Table of Content

Sure, you’ve made the important decision to part with your hard-earned money and invest. Before getting into it, you need to answer some crucial questions before you pick an approach that will suit your personality, situation, and resources. Of course, it should also match your investing goals.

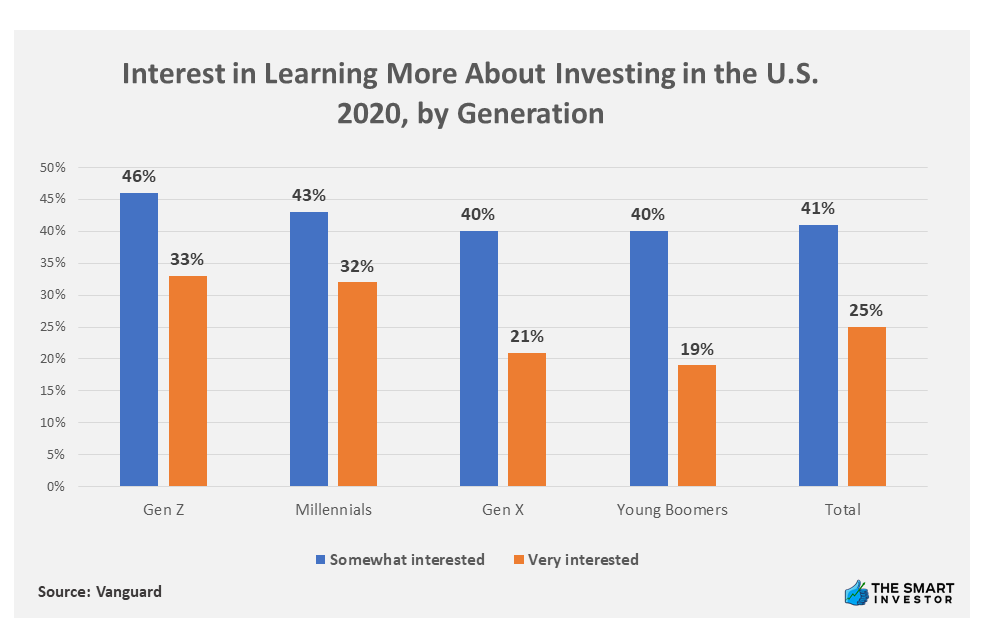

According to a survey conducted by

Some of the things you need to settle would include the following:

- Would you be investing in single stocks or would you rather invest through a fund that would give you a more diverse investment?

- Will you actively personally participate in the investing process or would you rather rely on experts to do it for you?

- Will you regularly check on the progress of your investments or would you rather leave it and do nothing at all until they grow?

There are a lot of variations and possibilities available for you. You are the best person to decide which one is the best and this article aims to help you decide through the upsides and downsides of each of them.

Let us give you an overview of the general approaches to stock selection.

1. Active Investing

Are you comfortable with risks? Do you see yourself being active in trading several times a day every week? If so, an active investing style fits you perfectly. Active investing is for investors who do not really look at the long-term horizon but would rather focus more on the present-day scenarios.

Active investors normally target specific stocks and take advantage of market timing to trade their stocks and get short-term profits from the trade. Active investing will demand the investor to be constantly watching the market to improve his/her position for the best results.

There are many advantages to active investing but the biggest one would probably be the flexibility that it affords the investor. When an asset doesn’t perform up to par, you have a free hand to make changes in your position and it gives you more control over your portfolio.

In case you need to make sudden or drastic measures such as building a hedge by short sales, or setting options to prevent losses, you can do it fast and easy by yourself.

Yes, There Are Fees

The disadvantage would be the fees that you have to pay each time you make a transaction, both in buying and selling your stocks. Although the trading fees will vary per market, they can quickly add up to a substantial amount. And they will eat up your profits.

Oh, did we already mention the fund manager’s fee? At first glance, they don’t look too burdensome because we’re talking around the area of 1.5%. Except that when you’re paying 1.5% over a period of 30 years, that’s quite big. And 1.5% is the average rate so it means you may find a fund manager who charges more. You should also pay attention to those obscene entries and exit fees. They can be very costly.

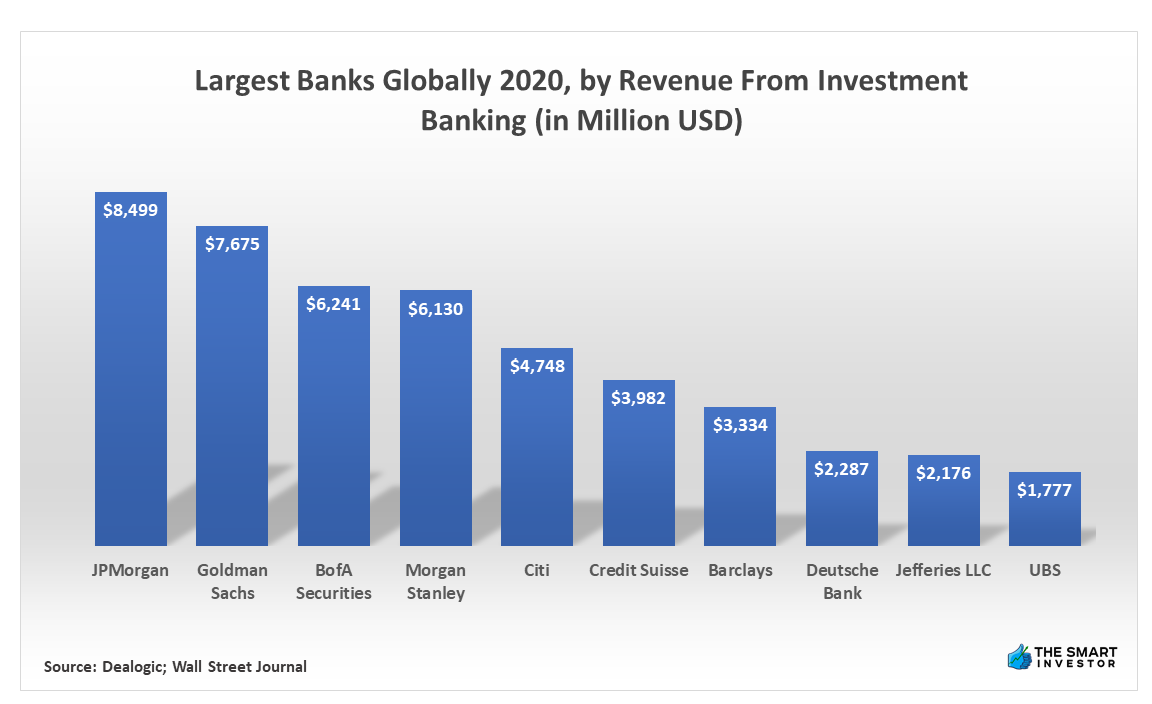

In 2020, JPMorgan recorded the highest revenues from investment banking in the world at $8.5 billion . The new record made JPMorgan the largest bank in the world, with a market share of 9.3%. In the same period, Goldman Sachs recorded approximately $7.1 billion, making it the second-largest bank. BofA Securities and Morgan Stanley ranked third and fourth, with a difference of $111 million between them. UBS secured the 10th spot with $1.8 billion in revenue, $6.9 billion behind JPMorgan.

These are the most prominent disadvantages but there’s one that stands above the crowd. After paying all these fees and costs, you’re still going to be clueless about whether you’ll actually do better than the market.

In truth, 70% to 80% of active investment funds fail to beat the market. At the end of the day, when you have factored in all the different costs and fees you’ve paid, you might end up in the red. It’ll be too late by the time you realize that you’ve lost money.

2. Passive Investing

If you are looking at passive investing, this means you are investing for the long haul. A passive investor limits the amount of buying and selling within his portfolios in order to minimize his costs. The strategy requires the will power to buy and hold the securities. It’s the discipline that resists the temptation to react or adjust to the stock market’s ever-changing motion.

Probably the best example of the passive approach is by buying an index fund. But be sure that it’s a fund that follows one of the major indices such as the S&P 500 and Dow Jones. The principle behind this is that you become the owner of small fragments of thousands of company stocks and you earn your returns as a participant when the corporate profits of these companies go up over time.

Successful passive investors simply keep their gaze fixed on the prize at the end of the line and do not let the short-term mishaps and even market dips bother them.

The Pros: Time And Flexibility

Perhaps the best benefit to you would be the time you save. The process is simple: you invest your money and do the other things you want to do. There’s no need to scan the business and financial news every day or chart the movement of your stocks. What we’re saying is, it does not place a big demand on your time and thinking.

Now that we’ve got that out of the way, let’s talk about the fees. Or more significantly, the fees that you save when you buy and sell. Although the actual costs would depend on where you invest your money, they could run up to under 0.10% per annum.

The higher end of that scale would be just about 0.5% per year. When you lay that side by side with what you have to pay for other active investment schemes, it’s enough to make you smile.

The next benefit that many investors ignore about passive investing is that passive investing allows some room for flexibility as well. It doesn’t mean that the decision you make today will stay permanent for the next forty years or so.

You have the option to review your investment strategy after five years or make a re-evaluation every ten years. You might want to invest in high-risk options for ten years for higher returns, shift to a different mix for the next 20 years, then settle to a low-risk portfolio when you’re about to retire.

The Cons Of Passive Investing

But do you know what many investors don’t like about passive investing? It’s that long period of inactivity because waiting is difficult. This is especially true when they see that their stocks are performing below their expectations and they get this compulsion to sell at once.

The truth is, setbacks are normal in passive investing, so investors should expect them. You should have a long-term perspective and have faith that eventually, they will rise. If you still worry after that, we can’t blame you – we’re all only human.

Another downside to index investing is the composition of indexes. Any company, whether it’s doing good or not, can find its way to the index. So, it’s possible that there might be some losers in the mix and you’ll still be putting money in them. Of course, if your investment is doing great as a whole, it negates the bad apples in the basket.

3. Growth Investing

Growth investing makes use of growth shares to realize profits in the long run. Basically, growth shares are those that the investor believes are good prospects for future returns because of the company’s potential to generate rising income year after year. The principle behind this is that the growth in the company’s earnings will boost its share price.

As a rule, the investor should pick the ones that have the capacity to grow quicker than the overall market. They can see this from the company’s track record in the past plus an intelligent analysis of its future returns. Potential growth would depend on factors such as sector, geography, asset class, regulation and for cyclical industries, the point in the cycle.

It's basically double-betting. As an investor, you bet on a stock that has already shown better-than-average growth (whether it’s earnings, revenues or some other measure) and believes will continue to do so, which makes it a strong investment candidate. These are the leading companies in their own industries, they have above-average price-to-earnings ratios and often pay low (or none at all) dividends. However, if you buy at a high price, there’s always the risk that an unexpected event could cause the stock prices to plummet.

4. Value Investing

Value investors are the treasure hunters of the financial industry. They look for hidden gems in the market or stocks with low prices but showing a lot of promise. The reasons why these stocks are undervalued can vary such as a short-term public relations crisis or a more permanent situation like a distressing condition in its industry.

These investors look for underpriced stocks from within a specific industry or across the market, hoping that the price will rebound once other stocks begin to move upward. Generally, these stocks have low price-to-earnings ratios (which is a metric for determining a company’s value) and high dividend yields (the proportion of dividends that a company pays in relation to its share price). Of course, the price may not go up at all – which is a real risk.

Investors should avoid the value traps – a company that looks cheap on paper but will not be able to turn around and revalue upwards. Instead, they should invest in companies where the bad situation is only for a short while and there is real potential to turn around.

A report by Gallup shows that a majority of Americans consider real estate as their best long-term investment from a pool of several investment options. Real estate leads the list of preferred long-term investments by 35%, against stocks at 21%, gold at 16%, and Savings accounts at 17%.

5. Market Capitalization

The last question for investors has something to do with investing in either small or large companies. A company’s size technically depends on its capital which investors call ‘market capitalization’ or ‘cap’ for short.

So, these investors who pick stocks according to the size of the company are using a market capitalization investing style. The computation for market capitalization or market cap is the number of outstanding shares multiplied by earnings per share. Small cap companies have a market capitalization of $300 million to $2 billion, mid-cap companies carry a capitalization of $2 billion to $10 billion while large-cap companies flaunt a market capitalization of over $10 billion. In terms of risks, small-cap stocks are riskier investments than large-cap companies.

However, you may meet some investors who feel that small-cap companies have the bigger potential to deliver better returns just because of the bigger room for growth opportunities and they can respond faster to situations.

In truth, the potential to get greater returns in small caps is proportionate to the size of the risk you’re going to take. For one, smaller firms have fewer resources and often have less diversified businesses. Their share prices can swing much more widely and can cause large gains or large losses. So, if you’re this type of investor, you should be comfortable with taking on this additional level of risk if you want to tap into a potential for bigger returns.

The large-cap companies have been around much longer and are usually more stable. Many investors keep large-cap stocks in their portfolios because of their dividends and stability.

Which Style If Investing Is Best For Me?

The right personal investment style for you begins with an honest assessment of your risk tolerance. Remember the basic investment principle of risk and return is this: the higher the risk, the higher the returns; the lower the risks, the lower the returns. This ‘risk’ in any investment setting is simply losing money.

Your age, income, experience, and personality are a few of the most common attributes that affect your risk tolerance. Younger investors are more aggressive and tend to pick riskier investments while older investors usually pick safer investments. First-time investors and people with moderate budgets are usually more conservative than those with bigger disposable income. Also, some people are risk-takers and some would rather prefer to take it safe and slow.