Acorns

Monthly Fee

Minimum Deposit

Our Rating

Savings Rate APY

-

Overview

- FAQ

Acorns offers a micro-investing platform designed to make investing simple and accessible for everyone. It offers various investment options, including automated recurring investments and a retirement account.

Put it simple, every dollar invested is automatically spread over more than 7,000 stocks and bonds, due to fractional share ownership.

The premise of this platform is that you can grow your acorns into mighty oaks, appealing to those who want to dip their toes into investing, even if they don’t have an impressive investment fund.

This robo advisor offers a hands off investing approach and the platform has some nice features. While some of these are not unique to Acorns, and it may lack the sophistication of some other platforms, the simple fee structure can make it easier to access a decent feature set.

What investment options does Acorns offer?

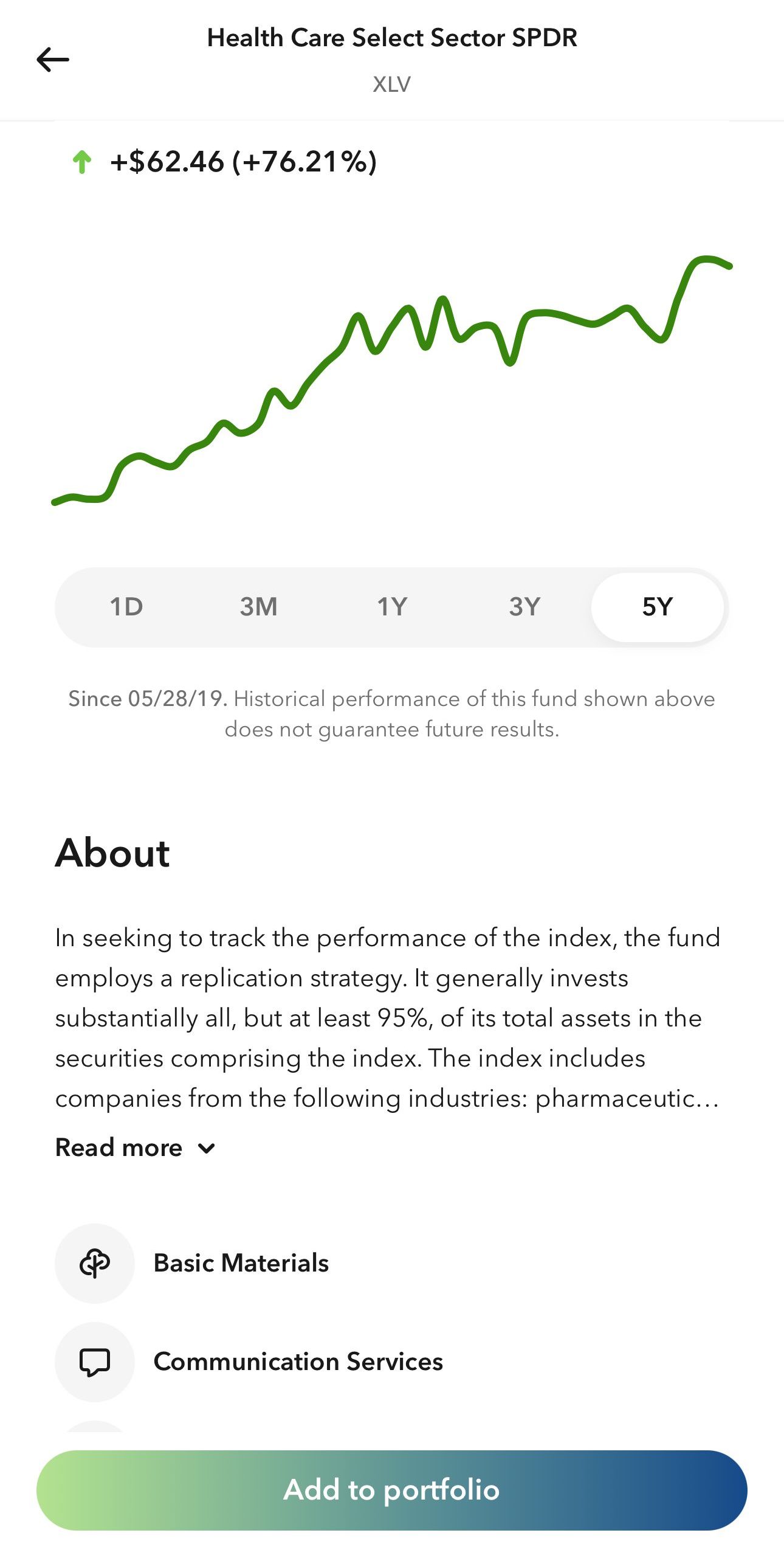

Acorns offers five different portfolio options, ranging from conservative to aggressive, each composed of ETFs (Exchange-Traded Funds) to match your risk tolerance and investment goals.

What is Acorns Round-Ups?

Round-Ups is a feature that rounds up your everyday purchases to the nearest dollar and invests the spare change. This helps you invest small amounts regularly without even noticing.

Is Acorns safe to use?

Yes, Acorns uses bank-level security measures to protect your personal and financial information. It is also a member of SIPC, which protects securities up to $500,000.

Pros | Cons |

|---|---|

Automated investing with pre made experts portfolio | High Fees For Low Portfolios |

Cash management account with high savings rates | Rebalancing can be better |

Invest in individual stocks | No tax strategies to minimize tax bills |

Earn rewards when you shop with hundreds of brands | No Budgeting or personal finance tools |

Retirement Plans benefiting from tax advantages |

Acorns Features I Mostly Liked

Here are the key features that I found most appealing in Acorns:

-

Automated Investing With Over 7,000 Assets

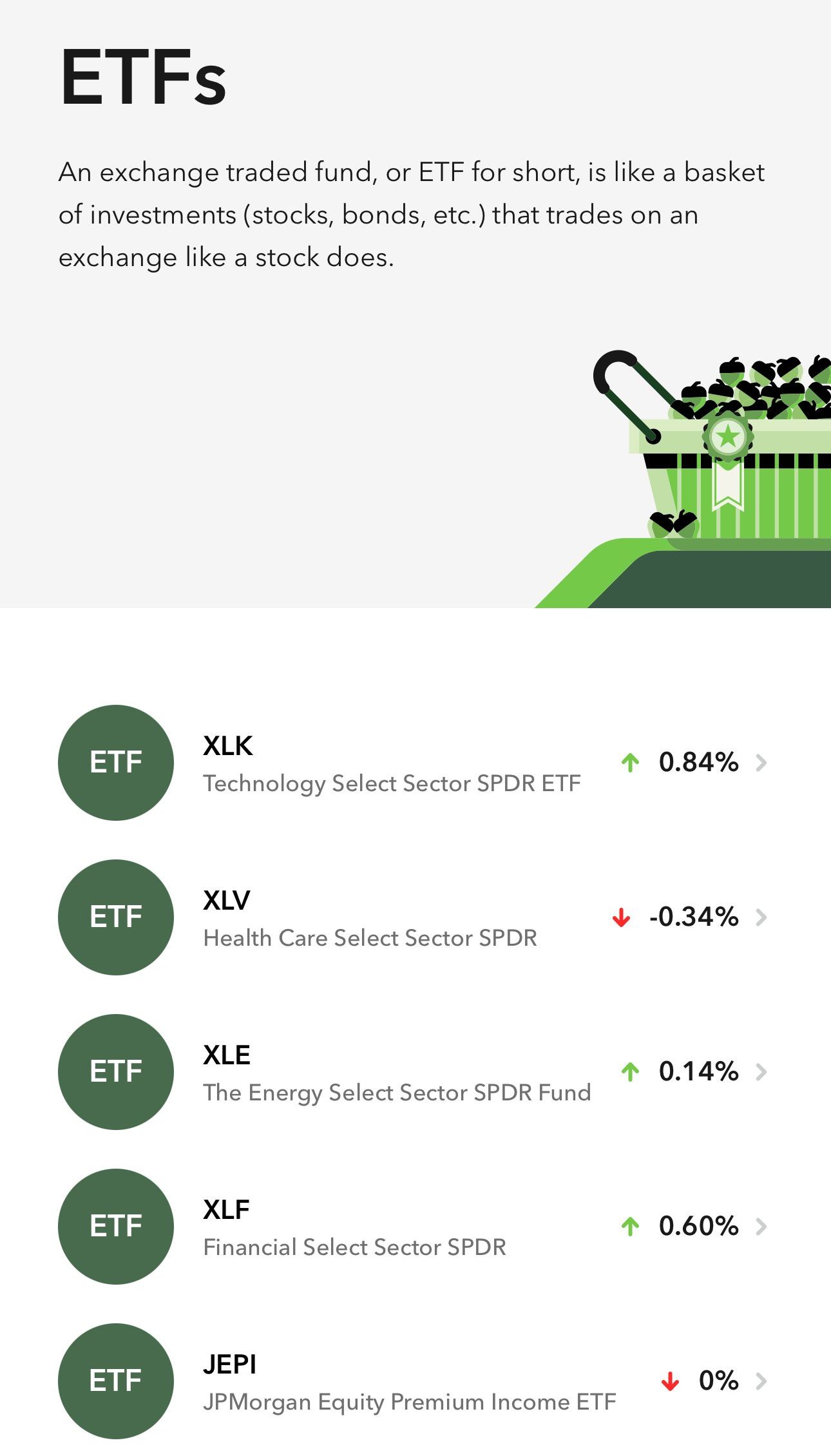

Acorns builds and manages your portfolio automatically based on your risk tolerance and financial goals. Acorns invests your money into highly-rated Exchange Traded Funds (ETFs), which are expert-built portfolios.

These ETFs are like baskets containing a variety of investments, including stocks and bonds, offering benefits such as diversification, lower costs, and potential tax efficiency.

- Diversified Mix of Stocks and Bonds: By investing in Acorns ETFs, your portfolio is exposed to a broad range of stocks and bonds, possibly over 7,000 different assets. This diversification helps reduce risk compared to trading individual stocks.

- Invest in Top Companies: Acorns ETF portfolios often include investments in some of the world's largest and most successful companies like Apple, Amazon, Google, and Berkshire Hathaway. This provides exposure to top-performing businesses as part of your diversified portfolio.

- Expert-Built Portfolios: The diversified portfolios offered by Acorns are constructed by experts and include ETFs managed by professionals at leading investment firms such as Vanguard and BlackRock. This ensures your investments are handled with a high level of expertise.

-

Simple Portfolio Construction

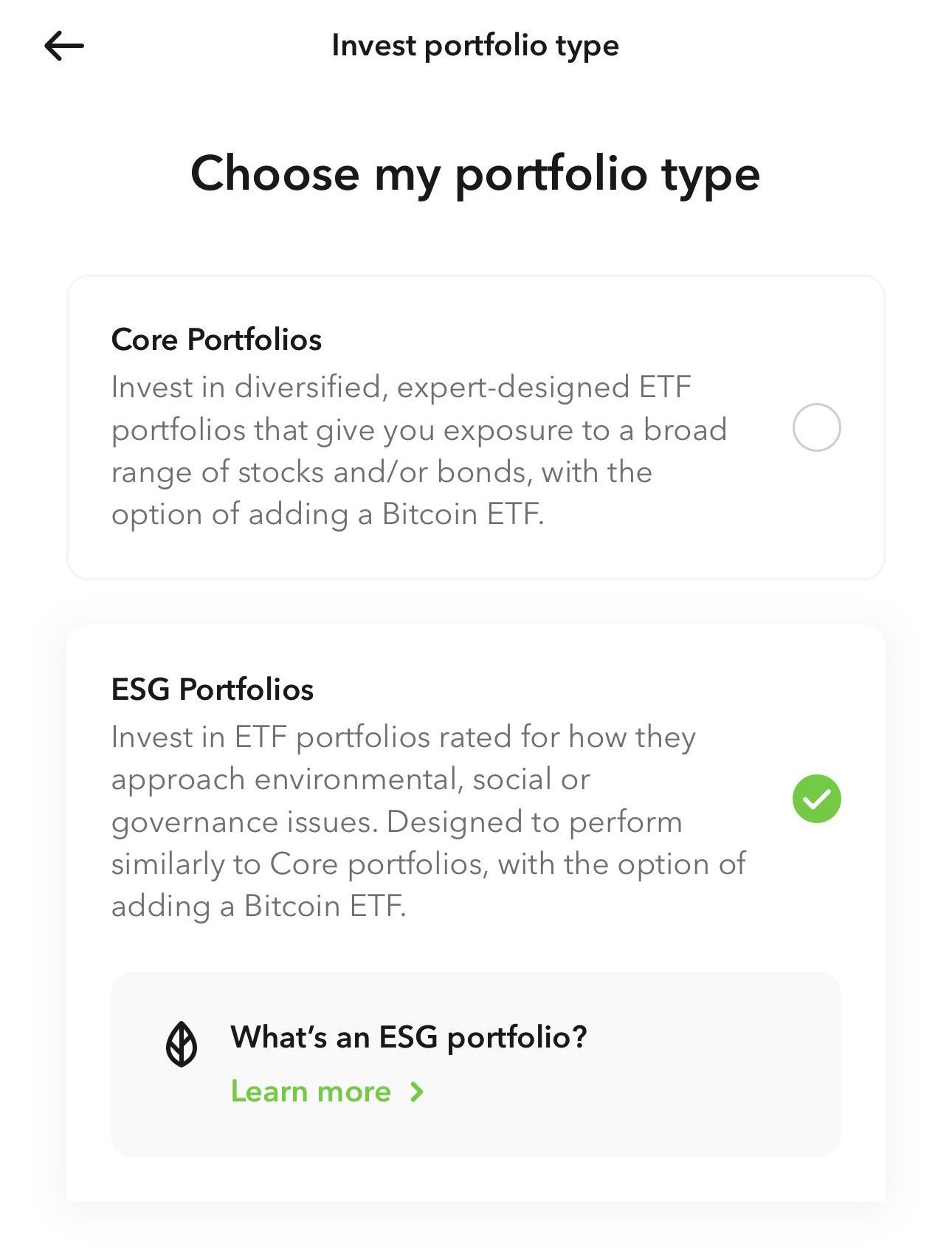

As with many robo advisor platforms, Acorns has designed the portfolio construction to be as simple as possible.

The platform walks you through investment preferences and goals during set up, but you can choose from ETFs that are based on themes.

The five base portfolios relate to risk. So, you can choose from Aggressive, Moderately Aggressive, Moderate, Conservative and Moderately Conservative.

However, what I found helpful was that there are also environmental, social and governance ESG portfolios and a Bitcoin linked ETF.

I found this a great way to start my investing journey, as I could simply choose a portfolio according to my risk preferences.

-

Fractional Shares

Another of the Acorn features that I love is that you can access fractional shares. This platform offers fractional shares for new purchases and more importantly, reinvested dividends.

When I first started using the platform, I had a limited investing fund, so every dollar counted. With fractional shares, I could put every dollar to work, as I wasn’t limited to purchasing full shares.

Although fractional shares are not a unique feature on robo advisor platforms, many platforms limit fractional shares to reinvested dividends.

This means that I would not have been able to access higher value individual stocks from day one of using the platform.

-

Cash Management

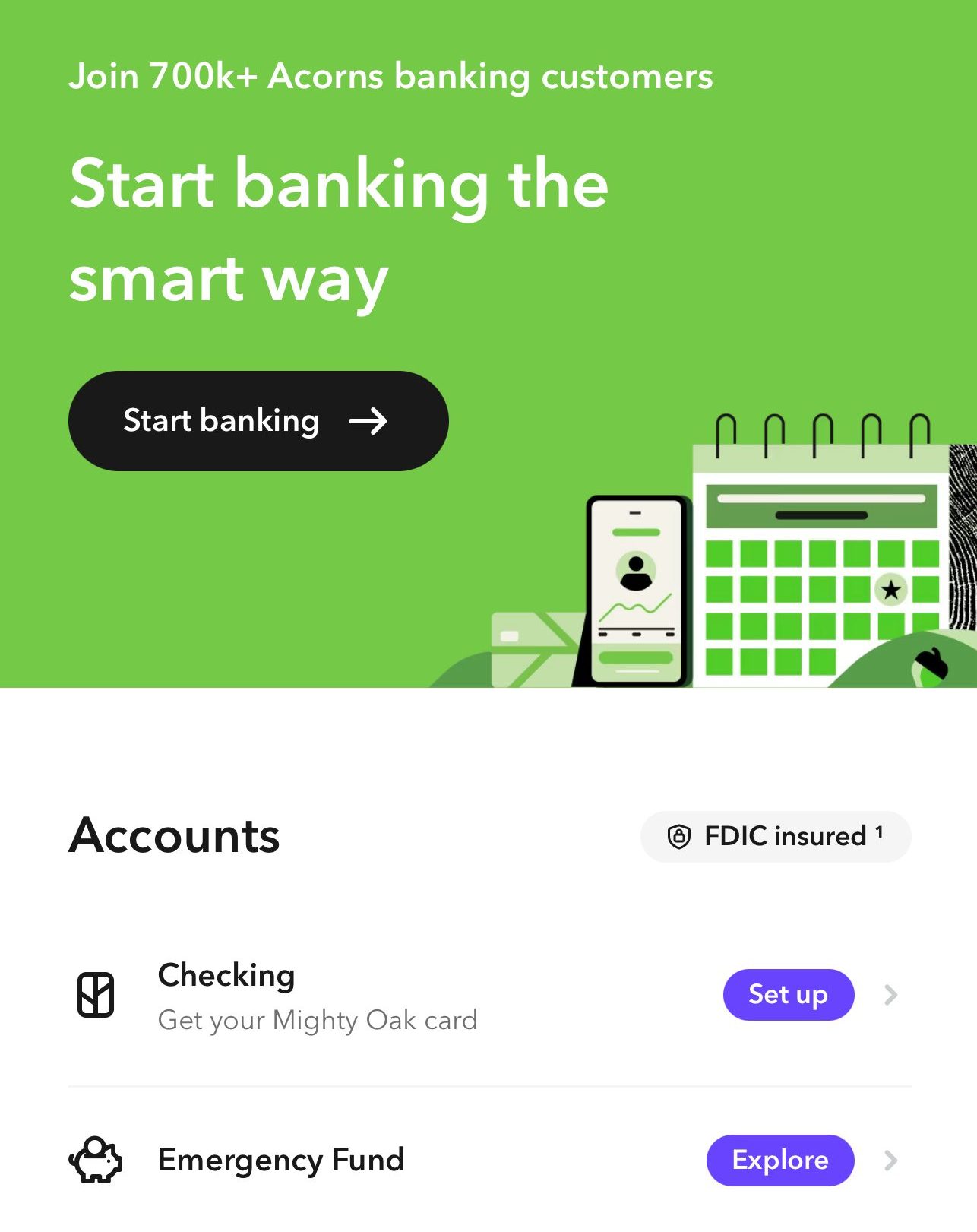

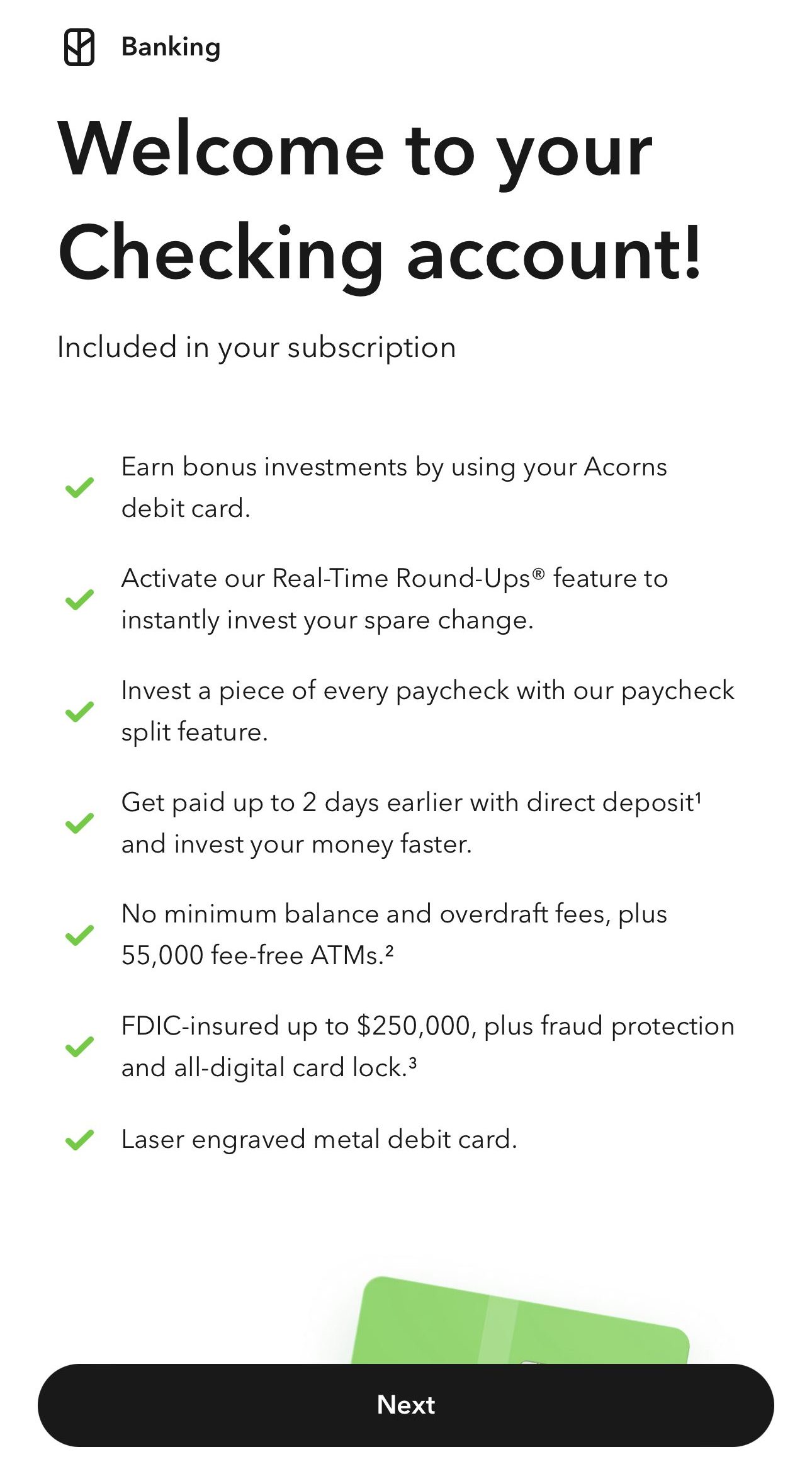

While I was primarily interested in Acorns for its investing capabilities, I did appreciate the cash management aspect of the platform. Acorn members at any account tier can access a checking account to save and invest, with Round Ups.

With this account, I received a Visa debit card that I could use at over 55,000 locations in the US and other areas of the world with no ATM fees. The account also has no overdraft fees.

Where the potential for this feature really comes into its own is with the Emergency Fund account. This is available to Plus and Premium members. With this I can earn 3% APY on my checking account and 5% on my emergency fund.

Banking services provided by and Mighty Oak Debit Cards issued by nbkc bank, Member FDIC.

-

Acorns Later

Acorns Later is designed to help you automatically invest for retirement while potentially benefiting from tax advantages.

Here's an overview of what this feature offers:

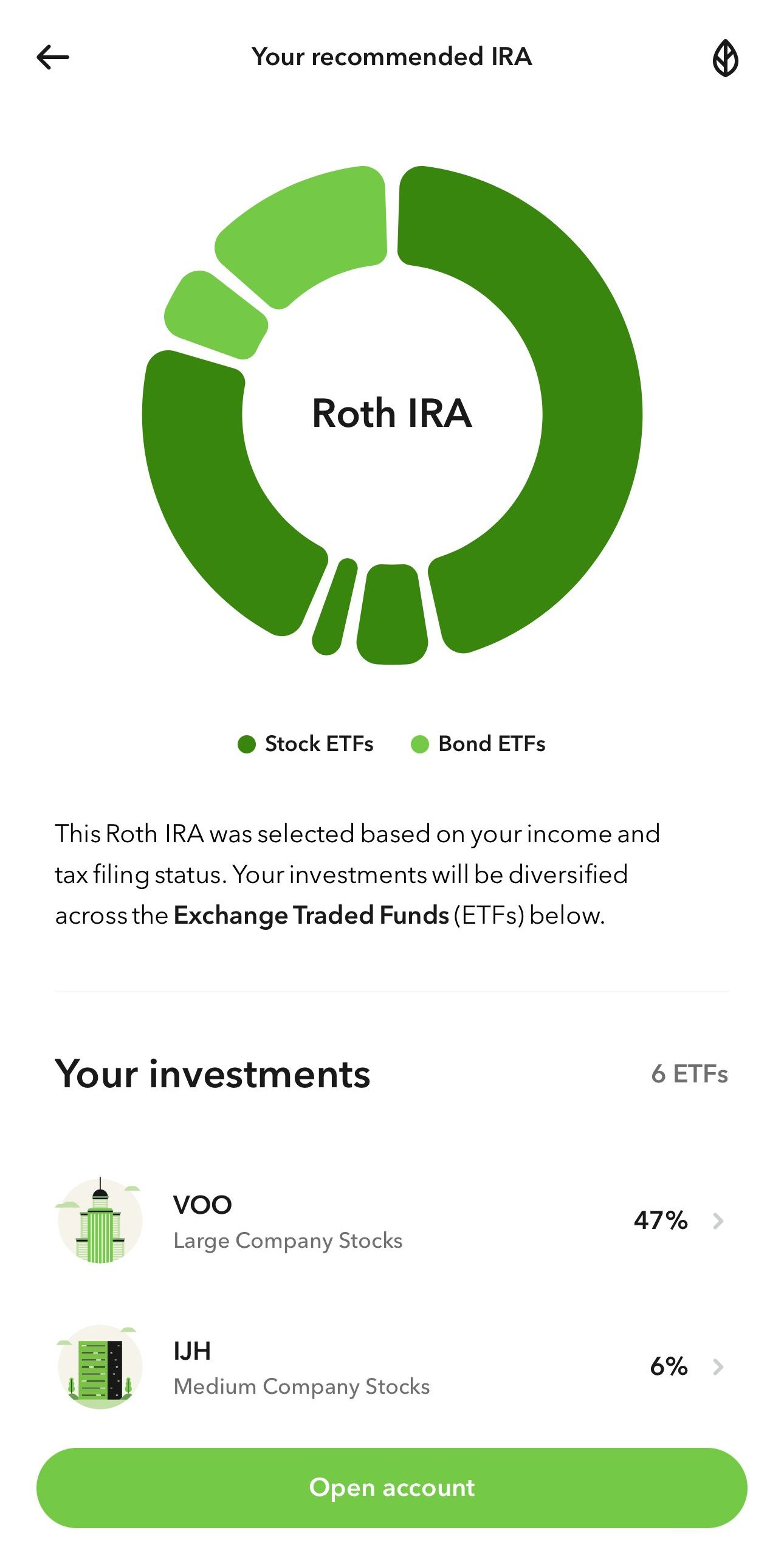

- IRA Plan Recommendations: In just a few minutes, Acorns Later recommends an IRA plan tailored to your long-term goals. By answering a few questions, you can determine whether a Roth, Traditional, or SEP IRA is right for you.

- 3% IRA Match: With Acorns Premium, you receive a 3% match on new contributions to your Acorns Later retirement account. This match applies to contributions kept in the account for at least four years, potentially adding up to $210 annually to your investment.

- Automatic Recurring Contributions: You can set up recurring contributions on a daily, weekly, or monthly basis, making your retirement investing automatic and hassle-free.

- Invest with Paycheck Split: This feature allows you to automatically invest a portion of your paycheck into your Acorns Later account. You can choose the percentage to allocate, starting at 1%, and adjust it anytime.

-

Portfolio Customization

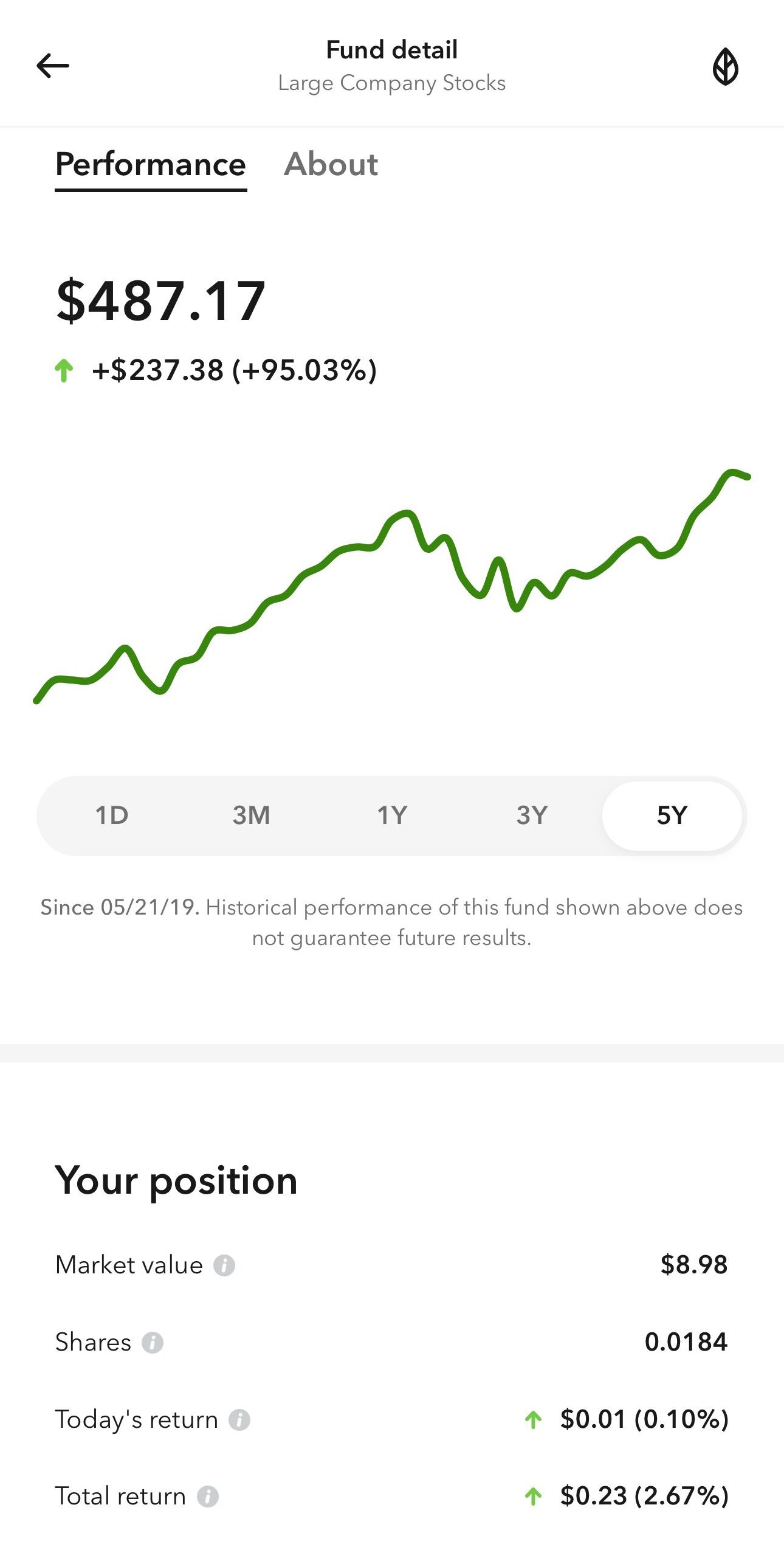

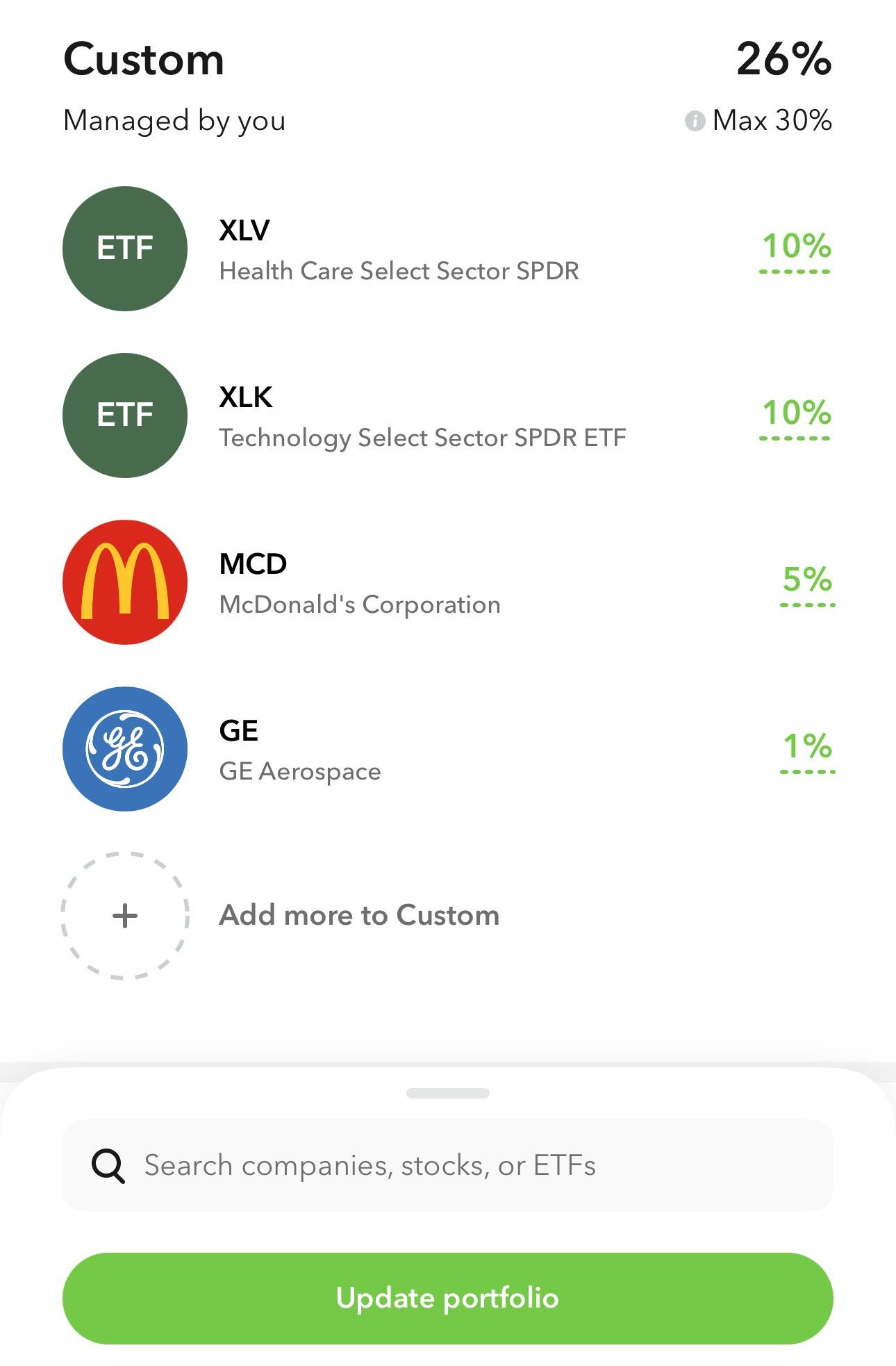

Once I started to build my investing confidence, I also appreciated the portfolio customization feature on Acorns. At the base level, there is not much customization, as the portfolio set up is keyed into the initial account questions. But, at the Premium account level, you can add individual stocks to personalize.

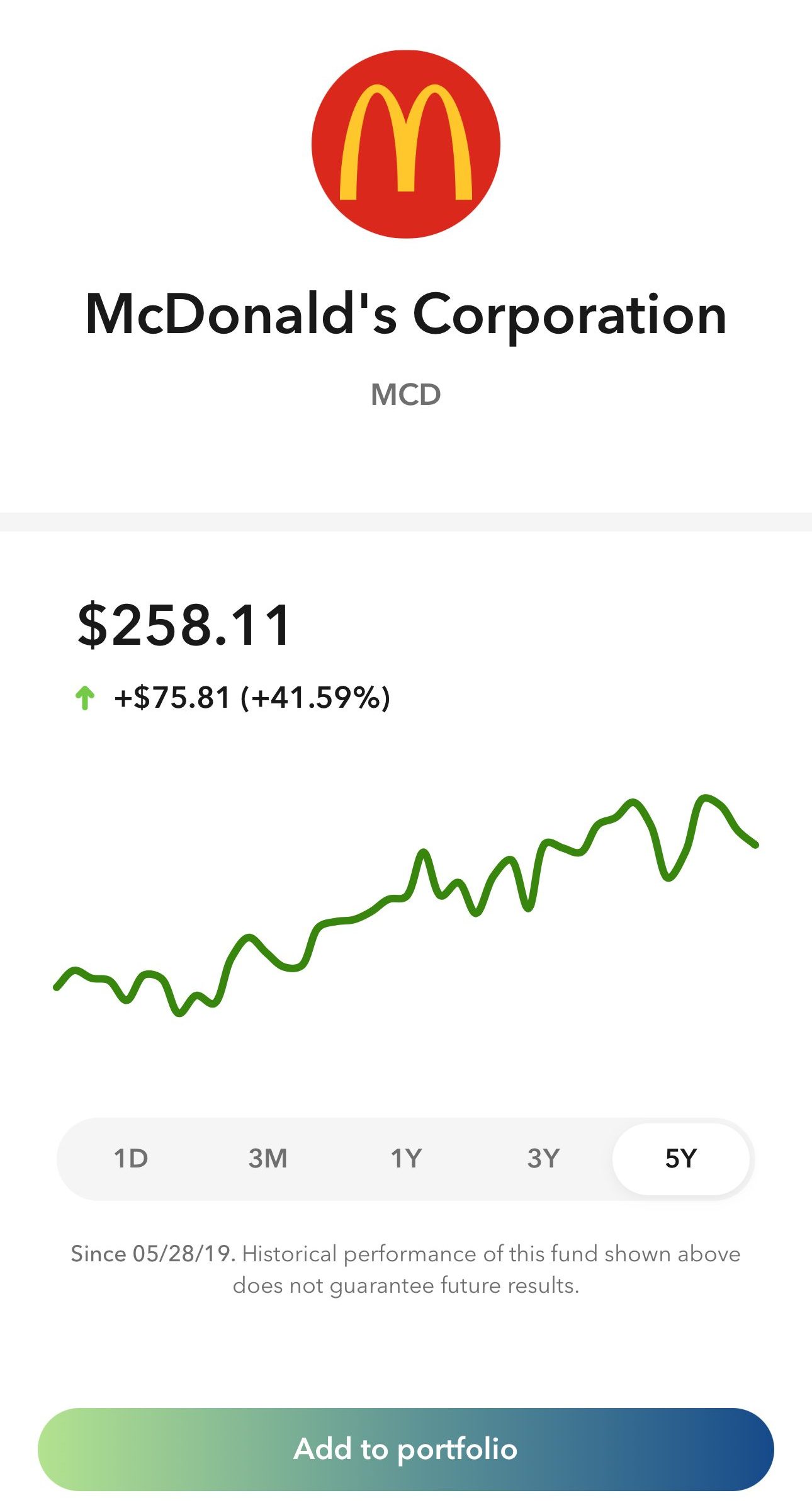

I found this interesting, as I could add single stocks that appealed to me to my portfolio. You can search for individual stocks and ETFs as seen in this screenshot.

When I found a stock that appealed to me, all I needed to do was tap on “add to portfolio” and it would be included in my custom portfolio. At any point I can check my diversification score to make sure that I’m not investing too heavily in one area over another.

Additional Features That Helped Me

There were also some additional features that I found helpful:

-

Low End Fund Expenses

One of the main barriers for many investors is fund fees. Funds tend to offer more consistent returns, but it can be counterintuitive if you end up paying hefty charges. However, with Acorns the expenses for ETFs are low end.

Most funds cost approximately 0.03% to 0.25% annually of the invested assets. This works out to $3 to $25 per $10,000 invested.

-

Round Ups

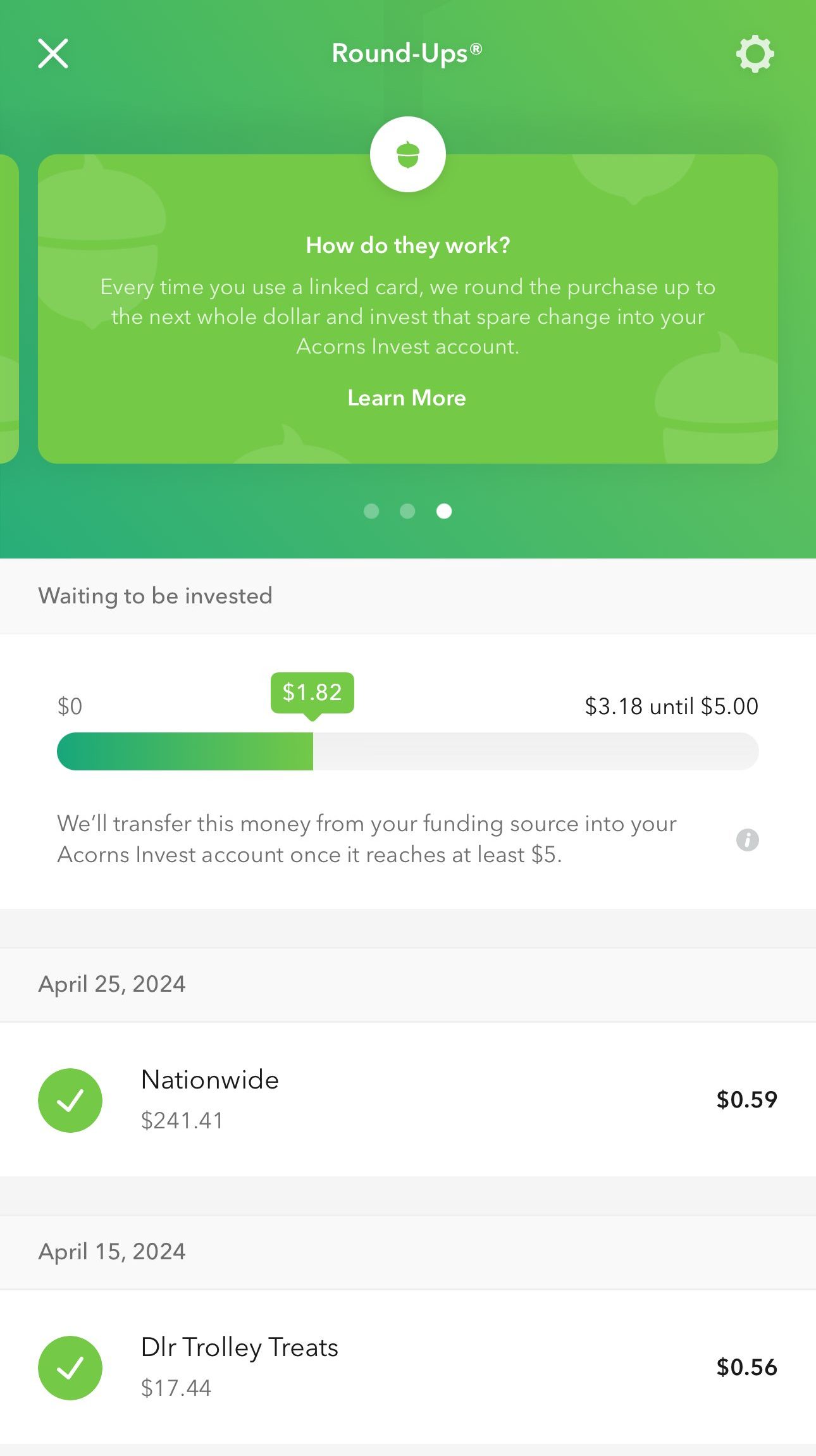

One of the features I really loved about Acorns is the “round ups.” You need to opt into using this feature, but once it is active, this is a simple way to boost your investing fund.

Essentially, Acorns automatically rounds up purchases, moving the extra money from the linked bank account to the investment account.

For example, say I go out for coffee and spend $6.25 using the debit card for my linked bank account. I’ll pay $6.25 to the retailer, but the transaction amount coming out of my bank account is $7. The remaining $0.75 will go into my investing account.

Although this doesn’t seem like much, this is the beauty of round ups. You’re not likely to notice these small amounts, but as you can see in the screenshot above, they can quickly add up over a month. Once I have accumulated $5 or more, Acorns automatically invests the funds into my target portfolio.

-

Variety of Account Types

As an Acorns Investor, I can choose from four different types of accounts according to my investing goals. Invest is the regular investing account, but you could also use Later if you’re investing for your retirement via a traditional, Roth or SEP IRA.

As we touched on above, Early is a custodial account for children, which is only available at the Premium level. The final account type is Banking.

As you can see from the screenshot above, it is quite easy to set up a Banking account and it allows you to invest your spare change or set up automatic investments each time you receive your salary.

You can also receive an associated debit card, making it easy to move your banking and investments on to one platform.

-

Acorns Earn

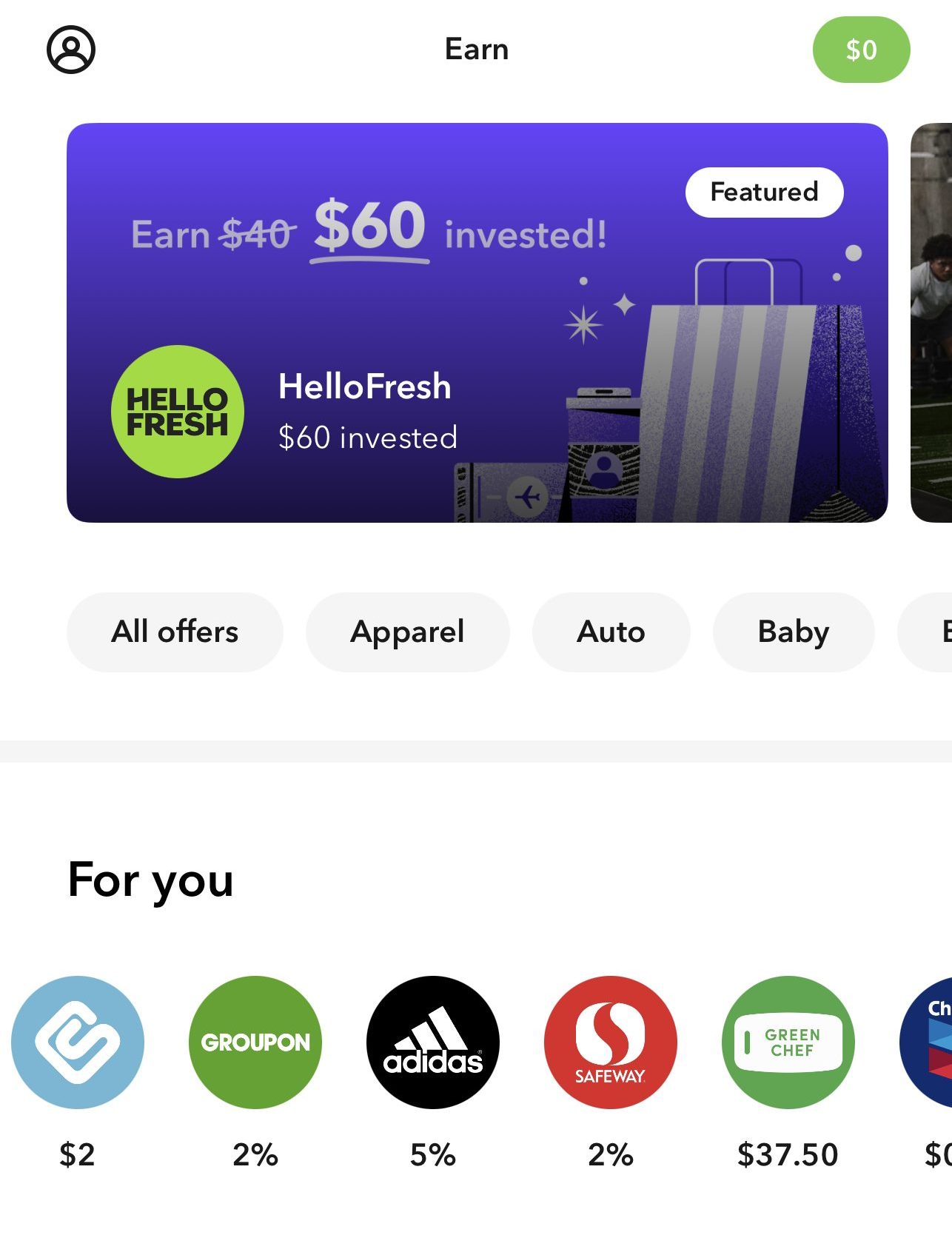

Acorns Earn is quite a unique feature that makes the platform even more appealing. Essentially, you can earn rewards when you shop with hundreds of brands.

Acorns has more than 300 participating partners and I can receive a reward with every eligible purchase. These rewards go into my Invest account, further boosting my available investing funds.

This feature is only available with the higher Acorns tiers, but you can earn a 25% match on all your Earn rewards for Personal Plus and 50% for Premium customers.

Rewards are available within seven business days of making your purchase, but there are promotions and exclusions. So, it is a good idea to check the exclusions tab to ensure that you receive your rewards.

-

Bits of Bitcoin

Acorns “Bits of Bitcoin,” is a feature allocating up to 5% of your investments towards a Bitcoin-linked ETF, diversifying your long-term portfolio. Acorns aims to offer controlled exposure through ProShares Bitcoin Strategy (BITO), which invests in Bitcoin futures rather than the cryptocurrency itself.

Users can allocate up to 5% of their portfolio to this ETF, based on their investment profile, including factors like age and income. Acorns simplifies the process, eliminating the need for extra apps or digital wallets, allowing easy Bitcoin exposure through the app.

-

Great Mobile App

The Acorns App is available for Android and iOS devices. What makes it quite unique is that the functionality mirrors the desktop platform. This means that viewing my account and making changes is as simple as when I use the desktop platform.

This includes seeing an overview of my stocks and ETFs as you can see in this screenshot.

I appreciate this as I can check in, even if I’m on the go. If I have an inspiration for a stock I want to add to my portfolio or I hear something on the news, I can see how this has impacted my portfolio.

In fact, the functionality of the app is actually greater compared to the desktop. For example, if you want to deposit a check, you cannot do this with the desktop version nor can you use an ATM. However, with the app, you can simply log in and upload images of the check.

-

Easy Account Set Up

Acorns is incredibly user friendly and I found the account set up very simple. I completed the entire process online without any issues.

During the set up, I was guided through the process with questions about my age, income, financial goals, timeframe and risk tolerance, which allowed Acorns to determine my optimal portfolio asset allocation.

Once I had answered all of these questions, Acorns recommended a diversified ETF portfolio that was customized for me according to my preferences and requirements.

From that point, I could turn on some of the optional features and allow Acorns to take care of rebalancing my portfolio, reinvesting my dividends and diversifying automatically.

Plans And Pricing

Another thing I really enjoy about Acorns is that you can choose from three service tiers, each with different subscription charges.

I started out with the base service tier, Personal. This is the cheapest Acorns option, but it provides access to an individual investing account, checking account and an IRA.

Plan | Monthly Fee | Main/Additional Features |

|---|---|---|

Acorns Personal

| $3

| Investing, Banking, Earning, Learning

|

Acorns Personal Plus

| $6 | Deposit Rates, 1% IRA Match on New contributions, Live Q&As with Investing Experts |

Acorns Premium

| $12 | Investment Account For Kids, Add Individual Stocks, Educational Courses |

However, as I gained investing experience, I wanted to access some of the other Acorn features.

The mid tier, Personal Plus, offers a premium education account, an opportunity for rewards matching and an emergency fund, but I found Premium was a better fit.

The Premium level is the highest tier and is the most flexible.

I can purchase individual stocks, enjoy the benefits hub and access higher rewards matching. With this tier, you can also set up custodial accounts with Acorns Early.

Is Acorns Safe?

There are a number of measures to keep my account details safe and secure. This includes two factor authentication which is mandatory for all accounts. There is also optional verification through the Social Security Administration eCBSV service.

Acorns also monitors accounts for unusual activity, so if there is any suspicion of fraud, Acorns will send me an account alert.

Acorns is also a member of SIPC, so my account balance up to $500,000 is protected and funds up to $250,000 in my checking out also has federal protection.

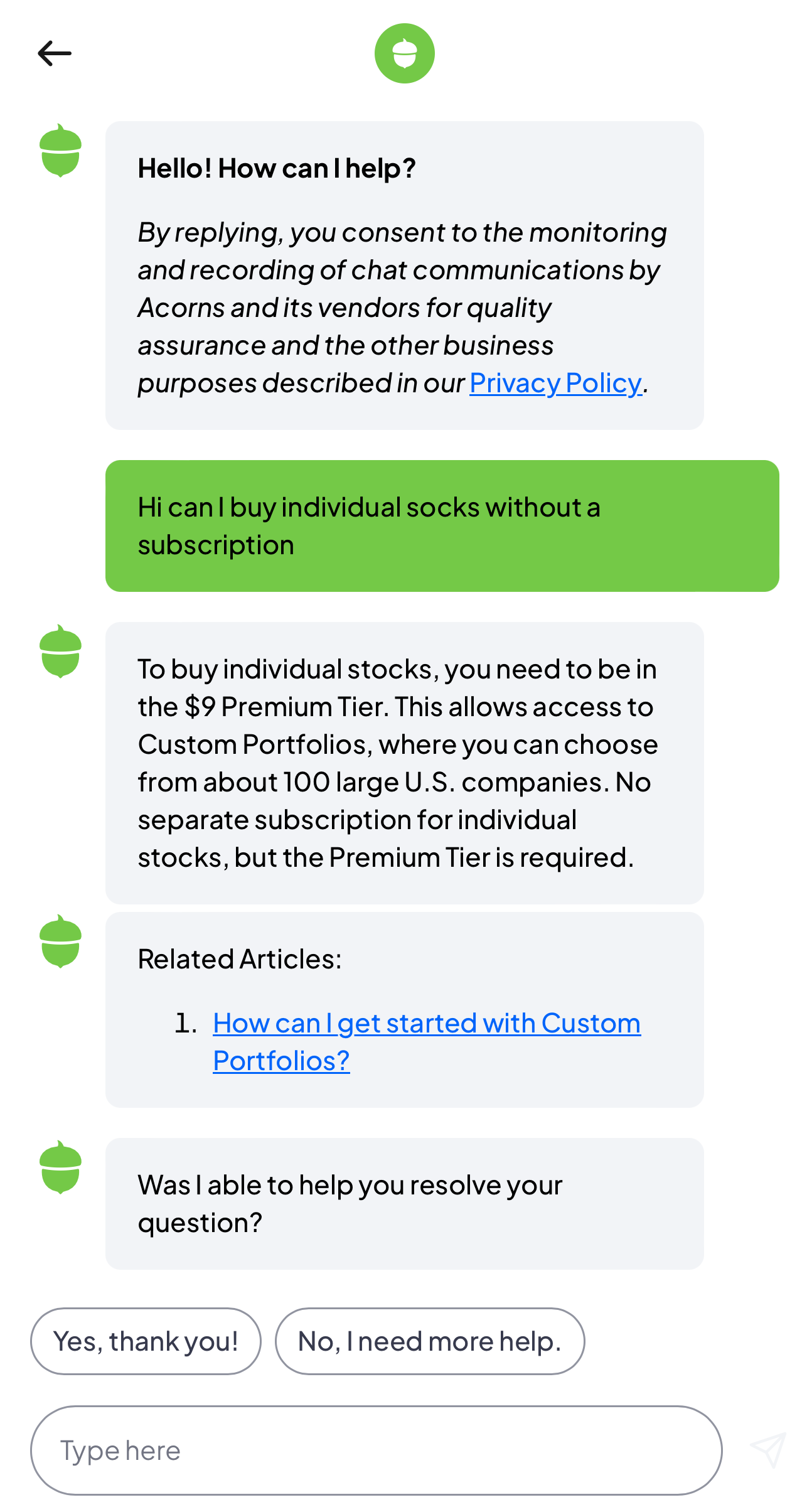

Acorns Customer Service

One of the main drawbacks of many low cost robo advisor platforms is that it can be difficult to speak to someone if you have an issue.

I found the Acorn customer support very solid. Along with a Help Center where I could search for topics, I could use the Live Chat feature 24/7.

This is a great feature where I can ask specific questions and get immediate guidance, but there is also the option to use the phone helpline.

This is only available 8 am to 10 pm ET, but this is seven days a week. There is also email for non urgent issues, so you can submit a ticket with a query or question.

What Can Be Improved

Although Acorns is a solid platform, there are still a few areas where some improvements could be made.

-

High Fees For Low Portfolios

While three dollars for the basic Acorns tier isn’t much, if you have a very limited investment fund, this can quickly add up.

For example, if I only have a $1,000 portfolio, at the basic tier, I would be paying $36 per year, which is 3.6%. This is a lot higher compared to many robo advisors, particularly those offering the base tier with minimal functionality.

However, it is still worth noting that this fee does remain the same, regardless of your investment fund. So, if you grow your fund to $100,000, you’ll still only be paying $36 per year for the base tier, which is 0.036%

-

Rebalancing Refinements

Acorns automatically rebalances portfolios quarterly if they have moved over 5% from their target allocation.

This means that outperforming assets may be trimmed if they increase too much relative to the target allocations and underperforming assets will be purchased after falling too far.

Many platforms offer rebalancing, but this feature on Acorns could benefit from some refinements.

-

Tax Minimizing

Finally, Acorns doesn’t offer tax strategies to minimize tax bills. Many platforms offer tax loss harvesting or the inclusion of municipal bonds to offset gains to reduce taxable income.

While this does tend to require a higher portfolio value on some platforms, it would be nice if Acorns offered some form of tax minimizing feature.

Which Type of Investor is Acorns Best For?

Acorns is a good option if you don’t have a large investment fund, but want to try your hand with a robo advisor. The round ups allow you to accumulate spare change and you can even earn rewards on your retail purchases, which can provide you with a boost.

Another type of investor that would appreciate Acorns is the one who wants to combine their banking and investing within one platform. The Acorns banking account has no overdraft fee and many fee free ATMs, making it a viable option. This makes it easier to move excess funds over to your portfolio, but you can also earn interest on your everyday money.

Acorns is also a good option for those with a very large investment fund. If you’re looking for a hands off investing approach with minimal effort, the Acorns fees work out to be quite reasonable. Even if you opt for the top tier, the set fees work out to a very reasonable percentage.