Table Of Content

How Many Checking Accounts Can I Have?

No laws or regulations in the United States limit how many checking accounts an individual can have. However, it is worth mentioning that some banks limit the maximum number of checking accounts an individual might have at the same financial institution.

There are several factors to consider when deciding how many checking accounts you might need:

- Fees – You can open as many accounts as you want with different banks. However, one thing to keep in mind is that most accounts have monthly fees. So you need to keep this potential expense in mind when deciding on this matter.

- Need to separate expenses – You must consider whether you have to separate your personal and business expenses or some other categories.

- Bonuses – It is also worth considering whether or not the checking accounts in question offer some bonuses or other types of rewards to customers.

Multiple Checking Accounts Pros & Cons

Having two or more checking accounts can certainly have some advantages – but also disadvantages. Here are some of those:

Pros | Cons |

|---|---|

Separate Personal and Business | Monthly Service Fees |

Bonuses and Rewards | Difficult of Keep Tracking of Finances |

Accounts For Different Purposes | Lost Opportunities to Earn Benefits |

Higher FDIC Insurance Coverage |

- Separate Personal and Business

For most people, it is tough to separate personal and business expenses using the same checking account.

One way to make things easier here would be to open a separate account for business expenses.

- Bonuses and Rewards

From time to time, some banks offer special cash bonuses or other rewards for new clients who open checking accounts with them.

Having multiple accounts allows you to take advantage of those opportunities and earn bonuses, especially if you maintain a high amount of money in your accounts.

- Accounts For Different Purposes

With the best checking accounts, it is easier to keep track of different expense categories and avoid overspending.

For example, you can have a separate account for monthly expenses, car purchases, an emergency fund, etc.

- Higher FDIC Insurance Coverage

The FDIC insurance covers accounts in the US up to $250,000 per account per person.

So if you have a higher balance, it might make more sense to divide this amount between different accounts so that you get full insurance coverage if the bank becomes insolvent.

- Monthly Service Fees

One of the most significant downsides of having several checking accounts is that with most banks, you have to pay a monthly maintenance fee for each of them. This might seem a small sum, but over time, it can add up to a significant amount.

For example, if you have five checking accounts with a $12 per month fee each, within a year, you have to pay $720 just to cover bank fees. Some banks waive fees if you maintain large balances, but you might need much money to cover all checking accounts.

- Difficult of Keep Tracking of Finances

When you have just one checking account, it is straightforward to keep track of your income and expenses.

However, this task becomes much more complicated and time-consuming with multiple checking accounts.

- Lost Opportunities to Earn Benefits

Some banks offer benefits for their customers if they maintain large balances on their accounts.

For example, Citibank waives $2.50 non-Citi ATM fees if you hold balances of $10,000 or above. However, if you have your funds are dispersed in small amounts across different accounts, you are likely to miss those opportunities.

Top Offers From Our Partners

When It May Makes Sense to Open Two or More Checking Accounts?

With all of the benefits and drawbacks of multiple checking accounts in mind, it is worth mentioning that there are several cases where it makes sense to open several accounts:

- You Have Business Expenses

If you are a business owner, it makes sense to open a separate account for your business expenses. Otherwise, you might have difficulty differentiating how much you spend on your personal needs and business affairs.

Consequently, a different account for business expenses can make managing things more manageable.

- You Have High Balance

if you have high balance on a single account, you may want to hedge it by open another checking account and enjoy higher FDIC insurance.

- You Are Saving Money For Big Purchases

You might be saving money for car purchases, home appliances, furniture, or even a mortgage down payment. Having all the funds in one checking account can make it difficult to manage finances.

On the other hand, you can have one account for regular expenses and another for large ticket purchases. This can make managing finances much more straightforward.

When It Make Sense | When It May Not Make Sense |

|---|---|

You Have Business Expenses | Can't Waive Fees |

You Have High Balance | You Have Inactive Checking Accounts |

You Are Saving Money For Big Purchases | You Already have Different Savings Accounts |

You Have Difficulties Tracking Your Spending And Income |

When It May Not Makes Sense?

At this point, it is important to mention that there are also some scenarios where opening two or more checking accounts might simply not make any sense. Here are some examples of those

- Can't Waive Fees

You might not have enough money dispersed between different accounts to waive the monthly service fee with two or more checking accounts.

In this situation, moving your balance to one account might be better; avoid fees and close the other. Reducing fees is important if you want to get the most of your bank account.

- You Have Inactive Checking Accounts

It makes little sense to keep multiple checking accounts open if you only use one of those accounts. Here you still have to pay a maintenance fee, so it is may be better to close such accounts.

- You Already have Different Savings Accounts

If you already have savings accounts for large purchases and emergency funds, it makes little sense also to have multiple checking accounts. In this case, closing those checking accounts might be better and save some money on fees.

- You Have Difficulties Tracking Your Spending And Income

Having multiple checking accounts might make managing things more challenging if you have a problem tracking your expenditure. In this case, it might make more sense to consolidate all those balances into one account.

This way, you can track your revenues and expenses by reading a bank statement from a single account.

How to Manage Multiple Checking Accounts?

Having multiple checking accounts might be difficult to manage for some people. However, there are some ways to make it easier and more manageable:

- Spreadsheets – One way to approach this would be to open a spreadsheet and fill in your transaction and balances. Some online and mobile banking applications allow you to download your latest bank statements in a spreadsheet format. So, this can significantly reduce the workload you need to keep track of your finances.

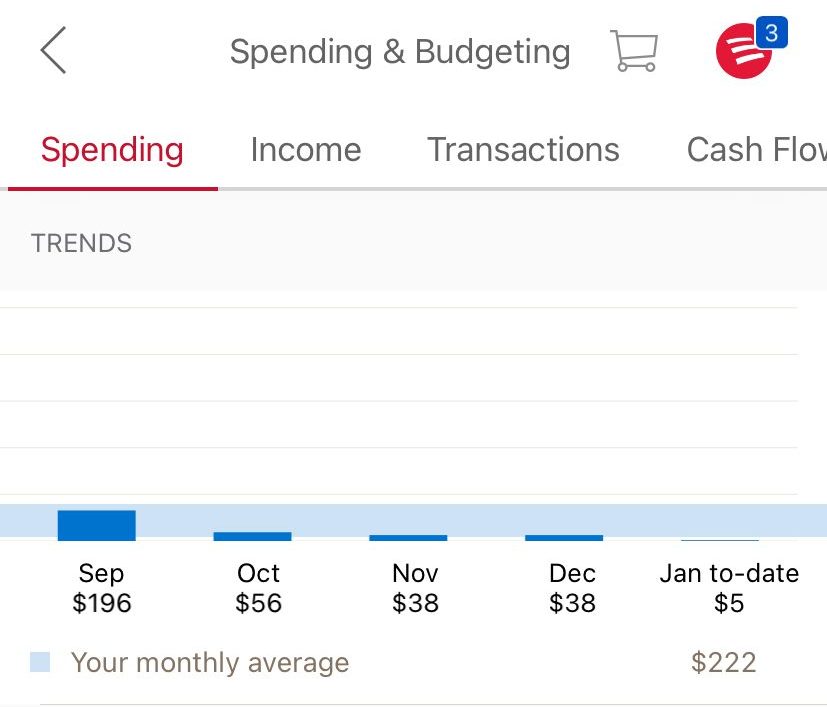

- Budgeting Apps – If you find working on spreadsheets complicated or time-consuming, there is an alternative. Hundreds of budgeting applications can make the budgeting process much easier. Some offer a function to integrate your latest bank statements into those applications and do financial analysis for you.

- Close Inactive Accounts – There is no benefit in keeping inactive accounts open. You will have to keep paying service fees for no tangible gain. So it is important to identify inactive accounts and close them, saving some money.

- Avoid Money Transfer Fees – If you have all your checking accounts at the same bank, those internal transfers are free. However, if you have accounts spread across different financial institutions, it is worth keeping in mind that you are likely to pay commissions for transferring funds between those accounts. Therefore, keeping those expenses at a minimum and avoiding unnecessary fees is important. You can also use free services such as Zelle to transfer funds for free.

FAQs

Most banks allow you to have multiple checking accounts in one financial institution. However, some limit the total number of checking accounts you might have in the same bank.

For example, some banks, like Capital One, only allow customers to open up to 3 checking accounts. Here it is worth noting that this limit does not include savings, money market, or investment accounts.

The requirements for opening a checking account depending on the bank in question. However, in most cases, you only need to provide a government-approved ID, your social security number, and a minimum deposit, such as $25 or more.

Here it is helpful to keep in mind that some premium-type checking accounts might have additional requirements, such as large minimum balances.

It is possible to get a new account bonus even if you have multiple checking accounts, but this depends on the terms and conditions of the bonus itself.

For example, Citibank does offer up from $200 to $2,000 in cash bonuses for new clients, depending on the initial deposit. In this case, you can not get this bonus if you already have a checking account with Citibank.

However, you can get a bonus if you have a checking account at some other bank and no accounts at Citibank.

The FDIC coverage insures up to $250,000 per person and account. This means that if your total balances are below this number, it makes little difference whether or not you have multiple checking accounts.

On the other hand, if your balance is higher than $250,000, it might be better to divide this sum and place some of the amounts in the new checking account. So the main idea is that none of your accounts should exceed $250,000 to keep the full coverage.

Can I combine two bank accounts?

There are essentially two scenarios in this situation. If you hold those two bank accounts at the same financial institution, then in many cases, you can go ahead and request those two accounts to be combined.

On the other hand, if you have opened those two accounts at different banks, then the only way to combine them is to close one of them and move funds to the second account.

There is no limit to how many accounts you can open with different financial institutions. However, when it comes to how many accounts you can have with the same bank, there are different limits depending on the bank in question.

Some banks do not impose such limits, while others might only allow customers to hold up to 3 checking accounts simultaneously.

Having multiple checking accounts does not hurt your credit score since this decision has nothing to do with your payment history, credit utilization ratio, or any other component that makes up your credit score.