Robinhood

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- FAQ

Robinhood is considered the brand that spearheaded the low cost investment platform and revolutionized the industry.

Since it launched in 2013, Robinhood has forced even traditional brokerages to rethink their fee structures and make investing more accessible for anyone.

Since it has been around for over a decade, it would be easy to think that Robinhood has become stagnant, but the Robinhood team has been working to upgrade its feature set. So, how does Robinhood stack up today?

In this review, I’ll walk you through my experience of using Robinhood with the features that impressed me and where I identified some areas where Robinhood still has some work to do.

All of this should help you to decide if Robinhood is the right platform for you

How do I sign up for Robinhood?

Download the Robinhood app or visit their website, provide your personal information, and complete the verification process to open an account.

How does Robinhood make money?

Robinhood makes money through interest on uninvested cash, rebates from market makers, fees from premium services, and margin interest.

Can I trade cryptocurrencies on Robinhood?

Yes, Robinhood supports trading of several cryptocurrencies including Bitcoin, Ethereum, and Dogecoin.

Is Robinhood safe to use?

Yes, Robinhood is a member of SIPC, which protects securities customers up to $500,000, including $250,000 for cash claims.

What are Robinhood's margin requirements?

To use margin, you must have a Robinhood Gold account and a minimum balance of $2,000 in your account.

Does Robinhood provide research and analysis tools?

Robinhood offers basic research tools and news articles, but more advanced tools are available through Robinhood Gold.

Pros | Cons |

|---|---|

Fractional Shares, Crypto Access | Lacking Mutual Funds and Bonds |

Advanced Charting And Research Tools

| No Automated Investing |

Robinhood Gold Features | No Advisory Services |

IPO Access | Reliability Issues |

Manage Retirement Accounts |

Robinhood Features I Mostly Liked

Here are the key features that I found most appealing in Robinhood:

-

Fractional Shares

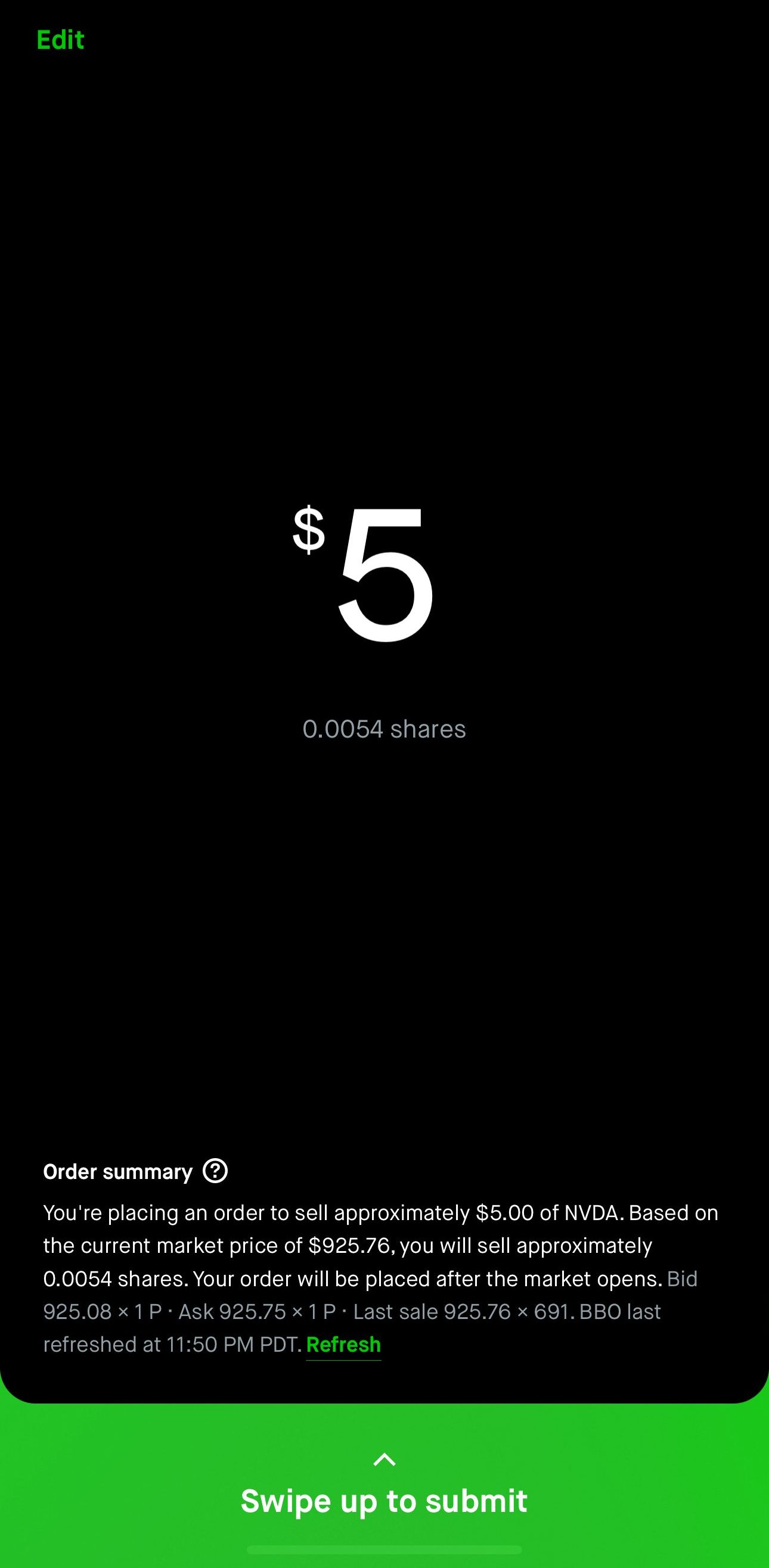

While offering fractional shares is not unique to Robinhood, many platforms have limitations on this feature. With Robinhood, I can buy fractional shares in many stocks.

Providing the stock is $1 or more per share and the company has a market cap of $25 million+, it is eligible for ordering fractional shares.

Additionally, as with other brokers, I can enable DRIP or dividend reinvestment in my account, so any dividends I earn on my stocks or ETFs is automatically reinvested providing that the related product supports fractional share trading.

This ensures that every dollar of my investment fund is put to work.

-

Advanced Charting

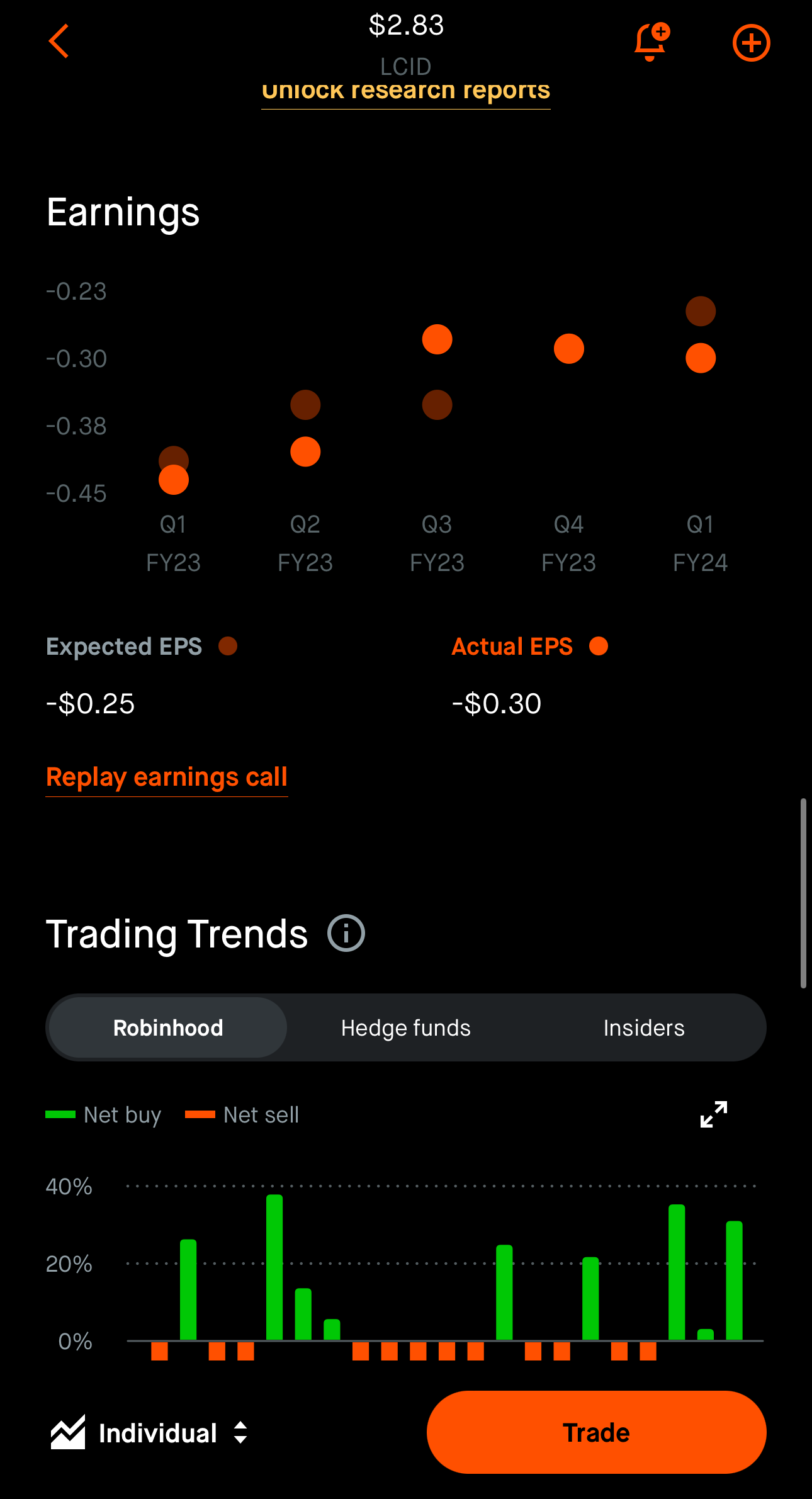

Robinhood has always offered charts, but the feature was revamped a couple of years ago. I enjoyed using the customizable, quick yet in depth analysis that I could access directly in the app.

I found the charting feature simple to research and analyze stock prices, which made it easier to identify trends. You can also get trading trends charts and stock earnings graph:

The advanced charting feature uses real time data and there is even a scrubbing feature, so I can compare securities at specific times.

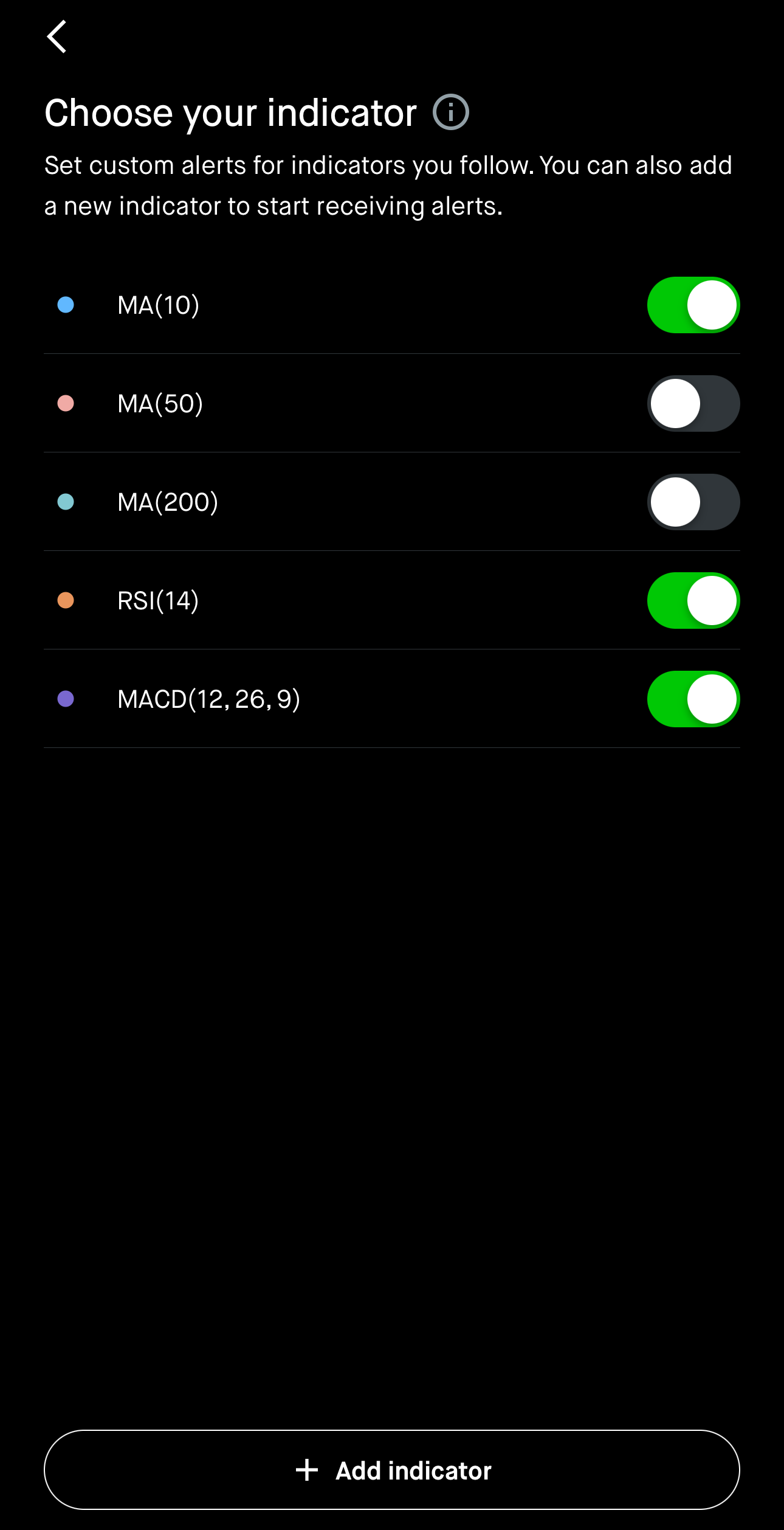

If you need technical analysis charts, you can add Moving average, RSI, MACD and more indicators to selected stock chart:

-

Robinhood Gold

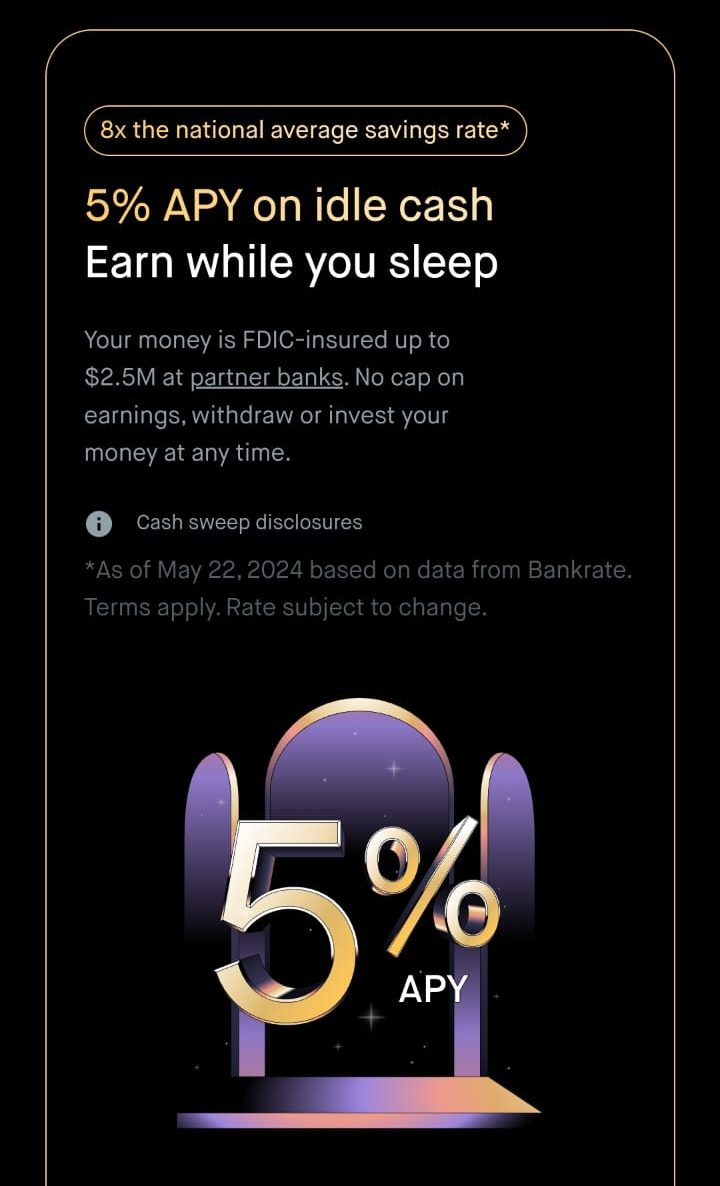

Although I do love a fee free trading platform, the benefits of upgrading to Robinhood Gold are usually well worth the subscription cost.

Firstly, I can earn 8x the national savings rate on my spare cash. The funds are FDIC insured and there are no caps on withdrawals or earnings, allowing me to be able to invest my money at any time.

There is also an exclusive Robinhood Gold Card, free instant deposits up to $50,000 per day and access to Morningstar insights and Nasdaq Level 2 data included in the subscription.

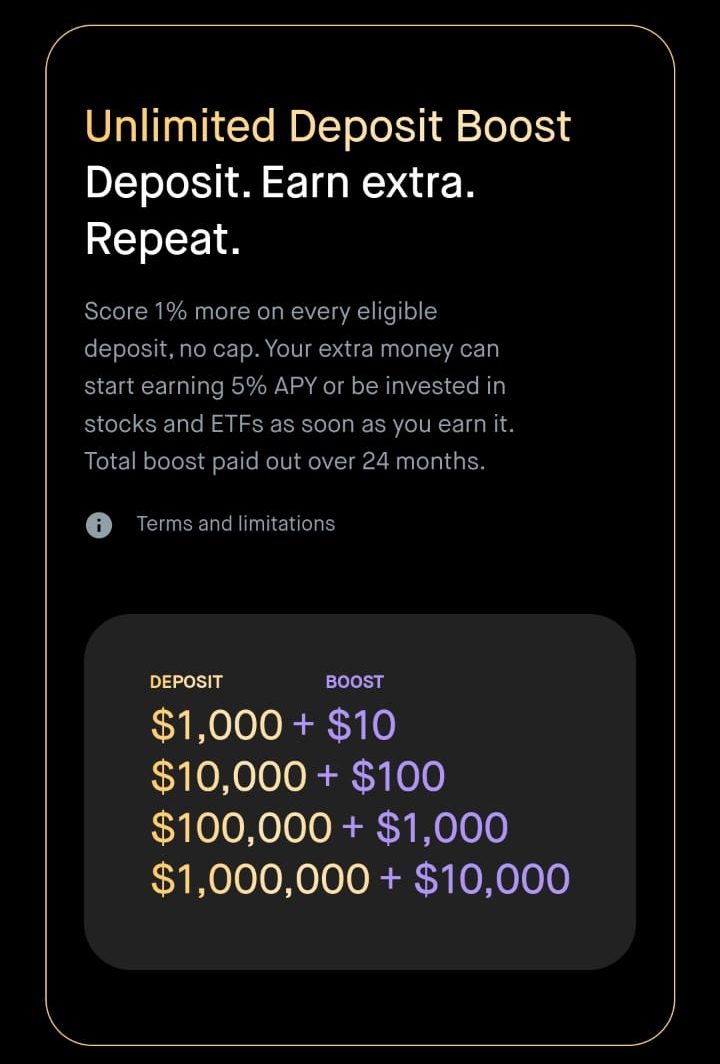

However, where I feel you can really leverage the potential of Robinhood Gold is with the deposit boost.

Customers earn an additional 1% on all eligible deposits with no cap. This extra money can be either invested or placed into the cash account to earn interest.

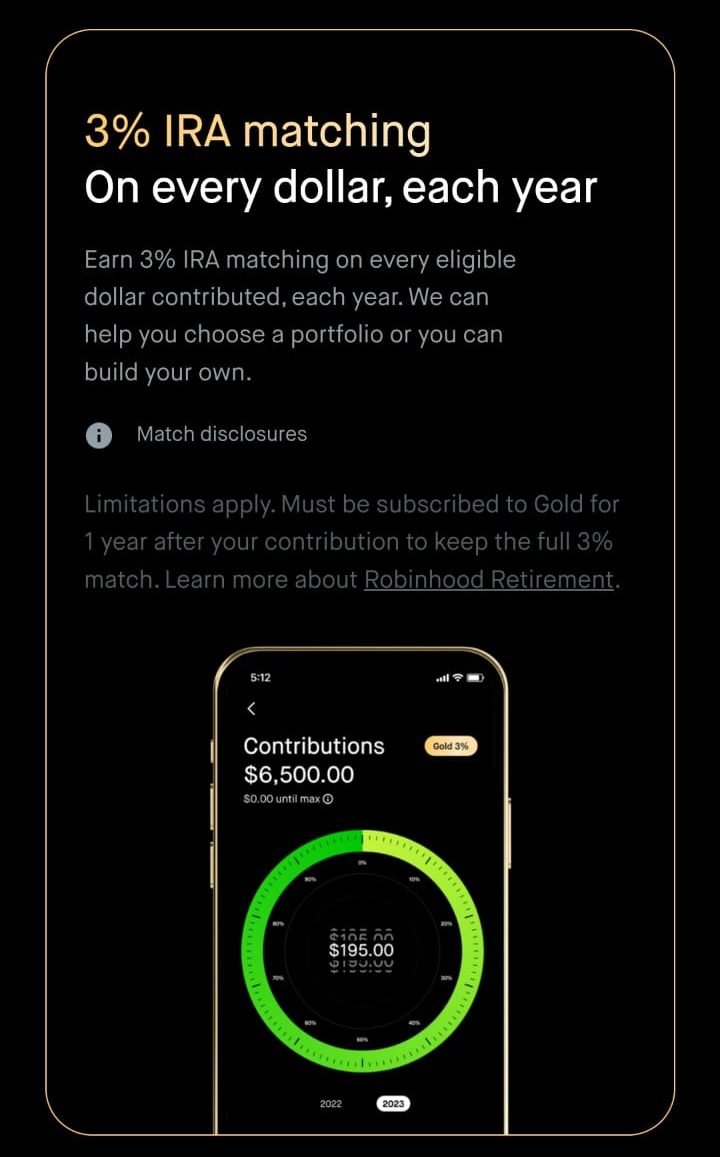

Additionally, there is a 3% IRA match, allowing customers to earn 3% on every eligible dollar contributed to their IRA each year. Gold members receive their first $1,000 of margin without incurring any interest fees.

-

Choice of Retirement Accounts

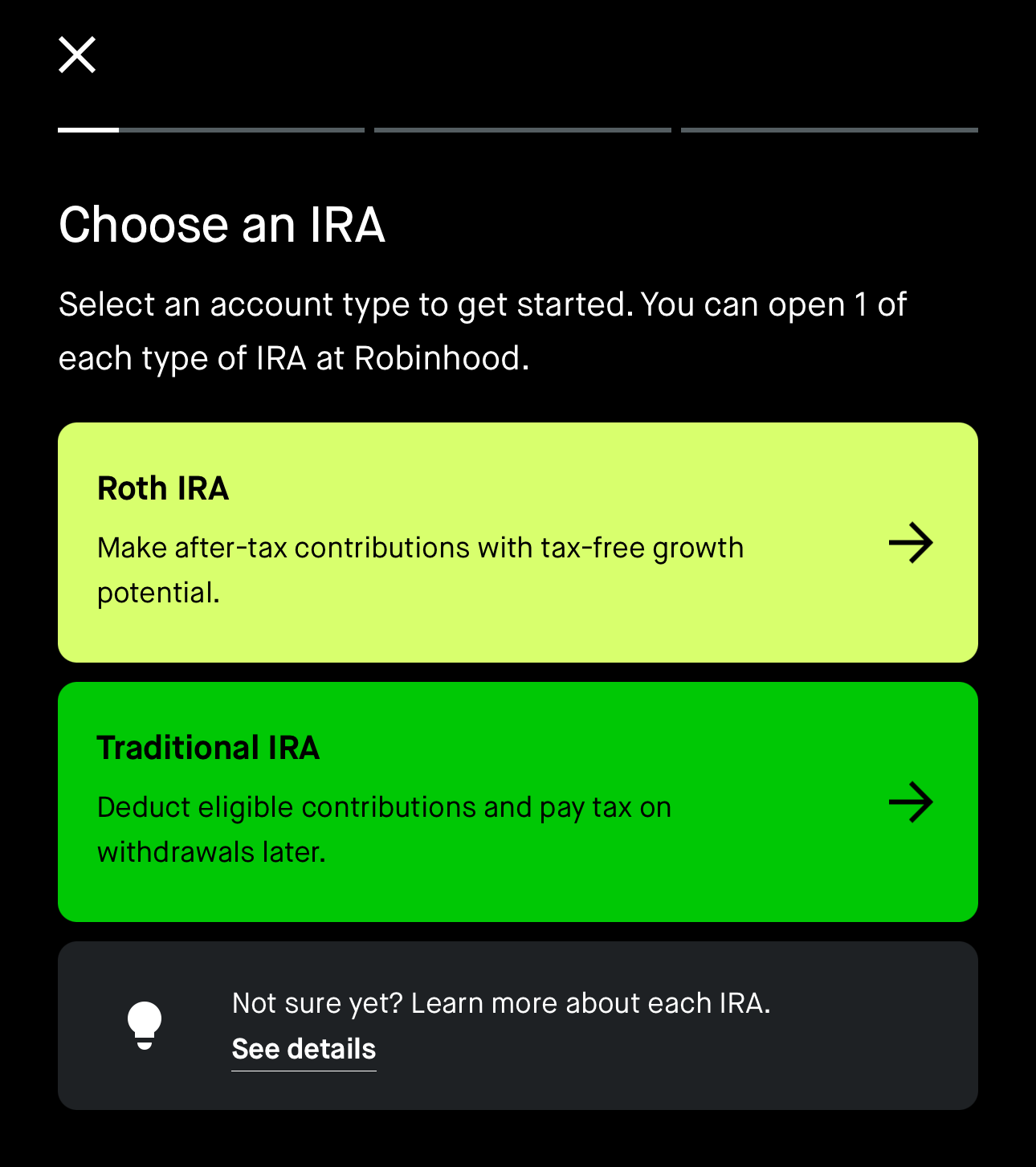

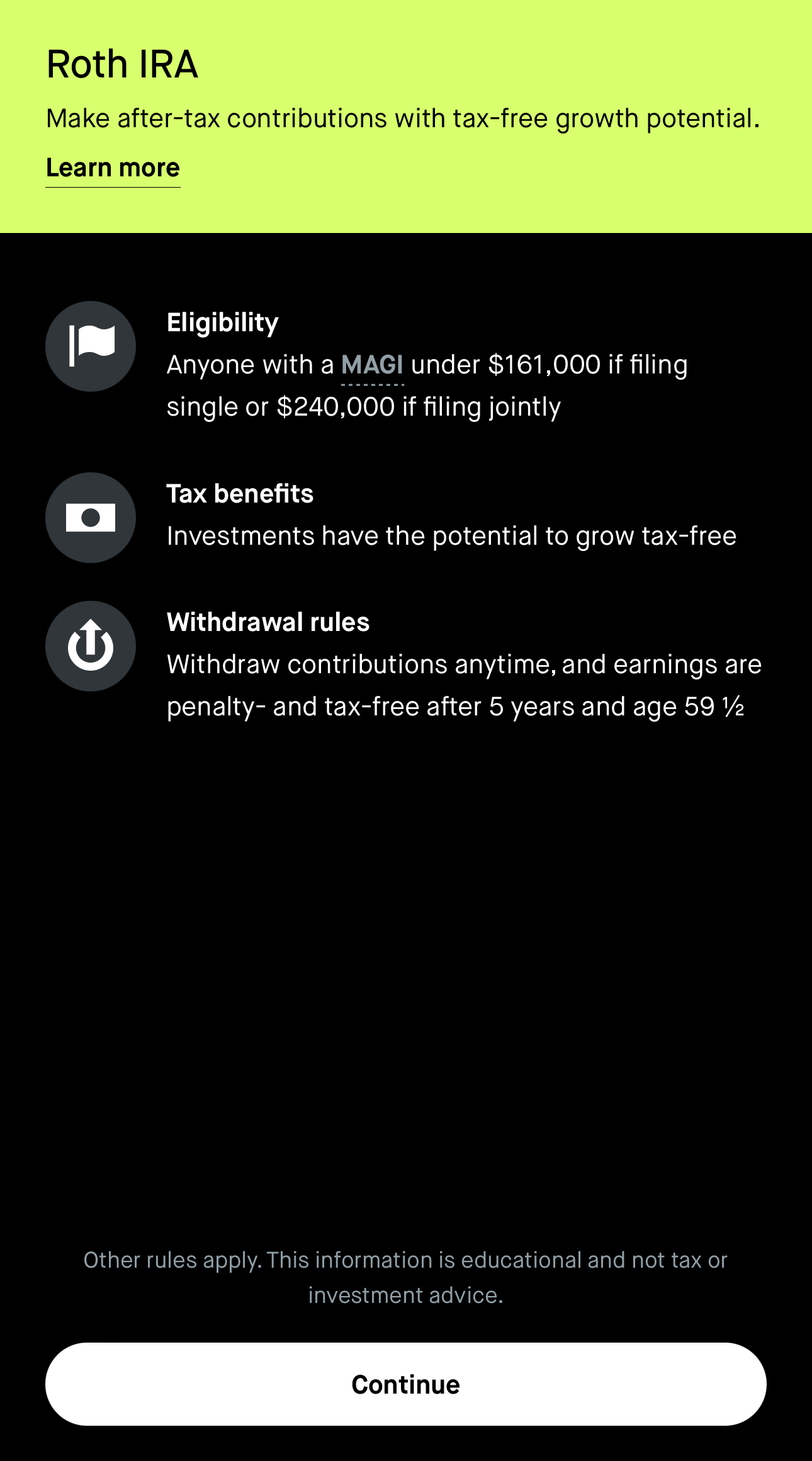

I appreciate that Robinhood also has a number of IRAs, making it easier to save for retirement.

You can choose from a traditional, Roth or Rollover IRA. Opening an account is simple and Robinhood makes the benefits, eligibility and any limitations clear before you commit as you can see in this screenshot.

However, what makes Robinhood’s retirement accounts so appealing is that there is contribution matching.

Since this is not a workplace retirement plan where an employer may contribute, it is nice that the investment platform provides a boost.

As you can see, Robinhood allows you to choose your IRA match rate, although you’ll need to upgrade to a Gold subscription if you want to access the highest rates.

But, even with the basic free Robinhood tier, you can still receive a 1% match on qualified IRA deposits. While this may seem an insignificant amount, in real terms, for every $10,000 I deposit, I’ll actually get $10,100 into my account.

-

Simple Access to Crypto

Simple access to crypto has to be one of my favorite things about Robinhood. Robinhood is one of the few platforms where it is possible to crypto trade for free.

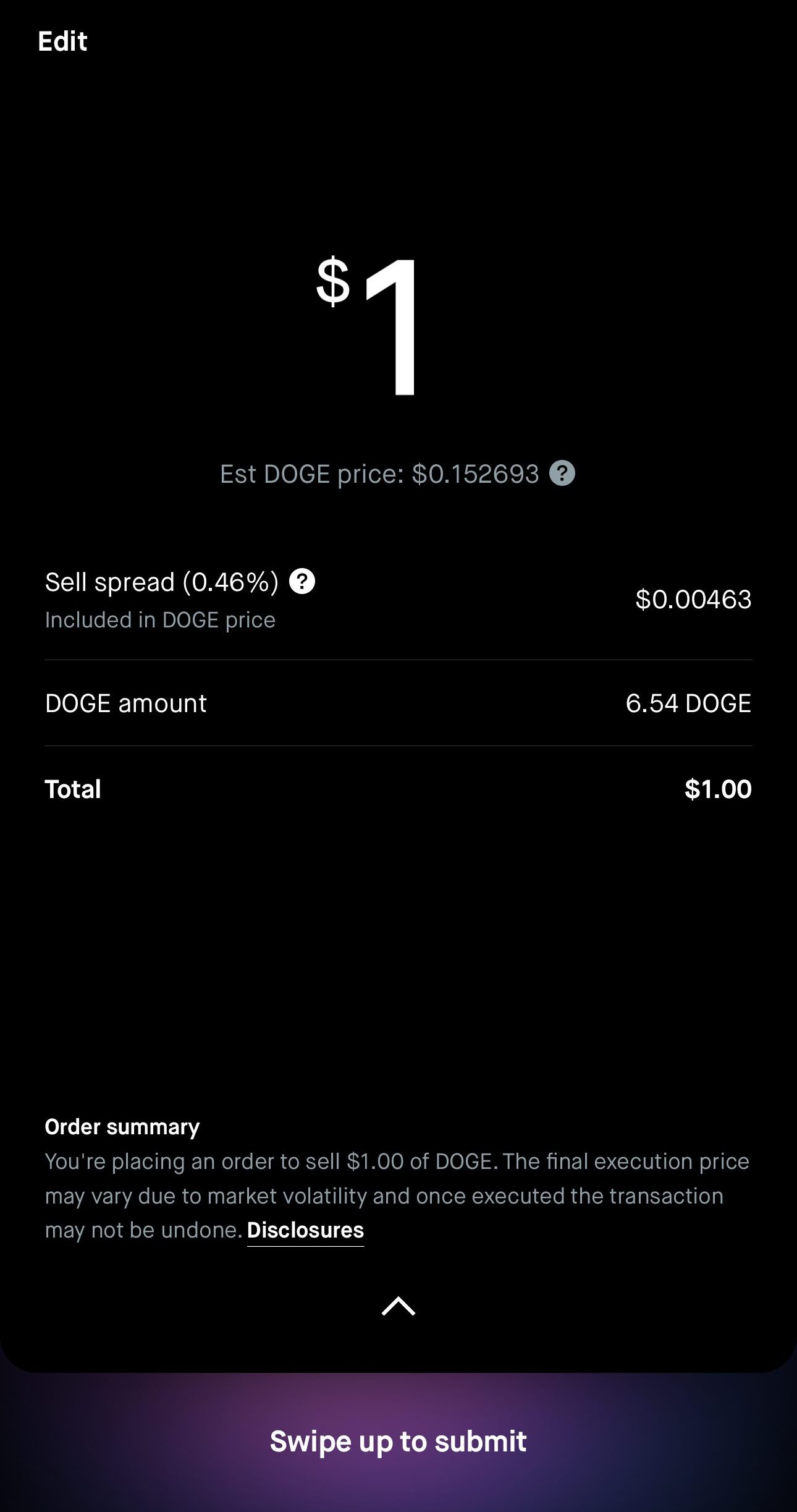

While the number of coins is limited, the most popular cryptocurrencies are available. For example, you can buy and sell Dogecoin:

I can buy, sell and hold cryptocurrencies and stablecoins., but it is also possible to set up recurring buys. I found it easy to set up an automated schedule and the minimum for this feature is just $1.

Another great thing about the Robinhood Crypto feature is that it is possible to send crypto to and from Robinhoos easily to other crypto wallets. This is a secure service and there are no withdrawal or deposit fees.

-

IPO Access

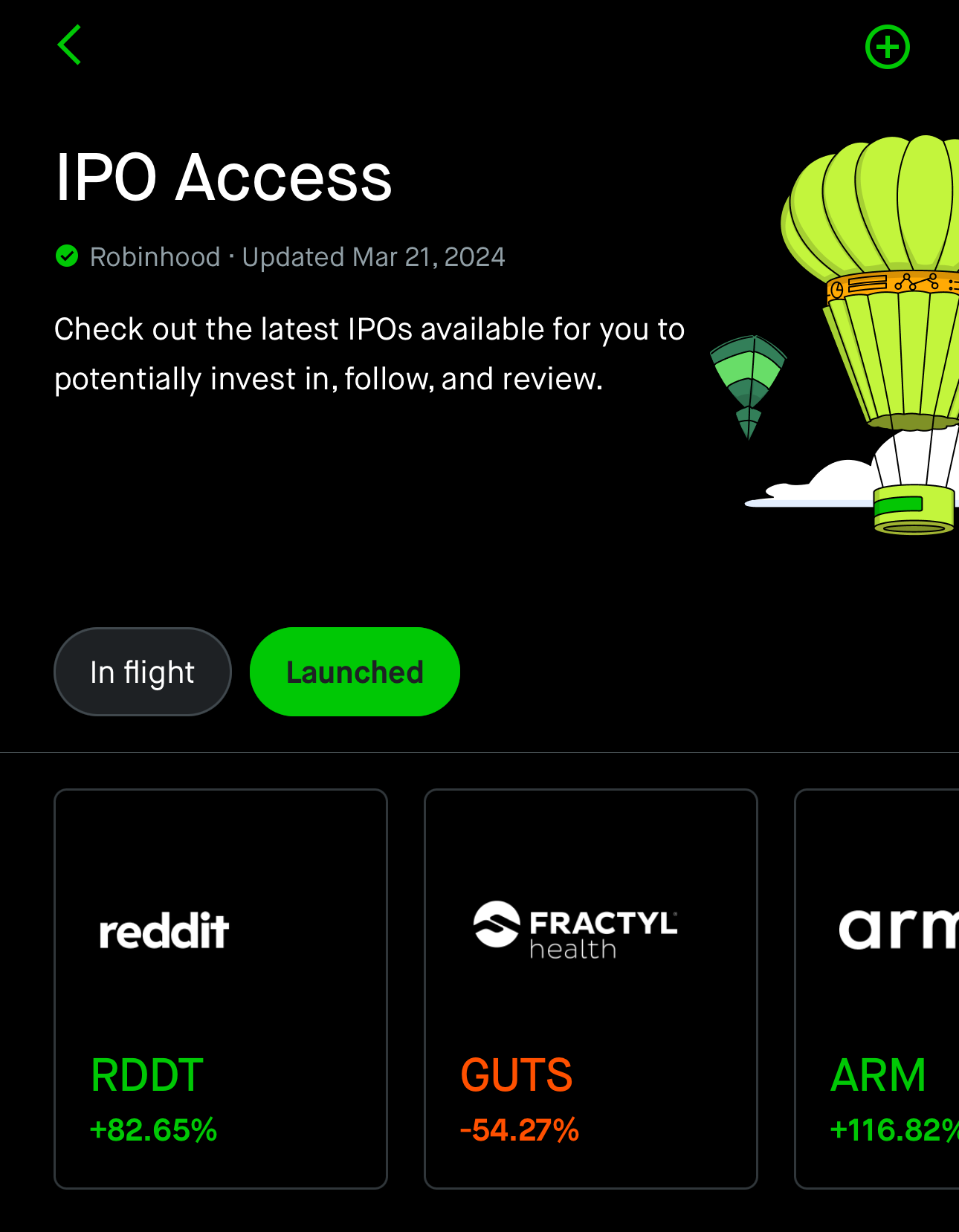

IPOs or Initial Public Offerings are the first chance to buy shares in a company that is starting to trade on the stock exchange. In the past, it was difficult to get into this potentially lucrative segment.

So, I found it helpful that Ronbinhood rolled out IPO Access, allowing me to participate in upcoming IPOs without any account minimums.

I liked the fact that I could browse the participating upcoming IPOs. The IPO feature also allows me to read the preliminary prospectus and see other details about the company including the management team and risk factors.

If I find a company that appeals to me, I can then request to buy shares at the initial listing price range. IPO shares are limited, but once the final price is set, I can review the details and edit or cancel my request before shares are allocated.

Additional Features That Helped Me

There were also some additional features that I found helpful:

-

24 Hour Market

One of the best features of Robinhood is that there is a 24 Hour Market. Essentially, this means that I can trade many stocks and ETFs 24 hours per day for five days a week.

This feature began to roll out in 2023, but it has now been fully launched for all customers.

The 24 Hour Market allows placing limit orders at any time between 8 pm on Sunday and 8 pm on Friday.

Despite this flexibility, the trades are still free of commission.

-

Custom Alerts

Another feature that I found helpful on Robinhood is the custom alerts. The alerts made it easy to set my pricing parameters and then walk away from the platform.

If there are price movements, I will receive an alert, so I can check the details and then take action.

This is a great feature as I don’t necessarily want to be tied to my home computer or even my mobile device. Sitting watching any minute pricing changes is a gateway to making emotional decisions.

So, it is nice to be able to put my phone away confident that I’ll get an alert if there is a change I need to know about.

-

My Watchlist

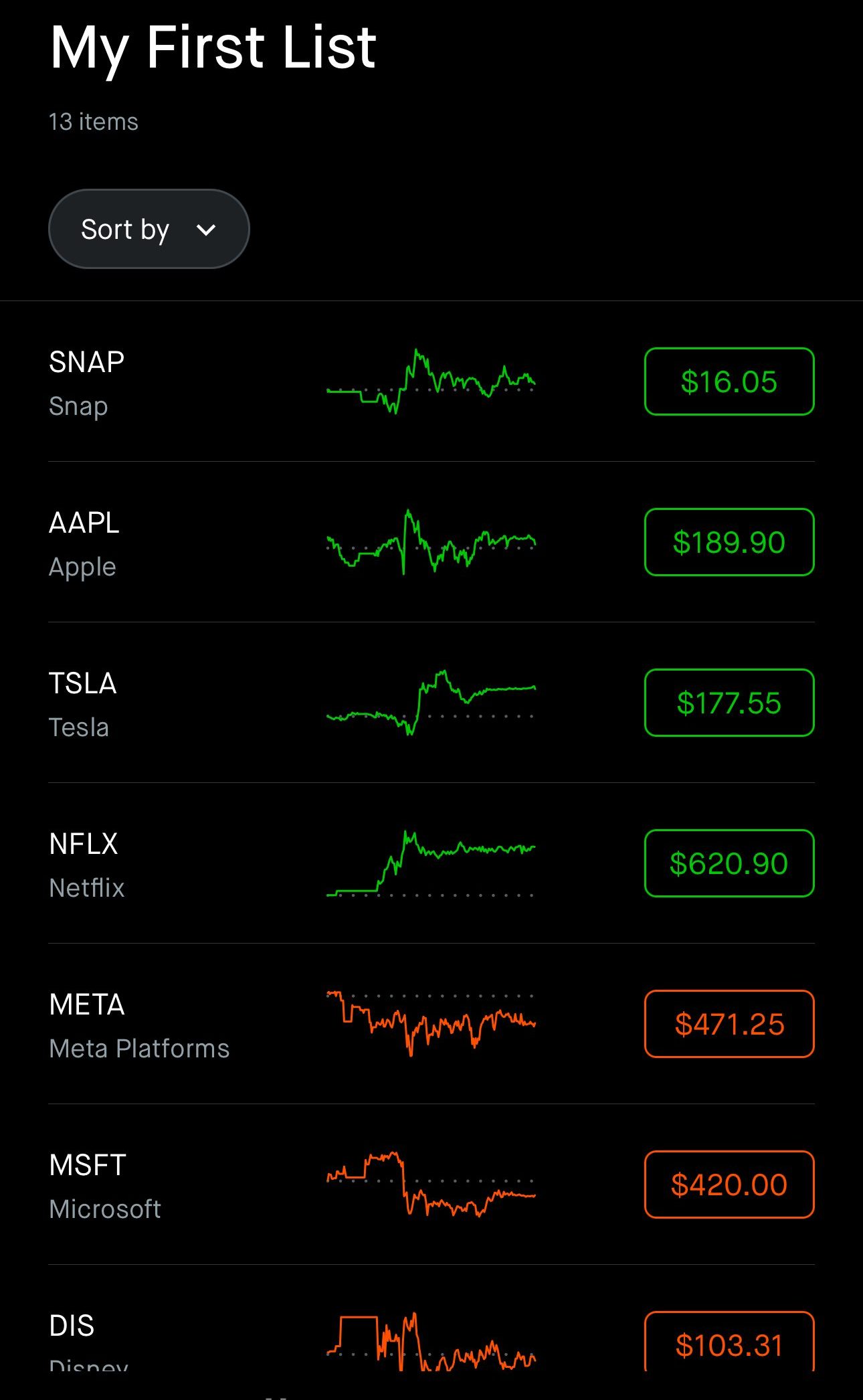

Another feature I found helpful was the watchlists. If I’ve found a stock of interest, but I’m not ready to take the plunge and buy shares, I can add the company to my watchlist.

I can create multiple lists, so I can watch stocks for my different investing accounts. The watchlist feature shows pricing changes with a neat graphic for each one.

I can even sort my list to make it easier to spot potential trends quickly.

-

Educational Resources

One area where many fee free investing platforms tend to fall short is on the educational resources. Robinhood doesn’t have a massive library of resources, the podcast, articles and newsletter can take you from complete beginner to confident trader.

The Learning Center library contains a variety of articles that take you through the very basics, such as “what is a crypto wallet” through to topics like short selling.

You can browse through all the articles to find topics of interest to you, but some are grouped together to make things easier. For example, I found the Options Trading section helpful as this was a weak area in my investing toolkit.

I also found the Robinhood YouTube videos interesting. The channel has limited subscriber numbers, which could be why the content is not regularly updated, but the current selection of videos are helpful and informative.

-

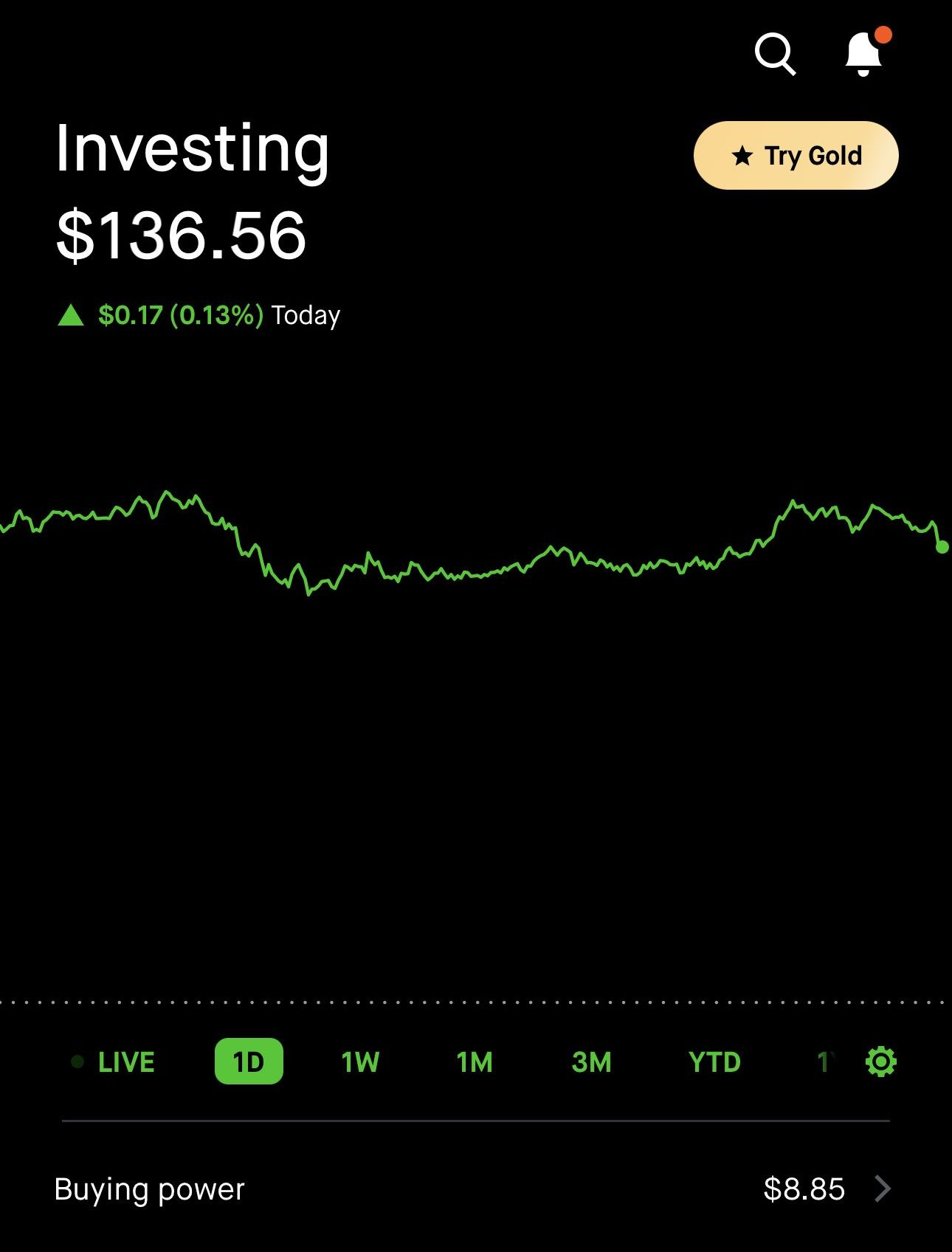

Asset Management Presentation

I found the way that Robinhood presents my portfolio and assets helpful. I can get an overview of my portfolio with graphic representations, so I can see at a glance what’s happening.

I found this to be helpful when I noticed changes in the market and wanted to immediately see how this had influenced my holdings.

-

Snacks News Feed

Although not unique to Robinhood, I did find the Snacks news feed helpful. As you can see in this screenshot, I can immediately see what is happening in the financial world and how this impacts investing trends.

The news feed is not simply filled with dry financial information, but the articles are thoughtful and provide some great insights into what is happening across a variety of industries.

-

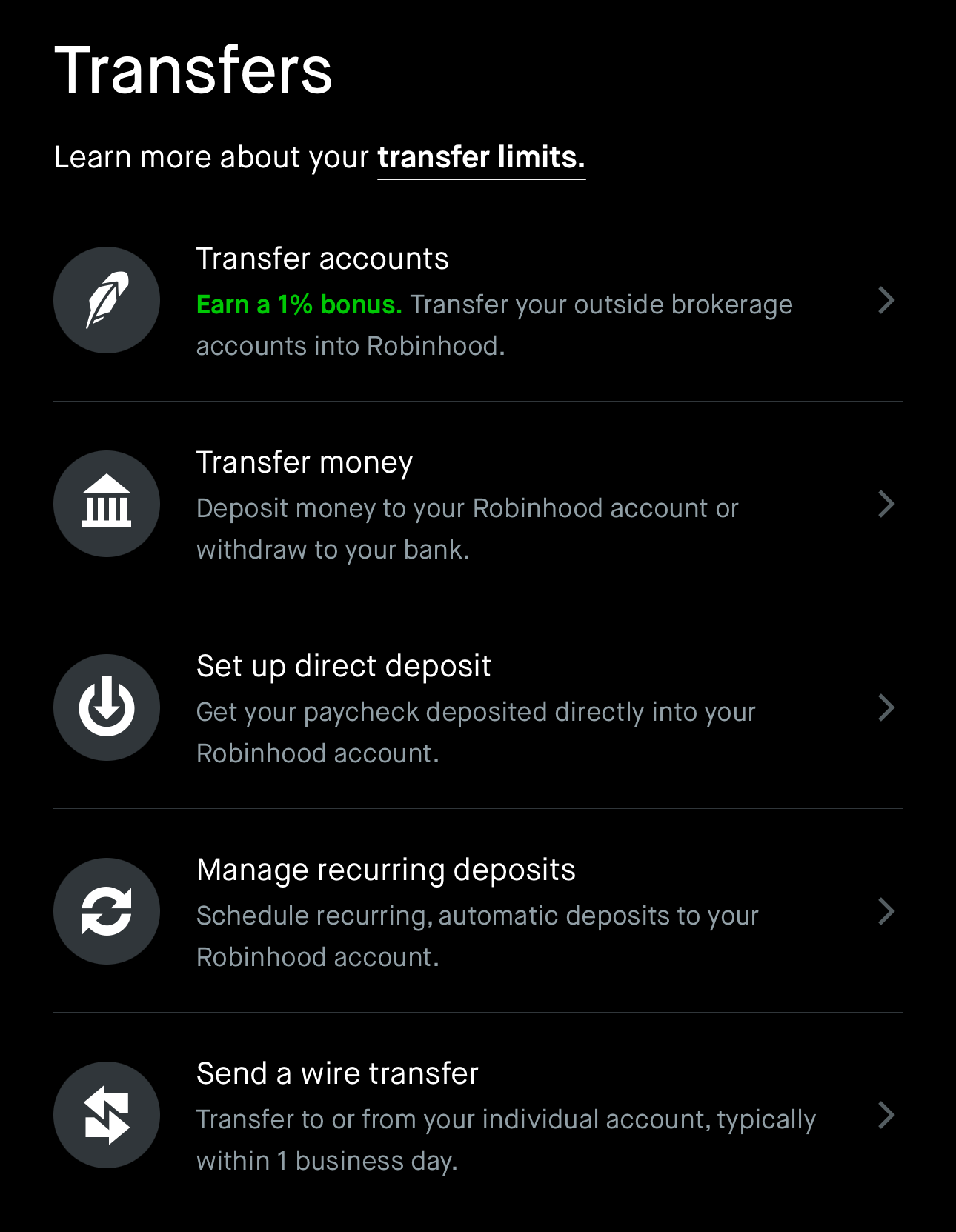

Simple Transfers

Every investing platform needs to provide ways to add money, but Robinhood makes transferring funds simple and easy.

The transfers screen is intuitive and walks you through the process of moving money into and out of the platform. I linked my bank account through the app, which made it easy to transfer funds directly.

The funds are marked as pending, but after approximately five days, they were cleared and ready to use for asset purchases.

All I needed to link my account was my ACH account number and routing number. I entered these details and then I could use direct deposit or wire transfers. There was also an option to set up a direct debit, which some platform users may prefer.

-

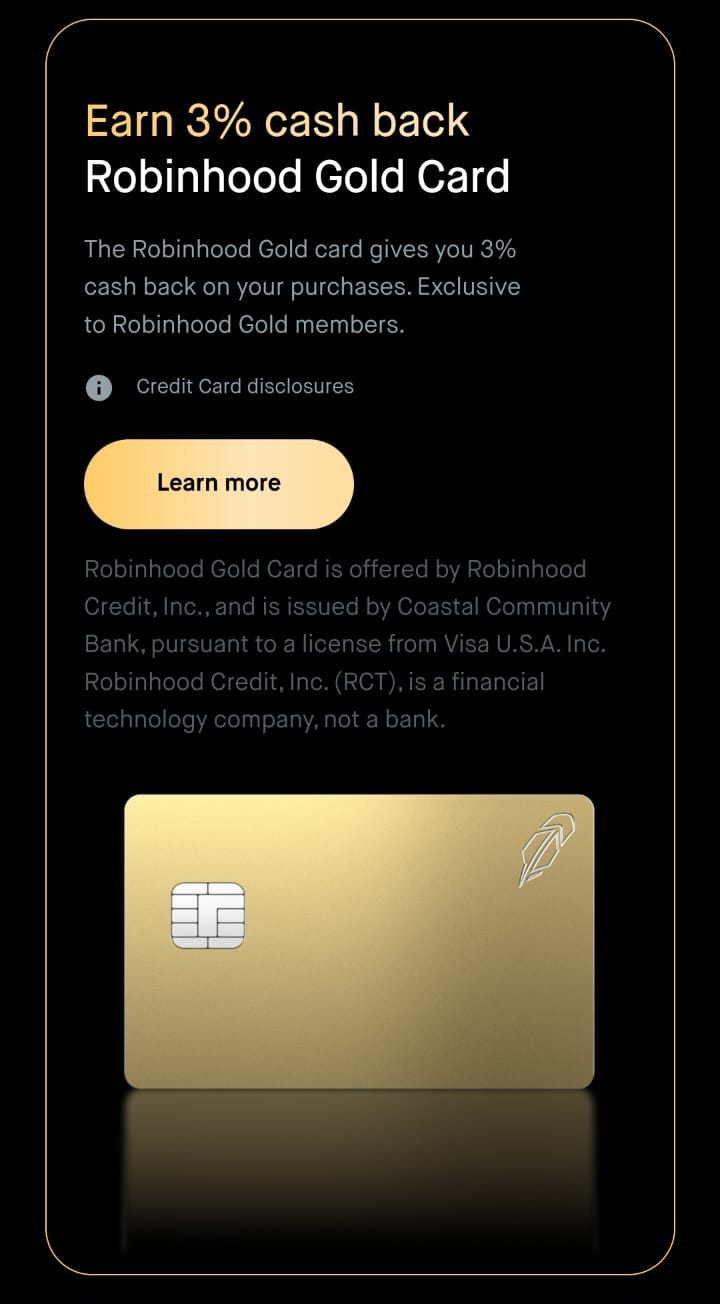

The Robinhood Gold Card

I touched on this earlier, but one of the perks of upgrading my subscription to Robinhood Gold is the Gold credit card. This is a rewards credit card that is exclusive for Gold members.

There is 5% cash back if I book travel using the Robinhood travel portal and 3% on all other purchases.

I also found the card benefits package helpful. It includes a number of insurance coverages including trip interruption, auto rental collision, travel and emergency assistance and roadside dispatch.

I can also enjoy purchase security, return protection and extended warranty protection on items purchased with the card.

What Can Be Improved with Robinhood

Robinhood has some great features, but there are a couple of areas where there could be some improvements:

-

Lacking Mutual Funds and Bonds

Robinhood has a wide selection of assets, but the lack of bonds and mutual funds does create a gaping hole in the line up. Since many investors use mutual funds to create a well diversified portfolio, this could be a problem.

There is a workaround by buying ETFs, but this does require more work than simply purchasing a single target date mutual fund.

-

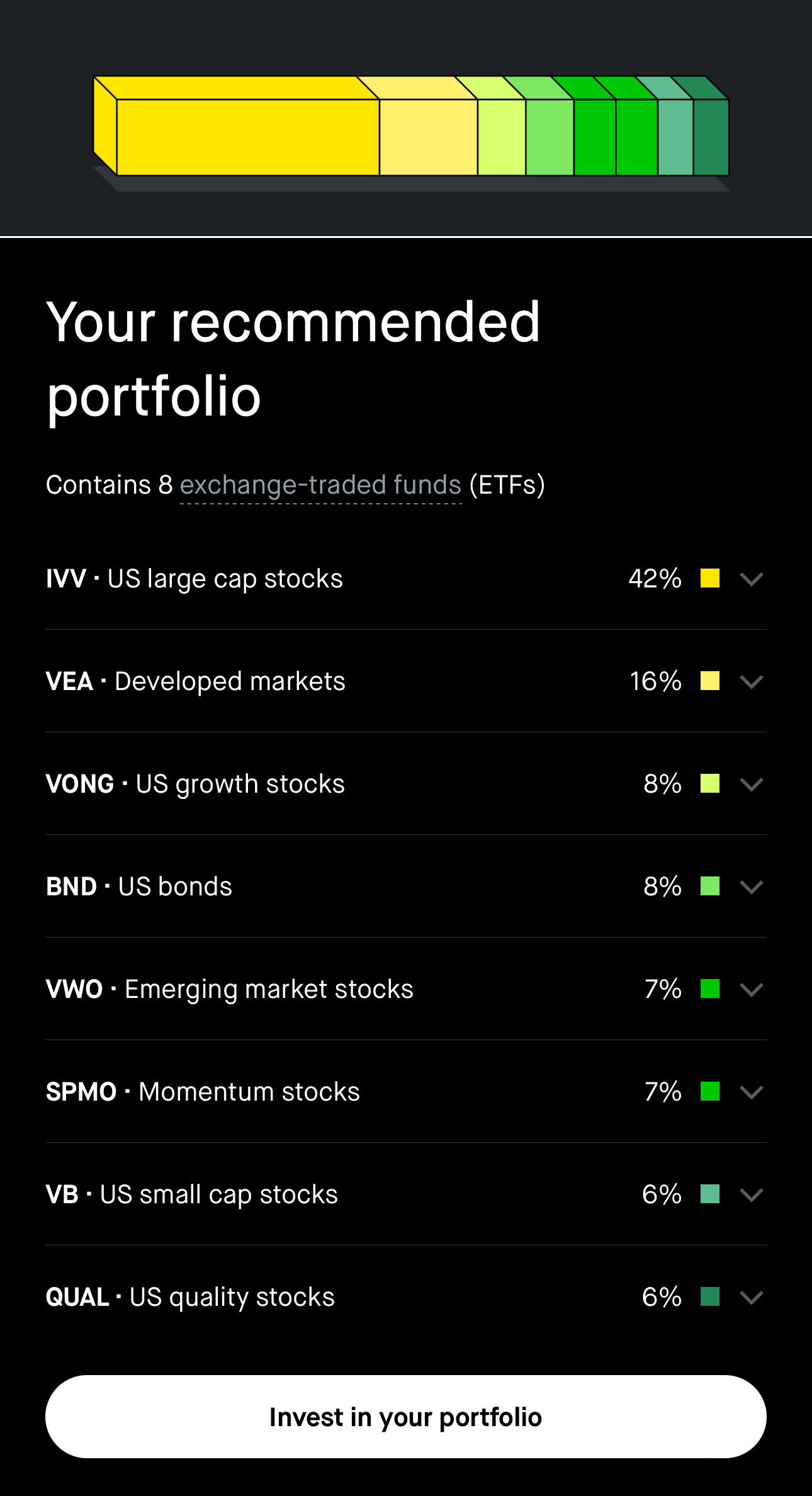

No Automated Investing

While Robinhood creates a recommended portfolio basedon your risk level, it does not offer automated investing options, which means users must manually select and manage their investments.

This can be a drawback for those who prefer a hands-off approach or lack the time and expertise to manage their portfolio actively.

Automated investing, often found in robo-advisors, helps in maintaining a diversified portfolio and rebalancing automatically based on market conditions.

-

No Advisory Services

Robinhood does not provide advisory services. This can be a significant drawback for investors who need guidance on creating investment strategies, retirement planning, or other financial decisions. Without advisory services.

-

Reliability Issues

Robinhood has received criticism in the past for trade restrictions and outages particularly at times of market volatility. There have also been regulatory charges and fines.

So, Robinhood will need to do a lot more work to re-establish its reputation as a reliable platform.

Who is Robinhood Best For?

While Robinhood does have mass appeal, some people will find the platform a great fit:

- Mobile Users: The Robinhood app is fantastic and offers all of the functionality of the platform. So, if you’re the type of person who likes to initiate trades on the go and do all your trading research on your mobile device, you’ll find Robinhood a great fit.

- Retirement Investors: While Robinhood does not have many retirement account types for the self employed, the overall retirement features of the platform are solid. With contribution matching and innovative management tools, Robinhood is a great way to save for your retirement without incurring excessive fees.

- Crypto Traders: Robinhood remains one of the few brokers that offer fee free crypto trading. Although the selection of coins is not as extensive as some other platforms, the fee structure and ability to move crypto into and out of the platform should appeal to most crypto traders.