Rewards Plan

Welcome Bonus

Credit Rating

0% Intro

N/A

Annual Fee

APR

- Birthday Gift

- Exclusive offers

- High APR

- Limited Redemption Options

Rewards Plan

5% (10 points) back in rewards at Victoria Secret or PINK, 2% (4 points) on dining, travel and streaming services and 1% (2 points) on all other purchases

Welcome Bonus

$25 off in first purchase

0% Intro

PROS

- Birthday Gift

- Exclusive Offers

CONS

- High APR

- Limited Redemption Options

APR

29.49%

Annual Fee

$0

Balance Transfer Fee

N/A

Credit Requirements

Fair

- Our Verdict

- Pros & Cons

If you shop at a specific retailer on a regular basis, getting a store credit card could be a wise financial decision.

This is relevant also for Victoria's Secret card – if you have a strong affinity for Victoria's Secret and/or PINK and are always looking for exclusive deals, applying for a Victoria card could be a wise decision. The card not only grants you access to exclusive promotions and discounts, but it can also assist you in earning reward points that can be redeemed for exciting products and services.

A Victoria's Secret credit card can also provide a variety of additional benefits such as free shipping, birthday gifts, and early access to sales events.

- Birthday Gift

- Exclusive Offers

- $25 Off On First Purchase

- $30 Bonus Gift Upon Spending

- Limited Redemption Options

- Low And Limited Reward Rates

In this Review

Estimating Your Rewards: A Practical Simulation

The following table showcases a rewards simulation that highlights the benefits of using Victoria's Secret. It provides an approximate calculation of the rewards that you could earn by using the card for your expenses across various categories.

| |

|---|---|

Spend Per Category | Victoria's Secret Credit Card |

$10,000 – U.S Supermarkets | $100 |

$3,000 – Restaurants

| $60 |

$3,000 – Victoria’s Secret

| $150

|

$5,000 – Airline | $100 |

$3,000 – Hotels | $60 |

$4,000 – Gas | $40 |

Estimated Annual Cashback | $510 |

Pros and Cons

Just like any other credit card, the Victoria’s Secret card has some advantages and disadvantages:

Pros | Cons |

|---|---|

Birthday Gift | Low And Limited Reward Rates |

Exclusive Offers | High APR |

$25 Off On First Purchase | Limited Redemption Options |

$30 Bonus Gift Upon Spending | |

Free Shipping |

- Birthday Gift

There is a gift in this card for your birthday. On your birthday, you will receive a $10 ($15 for Gold Cardmemeber) reward to spend in-store or online at Victoria's Secret or PINK.

- $25 Off On First Purchase

Victoria’s Secret Credit Card offers $25 off on the first purchase when you get approved and use Victoria’s Secret Credit Card at Victoria’s Secret or PINK.

- $30 Bonus Gift Upon Spending

When you apply and get approved for the Victoria's Secret Credit Card, you will be eligible for a $30 bonus gift.

To receive this gift, you must spend a minimum of $500 on purchases outside of Victoria's Secret within the first 90 days of opening your account.

- Free Shipping

When you shop at Victoria's Secret or PINK, you will receive free shipping on orders over $50. If you are a Gold Cardholder, you will receive free shipping on orders over $25.

- Exclusive Offers

As a Cardholder, you can take advantage of several exclusive benefits offered by Victoria's Secret.

These benefits include access to exclusive offers, invites and discounts throughout the year, such as free shipping or percentage off purchases.

- Low And Limited Reward Rates

The Victoria’s Secret credit card offers good rewards for purchases done only at Victoria’s Secret and PINK, but on other categories like dining and travel, it offers lower rate, especially when comparing it to other store cards such as Amazon or Apple cards.

Also, the rewards may be limited in comparison to other credit cards that offer rewards for purchases made at a wider range of merchants.

- High APR

Victoria's Secret Credit Card comes with an high APR rate of 29.49% . The APR is the interest rate charged on any balance carried on your credit card.

A high APR can result in higher interest charges, making it difficult to pay off your balance in full and leading to debt accumulation.

- Limited Redemption Options

If you’re not a frequent Victoria’s shopper you won’t be much benefiting from this card. There are no transfer partners with this card, so you cannot transfer your points.

You only have the option to redeem your points with Victoria’s Secret or Pink, so its usability is limited.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Who Is The Victoria’s Secret Credit Card For?

Using a co-branded credit card can provide significant benefits for people who frequently shop at Victoria's Secret.

The Victoria's Secret Credit Card is tailored for those who make regular purchases at the store or online, and offers access to exclusive promotions, free shipping, and unique financing opportunities. The card provides exceptional discounts, reward points, and other advantages that are geared towards frequent Victoria's Secret shoppers.

Moreover, the Victoria's Secret Credit Card can be a suitable option for individuals who want to establish or improve their credit history, especially if they are frequent shoppers at Victoria's Secret. By using the card responsibly and regularly, you can build a positive credit profile that could lead to higher credit scores and eventually provide access to other credit options.

If you are looking for an alternative co-branded, clothing store card – here are some options:

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

| 30X – 40X

15 points Instant for cardmembers. 30 points per dollar spent at American Eagle, 20 points if you spend more than $350 annually | 30% off your first order | $0 | |

| 2X – 5X

spend $1,200 or more annually to get 5X points per dollar on purchases made at Macy's, 3X points if you spend $500 to $1199 and 2X points if you spend up to $500. Also, get 3X points at restaurants including delivery, 2X at gas stations & supermarkets and 1 point per $1 spent everywhere else

| 25% discount

25% discount on Macy's on the day you are approved and the following day, up to $100

| $0 | |

| 1% – 5%

5% back on Sears + 5% eligible gasoline purchases, 3% back on grocery stores and restaurants (limited to the first $10,000 of qualifying payments, then 1% thereafter), plus 2% back when used at eligible merchants such as Sears or Kmart, and 1% on all other purchases

| None | $0 | |

| 7.5%

7.5% cash back on Kohl’s purchases | %35 off on first purchase

35% off on the first Kohl’s Card purchase you make within 14 days of opening your Kohl’s Card | $0 | |

| 5%

1 point for every dollar at JCPenney, 200 points worth $10 -> $10 per $200 spend on JCPenney = 5% back

| Extra 5% – 35% off

Extra 5% – 35% off on selected merchants in the first purchase on the same day the card has been opened

| $0 | |

| 1X – 5X

5 points for every dollar spent at Banana Republic, Gap, Athleta and Old Navy. 1 point per dollar on all other purchases | 20% off your first order

20% off your first order at Banana Republic

| $0 | |

| 1x – 2x

2X points per dollar spent at Nordstrom and its brands, including Nordstrom Rack, and 1X points on all other purchases

| $10 – $20

$10 Nordstrom Note for Members and Influencers. $20 Nordstrom Notefor Ambassadors and Icons.

| $0 |

How To Maximize Card Benefits?

Here are some tips that will help you to maximize the benefits of Victoria’s Secret Credit Card:

-

3X Points on Bra Purchases

This is an exclusive offer that comes with the Victoria's Secret Credit Card, and it allows you to earn 3X points on bra purchases (which means 15% back on bra).

For example, if you spend $40 on a bra, you will receive 120 points that you can later redeem.

-

Upgrade To Upper Tier Membership For More Rewards

This card has three levels of membership: cardmember which is default without spending, silver cardmember when you spend $300 in a year, and gold cardmember when you spend $750 in a year. Gold and silver cardholders are entitled to additional benefits.

For example: With Gold card membership you will eligible for free shipping on order only above $25.

-

Credit Card Anniversary

If you are a Silver or Gold Cardmember, you will receive 15% off with Silver and 20% off with Gold Card membership on shopping at Victoria’s Secret and PINK once a year.

How To Apply?

It's easy and quick to apply for the Victoria’s Secret Credit Card:

Step 1: You can apply for the card through the Victoria’s Secret Credit Card website. Make sure you have all your personal information available and make sure you have photocopies or pictures of your identification documents.

Step 2: Once you click on the apply now, you will be directed to the page of the application where you will enter your personal information. This includes your name, date of birth, address, telephone number and your annual income. You will need to enter your social security number so that the company can check your credit score.

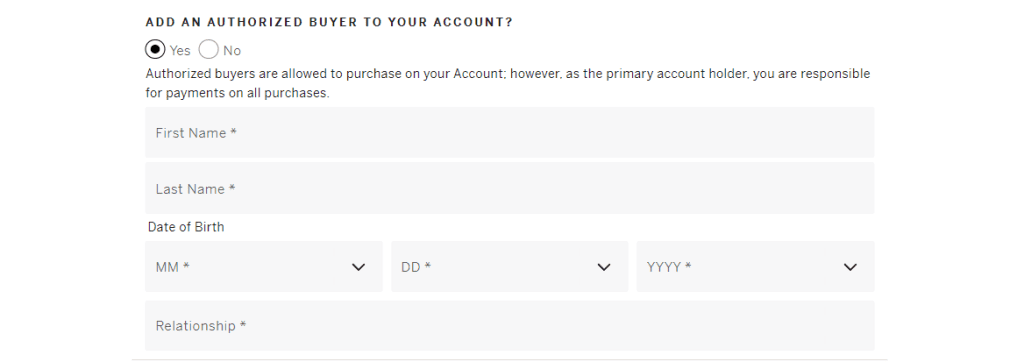

Step 3: in this page you will have the option to add additional users, if you would like to do that so you need to add their details as well:

Step 4: The last step is to review the terms and condition and submit the application.

FAQs

Yes, you can use your Victoria's Secret Credit Card to make purchases outside of Victoria's Secret stores, but you won't earn rewards points on those purchases.

Typically, you'll receive an instant decision on your application, but it may take up to 10 days to receive a final decision.

You can redeem your rewards points for on bras, panties, and other merchandise at Victoria's Secret and PINK stores or the stores or online.

Compare Victoria Secret Credit Card

The AE wins if you use your credit card only on American Eagle or Victoria's Secret. But what if you plan to use it outside these brands?

American Eagle vs Victoria Secret Credit Card: Side By Side Comparison

Victoria's Secret credit card is our winner as it offers points rewards on all categories and higher estimated cash back than Lane Bryant.

Lane Bryant vs Victoria Secret Credit Card: How They Compare?