Table Of Content

Opening a Capital One CD account will provide you with some of the best rates you can find these days. In the current interest rate environment, a CD is a secure and reliable way to invest your money and watch it grow over time.

In this article, we'll guide you through the simple steps to open a Capital One CD account

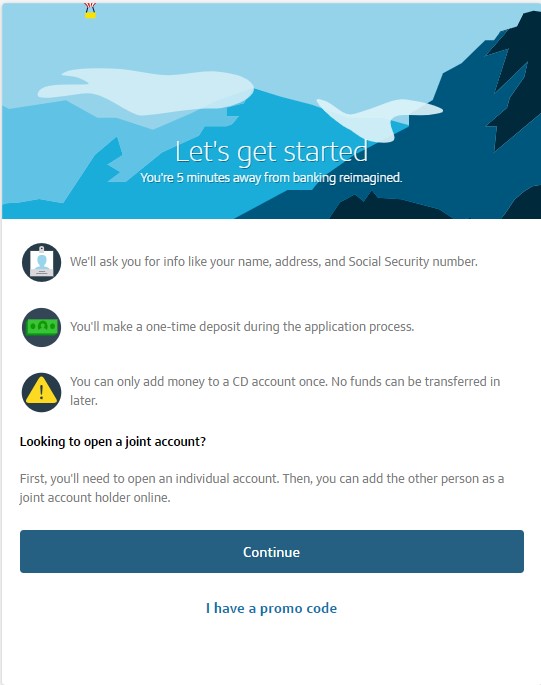

1. Launch Your CD Application

To start opening a CD account with Capital One, you need to go to their website. Capital One is an online bank like Ally, Synchrony, or Barclays, so you won't need to visit a physical branch or make phone calls.

Everything happens online, which means you don't have to go anywhere or talk to anyone in person. If Capital One needs more information from you, they might get in touch with you.

To begin, just go to the Capital One website and click the “Open CD Account” button to start.

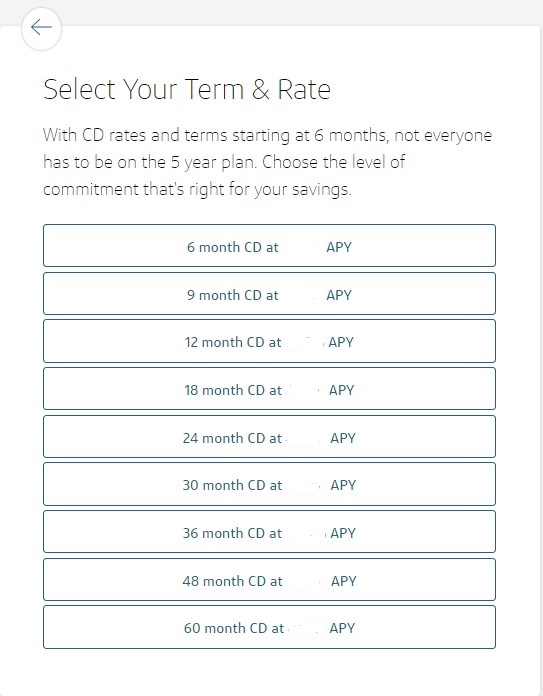

2. Select Your Term & Rate

In this step, you will be given the opportunity to select the term and rate for your Capital One CD account. The term refers to the length of time that your money will be held in the CD before it reaches maturity.

Each term will have its own corresponding interest rate, which can vary based on market conditions and the current rates offered by Capital One. It's important to consider your savings goals and timeline when selecting the term for your CD account.

Capital One offers a range of terms for their CD accounts, starting from as short as 6 months up to 60 months (5 years). This flexibility allows you to choose the term that suits your financial goals and savings preferences.

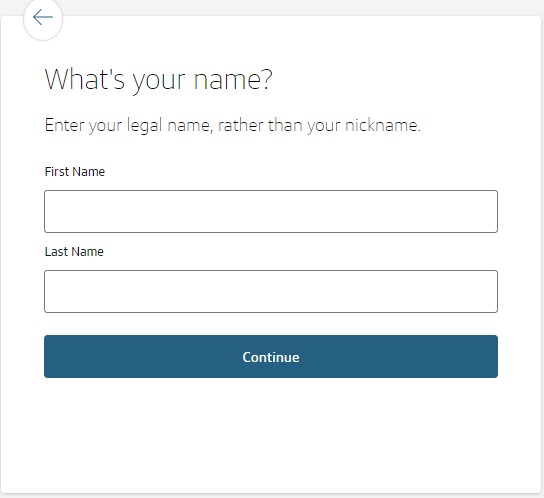

3. Add Personal And Contact Details

During this step, you'll need to share some personal information as part of the Capital One CD application process. Here's what you'll need to provide:

Name: Simply enter your full legal name, including your first name and last name, exactly as it appears on your official identification documents. Avoid using any nicknames or variations.

Email Address: Provide the email address where you want to receive important communications regarding your Capital One CD account. This is where they will send you account-related information and updates.

Phone Number: Enter your mobile phone number. Capital One may use this number to send you text messages with important account updates and for identity verification purposes if needed.

Residential Address: Fill in your home address, including the street address, apartment or suite number, city, state, and ZIP code. Please note that they cannot accept P.O. Box addresses for security reasons.

Country of Citizenship: Indicate your primary citizenship by specifying the country in which you hold citizenship.

By providing this information accurately, you'll be able to proceed with your Capital One CD application smoothly.

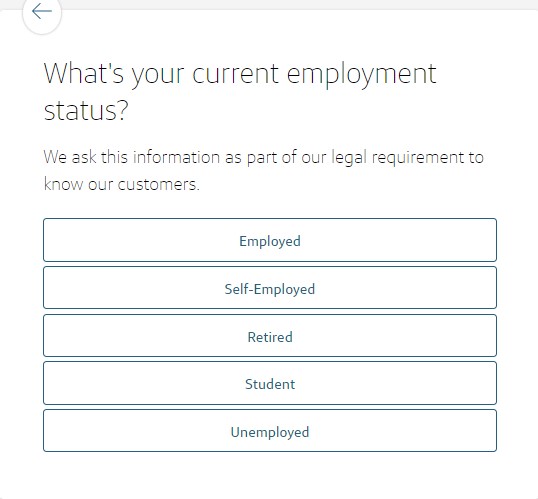

4. Employment Status And Annual Income

When applying for a CD account with Capital One, they are legally required to collect some information about your employment. Don't worry, it's a standard procedure and helps them comply with regulations and get to know their customers better.

Here's a breakdown of the steps involved in providing your employment details:

Current Employment Status: You'll need to indicate your current employment status from the options they provide. Whether you're employed, self-employed, retired, a student, or currently unemployed, they just want to know your current professional situation.

Job Title: Simply provide your job title or the position you hold in your current employment. This helps them understand your role and responsibilities.

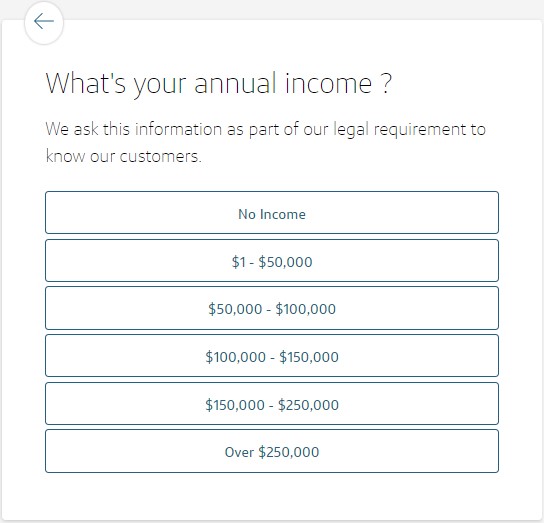

- Annual Income: Capital One requires information about your annual income to fulfill legal requirements and gain insights into your financial situation. You'll need to choose the income range that best represents your annual earnings from the options they provide.

The ranges include options like No Income, $1 – $50,000, $50,000 – $100,000, $100,000 – $150,000, $150,000 – $250,000, or Over $250,000.

5. Approve Terms And Conditions

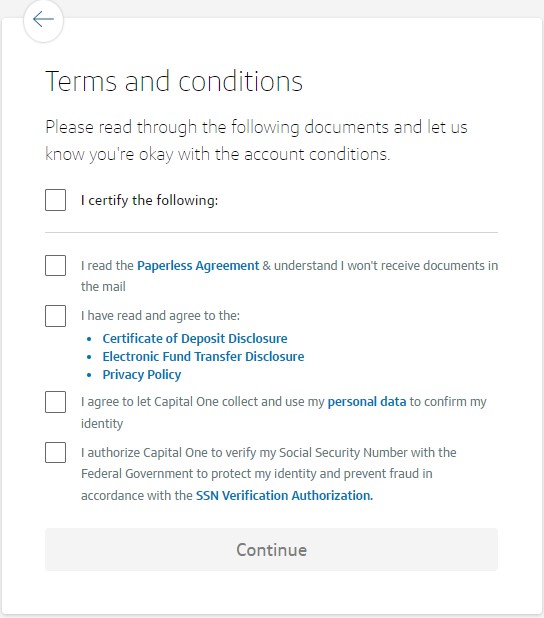

In this step, you will be asked to certify certain statements regarding your understanding and agreement with important terms and conditions. Here's what it entails:

Paperless Agreement: By checking this box, you acknowledge that you have read and understood the Paperless Agreement. This means that you agree to receive all necessary documents and communications electronically, and you won't receive physical copies via mail.

Disclosures: You are required to confirm that you have read and agree to the terms outlined in the following documents:

- Certificate of Deposit Disclosure: This document provides important details about the terms and conditions of your CD account.

- Electronic Fund Transfer Disclosure: This disclosure explains the rules and regulations regarding electronic fund transfers.

- Privacy Policy: By agreeing to this, you acknowledge that you have read and understood Capital One's Privacy Policy, which outlines how they handle and protect your personal information.

Personal Data Collection: By agreeing to this statement, you give Capital One permission to collect and use your personal data for the purpose of confirming your identity. This is an essential step in maintaining the security of your account and preventing fraud.

Social Security Number (SSN) Verification: By authorizing Capital One to verify your Social Security Number with the Federal Government, you allow them to confirm your identity and protect against potential fraud. This verification process ensures that your information is accurate and secure.

By certifying these statements, you confirm your understanding, agreement, and consent to the terms and conditions provided.

It is important to carefully review and comprehend the documents and disclosures mentioned to ensure that you are comfortable with the outlined terms before proceeding with the account application.

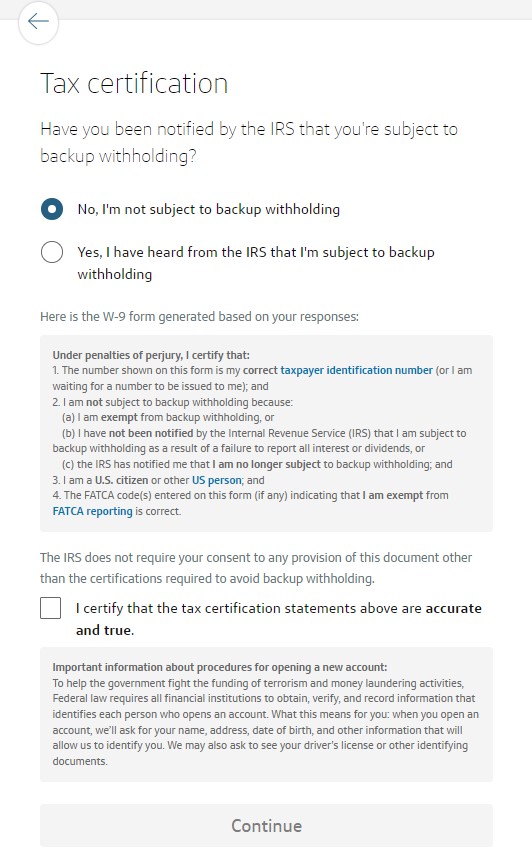

6. Tax Certification

During the CD account opening process with Capital One, there is a step that involves verifying your tax information. This is done to ensure accuracy and compliance with tax regulations.

The purpose of this step is to confirm whether you have received any communication from the IRS (Internal Revenue Service) regarding backup withholding. Backup withholding is a process where a portion of your income is held back by the payer (in this case, Capital One) for tax purposes.

Based on your response to this question, Capital One will generate a form called W-9. This form is a standard document used to collect taxpayer information. It includes statements where you certify your taxpayer identification number, your exemption from backup withholding if applicable, and your U.S. citizenship status.

Top Offers From Our Partners

![]()

Top Savings Accounts From Our Partners

Quontic High Yield Savings

- 4.50% APY on savings

- Interest is compounded daily

- No Monthly Service Fees

CIT Savings Connect

- Up to 5.00% APY on savings

- No monthly service fees.

- Zelle, Samsung & Apple Pay

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Top Offers From Our Partners

![]()

![]()

7. Deposit Money To Your CD Account (Optional)

Now it's time to fund your CD account. This step is optional since Capital One has no minimum deposit to open a CD account.

Here's what you need to provide to link your bank account:

Type of Account: Specify the type of account you want to link, such as a checking or savings account. If you already have a Capital One savings account, it's even easier.

Routing Number: Enter the routing number of your bank. This number helps identify the financial institution associated with your account.

Account Number: Fill in your bank account number. This unique number identifies your specific account within the bank.

Confirm Account Number: Double-check and re-enter your account number to ensure accuracy.

Amount to Transfer: Indicate the amount you want to transfer from your linked bank account to your new CD account. Initially, it will be set at $0.00, but you can enter the desired amount.

Please note that there may be a hold placed on your funding deposit. However, even during this hold period, your deposit will still earn interest.

8. Review And Open Account

In the final approval step, you'll have the opportunity to review all the information you have provided before proceeding. It's important to carefully check that everything is accurate because once you proceed, you won't be able to go back and make changes.

Do Capital One CDs Competitive?

Yes, Capital One CDs are known to be competitive in the market. Additionally, Capital One is a reputable and well-established bank, known for its customer service and digital banking capabilities, which adds to the overall appeal of their CD offerings.

However, it's always a good idea to compare rates from different financial institutions to ensure you get the best possible investment return. Here's how's Capital One compared to other banks and credit unions:

CD APY Range | Minimum Deposit | |

|---|---|---|

Marcus (Compare) | 3.90% – 5.15% | $500 |

Barclays Bank | 0.10% – 4.85% | $0 |

Quontic Bank | 4.30% – 5.05% | $500 |

PenFed Credit Union | 2.00% – 4.35% | $1,000 |

Alliant Credit Union | 5.10% – 4.98% | $1,000 |

Sallie Mae | 5.10% – 5.20% | $2,500 |

Chase Bank (Compare) | 3.00% – 4.75% | $1,000 |

Discover Bank (Compare) | 2.00% – 5.10% | $2,500 |

CIT Bank | 0.30% – 3.50% | $1,000 |

Ally Bank (Compare)

| 3.00% – 4.85% | $0 |

Citi Bank (Compare) | 0.05% – 4.65% | $500 |

Fidelity | 4.20% – 5.30% | $1,000 |

Vanguard | 4.45% – 5.25% | $1,000 |

BMO Harris | 0.05% – 4.50% | $1,000 |

Synchrony Bank | UP TO 5.15 % | $0 |

Navy Federal | 4.85% | $1,000 |

LendingClub | 4.00% – 5.20% | $2,500 |

FAQs

What happens when my CD reaches maturity?

When your CD matures, you have three options during the 10-day grace period: withdraw and transfer the money, withdraw and open a different CD, or let it automatically renew (possibly at a different rate).

Do CDs pay interest monthly?

Yes, Capital One 360 CDs accrue daily interest, which is compounded and credited to your account on a monthly basis. You can choose to receive the interest monthly or annually, according to your preference.

Can I add beneficiaries to my 360 CD savings account?

Yes, you can designate up to 10 beneficiaries for your CD account. They won't have access to the funds while you're alive, except for Trust accounts.