolio. Here's an example:

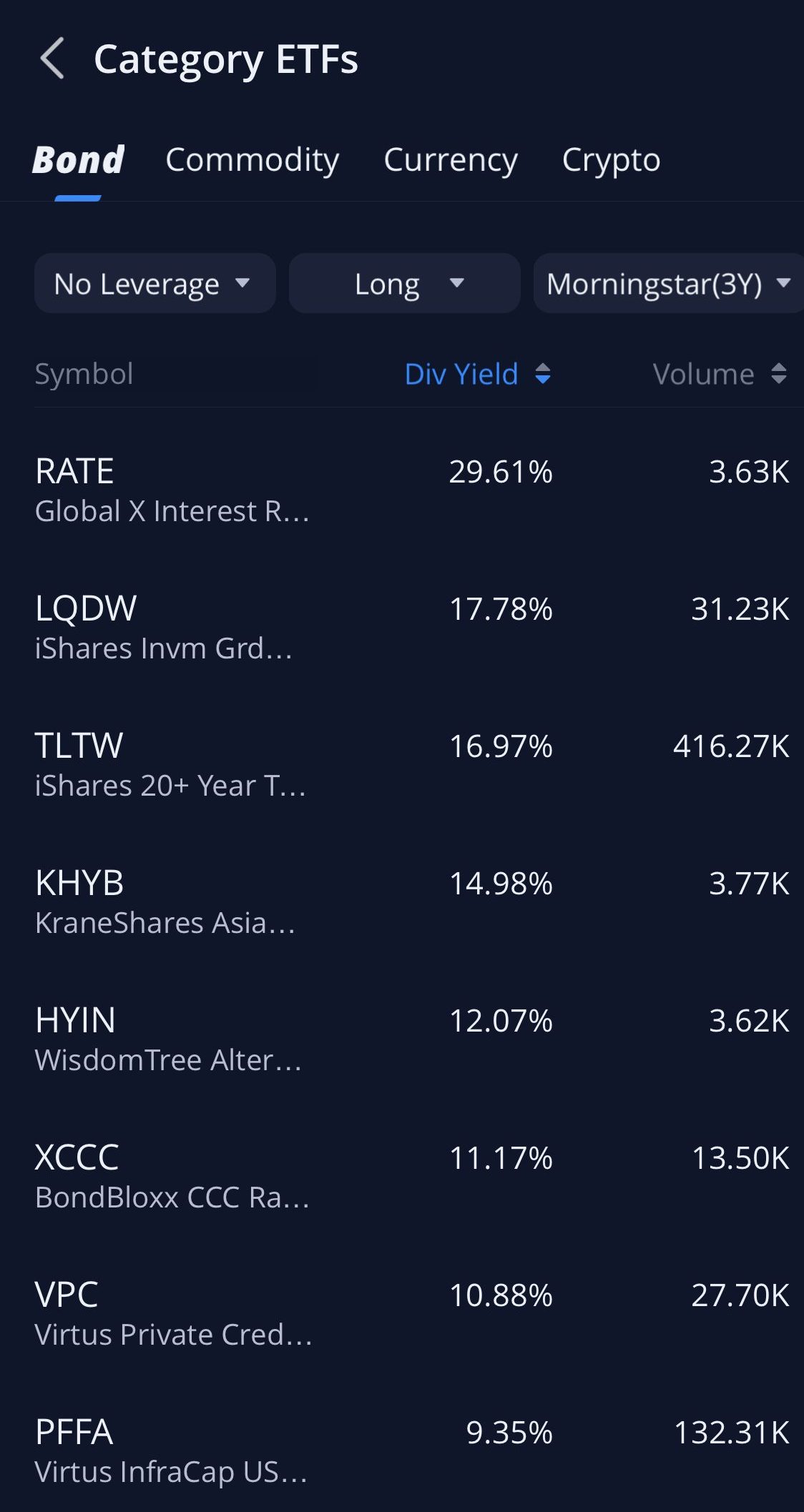

Webull's self-investing platform allows users to trade a variety of financial instruments including stocks, options, index options, futures, ETFs, and OTC stocks.

It supports margin trading, enabling investors to borrow funds to increase their purchasing power. Similar to Robinhood, traders and investors can also invest in fractional shares, allowing them to buy smaller portions of expensive stocks.

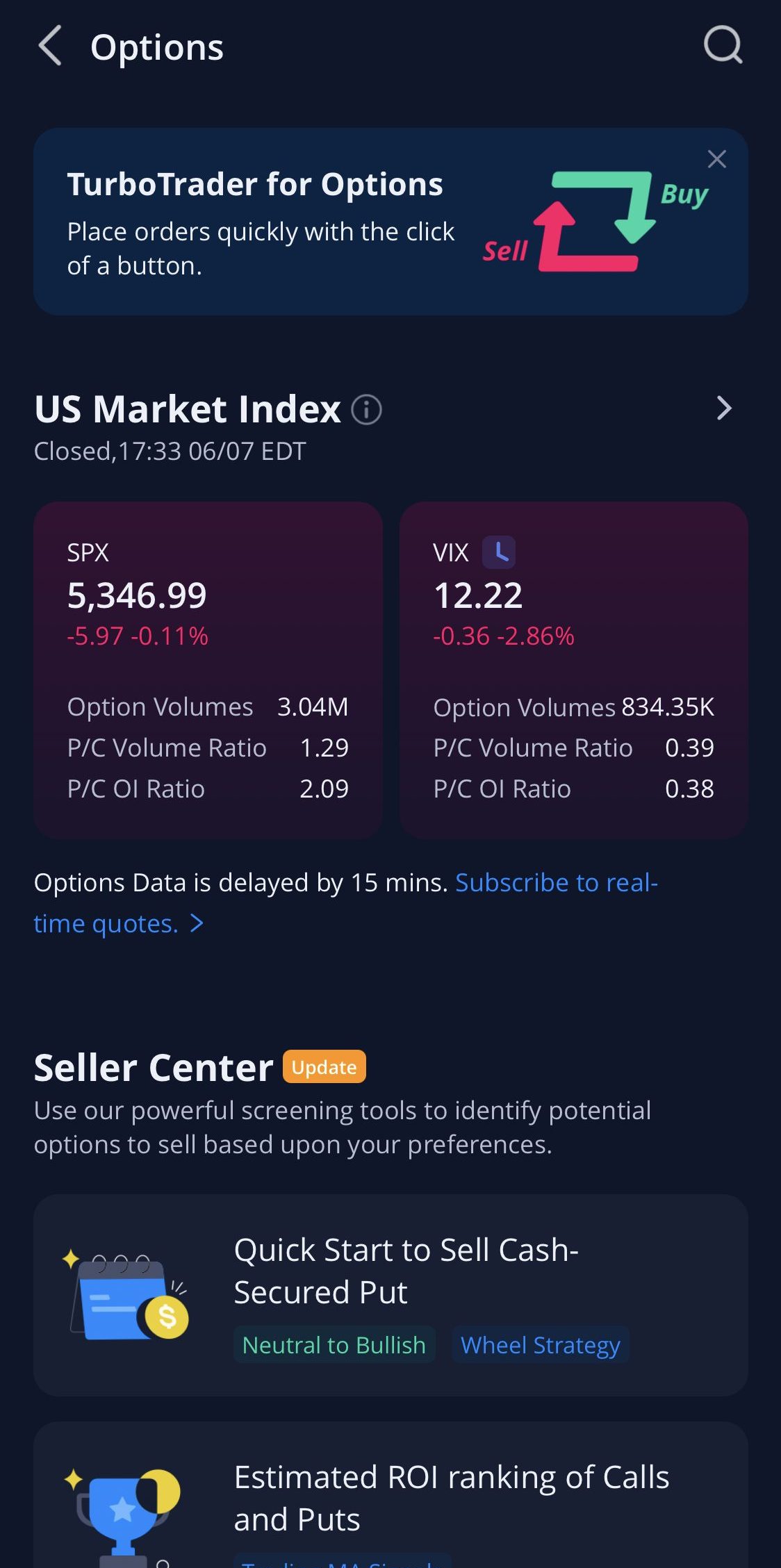

Customers can also easily trade options:

One of the main strengths of Webull is their advanced charting tools and technical indicators.

-

Managing Retirement Accounts

Robinhood options seem more attractive due to their additional benefits. But overall, both companies offer quite similar retirement products.

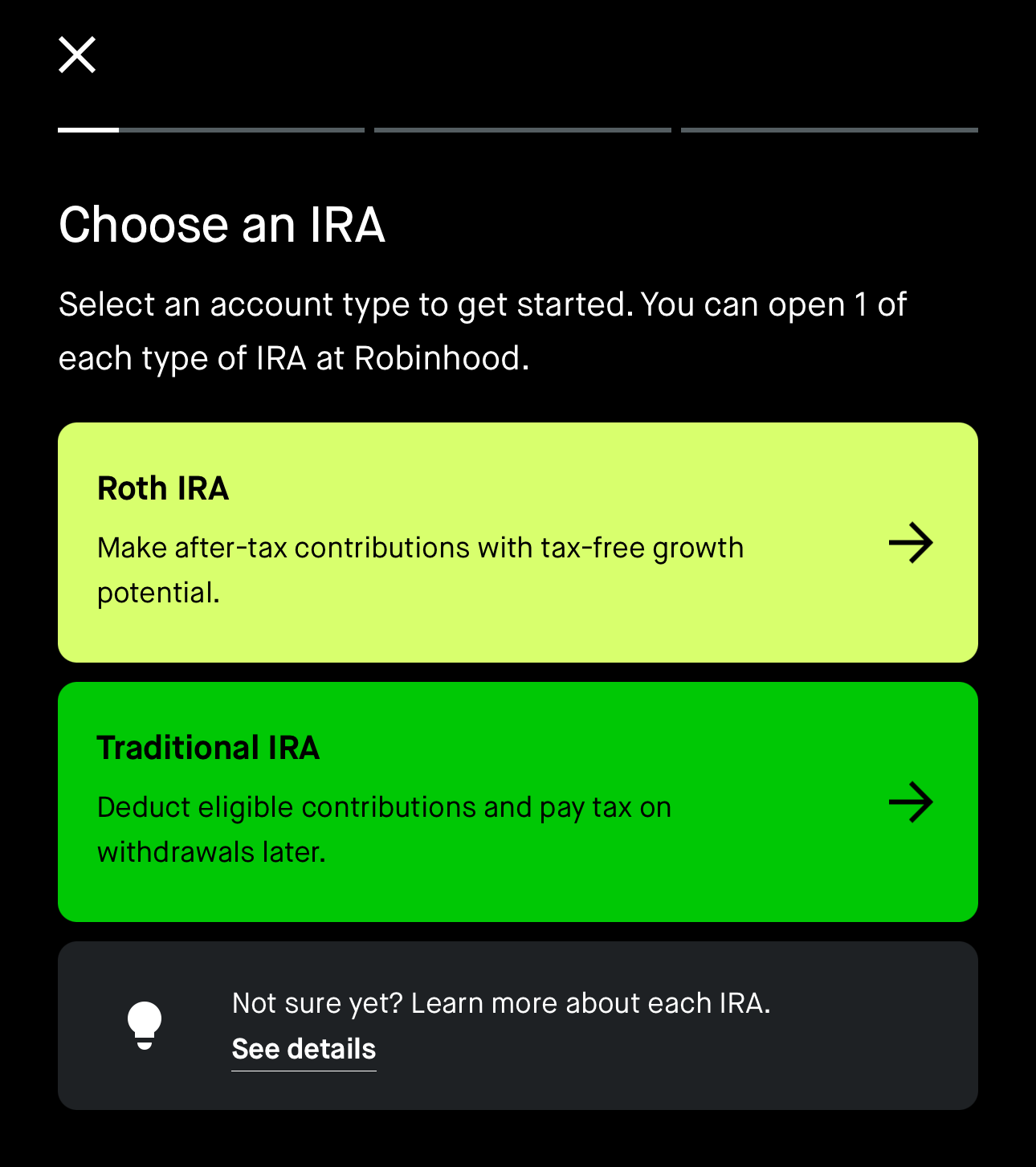

With Robinhood, you have the option to choose from a Traditional, Roth, or Rollover IRA. Opening an account is straightforward, and Robinhood clearly outlines the benefits, eligibility, and any limitations before you commit, as shown in this screenshot.

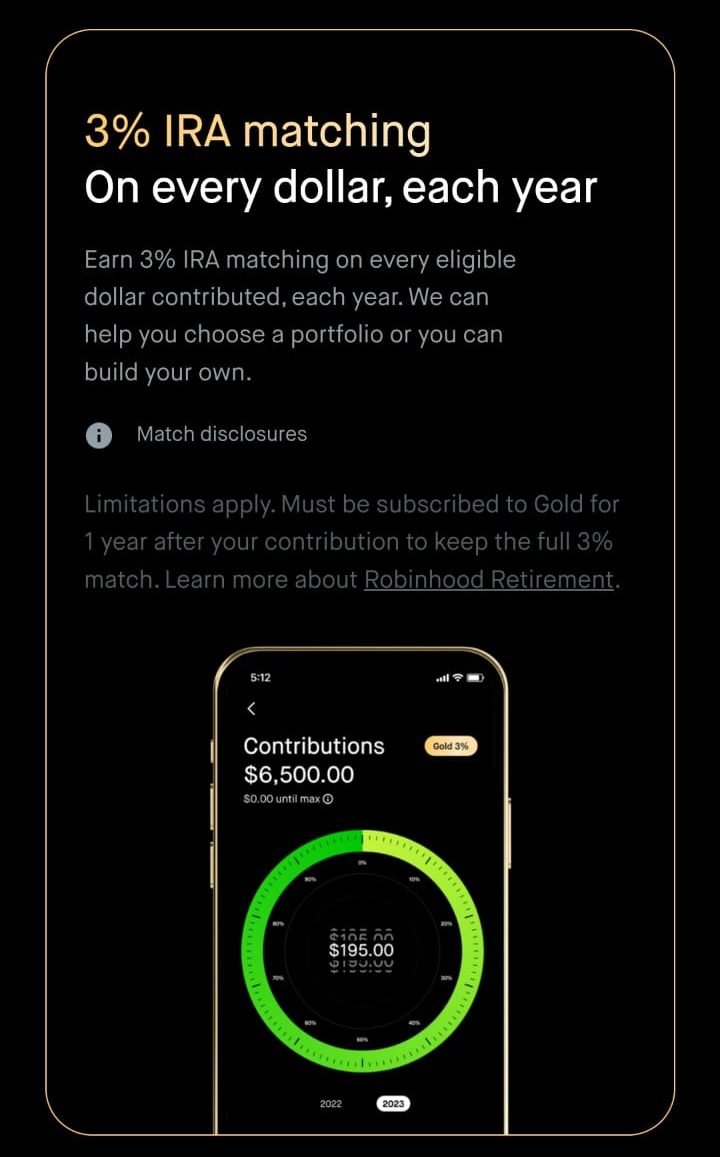

Moreover, even with the basic free Robinhood tier, you can receive a 1% match on qualified IRA deposits. If you subscribe to Robinhood Gold, you can benefit from a 3% IRA match, allowing you to earn 3% on every eligible dollar contributed to your IRA each year.

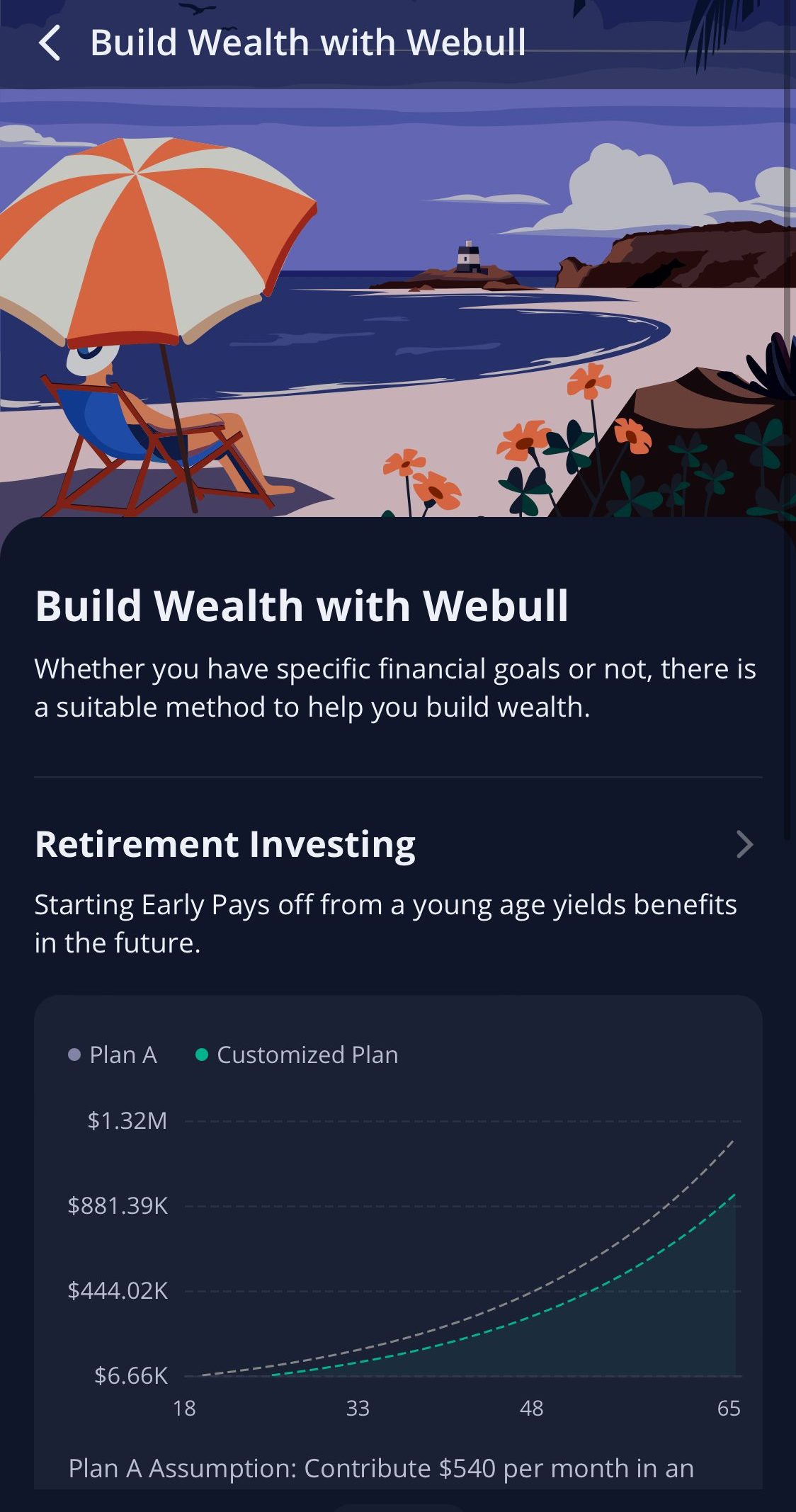

Webull offers a variety of retirement account options to help pave the way to financial freedom in your golden years. There are no special benefits as you can find with Robinhood.

With a Webull IRA, you can choose between Traditional, Roth, and Rollover IRAs, all with no account minimums or fees.

Your investments can grow tax-deferred (Traditional) or enjoy tax-free withdrawals (Roth).

Webull's platform allows you to trade stocks, ETFs, and options commission-free within your IRA. Customers can automate their contributions and manage the account through the Webull mobile app.

-

Cash Management And Savings Rates

Webull High-Yield Cash Management offers an impressive 5.00% APY on uninvested cash within your Webull account, with no need for a new account, no fees, and no minimum balance.

In contrast, Robinhood's basic cash account offers a relatively low rate. To access a higher, more competitive APY, customers need to subscribe to Robinhood Gold

Robinhood | Webull | |

|---|---|---|

Savings APY | 0.01% – 5.00%

You’ll earn 0.01% Annual Percentage Yield (APY) on your uninvested brokerage cash, or 5% for Robinhood Gold members. | 5.00% |

Webull: Which Features Are Unique?

Here are some of the features that investors can find only with Webull:

-

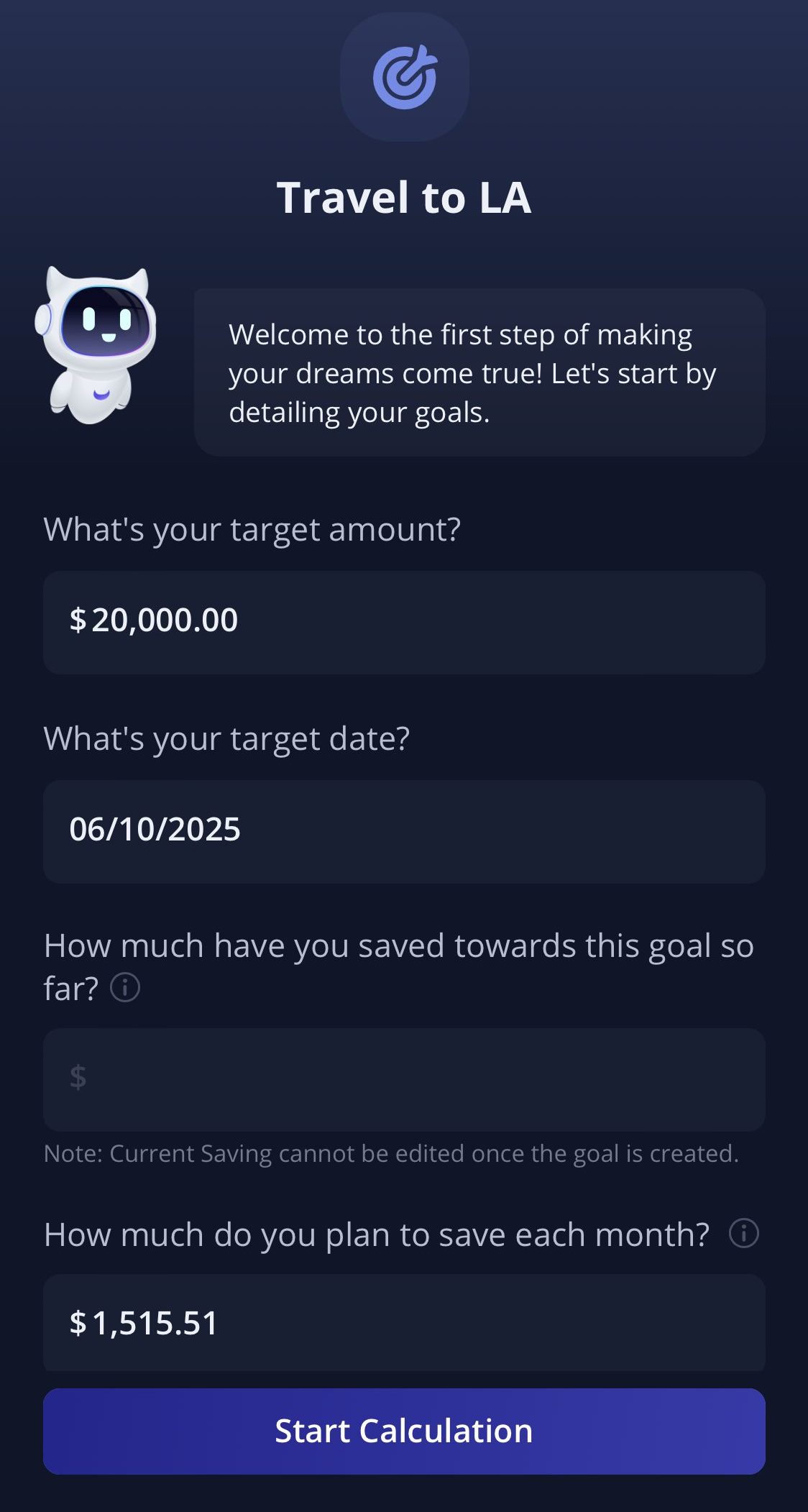

Create And Track Savings Goal

Creating and tracking a savings goal with Webull leverages their High-Yield Cash Management features to help you reach your financial objectives efficiently.

Customers can set savings target and specify the purpose within the Webull app. This could be for an emergency fund, a major purchase, or another financial goal.

Then you can track your savings in real-time through the Webull app, providing an overview of your contributions, current balance, and progress toward your goal.

-

Webull Smart Advisor

The Webull Smart Advisor constructs a tailored investment portfolio designed to match your specific needs and preferences.

It creates a diversified mix of ETFs, covering various asset classes such as equities, fixed income, and other alternative investments. This diversification helps reduce risk and enhance potential returns.

The Robo advisor is great for managing risk tolerance, but it lacks the advanced options and custom made portfolios that you can find with other robo advisors such as Wealthfront or Acorns.

Robinhood: Which Features Are Unique?

Here are some of the features that investors can find only with Robinhood:

-

Robinhood Gold

Robinhood Gold is a premium plan that provides a couple of additional benefits.

The subscription includes access to an exclusive Robinhood Gold Card, free instant deposits up to $50,000 per day, and insights from Morningstar and Nasdaq Level 2 data.

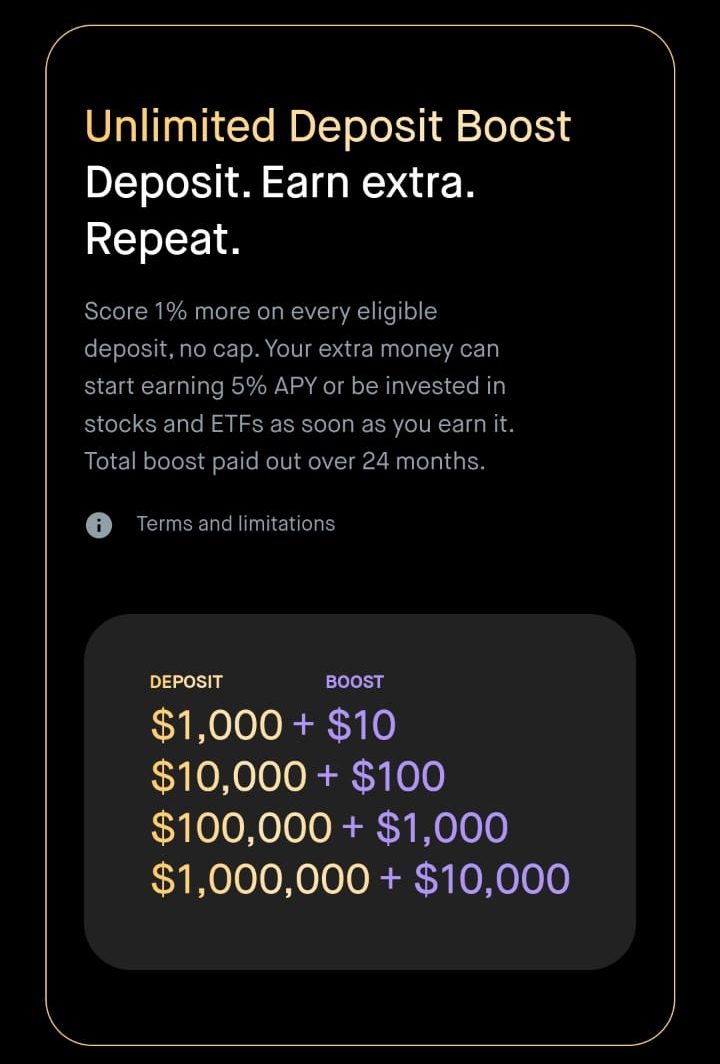

One significant feature of Robinhood Gold is the deposit boost, where customers earn an additional 1% on all eligible deposits with no cap.

This extra money can be invested or placed into the cash account to earn interest. Gold members also receive their first $1,000 of margin without incurring any interest fees.

-

Investing In Crypto

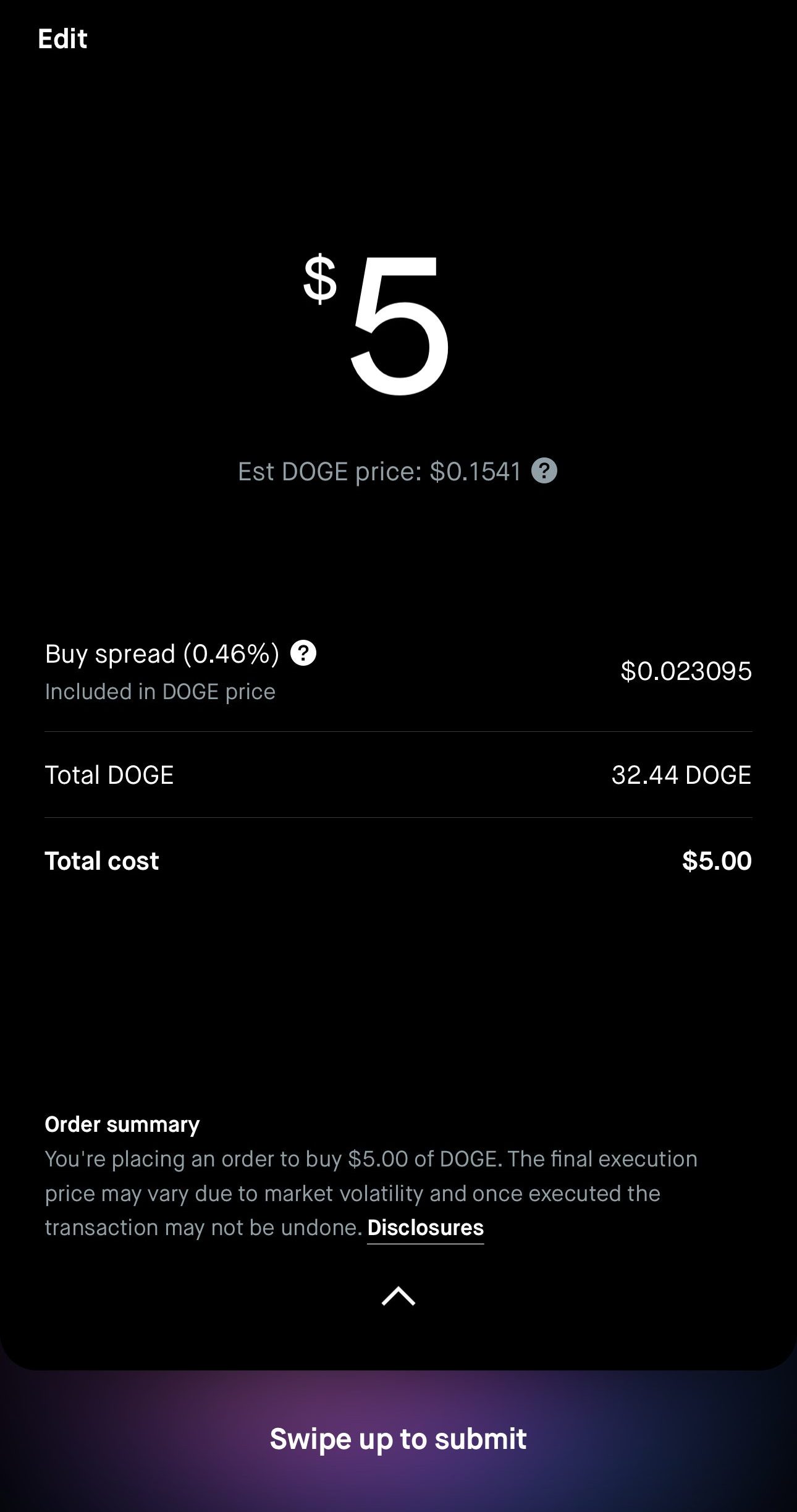

Unlike Webull, Robinhood offers a platform for trading over 35 cryptocurrencies, including BTC, ETH, SOL, DOGE, and more, with some of the lowest costs in the market. However, availability may vary by state due to regulatory requirements.

Robinhood keeps the majority of customer coins in cold storage and provides crime insurance against theft and cybersecurity breaches.

Another great thing about the Robinhood Crypto feature is that it is possible to send crypto to and from Robinhoos easily to other crypto wallets. This is a secure service and there are no withdrawal or deposit fees.

Bottom Line

Overall, Webull and Robinhood have many common features, but each has a slight edge in different aspects.

Webull’s charting and other advanced research tools make it an ideal platform for experienced traders who require advanced functionalities. It is also good for those who need a robo advisor and don't want to manage their portfolio actively.

In contrast, Robinhood’s user-friendly interface, its low-cost model, and crypto access cater to beginners and those who prioritize simplicity and ease of use.