Table Of Content

What Is A CD?

A Certificate of Deposit (CD) allows investors to earn a fixed rate of interest on their money for a specified period of time.

When you invest in a CD, you agree to leave your money in the account for a certain length of time, which can range from a few months to several years. In exchange for leaving your money in the account for this period, the bank offers you a fixed rate of interest that is usually higher than the interest rate offered on savings accounts.

The interest rate on a CD is fixed for the duration of the term, so you know exactly how much interest you will earn over the life of the CD. At the end of the term, you can withdraw your initial deposit plus any interest earned. If you withdraw the money before the end of the term, you may be subject to penalties.

CDs are considered to be low-risk investments because they are FDIC-insured up to $250,000 per depositor per insured bank.

How To Choose A CD Type?

There are several types of CDs that investors can choose from depending on their investment goals and preferences. Here are some of the main CD types:

Traditional CD: A traditional CD is a basic CD where the investor deposits a fixed amount of money for a set term, usually ranging from a few months to several years, and earns a fixed rate of interest for the duration of the CD.

- No-penalty CD: A no-penalty CD allows the investor to withdraw their money before the maturity date without incurring a penalty. However, these types of CDs usually offer lower interest rates than traditional CDs.

Brokered CD: A brokered CD is a CD that is sold through a brokerage firm rather than directly through a bank or credit union. Brokered CDs can offer higher interest rates, but investors should also consider the additional risks and fees associated with these types of CDs.

- Jumbo CD: A jumbo CD requires a high minimum deposit, often $100,000 or more. Jumbo CDs can offer higher interest rates than traditional CDs, but they may not be accessible to all investors.

Bump-up CD: A bump-up CD allows the investor to “bump up” the interest rate once during the term of the CD if the bank raises its rates. This can be a good option for investors who want to earn a higher interest rate but are concerned about missing out on future rate increases.

- Callable CD: A callable CD is less popular. It allows the bank to call or redeem the CD before the maturity date. This means that the investor may not earn the full interest rate if the bank calls the CD early, but it can also offer higher interest rates than traditional CDs.

CD Type | When To Choose It? |

|---|---|

Traditional CD | A traditional CD may be preferred by investors who have a specific savings goal in mind and want a guaranteed fixed rate of return over a specific term. |

No-penalty CD | A no-penalty CD may be preferred by investors who may need access to their funds before the maturity date and ok with earning lower rates compared to traditional CDs. |

Brokered CD | A brokered CD may be preferred by investors who want to get higher interest rates, diversify their CD investments beyond their local bank or credit union or prefer to invest through their investment brokerage firm. |

Jumbo CD | A jumbo CD may be preferred by investors who have a large sum of money to invest and want a guaranteed fixed rate of return with higher rates compared to traditional CDs. |

Bump-Up CD | A bump-up CD may be preferred by investors who believe that interest rates may rise in the future. Bump-up CDs can be a good option for investors who want to earn a higher rate of return but are concerned about missing out on future rate increases. |

Callable CD | A callable CD may be preferred by investors who are willing to take on additional risk in exchange for the potential of earning a higher interest rate. |

Factors To Consider When Choosing A CD

When choosing a CD, there are several factors an investor should take into account to ensure they get the best return on their investment. Here are some of the main factors to consider:

1. Interest Rate

The interest rate is the amount of money the bank will pay you for holding the CD. It's important to find a CD with a competitive interest rate because the higher the rate, the more money you will earn over the term of the CD.

For example, let's say you have $10,000 to invest in a CD for 1 year. Bank A offers an interest rate of 5% while Bank B offers an interest rate of 3%. If you choose Bank A, you will earn $500 in interest after 1 year, but if you choose Bank B, you will earn $300 in interest. That's a significant difference in earnings.

CD APY Range | Minimum Deposit | |

|---|---|---|

Marcus | 4.00% – 5.05% | $500 |

First Internet Bank | 4.14% – 5.31% | $1,000 |

Barclays Bank | 3.50% – 5.30% | $0 |

PNC Bank | 5.05% | $1 |

Quontic Bank | 4.30% – 5.30% | $500 |

PenFed Credit Union | 2.00% – 4.35% | $1,000 |

Alliant Credit Union | 5.08%-5.20% | $1,000 |

Sallie Mae | 4.00% – 4.95% | $2,500 |

Bread Financial | 4.25% – 4.75% | $1,500 |

Capital One | 4.00% – 5.10% | $0 |

Chase Bank | 3.00% – 4.75% | $1,000 |

Discover Bank | 2.00% – 4.70% | $2,500 |

CIT Bank | 0.30% – 3.50% | $1,000 |

Ally Bank | 3.00% – 4.50% | $0 |

Citi Bank | 0.05% – 4.75% | $500 |

Connexus Credit Union | 3.51% – 4.85% | $5,000 |

Merrick Bank | 4.05% – 5.25% | $25,000 |

Fidelity | 4.95% – 5.35% | $1,000 |

Charles Schwab | 5.00% – 5.40% | $1,000 |

Vanguard | 4.05% – 5.40% | $1,000 |

BMO Harris | 0.05% – 4.50% | $1,000 |

Wells Fargo | 4.75%- 5.01% | $2,500 |

Synchrony Bank | 2.05% – 5.15% | $0 |

Citizen Bank | 2.75% – 5.50% | $1,000 |

TD Bank | 1.00% – 5.00% | $250 |

Navy Federal | 4.85% | $1,000 |

LendingClub | 4.00% – 5.15% | $2,500 |

2. Term

The term of the CD is the length of time you agree to leave your money in the account. The longer the term, the higher the interest rate, but also the longer you have to wait to access your money without penalty.

For example, let's say you have $10,000 to invest and you have the option to choose between a 1-year CD with an interest rate of 4% or a 2-year CD with an interest rate of 5%.

If you choose the 1-year CD, you will earn $400 in interest after 1 year, but if you choose the 2-year CD, you will earn a bit more than $500 in interest every year on average. However, if you need to access your money before the 2-year term is up, you will have to pay an early withdrawal penalty (which is usually higher than the $100 difference).

3. Minimum Deposit

The minimum deposit is the amount of money required to open a CD account. Some banks require a minimum deposit of $500 or $1,000, while others may require a higher minimum deposit

For example, Ally bank doesn't have a minimum deposit for its CD, Discover bank requires $2,500 minimum deposit, and Merrick bank has one of the largest minimum – $25,000.

Institution | CD Minimum Deposit |

|---|---|

Vanguard | $1,000 |

Chase Bank | $1,000 |

Discover Bank | $2,500 |

Capital one | $0 |

Marcus | $500 |

Citi Bank | $500 |

Merrick Bank | $25,000 |

PenFed Credit Union | $1,000 |

4. Early Withdrawal Penalty

The early withdrawal penalty is the fee charged if you withdraw your money before the end of the term. The penalty varies depending on the bank and the term of the CD, but it's important to know the penalty before you invest because it can significantly reduce your earnings.

For example, for a 1-year CD, American Express bank charges 270 days of interest (or maximum interest earned) if you choose to withdraw your funds earlier, while Synchrony bank charges only 90 days of interest in such a case. This can be a great difference in interest if you need your money earlier than expected.

5. FDIC Insurance

FDIC insurance is important because it guarantees that your deposit is safe and insured by the federal government up to $250,000 per depositor per insured bank.

If you have more than $250,000 to invest, you may want to diversify your investment between 2 or even 3 banks.

Should I Choose a Bank, Credit Union Or Brokerage Firm?

Here are some differences and considerations for each option:

Banks: Banks may offer a range of CD options with different interest rates and terms, as well as a variety of other products and services. Traditional banks may require a higher minimum deposit to open a CD, but they may also offer incentives or bonuses for larger deposits.

Credit Unions: Credit unions may offer more competitive interest rates on CDs compared to banks, as well as lower fees and minimum deposit requirements than banks. Terms are usually more limited. When choosing a credit union for a CD investment, ensure the credit union is NCUA-insured.

Brokerage Firms: Brokerage firms may offer a range of CD options with higher interest rates and terms, as well as other investment options like stocks, bonds, and mutual funds. Brokerage firms may charge fees or commissions for CD investments, so investors should compare fees and expenses before choosing a brokerage firm. When choosing a brokerage firm for a CD investment, investors should ensure the firm is a member of SIPC, which provides insurance protection for securities and cash held in brokerage accounts.

Where I Can Compare CDs?

There are several ways to compare different certificate of deposit (CD) products, including:

Bank and financial institution websites: Many banks and financial institutions allow you to compare their CD products on their website. You can view interest rates, terms, minimum deposit requirements, early withdrawal penalties, and other features.

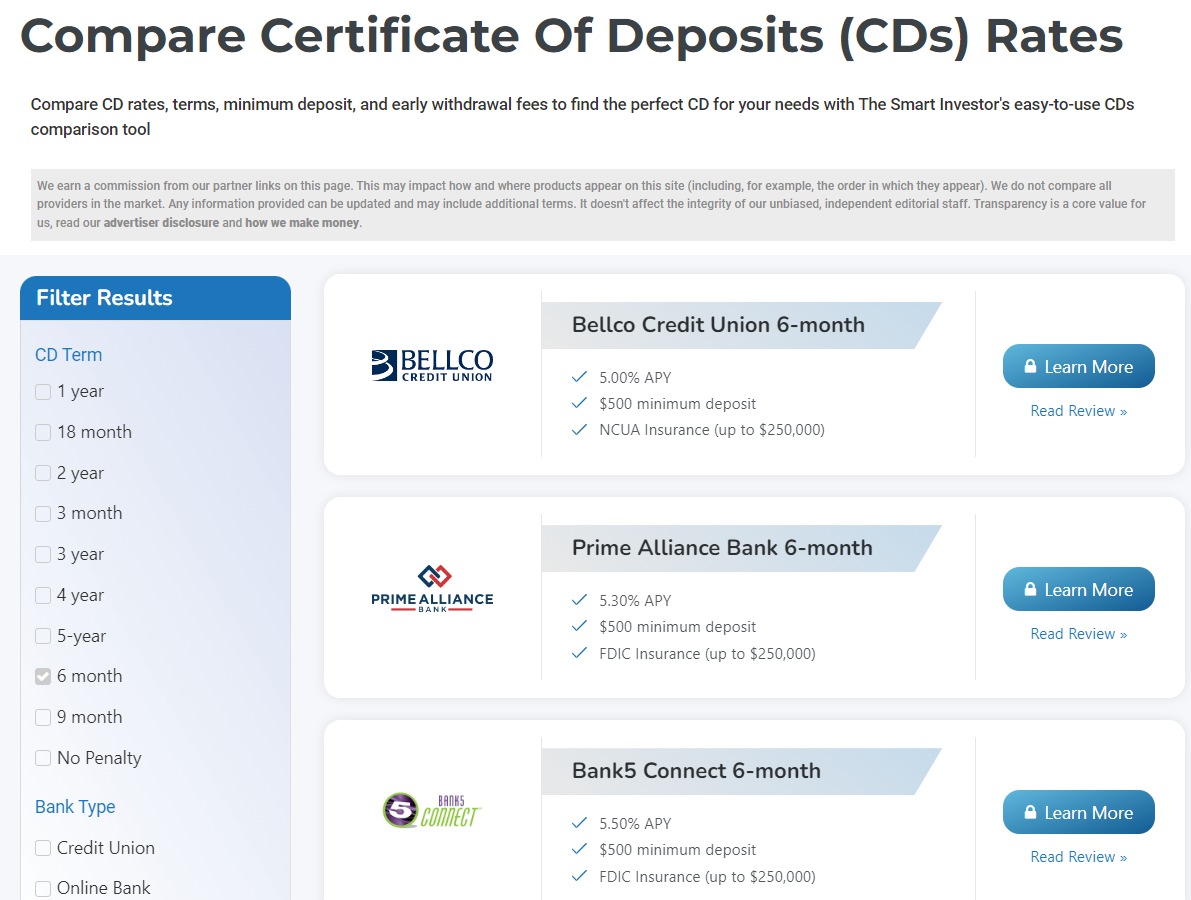

Comparison websites: There are several websites that allow you to compare CD products from different banks and financial institutions. These websites often provide a side-by-side comparison of interest rates, terms, and other features.

Financial advisors: If you work with a financial advisor, they can help you compare CD products and provide personalized advice based on your financial goals and risk tolerance.

By comparing different CD products, you can find the one that best meets your financial goals and needs.

FAQs

What is a CD ladder?

A CD ladder is a strategy where an investor purchases multiple CDs with staggered maturity dates to provide a steady stream of income while maintaining liquidity.

What is the difference between a CD and a savings account?

A CD is a time deposit with a fixed term and interest rate, while a savings account is a deposit account that pays interest on the balance and allows for easy access to funds.

Can I add funds to a certificate of deposit after it has been opened?

In most cases, you cannot add funds to a certificate of deposit after it has been opened. However, some financial institutions may allow you to do so.

How can I ensure the safety of my funds when investing in a certificate of deposit?

To ensure the safety of your funds when investing in a certificate of deposit, choose a reputable financial institution that is insured by the FDIC or NCUA. This will guarantee that your deposits are protected up $250,000.

Can I transfer my CD to another financial institution?

Yes, you can transfer your certificate of deposit to another financial institution. However, there may be penalties for early withdrawal if you do it before maturity date.

Are there any tax implications to consider when investing in a CD?

Yes, interest earned on a certificate of deposit is taxable as ordinary income. You will receive a 1099-INT form at the end of the year to report the interest earned on your taxes.

Can I use a certificate of deposit to build my credit score?

No, a certificate of deposit does not directly contribute to building your credit score since it is not a form of credit. However, some financial institutions may offer a secured credit card option that is backed by a certificate of deposit, which can help you build credit.