Table Of Content

What is The Federal Funds Rate (FFR)?

The Federal Funds Rate indicates the rates banks charge each other to buy and sell.

The Federal Funds Rate (FFR) is not an interest rate consumers will ever pay on a loan, however it is possibly the most important country-wide and the starting point for every other interest rate. As of September 2024, the Federal Funds Rate (FFR) is 5.25% – 5.50% .

How Does It Work?

Once set, large national banks borrow and lend to each other at the going FFR and adjust the rates they charge their borrowers accordingly. Any increase in this rate is typically reflected in the consumer savings account and CD APYs.

This means that if the FFR is increased, you are likely to see higher rates of returns on your deposit products including basic savings accounts and CDs. The rates on savings accounts are lower than CDs due to their liquidity – in case of the FFR increase, customers can withdraw the money anytime and enjoy higher rates.

CDs are generally locked for a set period, so banks offer higher rates for customers to compensate them for future FFR increases.

Who Sets The Federal Funds Rate?

The Board of Governors of the Federal Reserve System (the “Fed”), the nation’s central bank, sets the FFR eight times each year following a discussion about economic conditions. Their main concerns are maximum employment and low (generally around 2 percent) inflation, both of which can be measured.

Outside what the data reveal, they also consider future economic projections and their public reputation. Knowing how stocks, bonds, loans and other markets are impacted by their decisions, the Fed tries to be as predictable as possible.

What Was The Reason the Federal Reserve Raised Interest Rates so Drastically?

For most, 2022 has been anything but predictable. In June 2020, right after the pandemic started, the Fed cut the FRR and announced it would be “anchored” near zero until at least 2022 and then steadily peak at 2.5 percent. They did this partly not knowing what to expect, worried the economy would stall completely without reassurances about future rates.

The first cracks in their prediction appeared in 2021 with rising inflation due to supply chain breakdowns and strong consumer demand during breaks between Covid waves; demand stirred partly by the Fed’s cuts. At first, we heard that hot inflation was “transitory,” but this turned out not to be the case.

The situation worsened when Russia launched an invasion of Ukraine early in 2022, causing oil prices to spike – making just about everything more expensive. Rising costs, generally, persisted and spread to all areas of the economy – that’s when the Fed knew it had to act

From experience, the Board of Governors knows how inflation can creep in and stick around. In the 1970s and early 1980s, inflation was allowed to hang around –passing 10 percent– before the Fed suddenly played catch-up, ratcheting up FFR.

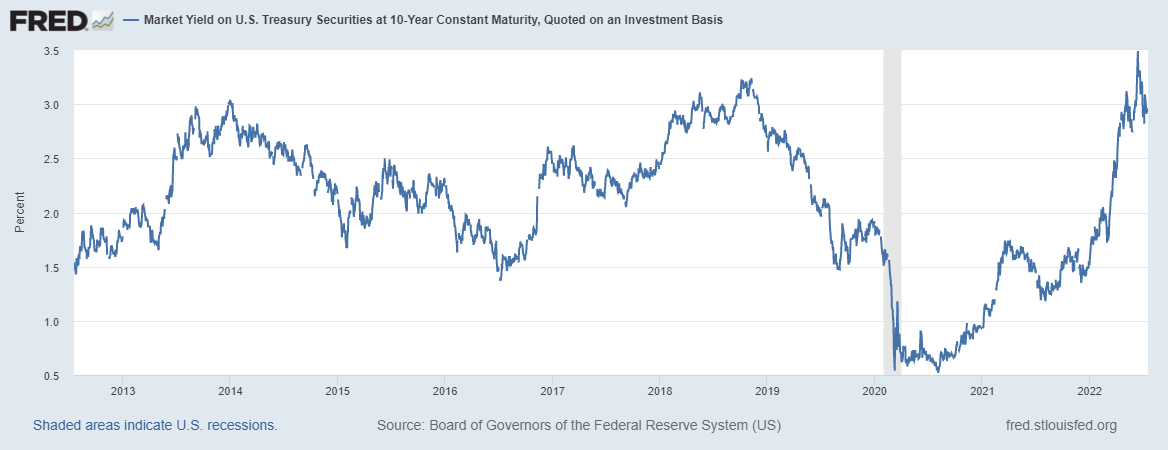

The Fed finally succeeded in controlling runaway inflation with a sky-high FFR but at a significant cost. The Fed knows it is too late and is trying to reign in control with larger-than-usual hikes (see chart ) to restore public trust.

How Does Inflation Affect The Federal Funds Rate (FFR)?

As set out in its mandate from the U.S. Congress, the Fed targets “inflation at the rate of 2 percent” along with maximum employment. The Federal Funds Rate (FFR) is one of the Fed's few tools to raise or lower inflation when it departs significantly from the 2 percent target.

It is important to realize that the Federal Funds Rate (FFR) is not a precise instrument and only acts on inflation by broadly encouraging (or discouraging) borrowing, thus increasing (decreasing) the level of consumer spending that inflation measures.

You can see that there is a circular effect between inflation and the Fed’s toolkit, including the FFR. It begins with market supply and consumer demand forces playing out, resulting in changes to the preferred measure of inflation (Personal Consumption Expenditure): pushing it up (low supply, high demand) or down (high supply, low demand).

This stirs the Fed into action once inflation departs from the target or is likely to do so. At its next Committee meeting, the Board of Governors considers whether action is needed and which tool/s are most appropriate.

Will the Fed continue Interest Rate Hikes in 2023?

The Fed has left little doubt about their plans to keep hiking through 2022, but next year will depend on how inflation reacts. First, how do we know further hikes are coming this year? This tells us something about possible future hikes:

- The Fed tells us so. In their Committee statements, the Fed explains why they came to their decision and what they expect from the economy in the short-term. They release future projections of the FFR to eliminate uncertainty and allow households, investors, and businesses to plan. Analysts scrutinize these statements and the tone used by the Committee to make longer-term predictions.

- The Market says so. Professional investors are paid to understand the Fed’s path and place bets. One way these bets up is in futures prices, telling us what size rate hike the market expects. The CME Group’s FedWatch tool, for instance, tells us there is a high probability to see higher interest rate in 2023.

Apart from these two essential sources, we can look at the inflation rate. If it’s above 3 percent, the Fed’s job is not done, and hikes are likely to continue. If below 3 percent, the Fed can tentatively claim victory or at least give FFR hikes a break while it watches incoming data for signs of returning to normalcy.

How Does the Federal Funds Rate Increase Affect Consumers?

As discussed earlier, the Federal Funds Rate (FFR) drives all interest rates, whether for a mortgage, credit card, personal loan, or business. So, hikes first and foremost impact borrowers unless they are already locked in with a fixed rate, i.e., 30-year mortgage holders are safe from hikes during their loan term.

Investments in stocks, bonds, and other assets are buffeted by inflation and FFR hikes. While bonds become more attractive because their yields (a type of interest rate) go up, stocks often drop due to higher borrowing costs for companies and investors switching to safer assets.

Some commodities (such as gold) and even currencies are thought to offer protection from inflation, but this is not always the case: cryptocurrencies, once considered safe from inflation, crashed in 2022. The US Dollar, in which much of world trade is conducted, appreciates as foreign investors seek safety and higher interest rates.

Some consumers will benefit from hikes so long as inflation is brought back to target. Savers benefit from higher interest rates compared with the almost-zero rates since 2020.

What Happens to Banks When the Federal Funds Rate Increases?

Banks must walk a fine line to manage the impact of FFR hikes. They rely on short-term deposits to issue loans, so must ensure depositors stay put.

This requires higher interest rates on checking and savings accounts, plus various term deposit options to limit any chance of a sudden drop in funding. If they fall behind other banks and financial institutions, depositors like you and me will jump ship, taking our savings with us.

On the other side of the balance sheet, banks must price loans to stay one step ahead of FFR hikes. Fewer consumers will demand loans when rates are rising (this is the purpose of higher FFR, after all), so banks must work out if they have enough deposits and other funding to pursue borrowers with lower-than-market rates aggressively.

We see this dynamic play out as banks adjust all deposit and lending rates shortly after a Fed announcement of further hikes. On the other hand, interest rates on savings products increase and encourage customers to put money in a savings account.

Banks generally do well as rates rise so long as they lend to solid borrowers who will repay loans. Past episodes of FFR hikes show that banks tend to loosen lending policies (making borrowing easier) and end up suffering later with delinquencies and losses.

What Happens to US Bonds When the Federal Funds Rate Increases?

If you

What Happens to Gold Prices When the Federal Funds Rate Increases?

Investing in gold is one of those commodities long regarded as offering protection from inflation. This opinion is hotly debated and stems from the idea that metal is a store of value and, possibly, from the once-popular gold standard, whereby currency could be directly exchanged for gold.

Research has focused on investment in gold during down markets and found some protection against inflation compared with stocks.

Instead of owning physical gold, investors may also buy stock in gold mining companies, which exposes them to the negative effect of inflation and FFR hikes on the stock market. On the other hand, gold offers no cash flows, such as dividends or coupons, to investors.

FAQs

If you already hold a fixed-rate mortgage, FFR hikes will not impact your monthly mortgage cost. If you choose to refinance or have a variable-rate mortgage, you will be subject to higher rates as the FFR climbs.

Refinancing from a variable- to a fixed rate will avoid this situation, but be aware that current fixed rates are much higher than they were just six months ago.

Also, keep in mind that some housing markets are seeing sharp declines as rates rise and residents move from areas popular during the pandemic for work or other reasons. This may mean refinancing to pull cash out will be less attractive.

Credit cards are highly reactive to FFR changes, especially on the way up.

Rates on credit cards will go up with almost immediate effect on existing balances unless you have agreed to a special rate for a defined term, i.e., 6 months at a fixed rate on a debt consolidation card.

Savings accounts will pay more as FFR hikes are enacted by the Fed but changes will not be uniform across all banks.

Banks trying to attract funding will offer better rates on savings accounts and could be worth the hassle of switching depending on your short- to medium-term savings goals.

Certificates of Deposit, or CDs, are set at the beginning and generally not open to renegotiation of maturity or interest rate without breaking the conditions and paying a penalty.

Unfortunately, if you locked in a CD at a low rate a year ago you are stuck with it until it matures, at which point you can take advantage of newly available rates.

Personal loans can be either fixed- or variable-rate. Much like mortgages, those with fixed-rate loans will be unaffected by the

FFR hikes while those with variable-rate loans will see an increase after a short delay. While variable rates are often lower than fixed rates, you should keep in mind that FFR hikes are not over and your interest could balloon.

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()