Prosper is the first peer-to-peer lending marketplace, offers personal loans for a wide variety of purposes and to a large market of borrowers.

APR

6.99% - 35.99%

Loan Amount

2,000 - $40,000

Term

36-60 Months

Min score

600

Prosper is the first peer-to-peer lending marketplace, offers personal loans for a wide variety of purposes and to a large market of borrowers.

APR

6.99% - 35.99%

Loan Amount

2,000 - $40,000

Term

36-60 Months

Min score

600

On Credible Website

Our Verdict

Prosper offers personal loans that can help you borrow money for various needs, like paying off credit card debt, making home improvements, or covering unexpected expenses. You can borrow anywhere from $2,000 to $50,000, depending on what you need. These loans come with terms from two to five years, giving you flexibility in how long you want to take to pay it back.

To get a loan from Prosper, you'll need to meet some requirements. You should have a credit score of at least 600

, be at least 18 years old, and have a valid U.S. bank account and Social Security number.

Prosper's loans have some advantages, like competitive rates and the option for joint applications if your credit isn't perfect. However, there are also some fees to consider, like an origination fee and charges for late payments.

The application process involves pre-qualifying to see what rates you might get, then formally applying with more details. It might take a few days for Prosper to approve your loan, but once approved, you could get your money as soon as the next business day.

Meeting Prosper Personal Loan Requirements

When you need extra money for various expenses, a personal loan from Prosper could be the solution. Here are the requirements and steps to apply:

- Credit Score Requirements: You'll need a credit score of at least 600

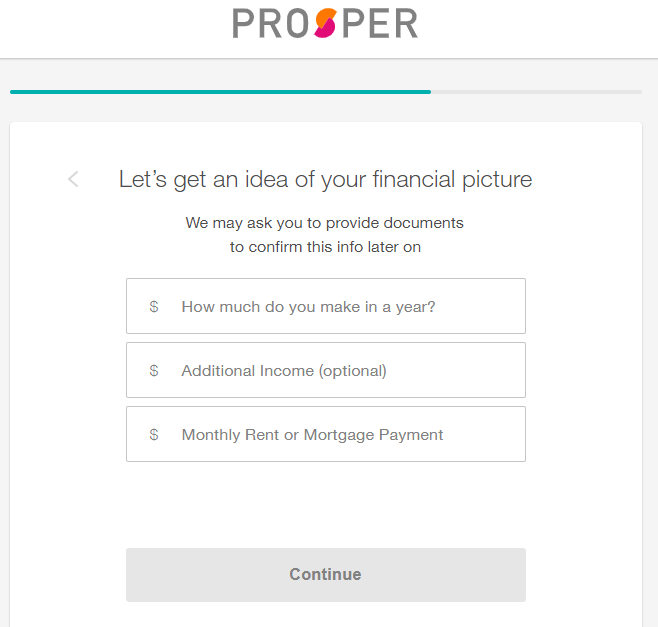

to qualify for a Prosper personal loan. - Income Requirements: While there's no minimum income requirement, having a steady income can increase your chances of approval.

- Co-signers and Co-applicants: Prosper allows joint applications, so you can apply with someone else to improve your chances of approval or get better loan terms.

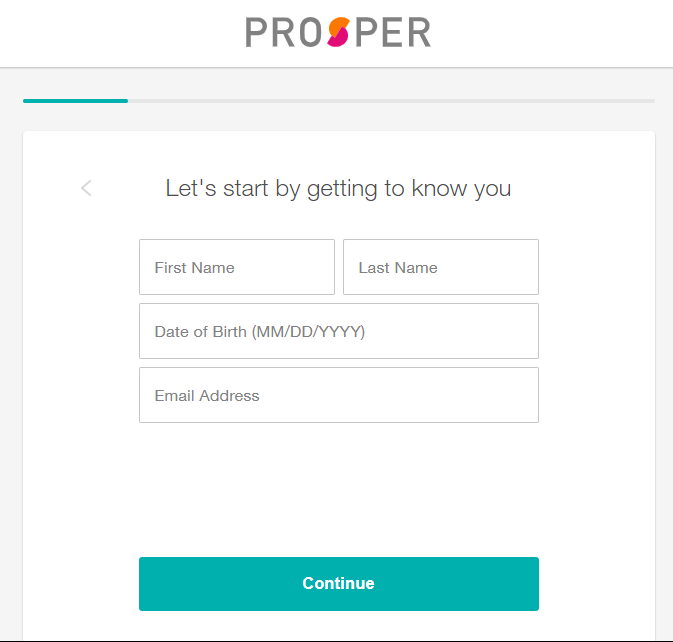

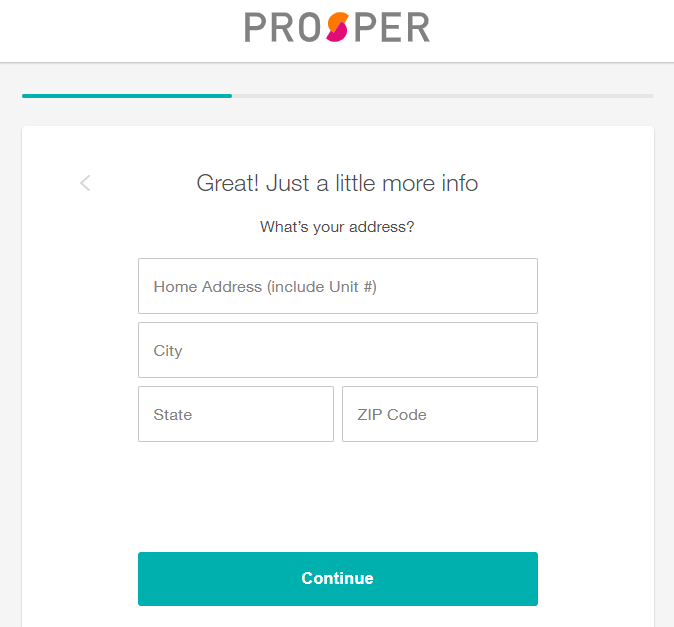

- Additional Documentation: You'll need to provide personal information such as your name, address, and Social Security number. Additionally, proof of income, like pay stubs or tax documents, will be required.

- Verification Process: Prosper will verify the information you provide, which may include a hard credit check.

With these steps and requirements in mind, applying for a Prosper personal loan can be a straightforward process to help you meet your financial needs.

Navigating Prosper Repayment Options

Managing loan repayments is crucial to maintaining financial stability. Prosper offers various options to facilitate repayment and assist borrowers facing difficulties:

- Payment Options: Borrowers can make payments online, over the phone, via autopay, or by check, money order, or cashier's check.

- Missed Payments: If you miss a payment, Prosper may charge a late fee. It's essential to communicate with them promptly to discuss repayment options and avoid further consequences.

- Rescheduling Payments: In some cases, borrowers can reschedule payments or change payment dates by contacting Prosper's customer support.

- Difficulties: Prosper offers a hardship relief program for borrowers impacted by unforeseen circumstances, such as the Covid-19 pandemic. This program may reduce monthly payments or extend the loan term to alleviate financial strain.

Prosper Personal Loan Pros & Cons

Like all lenders, Prosper has its own set of advantages and drawbacks that potential borrowers should consider:

Pros | Cons |

|---|---|

Competitive Interest Rates | No Joint Borrowers |

Accepts Fair Credit Scores | Verification Process Time |

Joint Applicants | Additional Fees |

Quick Funding | Origination Fee |

Soft Pull Inquiry | Lack of Rate Discounts |

No Prepayment Penalty | No Direct Payment to Creditors |

Reported to Credit Bureaus |

- Competitive Interest Rates

Prosper’s interest rates are competitive for borrowers with good credit histories and a strong cash flow.

- Accepts Fair Credit Scores

With a minimum credit score requirement of 600

, Prosper offers accessibility to borrowers with less-than-perfect credit.

- Joint Applications

Prosper allows borrowers to apply with a co-borrower, potentially improving approval chances or securing better terms.

- Quick Funding

Approved borrowers may receive funds as soon as the next business day after approval, providing timely access to needed funds.

- Reported to Credit Bureaus

Timely payments are reported to major credit bureaus, helping borrowers build or improve their credit scores.

- Perks and Features

Features like P2P lending, a mobile app for loan management, and flexible payment dates enhance the borrower experience.

- Soft Pull Inquiry

Prosper allows for an initial soft pull inquiry so the borrower can get an idea of the options for which they may qualify.

- No Prepayment Penalty

The borrower can pay off the loan early without any fees.

- No Joint Borrowers

Prosper does not allow for joint borrowers.

- Potentially Long Turn Around times

The verification and approval process may take several days, potentially delaying access to funds.

- Additional Fees

Prosper charges fees for check payments, late payments, and insufficient funds, increasing the overall cost of borrowing.

- Origination Fee

Borrowers may incur origination fees ranging from 1% to 7.99% of the loan amount, reducing the total amount received.

- No Rate Discount for Autopay

Unlike some competitors, Prosper does not offer a rate discount for borrowers who set up autopay, missing out on potential savings.

- No Direct Payment to Creditors

Prosper does not directly pay creditors for debt consolidation loans, requiring borrowers to manage repayments independently.

Prosper Customer Experience

Customer reviews for Prosper are mixed, with some praising its service and loan application process, while others express dissatisfaction with high interest rates and application difficulties.

On Trustpilot, Prosper has a rating of 4.6 out of 5.0 based on over 12,300 reviews, indicating generally positive feedback.

Prosper | |

|---|---|

iOS App Score | 4.7 |

Android App Score | 3.9 |

BBB Rating | A+ |

TrustPilot | 4.6 |

Contact Options | phone |

Availability | 9 am – 8 pm (ET) |

You can reach Prosper's customer service team by phone or email. For questions regarding existing loans, representatives are available over the phone Monday to Friday from 5 a.m. to 7 p.m. Pacific Time (PT).

For inquiries about recent loan applications, representatives are available on the same days from 5 a.m. to 5 p.m. PT. Prosper also provides support via email at [email protected].

Additionally, borrowers can access a comprehensive help center for self-service options and assistance.

Additional Insights to Keep in Mind

Before applying for a personal loan with Prosper, it's important to understand additional factors that could impact your borrowing experience:

-

What is the funding time?

The funding time with Prosper can vary, but in general, approved borrowers may receive their loan funds as soon as the next business day after approval.

However, it's essential to note that the verification and approval process may take a few days, so the actual time to receive funds can depend on factors such as the borrower's application details and any required documentation.

-

What Happens If I miss a payment?

If you miss a payment with Prosper, you may be charged a late fee.

It's crucial to communicate with Prosper promptly if you anticipate difficulties in making payments. Prosper offers a hardship relief program for borrowers facing financial challenges, such as the Covid-19 pandemic.

This program may reduce monthly payments or extend the loan term to help borrowers manage their repayment obligations during difficult times.

Which Loan Purposes Are Allowed? Which Aren't?

A Prosper personal loan can be used for various purposes, including debt consolidation, home improvements, medical expenses, large purchases, and vehicle purchases.

Borrowers have flexibility in using the loan funds to address their financial needs and goals. However, there are certain purposes that Prosper does not allow for personal loans. These include postsecondary education expenses, such as tuition or student loans.

Is Prosper Loan Right for You?

Prosper personal loans can be beneficial for individuals in various financial situations. Consider applying if you:

- Have Fair Credit Scores: Prosper accepts credit scores as low as 600

, making it accessible for individuals with fair credit who may struggle to qualify with other lenders. - Seek Debt Consolidation: If you have multiple high-interest debts, consolidating them with a Prosper personal loan can streamline repayment and potentially save money on interest payments.

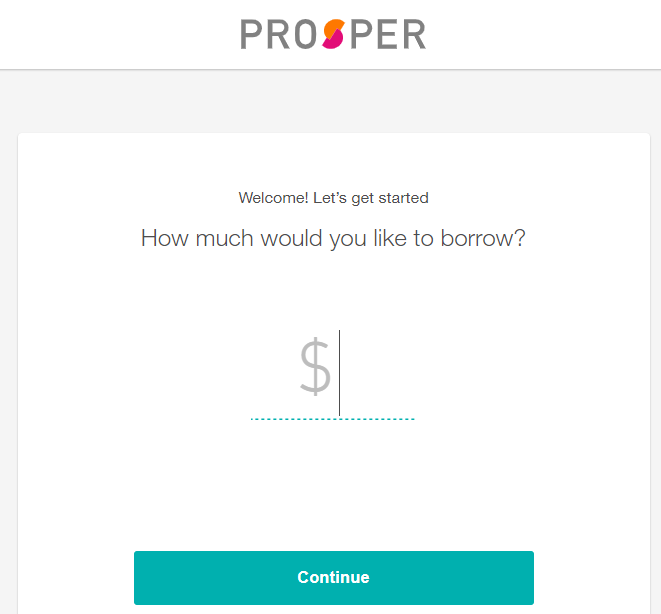

How to Apply For Prosper Personal Loan?

The application process is a little different with Prosper because you not only apply but also create a profile for potential investors to evaluate you as a risk and accordingly lend you money for a portion of the loan. You being the process by checking your rate through a soft pull.

Prosper will ask you some basic information and give you a couple of rate and loan options. Then you will need to provide more information so Prosper can do a hard pull or credit check.

This is where they will get the information they need to give you your rate. You will create a quick profile explaining why you need the loan.

Your listing will then be posted on Prosper’s marketplace for up to 14 days where investors will look at your profile and decide whether to invest in your loan. Many listings do not stay up for the entire 14 days.

After your loan is funded, Prosper may ask you for some verification information, such as state ID, social security card, and income.

You will sign documents electronically for the loan and then the funds will be sent to your bank. It could take a few days after funding for Prosper to deposit the money in your account.

Prosper FAQs

Prosper is a peer-to-peer lender offering personal loans to those with good or fair credit. However, the company uses more than your credit score to determine if you qualify. The criteria include your credit history and debt to income ratio.

Prosper is also a good option if you are interested in using a co-borrower on your application, which some lenders don’t allow. If you're still not sure, you can always keep comparing personal loan lenders or take a look at our best personal loans for fair credit.

Prosper does require applicant income verification, so you will need to provide documents such as bank statements, recent pay stubs or tax returns. Additionally, in some cases, Prosper may contact your employer or use other databases to confirm your employment status.

RocketLoans offers loans with a fast turnaround. If approved, you can expect to receive the funding the same business day. The RocketLoans starting APR is similar to Prosper and the maximum loan amount is also similar. However, you can expect to pay an origination fee of as much as 6%.

So, if you have a fair or good credit score and are looking for quick cash, Rocket Loans could be a better option

In the past, Citibank actually purchased Prosper loans, which may leave you thinking that the two entities are one in the same. However, this is not the case. Citibank's maximum loan amount has a higher t, yet its rates are lower and Citibank has no established minimum credit score.

To qualify for a Citibank personal loan, you do need to be an existing customer. So, if you already have a Citibank account, it is likely to offer a better deal than Prosper.

Is Lending Club better than Prosper?

Prosper is very similar to Lending Club in that you need a credit score of 630+ to qualify and it takes approximately one week to process your application. However, Prosper does require an additional one to three business days to issue the funds. So, if you’re looking for quicker access to the money, Lending Club is a better option.

Lending Club has no late fees, Prosper does not charge anything if you want to pay off your loan early and the late fees are the same.

One area where Prosper stands apart from Lending Club is that it is open to borrowers with a high debt to income ratio of up to 50%, whereas Lending Club’s maximum is 40%.

Peer to Peer Personal Loans: Alternatives

|

|

| |

|---|---|---|---|

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 11.52% – 24.81%

| 6.99% – 35.99%

| 5.20% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24 – 60 months

| 36-60 Months

| 36-60 Months

|

Loan Amount | $5,000 – $40,000

| 2,000 – $40,000

| $1,000 – $50,000

|

Minimum Score | 640

| 600

| $12,000

|

Funding Time | 2-5 days

| Up to 14 days and then 1 to 3 days to deposit

| 1-2 Days

|

Review Personal Loan Top Lenders

Compare Alternative Lenders

Prosper vs SoFi

SoFi is widely regarded as the best option for people with excellent credit who require larger loan sizes while paying low fees. Prosper is best suited to people with low credit scores.

Read Full Comparison: SoFi Vs Prosper: Which Personal Loan Is Better?

Prosper vs Peerform vs Happy Money

All of these lenders have some things in common, such as similar credit score requirements. There are, however, some significant differences that you will notice.

Prosper is a great option for people looking for a small loan, whereas Happy Money is better suited to applicants looking to minimize fees. Finally, if you want to get very competitive rates, Peerform is a good option.

Read Full Comparison: Peerform vs Happy Money vs Prosper: Which Personal Loan Is Better?

Prosper vs LendingClub

In many ways, Prosper and LendingClub are very similar. They are both peer-to-peer lending marketplaces that require a minimum credit score of 600 and offer the same term lengths. They also have flexible repayment options and a fee structure that is similar to ours. Even the APR rates and fee structures are very similar, so there isn't much to differentiate these two products.

Read Full Comparison: Prosper vs LendingClub: Which Personal Loan Is Better?

Prosper vs Rocketloans vs Upstart

Each of these three lenders shares and differs in some ways. In general, Upstart is the best option for people who need a small loan or who may not be able to obtain a FICO score. Rocket Loans is a viable option if you need quick access to borrowed funds, whereas Prosper allows you to get a joint loan and caters to people with fair credit.

Read Full Comparison: Rocketloans Vs Prosper Vs Upstart: Which Personal Loan Is Best?

Prosper vs Marcus vs Best Egg

Prosper offers a wide range of repayment options and accepts lower credit scores, whereas Best Egg provides secured loans and preferable debt consolidation options.

Read Full Comparison: Best Egg Vs Prosper: Choose The Right Personal Loan For You