Acorns | Wealthfront | |

Main Fees | Monthly Fee $3 – $12

$3 for Acorns Personal, $6 for Acorns Personal Plus and $12 for Acorns Premium

| Annual 0.25% (Automated investing only) |

Account Types | Brokerage, Retirement | Brokerage, Retirement, College 529s |

Savings APY | 5.00% | 5.00% |

Minimum Deposit | $0 | $500 |

Best For | Robo Advisor, Young Traders, Crypto Investing | Minimal Decision-Making Investing , Financial Planning, Low Cost Banking |

Read Review | Read Review |

Wealthfront vs Acorns Investing Features

Wealthfront and Acorns provide a range of sophisticated features for direct and automated investing, portfolio management, customization, research, and other investor options.

Below are the key features each platform offers, with screenshots taken by our team:

Acorns | Wealthfront | |

|---|---|---|

Investing Options | 100+ stocks, +40 ETFs (Up to 7,000 assets with automated investing) | 1,500 stocks, ETFs, and REITs |

Account Types | Brokerage, Retirement | Brokerage, Retirement, College 529s |

Financial Planning | No | Yes |

Automated Investing | Yes | Yes |

Tax Loss Harvesting | No | Yes |

-

Self Investing Options

Wealthfront offers a streamlined and intelligent approach to investing in individual stocks, providing tools and features designed to make stock investing easier and more effective. Customers can invest in individual stocks with as little as $1, thanks to the availability of fractional shares.

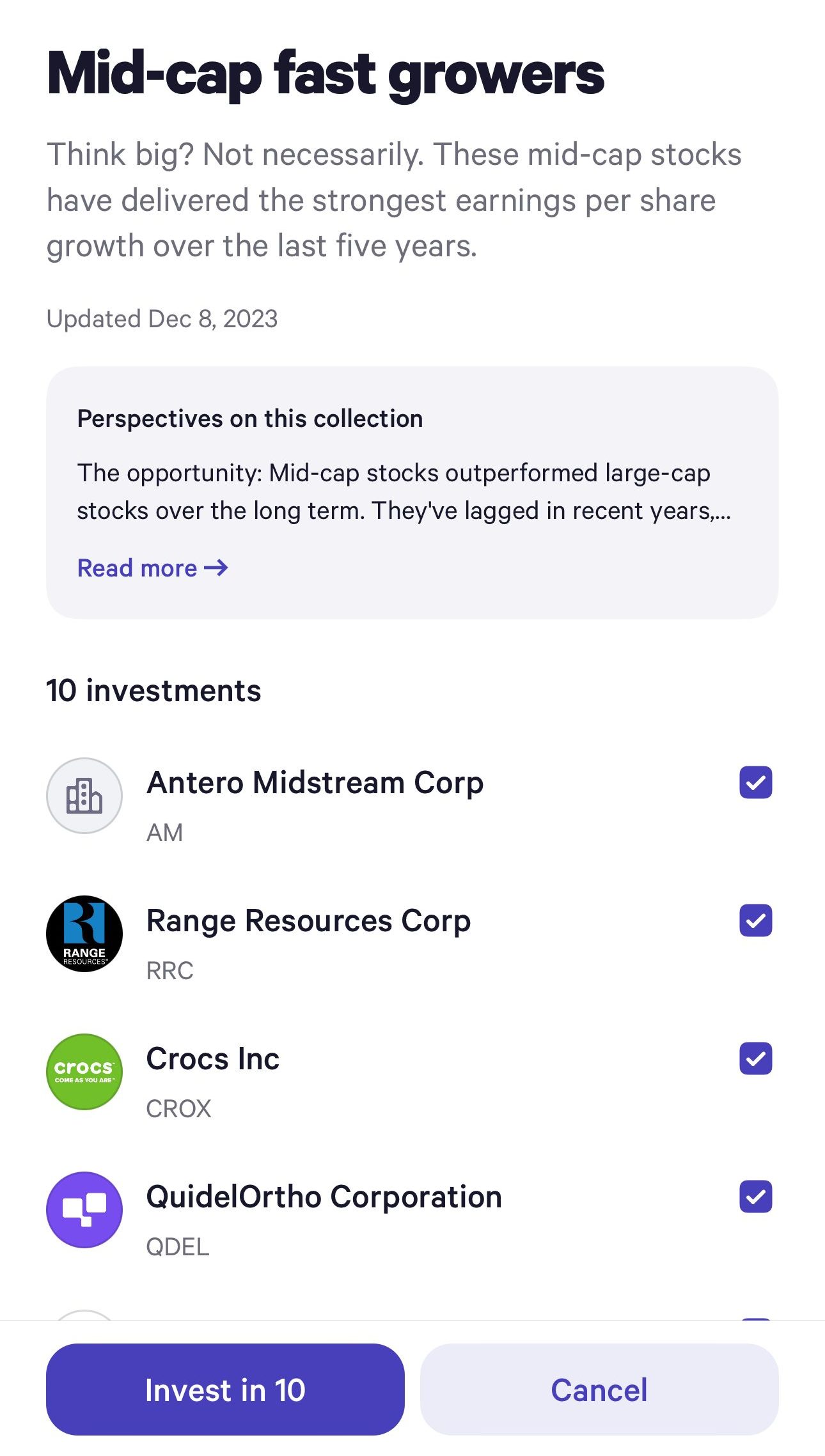

Wealthfront organizes stocks into pre-built collections such as blue chip, tech, semiconductor or cloud computing. These collections help you make smarter investing decisions faster by grouping stocks that share common characteristics or business models.

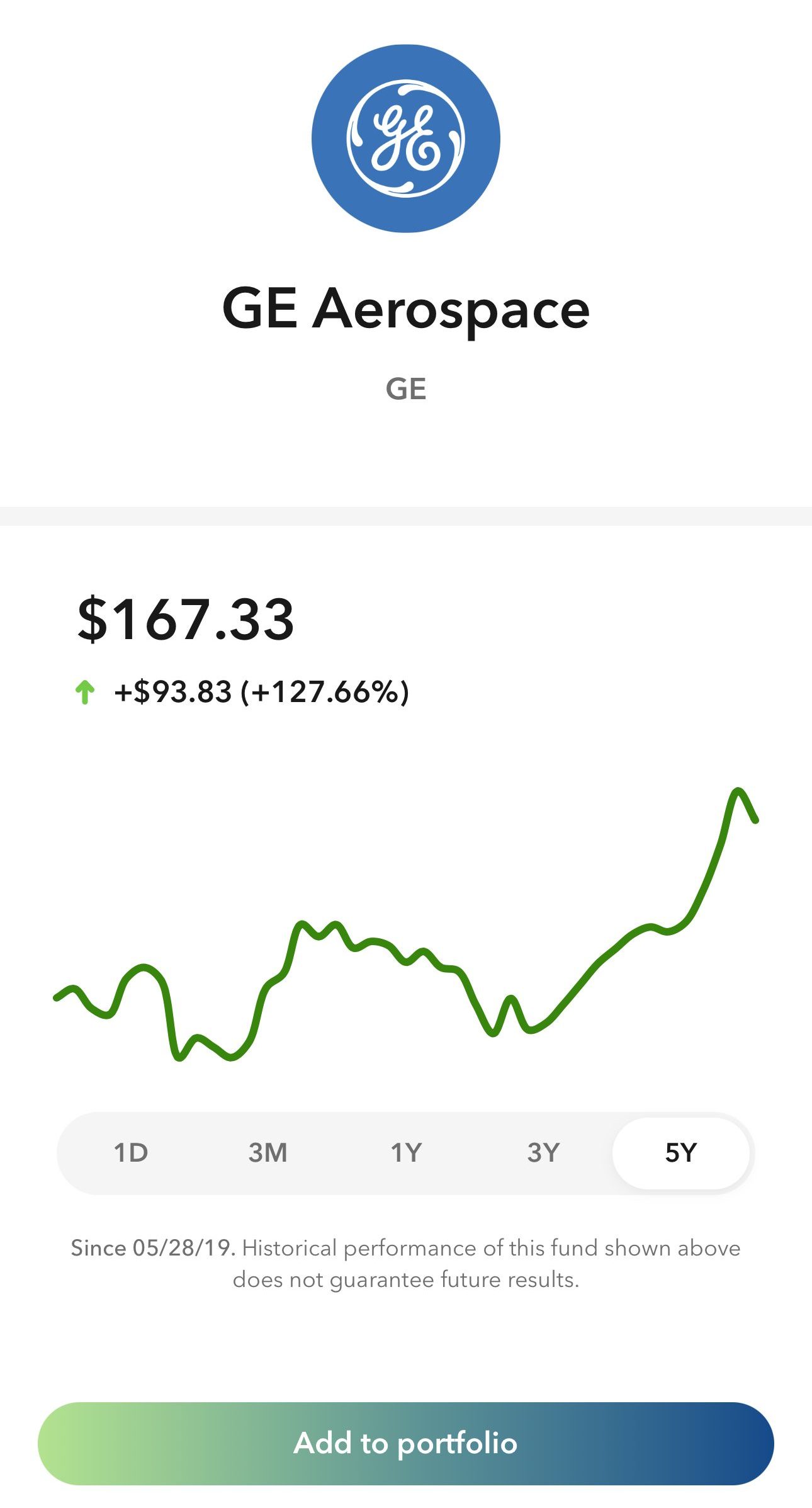

One of Acorns' notable features is the ability to access fractional shares. This platform provides fractional shares for new purchases and reinvested dividends. Users can choose from over 100 stocks and more than 40 ETFs.

For investors with limited funds, every dollar is significant. Fractional shares allow users to invest every dollar effectively, without being restricted to purchasing whole shares.

-

Automated Investing

Wealthfront creates personalized portfolios based on your risk tolerance, financial goals, and time horizon. During the sign-up process, you answer a series of questions that help determine your risk profile. Wealthfront automatically rebalances your portfolio to maintain the desired asset allocation.

The portfolios are created by industry experts, including renowned economist Dr. Burton Malkiel. These portfolios are designed to be diversified and optimized based on modern portfolio theory.

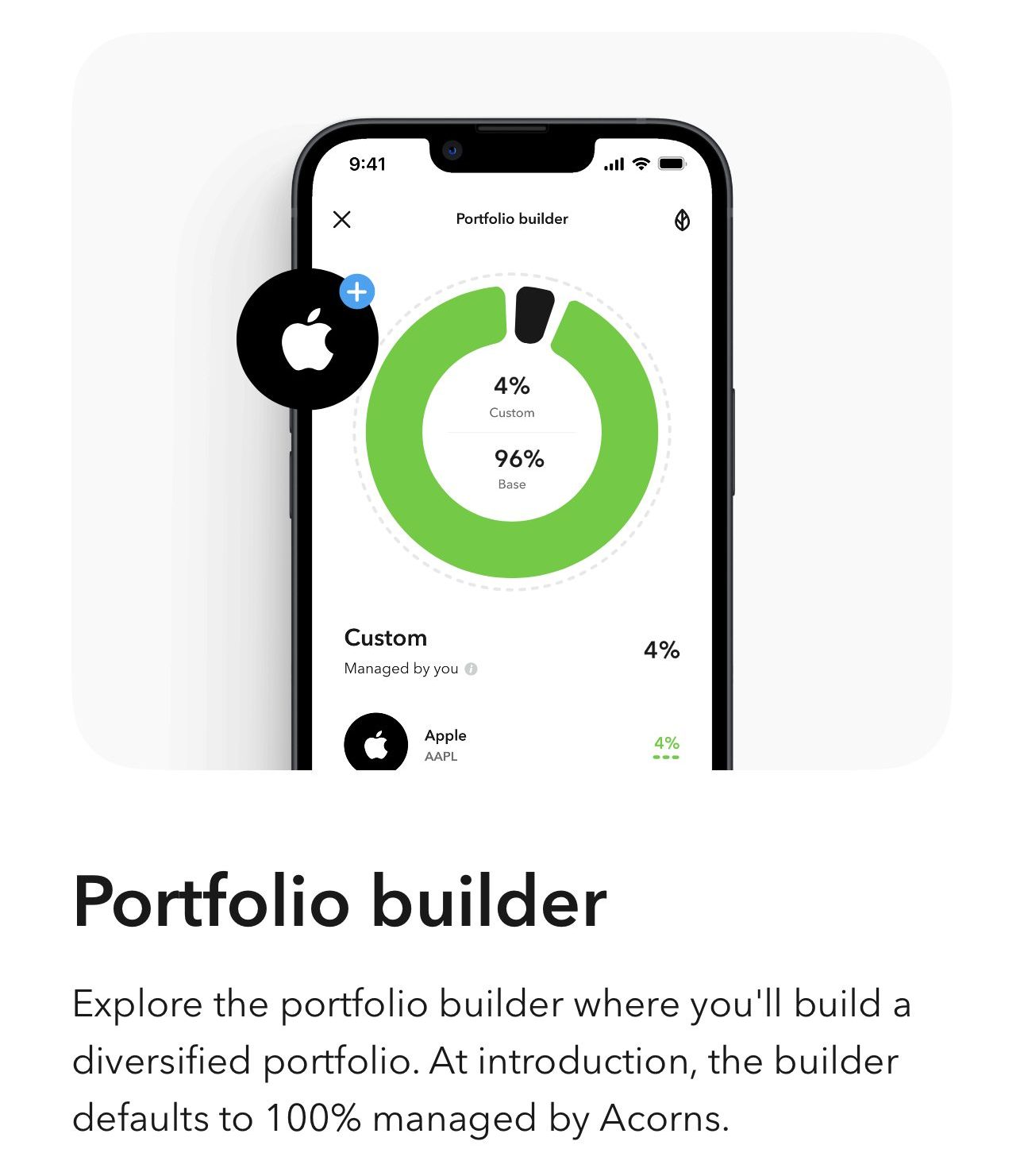

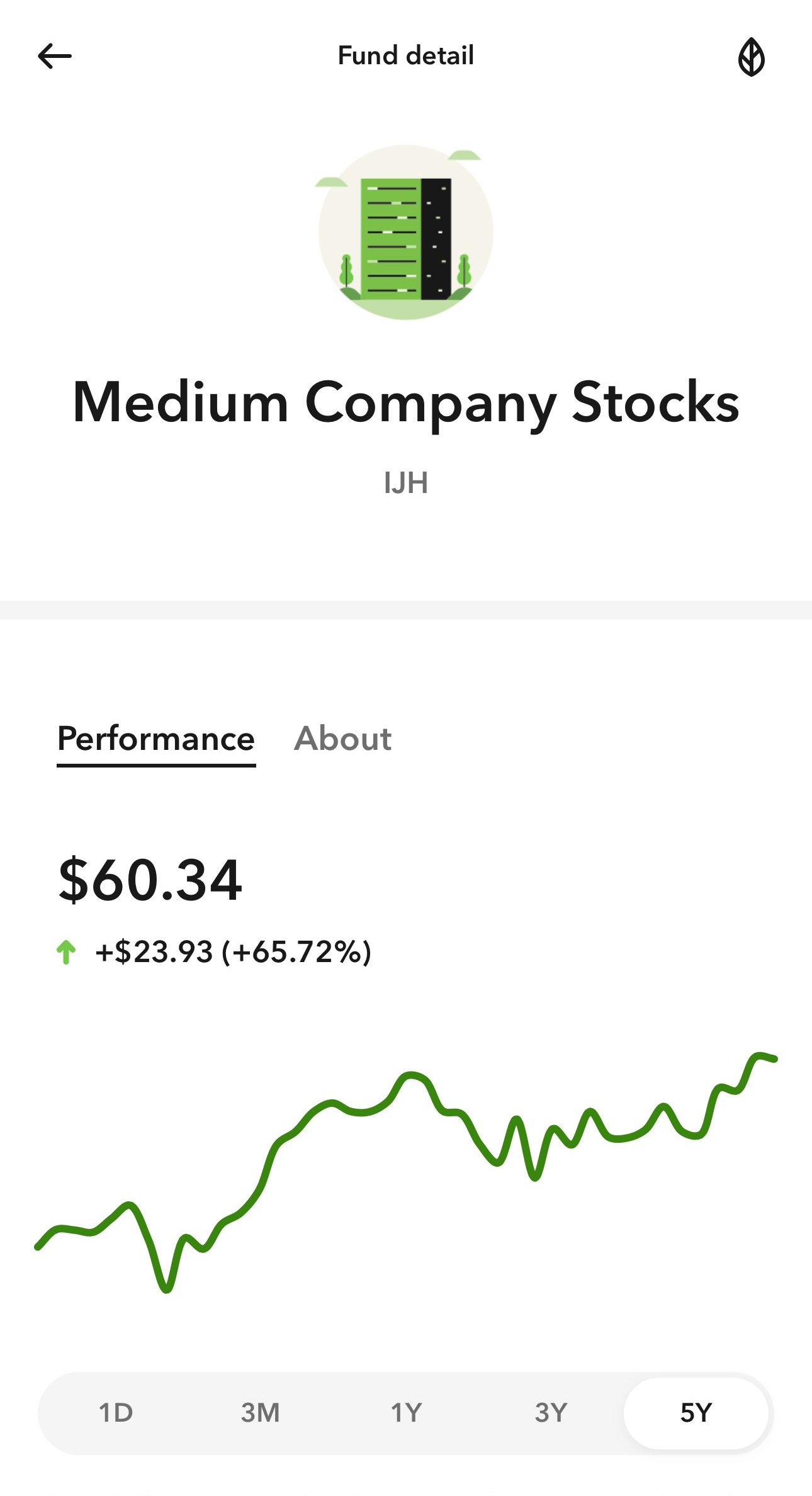

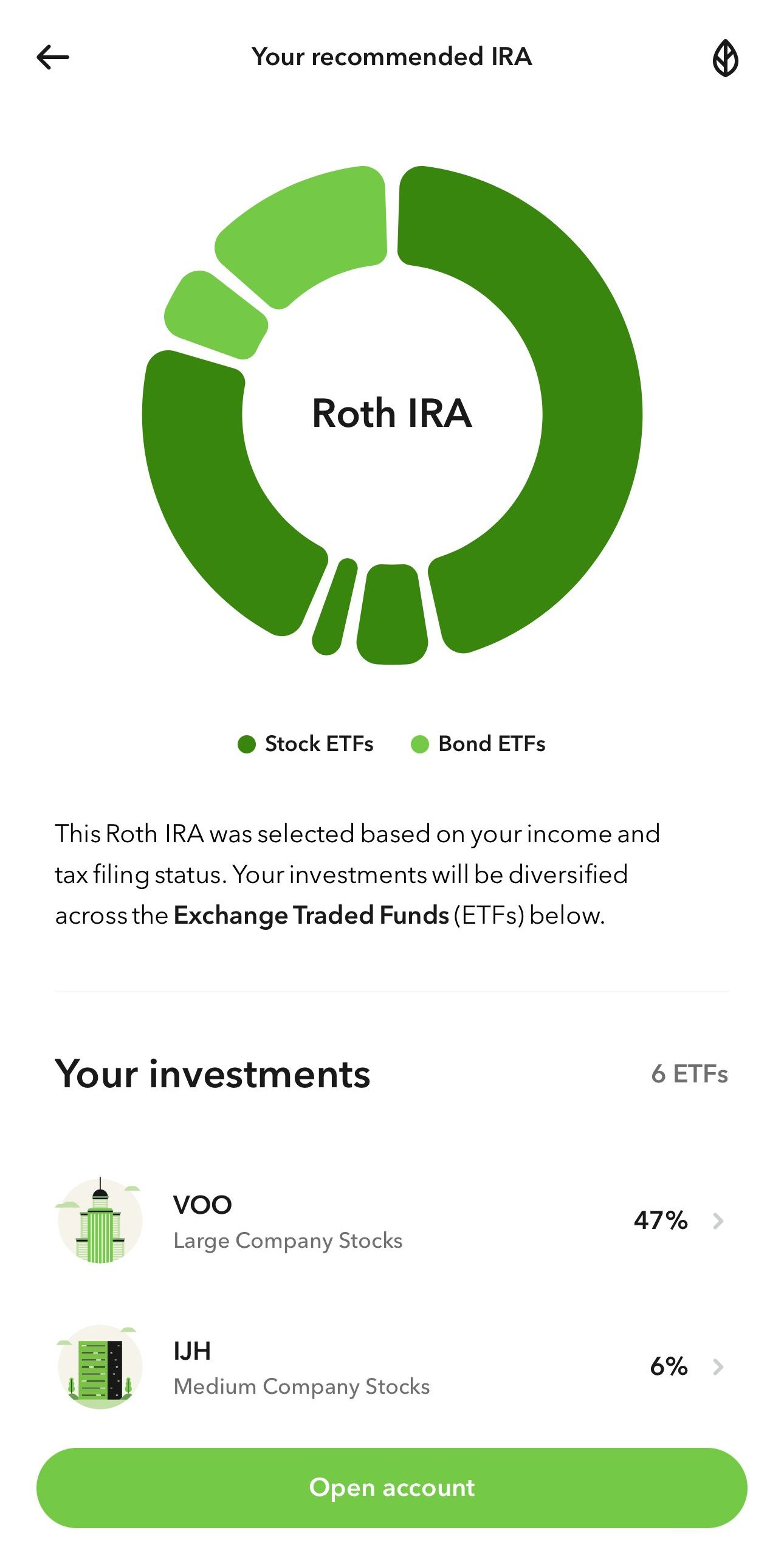

Acorns automatically builds and manages your portfolio based on your risk tolerance and financial goals, investing your money into highly-rated Exchange Traded Funds (ETFs), which are expert-built portfolios.

Acorns ETFs provide exposure to over 7,000 different assets, helping to mitigate risk compared to trading individual stocks.

These portfolios often include shares in top-performing companies like Apple, Amazon, Google, and Berkshire Hathaway, offering exposure to successful businesses.

They also include ETFs managed by professionals at leading firms such as Vanguard and BlackRock, ensuring high-level expertise and robust management.

-

Retirement Accounts

Acorns Later helps you automatically invest for retirement with potential tax benefits. It recommends an IRA plan (Roth, Traditional, or SEP) tailored to your goals by answering a few questions.

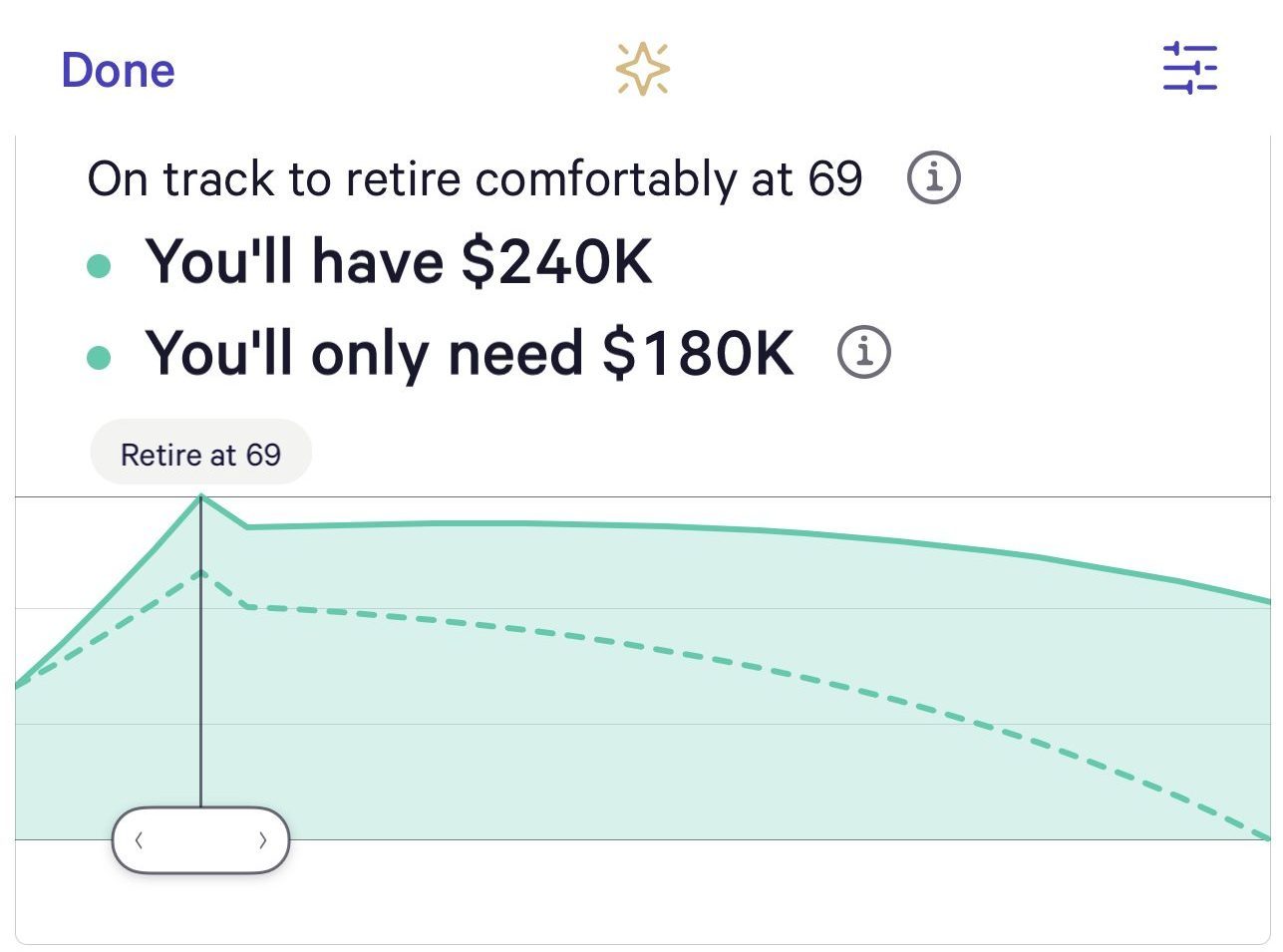

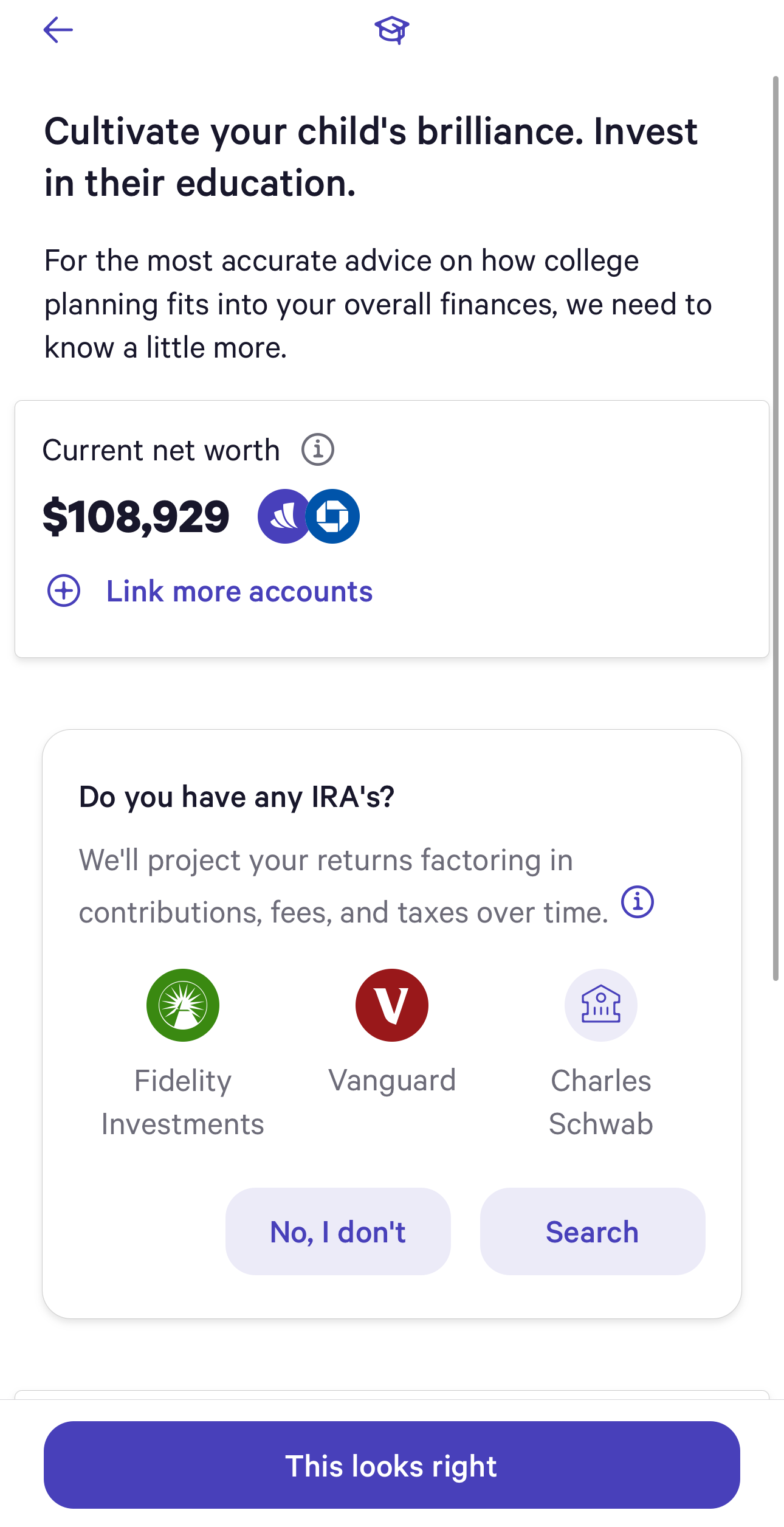

Wealthfront incorporates data such as your income, expenses, assets, and goals to create a tailored retirement plan, which provides a personalized financial plan based on your financial situation, goals, and risk tolerance.

Wealthfront offers several retirement account options, including Traditional IRA, Roth IRA, SEP IRA, and 401(k) rollovers. These accounts enjoy tax-loss harvesting to help reduce your tax liability by selling investments that have lost value to offset gains.

-

Additional Features Worth Mentioning

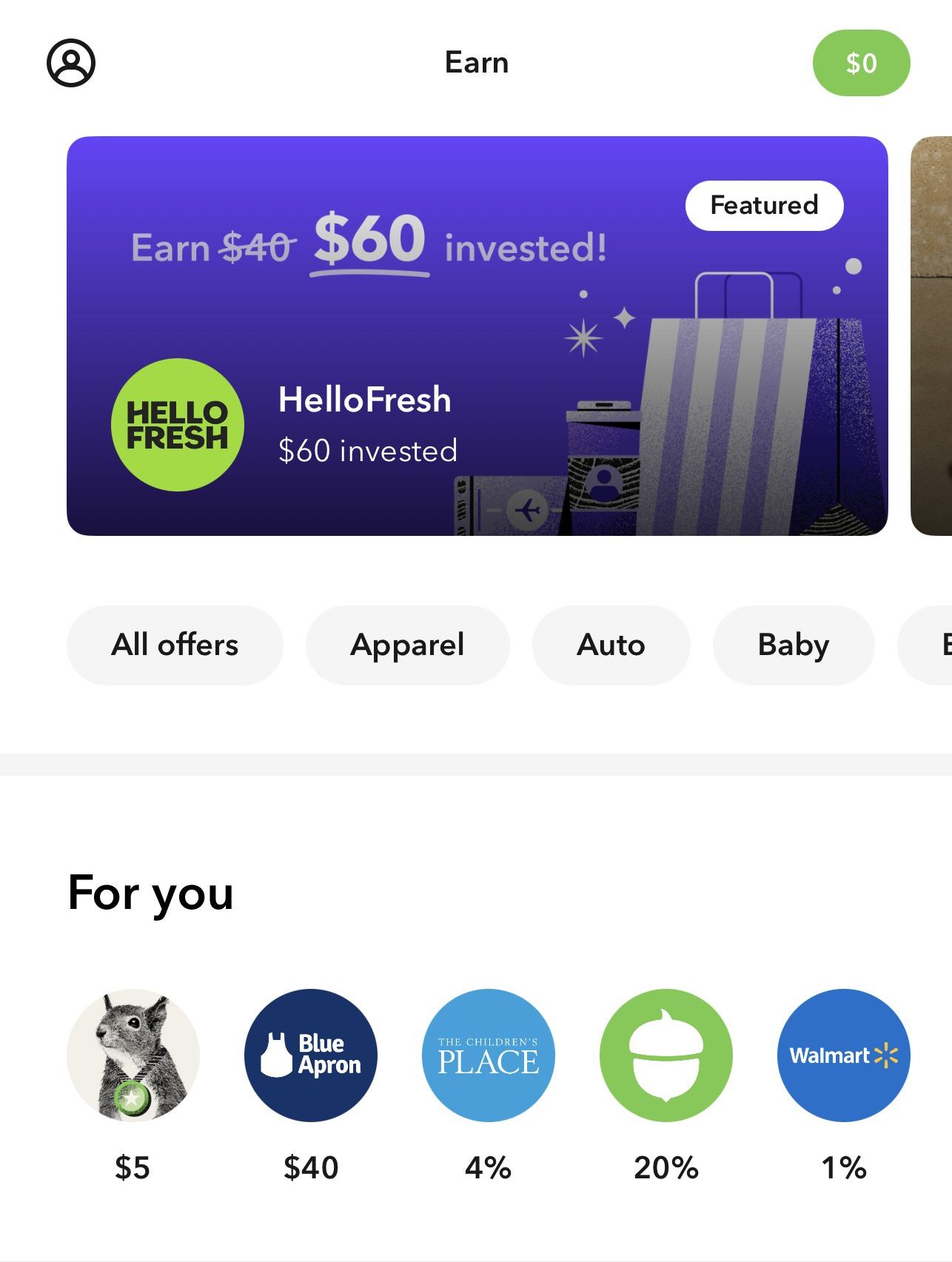

Acorns Earn stands out by offering rewards for shopping with hundreds of brands, making the platform even more attractive.

With over 300 participating partners, users earn rewards with every eligible purchase, which are then added to their Invest account, boosting their investment portfolio.

Moreover, the “Bits of Bitcoin” feature allows users to allocate up to 5% of their investments toward a Bitcoin-linked ETF.

This is done through the ProShares Bitcoin Strategy (BITO), which invests in Bitcoin futures rather than Bitcoin itself, providing a controlled way to diversify long-term portfolios.

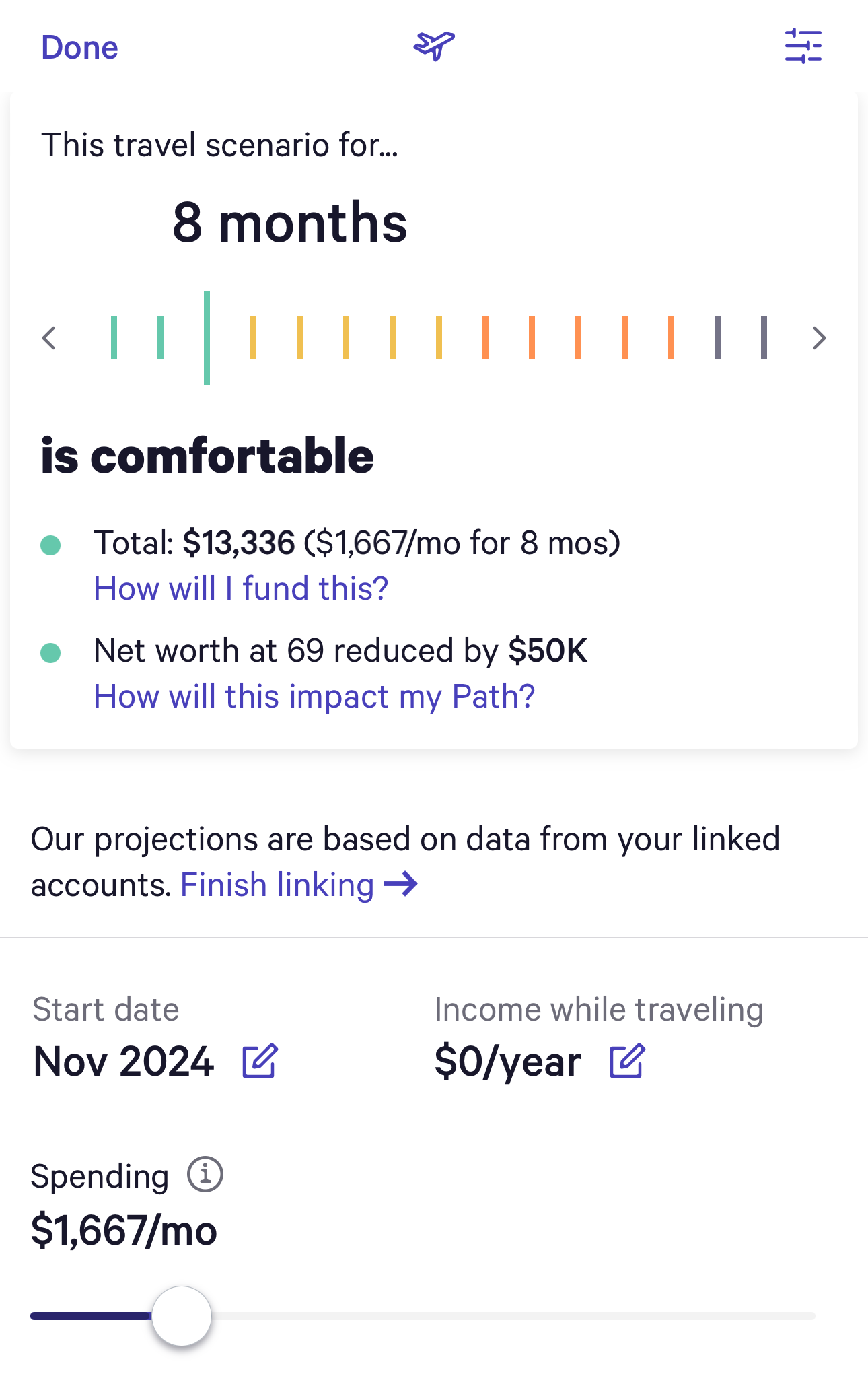

Wealthfront's financial planning helps users set and track savings goals. Users can create multiple goals, such as saving for a vacation or a new car, and monitor progress through the dashboard.

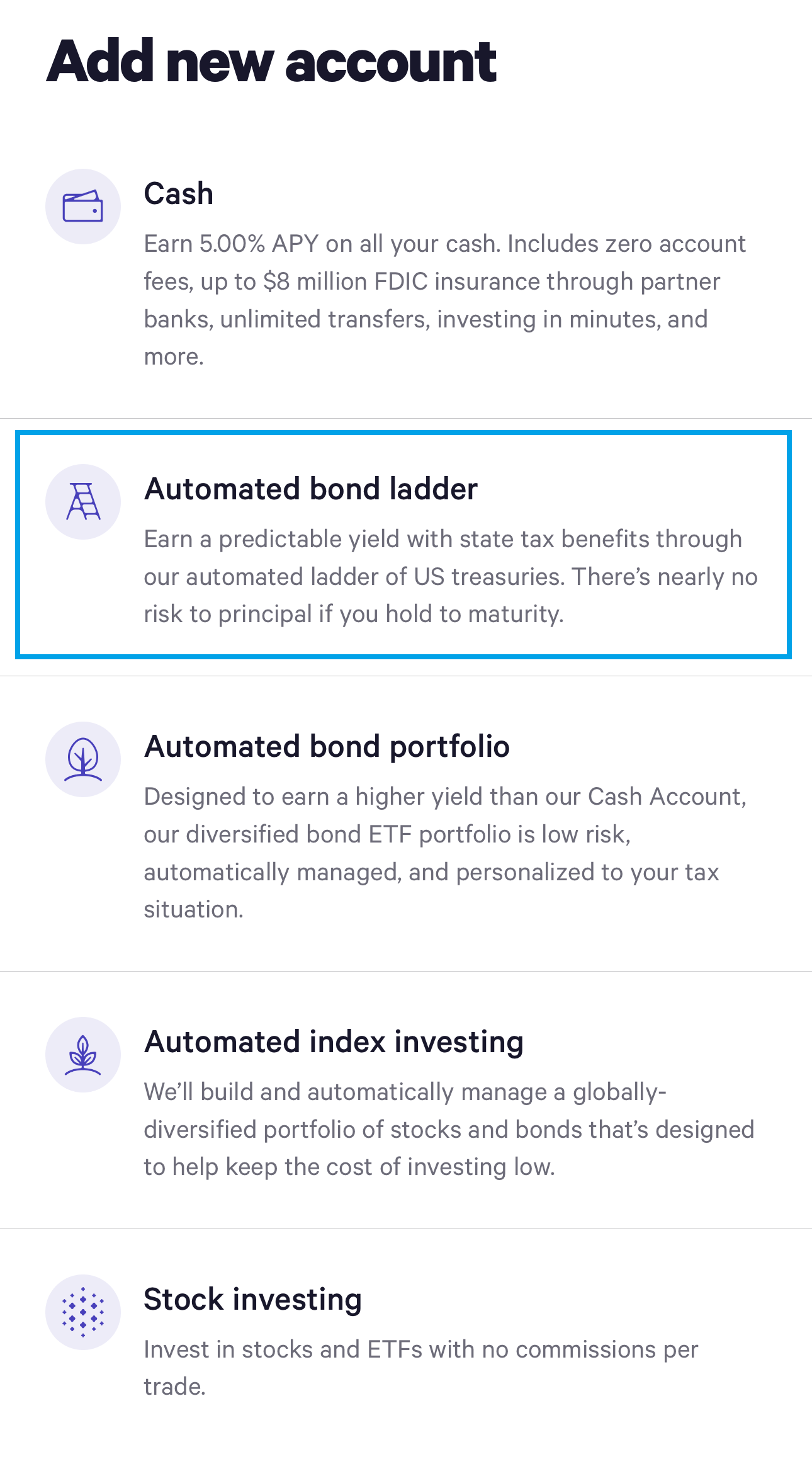

Wealthfront also offers an Automated Bond Ladder, investing in US Treasuries to earn more on extra cash. Treasuries are exempt from state and local income taxes.

Fees

Both platforms don't charge a fee if you trade stocks or ETFs. However:

- There is a monthly fee for Acorns, depending on your chosen plan. The fee is $3 – $12 $3 for Acorns Personal, $6 for Acorns Personal Plus and $12 for Acorns Premium

- Wealthfront, on the other hand, charges an annual advisory fee of 0.25% when if you use the automated portfolio to manage your investments.

Does Any Of Them Offer Advisory Services?

No, Acorns and Wealthfront focus on automated and self-investing, and they do not offer the option to meet or talk to a financial advisor.

Wealthfront vs Acorns Banking Options

Wealthfront and Acorns offer customers various banking options. Let's compare these options side by side:

-

Cash Management

Acorns offers a cash management and savings account service through its Mighty Oak debit card.

Banking services are provided by nbkc bank, ensuring that all accounts are FDIC-insured up to $250,000. Acorns does not charge overdraft or maintenance fees, and users have access to over 55,000 fee-free ATMs.

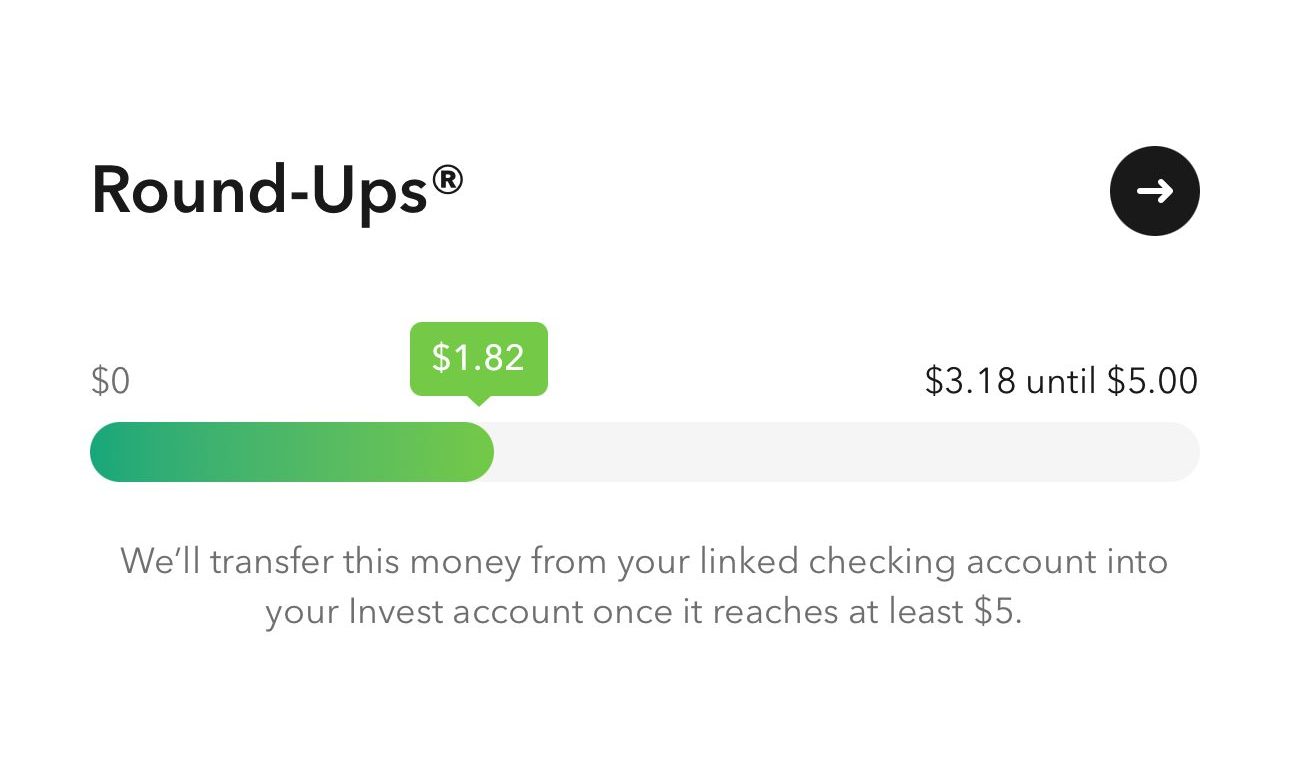

Additionally, the Round-Ups feature allows users to invest spare change from everyday purchases directly into their investment accounts, transforming routine spending into investment opportunities.

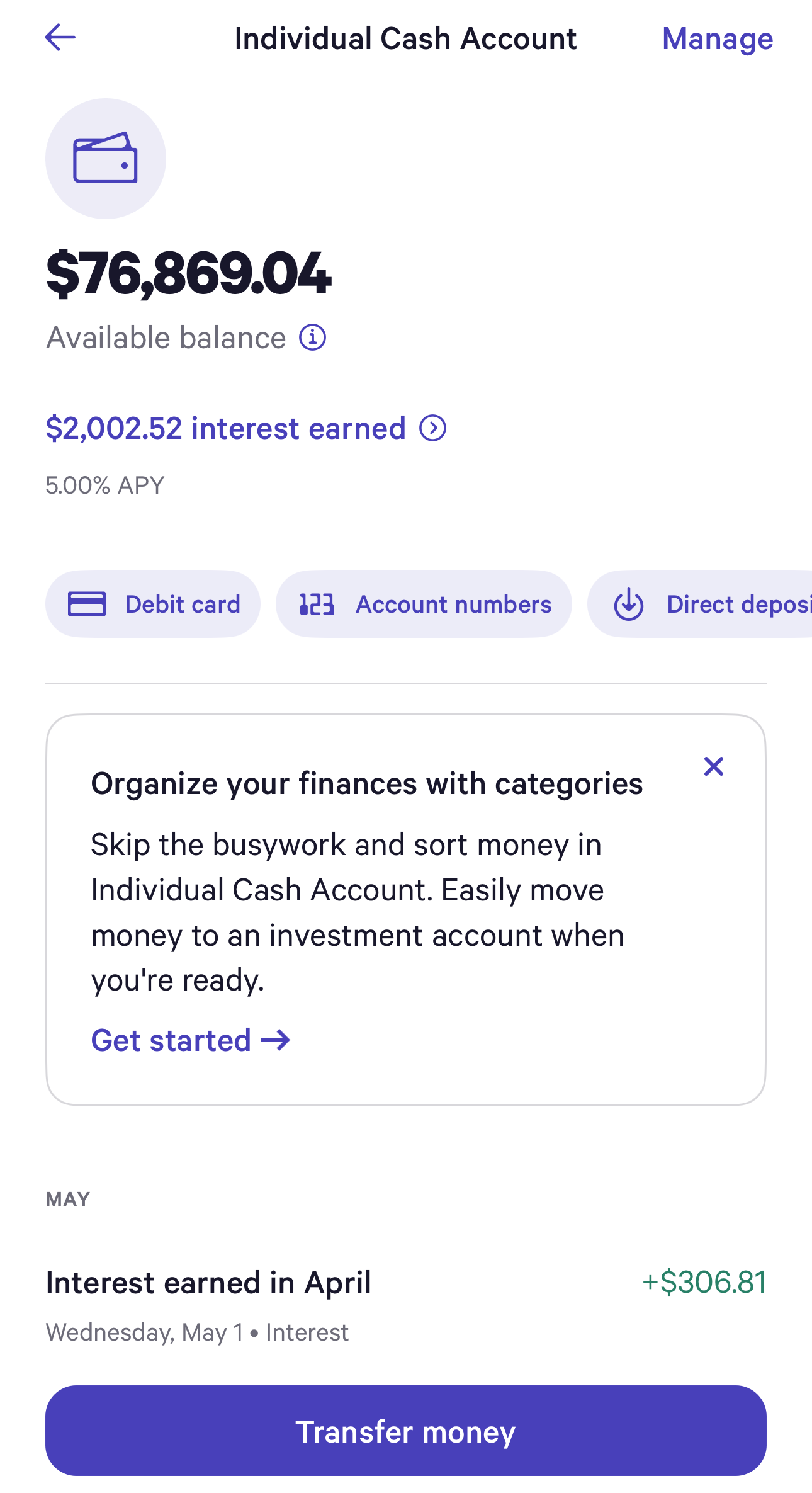

Wealthfront's Cash Management Account combines the best features of a high-yield savings account and a checking account. There are no monthly maintenance fees or ATM charges, and the account can be opened with just $1.

The Wealthfront mobile app allows you to manage your account, track your spending, and transfer funds on the go. Customers can pay bills and make purchases directly through popular payment platforms like PayPal, Apple Pay, Google Pay, Cash App, and Venmo.

-

Savings Rates And Financial Planning

When it comes to savings, both platform offers high yield savings rates – but wealthfront is better when it comes to financial planning and setting specific savings goals.

Acorns | Wealthfront | |

|---|---|---|

Savings APY | 5.00% | 5.00% |

Wealthfront offers its cash account through partner banks, providing up to $8M in FDIC insurance and a 5.00% APY without any minimum or maximum balance requirements.

Wealthfront also allows users to set multiple financial goals across different time horizons, including short-term, medium-term, and long-term objectives.

Acorns offers an Emergency Fund account that provides a high Annual Percentage Yield (APY) of 5.00%. This rate is significantly higher than the national average, allowing users to earn more on their savings.

Acorns facilitates automatic recurring contributions, allowing users to set daily, weekly, or monthly deposits into their accounts, promoting consistent saving habits.

-

Credit Cards And Lending Options

Acorns offers the Mighty Oak debit card. This card is linked to your Acorns Checking account, so when you use the card, the money comes directly out of your checking balance.

With a minimum of $25,000 invested in Wealthfront, you can access a line of credit up to 30% of your portfolio value. The application process is quick, with competitive interest rates and no additional credit checks.

Bottom Line

Overall, Wealthfront offers more features when it comes to investing and banking options that are not available with Acorns. It also has some great financial planning options.

However, Acorns may be a better option for young investors who want to manage their retirement or brokerage account with some control. It can also be a good option for those who have a significant amount and want to save on fees.