When it comes to choosing a store card that maximizes rewards, the Target Red Card and Macy's Credit Card stand out as contenders. Both cards aim to entice shoppers with enticing perks, but a closer look reveals distinctions that might sway your decision.

Target vs. Macy’s Credit Card : General Comparison

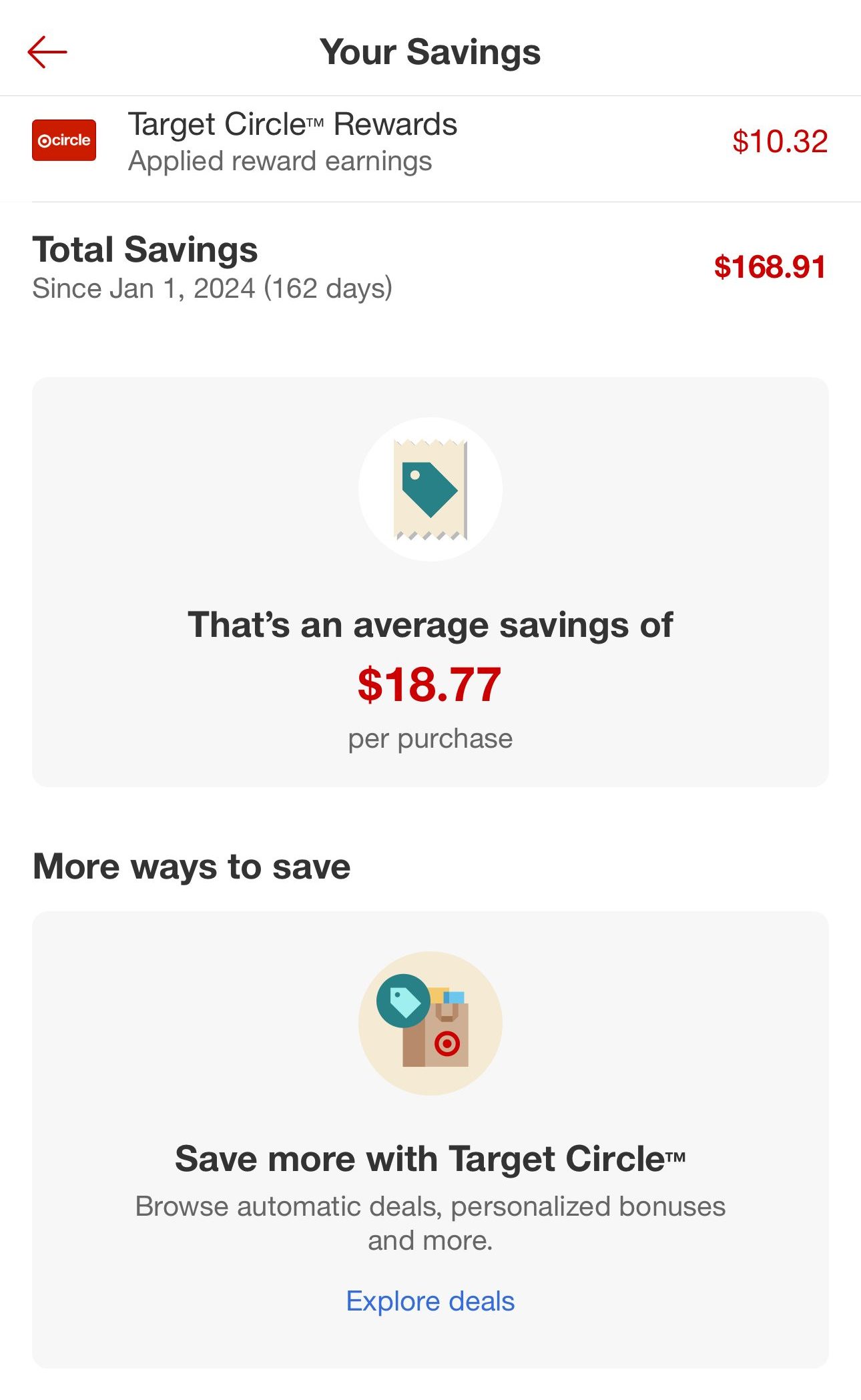

The Target Red Card boasts a straightforward approach to rewards, primarily centered around Target purchases. Cardholders enjoy an immediate 5% discount on all Target purchases, both in-store and online.

This can be a significant perk for frequent Target shoppers, especially those furnishing a home, stocking up on groceries, or indulging in the latest fashion trends.

Additionally, Red Card holders benefit from free shipping on most Target.com orders, further sweetening the deal for online shoppers.

On the other hand, the Macy's Credit Card introduces a nuanced rewards system with a tiered rewards structure. Shoppers earn a higher points rewards ratio in various categories, including dining, groceries, and gas.

In addition, there are additional perks such a discounts, surprise savings, and even free shipping events. For frequent Macy's shoppers, this intricate rewards program might result in more substantial long-term advantages.

|

| |

|---|---|---|

Macy's Credit Card | Target RedCard Credit Card | |

Annual Fee | $0 | $0 |

Rewards | spend $1,200 or more annually to get 5X points per dollar on purchases made at Macy's, 3X points if you spend $500 to $1199 and 2X points if you spend up to $500. Also, get 3X points at restaurants including delivery, 2X at gas stations & supermarkets and 1 point per $1 spent everywhere else | 5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target |

Welcome bonus | 25% discount on Macy's on the day you are approved and the following day, up to $100 | None |

Foreign Transaction Fee | 3% | $0 |

Purchase APR | 31.99% variable | 29.95% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Cashback Analysis: Which Card Gives More?

Based on our analysis, and assuming all supermarket and gas purchases are made via Target – the Target Red Card card will drive you more cash back:

|

| |

|---|---|---|

Spend Per Category | Macy's Credit Card | Target RedCard Credit Card |

$15,000 – U.S Supermarkets | 30,000 points | $750 |

$4,000 – Macy's | 20,000 points | $40 |

$5,000 – Restaurants | 15,000 points | $100 |

$4,000 – Travel

| 4,000 points | $40 |

$4,000 – Gas | 8,000 points | $80 |

Total Points / Cashback | 77,000 points | $1,010 |

Estimated Redemption Value | 1 point ~ 1 cent | / |

Estimated Annual Value | $770 | $1,010 |

* Assuming all supermarkets purchases made via Target

Additional Benefits: Target vs. Macy’s Credit Card

The Target card offers many extra shopping benefits for cardholders, such as exclusive deals, extended return time, and free shipping.

On the other hand, Macy's credit card provides member exclusive savings and perks, birthday surprise and free shipping.

Macy's Credit Card

Star Passes: Exclusive savings reserved for cardholders, providing special discounts on purchases.

Star Money Bonus Days: During these exclusive periods, cardholders can accelerate their rewards accumulation, making their shopping experiences more rewarding.

Birthday Surprise: Cardholders receive a delightful birthday surprise as a token of appreciation.

Member Exclusives: Enjoy bonus points when shopping for your favorite brands and other exclusive perks available only to cardholders.

Free Shipping at Macy’s with your card:

- Silver Tier: Free shipping on purchases of $25 or more.

- Gold & Platinum Tiers: Enjoy free shipping with no minimum purchase requirement, enhancing the convenience of online shopping for cardholders.

Target RedCard Credit Card

- Free 2-day shipping: Enjoy the convenience of swift delivery with free 2-day shipping on an extensive selection of items when shopping on Target.com.

- RedCard Exclusives: Gain access to special items and exclusive offers available only to RedCard holders, enhancing your shopping experience with unique perks.

- Extended Return Time: Benefit from an additional 30 days for returns and exchanges at Target, providing flexibility and peace of mind for your purchases.

- Starbucks Discount: Save 5% on your purchases at any in-store Starbucks location when using your Target Red Card, adding an extra perk for coffee enthusiasts.

- Specialty Gift Cards Savings: Receive a 5% discount on specialty gift cards for travel, restaurants, movie tickets, and more, allowing you to save on a variety of experiences and purchases beyond Target.

When You Might Prefer The Target RedCard?

You might prefer the Target Red Card If:

Frequent Target Shopper: If you find yourself regularly shopping at Target for everyday essentials or special items, the Target Red Card's consistent 5% discount on every eligible purchase can quickly add up, offering immediate and reliable savings.

Simple and Instant Savings: If you prefer a straightforward rewards system without the complexity of points and tiers, the Target Red Card might be your go-to choice. Its 5% discount at checkout provides instant savings without the need to track points or navigate a tiered structure.

Top Offers

Top Offers

Top Offers From Our Partners

When You Might Prefer The Macy's Credit Card?

You might prefer the Macy's Credit Card If:

Diverse Shopping Habits: If your shopping preferences extend beyond Target and include a variety of brands and products, the Macy's Credit Card offers a more versatile rewards system. Its tiered structure allows you to earn points on a broader range of purchases.

Frequent Macy's Shopper: For those who regularly shop at Macy's, the Macy's Credit Card provides an opportunity to capitalize on the tiered rewards system, potentially earning more substantial discounts and perks based on your annual spending.

Compare The Alternatives

If you're looking for a store credit card with great rewards for online shopping – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Costco Anywhere Visa® Card by Citi | Apple Credit Card | Sam's Club® Mastercard® | |

Annual Fee | $0 ($60 Costco membership fee required) | $0

| $0 ($50/$110 for Club/Plus membership – MUST)

|

Rewards |

1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

|

1-5%

5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases

|

Welcome bonus |

None

None

| N/A |

None

$30 statement credit after making $30 in Sam’s Club purchases within the first 30 days

|

Foreign Transaction Fee | $0

| $0 | N/A

|

Purchase APR | 20.49% (Variable)

| 15.99% – 26.99% Variable

| 20.40% or 28.40% Variable

|

Compare Target Red Card

While Target RedCard offers a less attractive cashback rewards ratio than Amazon, it still may be a better option for some. Let's compare.

If you focus on groceries – the Target RedCard wins, but if you focus on travel or gas – you may want the Costco credit card.

Target Red Card vs. Costco Anywhere Visa Card: How They Compare?

If you do all your grocery and fuel shopping at either Target or Sam's Club, the cashback you get from both credit cards is pretty similar.

The target RedCard is our clear winner, with a higher cash-back rate and estimated annual value. Here's what you can get with each card.

Compare Macy's Credit Card

The Macy's Credit Card is a clear winner with higher points rewards ratio and higher cashback value for the same spend than Nordstrom Card.

Nordstrom vs. Macy’s Credit Card: Which Store Card Gives You The Most Value?

The Macy's Credit Card is a clear winner with higher points rewards ratio and overall cashback value for the same spend than JCPenney Card.

Macy’s vs. JCPenney Credit Card: Which Gives You The Most Value?

Unlike Kohl's card, the Macy's Credit Card offers points rewards on all categories, making it more attractive for the average consumer.

Macy's Credit Card vs Kohl's Charge Card by Capital One: Which One Wins?