Table of Content

Whether you’re looking for your first bank account or want to switch from your current bank, you need to ensure that you choose the financial institution best suited to your specific needs and preferences.

With so many banks in the marketplace, it can be a little daunting to find the best ones for you. So, here we’ve compiled a list of 15 things to look for in a bank.

1. A Good Product Line

While you may be looking for a specific type of bank account, you can make things easier for yourself, if you can anticipate your future needs and find a bank that can meet them. Although you may only need a checking account, you may want to open a savings account, take out an auto loan, or even obtain a mortgage later.

Obtaining credit tends to be a little easier if you’ve already established a relationship with a bank. So, by choosing a bank with a good product line now, you can start working on that relationship for your future needs.

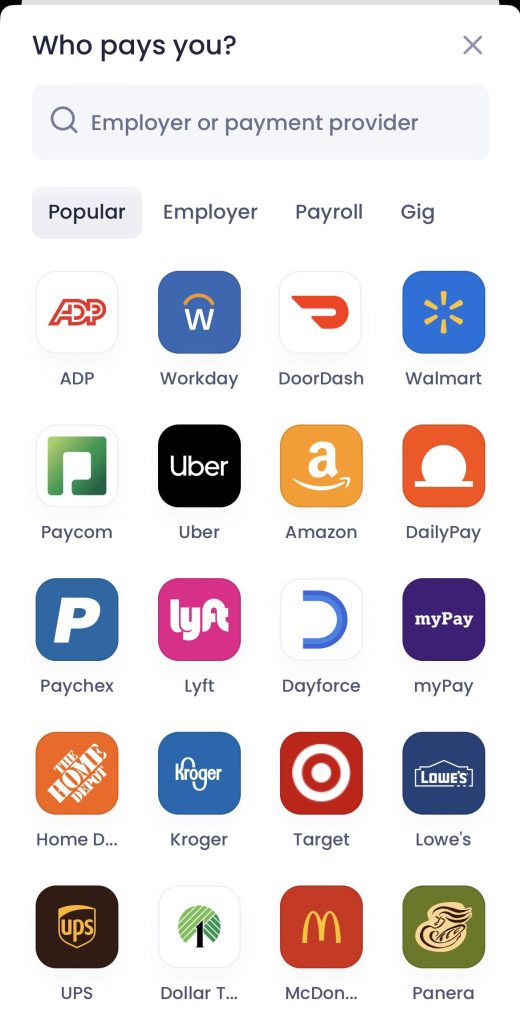

It is a good idea to choose a bank that offers checking, savings, some lending products, and possibly investments. This should provide for your current and future needs. For example, here's what you can get with Wells Fargo:

2. Excellent Customer Service

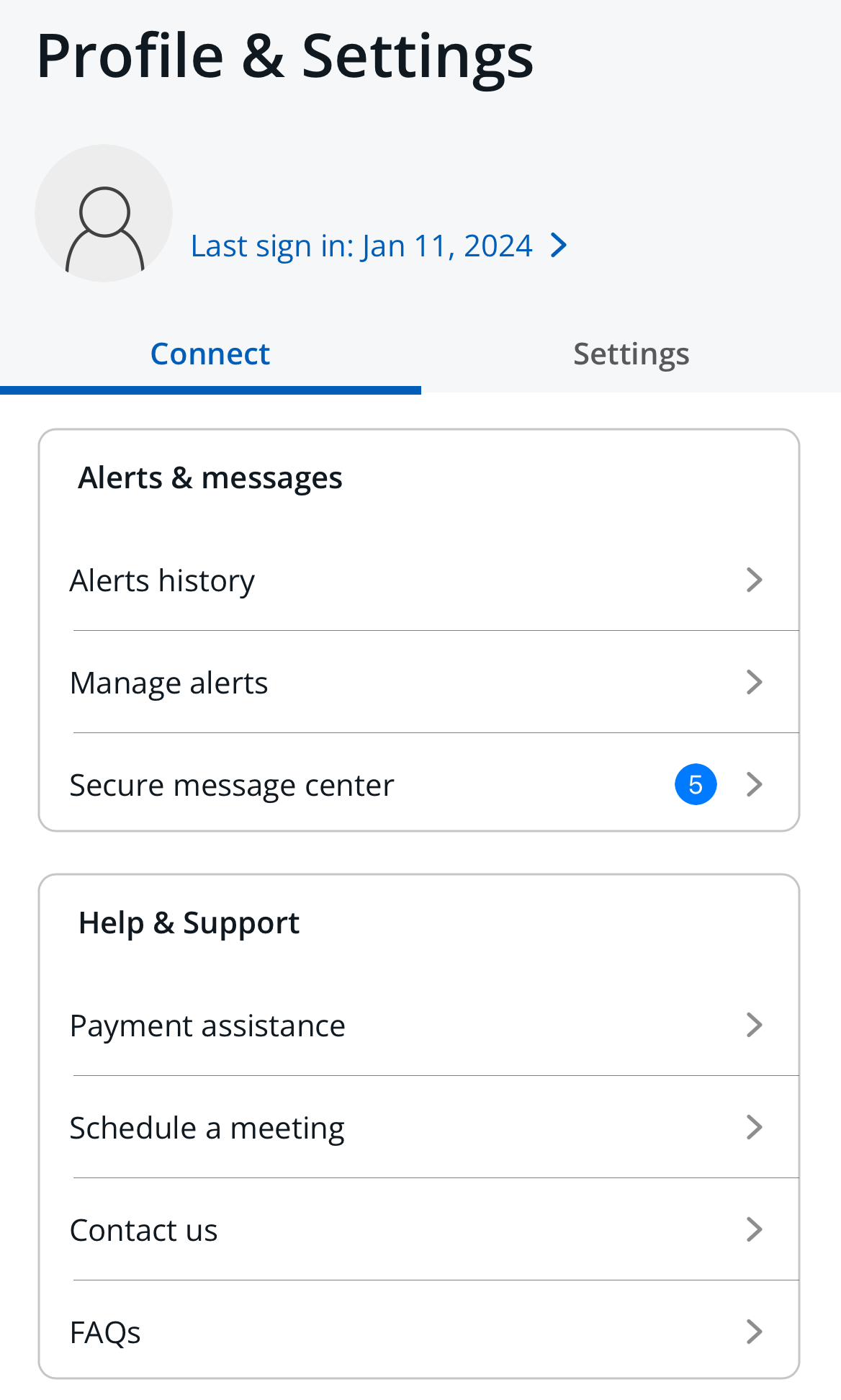

Even if a bank has a comprehensive variety of products, if they offer terrible customer service, you are not likely to enjoy your banking experience. You need the reassurance that if you have an issue with your accounts, need to report a suspicious transaction or just have a question, you’ll get attention promptly.

Your definition of excellent customer service may differ from others, so think about what you need. Do you prefer to be able to speak to an agent on the phone, or do you prefer online or chat attention? Whatever method you prefer, it is a good idea to look for a bank that has customer service availability outside standard business hours.

While most banks offer credit and debit card helplines 24/7, if you have a query on another matter, you may not want to have to wait until 8 am the following morning.

Fortunately, checking customer service is relatively easy. You can browse the comments and ratings on consumer review websites.

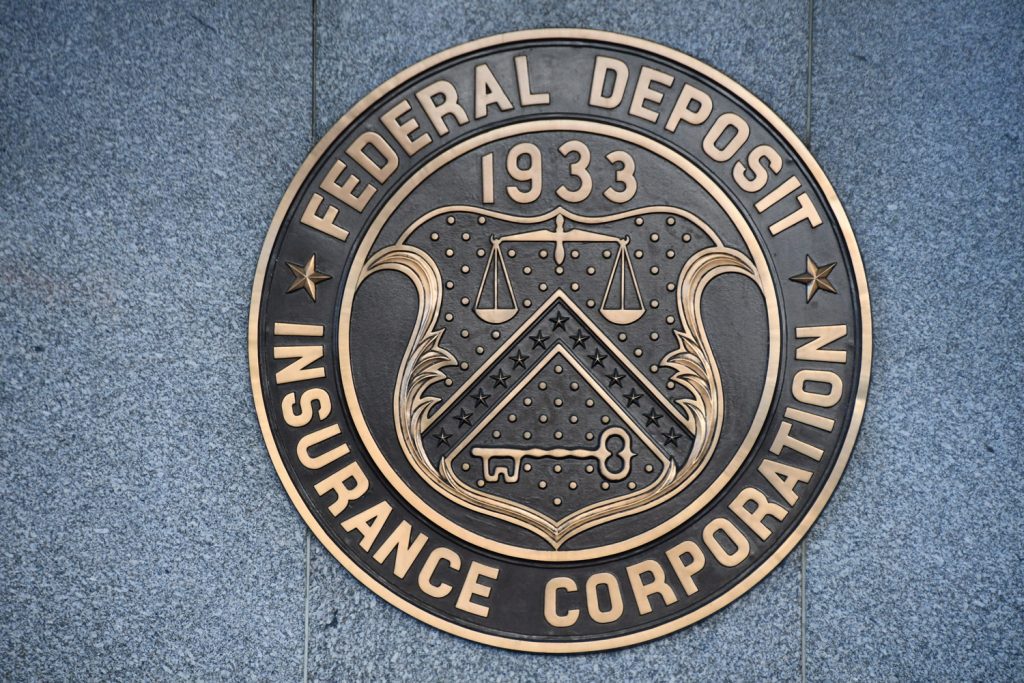

3. FDIC Insurance

This point is easy to overlook as many consumers assume that FDIC insurance is automatic. However, not all financial institutions offer this security. FDIC (Federal Deposit Insurance Corporation) insurance guarantees the funds of up to $250,000 held in deposit accounts.

This means that should the bank fail, the FDIC insurance kicks in to ensure that you get your funds. With the turbulent times in the financial markets over the last decade or two, FDIC insurance is a must.

You can check if a bank is FDIC insured by checking with the FDIC. However, most institutions will display the FDIC logo on their literature and website.

4. Branch Network

This point is a matter of preference. If you prefer to have the option to speak to a bank representative face to face, then you will need to choose a bank that has a decent branch network. Larger banks such as Chase, Citi, or Bank of America can have thousands of locations around the country, but you may find smaller banks still have a good presence in your area.

It is also worth checking the size and availability of the ATM network. Even if you don’t need to speak to someone face to face, having access to an ATM will allow you to pay cash into your account and handle other account management issues without incurring any fees.

If physical locations are important to you, don’t be satisfied with having access to one location in your hometown. It is also a good idea to have additional locations in nearby areas, in case of branch closures or technical issues.

5. Fee Free ATMs

This follows from the previous point, but if you do need to use an ATM, you should not incur hefty fees each time. If you need to print a statement, withdraw cash or make a deposit, even a $3 fee each time can quickly add up.

Ideally, your bank should offer access to fee-free ATMs, but if this is not possible, they should offer some ATM fee reimbursement. Some banks go further than this offering fee-free machines and reimbursement if you use a non-network machine, up to a specific limit each month.

This means that you don’t need to search around for a network machine, you can simply use the most convenient location to you at any time.

Bank | Estimated Number of ATMs |

|---|---|

Citi | 60,000 |

Chase

| 16,000 |

Bank Of America

| 16,000 |

Wells Fargo | 12,000 |

PNC Bank |

10,000 |

U.S. Bank | 5,000 |

6. Good Online Experience

These days, most banks offer at least a rudimentary form of online banking. This is convenient to manage your account, check transactions and initiate transfers at any time of the day or night. However, the website should have a clear, intuitive layout that makes it easy to use.

If the bank does not have physical branches, the online experience is even more crucial. Since you will need to handle all aspects of your banking online, it is vital that the website is easy to use.

It is also a good idea to choose a bank that supplements its online presence with an app. This will allow you to manage your accounts on the go using your mobile device. While you may not be able to check the full functionality of the apps before opening an account, you can check the reviews on the Apple Store and Google Play to see what other users are saying about using the apps.

7. Cash Limits

While many of us are going cashless, there may still be occasions when you need to get your hands on physical cash. However, many banks set limits on how much cash you can withdraw from ATMs.

Depending on your perspective, this can be a benefit or a negative. If the limit is too low, it could be inconvenient if you need access to a larger sum. However, if the limit is too high, you may have concerns about fraud.

Fortunately, there is a good compromise. Some banks allow you to modify the cash limits on your cards and accounts. You can set the limit that is most appropriate to you, and you’ll have the ability to adjust it if your circumstances or requirements change.

8. Fraud and Security Protections

Whether you’re using online banking or making a purchase with your debit card, you need to know that your account will remain secure. If a fraudster can gain access to your bank account, it could be catastrophic for your finances.

With cyber crimes on the increase, you need to choose a bank that has strong fraud and security protections to keep your finances safe and secure. At a very basic level, you should be required to provide a complex password to sign in and access your account. However, some banks go a little further with SMS code verification and other enhanced security measures.

The bank should also offer some reassurance that if you are the victim of fraud, your account will be reimbursed for any unauthorized charges.

9. Account Maintenance Fee Waivers

While monthly account maintenance fees are becoming less common, they do still feature on many checking and savings accounts. If your preferred bank does impose account maintenance fees, there should be a number of ways to have the fees waived.

Many banks offer several waiver methods such as linking an account, maintaining a specific balance, or receiving a minimum amount in direct deposits each month. Typically, the higher the maintenance fee, the higher the waiver minimums. So, it is important that you can comfortably meet one or more of the waiver criteria each month.

If you are not comfortable being tied into meeting minimums to not pay a monthly maintenance fee, you’ll need to look for a bank that does not impose these charges on its accounts.

Bank/institution | Monthly Fee | Bank Type |

|---|---|---|

Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Traditional |

Chase Total Checking® | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Traditional |

Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| Traditional |

PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

| Traditional |

U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

| Traditional |

Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Traditional |

Capital One 360 Checking | $0 | Online Only |

Amex Rewards Checking | $0 | Online Only |

SoFi Bank | $0 | Online Only |

10. Minimal Fees

In addition to monthly maintenance fees, there are other account charges that could impact your finances. So, it is a good idea to look for banks that impose minimal fees. The list of fees can include charges such as returned payment, unauthorized borrowing and late payment fees.There are some banks that impose multiple fees which can quickly spiral out of control.

For example, if you accidentally slip overdrawn even by just $15, but you have several payments due to go out of your account that day, you could incur an unauthorized borrowing charge for each one. With some banks charging $35 or more per fee, this could mean that you end the day with over $100 due in charges.

Fortunately, there are a number of banks that have a very reasonable fee structure, with some accounts not incurring any fees at all. These accounts may not offer the great perks of other accounts, but the lack of fees does make these banks attractive.

11. Attractive Rates

Even if you don’t have a massive amount to put into your savings account, it is nice to earn a great rate on your balance. This is where online banks typically have the edge over their traditional bricks and mortar counterparts. Since online banks don’t need to maintain a physical branch network, their costs are lower and this is reflected in the higher savings rates online banks offer.

The attractive rates can also be reflected in lowering lending rates. If you do need a personal loan, credit card, or other forms of borrowing, it is appealing if the bank has lower than average rates.

Again, try to anticipate your current and future needs to see how the rates of each potential bank could benefit you.

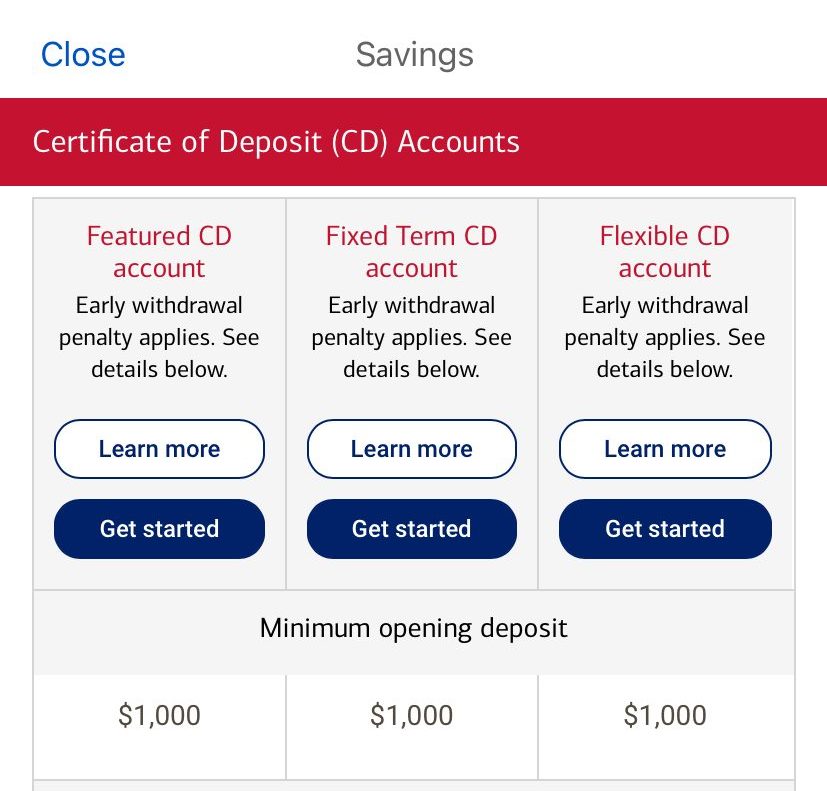

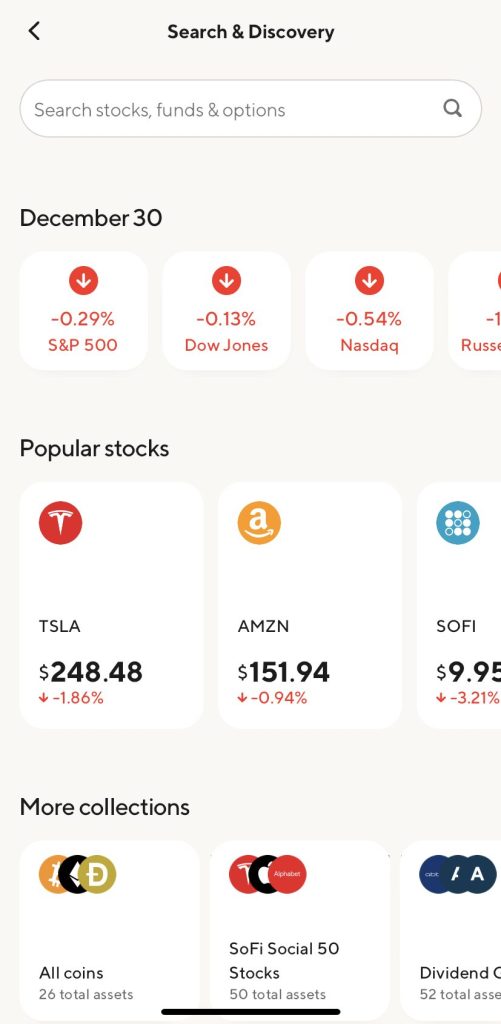

12. Investment Options

If you want to work towards your future financial goals, you are likely to need some investment products. Many banks offer CDs or certificates of deposit at a minimum for their investment options. CDs allow you to invest some funds for a set period to access higher interest rates.

However, the rates can vary significantly depending on the specific bank and the CD term. CDs can be a great way to dip your toes into investments as they are quite low risk. But, it is also nice if your new bank offers other forms of investments.

It is a good idea to take a close look at the terms and conditions of these products. Some banks impose hefty penalties on CDs if you need to access your funds before maturity, which could negate the benefits of the higher rate. You also need to look at the minimum requirements for these accounts.

Some banks require thousands of dollars at a minimum to invest in a CD, which could be a barrier for entry if you don’t have a large sum.

13. Help with Investing

While offering investment options is great, if you’re an investing newbie, your ideal bank should also offer help and guidance. This is an area where online banks tend to excel, but many traditional banks are now offering investing help.

This can take the form of robo advisors that allow you to create a balanced portfolio according to your specific risk preferences and investing goals.

At the very least, the bank should offer learning resources to help you familiarize yourself with basic strategies to help you to make informed investing decisions.

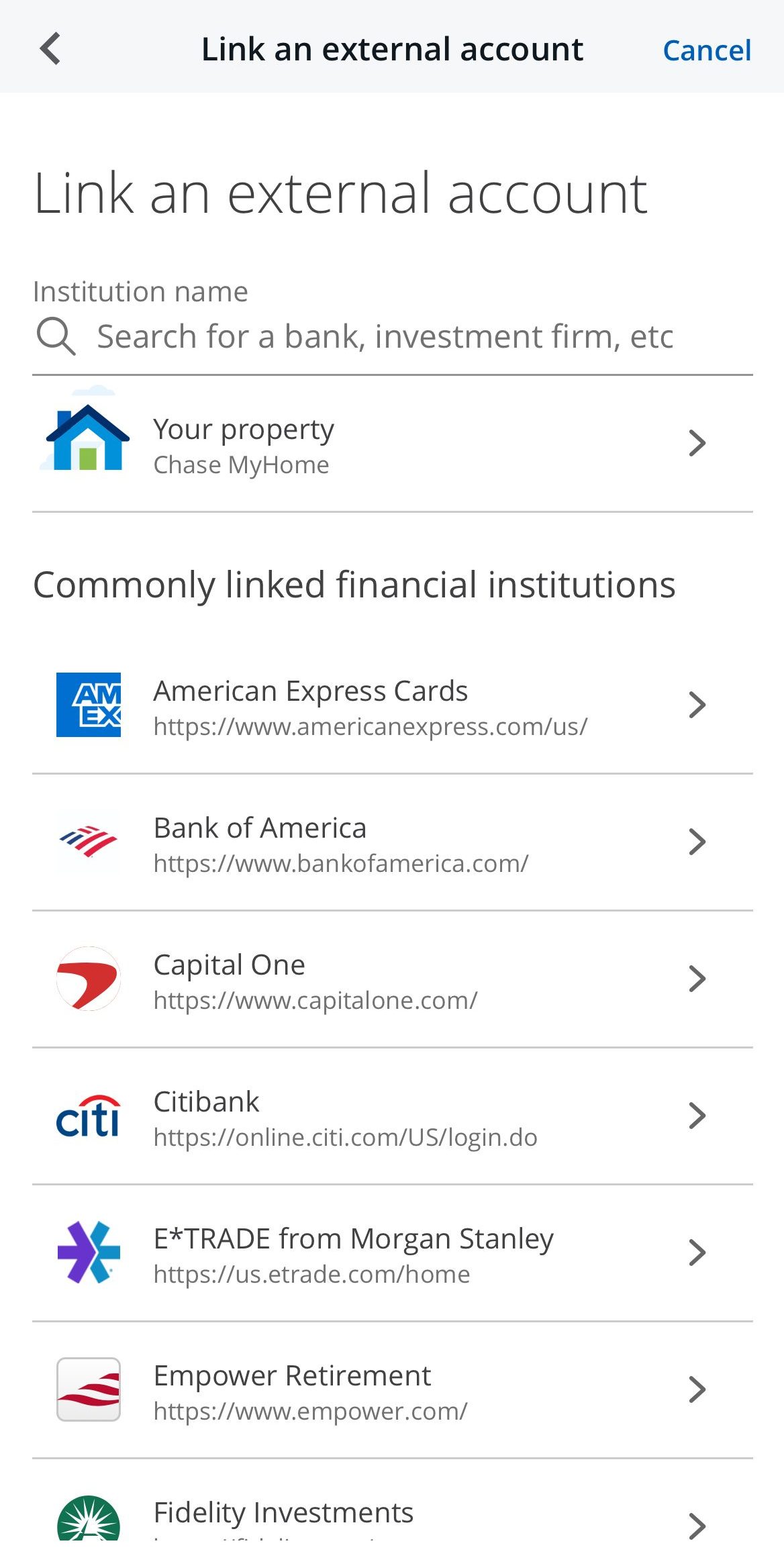

14. Account Linking

Being able to link accounts can make banking far more convenient. You can quickly avoid overdraft situations, make quick transfers, and even access account perks. Linked accounts also make it easier to set up automatic transfers, so you don’t need to keep such a close eye on your account management.

Just be aware that some banks impose a fee for linking accounts. Ideally, your new bank will allow you to link accounts without incurring any charges.

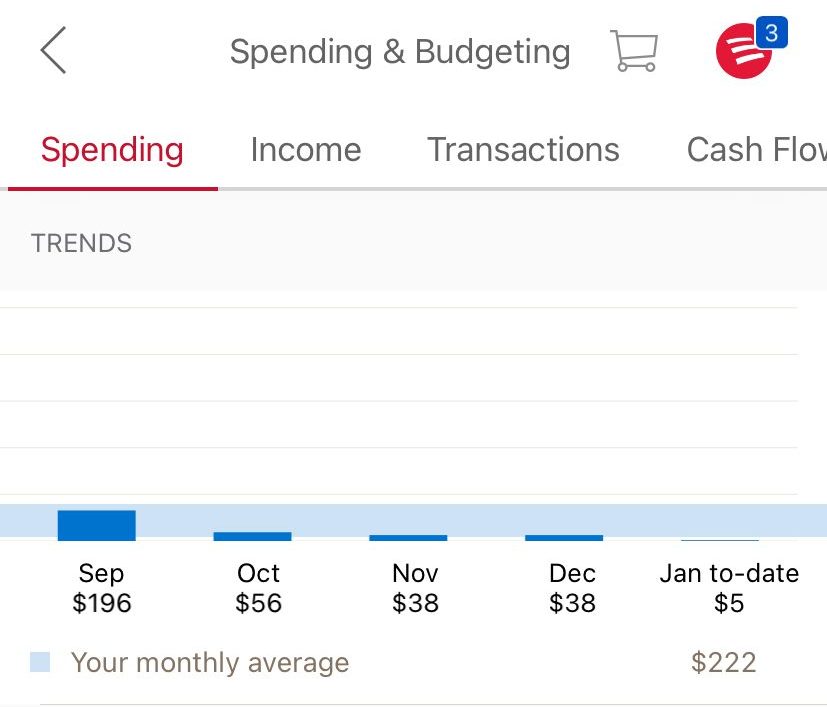

15. Finance Management Tools

Finally, your chosen bank should offer innovative tools and features to help you to manage your money. This could include features such as round ups, which “round up” the amount of debit card transactions and transfers the additional sum into savings.

For example, if you swipe for a purchase at $5.57, $5.75 may be billed to your account, with $0.18 going into savings. While you are not likely to notice this small amount, over the course of a month, you may add $20 to $30 to your savings.

These tools should be easy to use and allow you to work towards your financial well-being and meeting your money goals.

With so many traditional banks, online banks, and credit unions, it can seem daunting to find the right bank for you. However, if you look out for these 15 features, you are sure to find banks that offer the best services for your financial needs and requirements.