Huntington Bank and Fifth Third Bank provide various banking services, and figuring out which one suits your needs can be tricky.

This article will help you compare their savings accounts, checking accounts, CDs, credit cards, and lending products.

Checking Accounts

When it comes to checking accounts, there is no clear winner, as both Huntington and Fifth Third offer a variety of bank account options, including free checking accounts.

Fifth Third has special accounts for disabilities, kids, military, and other special situations.

-

Account Types And Fees

Fifth Third offers various checking accounts for many purposes, such as accounts for students and kids, military families, and individuals with disabilities.

There is a free checking account but also premium accounts with higher monthly fees and more benefits. The monthly fees can be waived in many ways such as carrying over $100,00 in your total balance.

Fifth Third Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Fifth Third Momentum® Checking | $0 | N/A |

Fifth Third Preferred Checking | $25 | $100,000 |

Fifth Third Student Checking Account | $0 | N/A |

Fifth Third Express Banking | $0 | N/A |

Fifth Third ABLE Checking | $2 | $250 |

Fifth Third Military Checking | $0 | N/A |

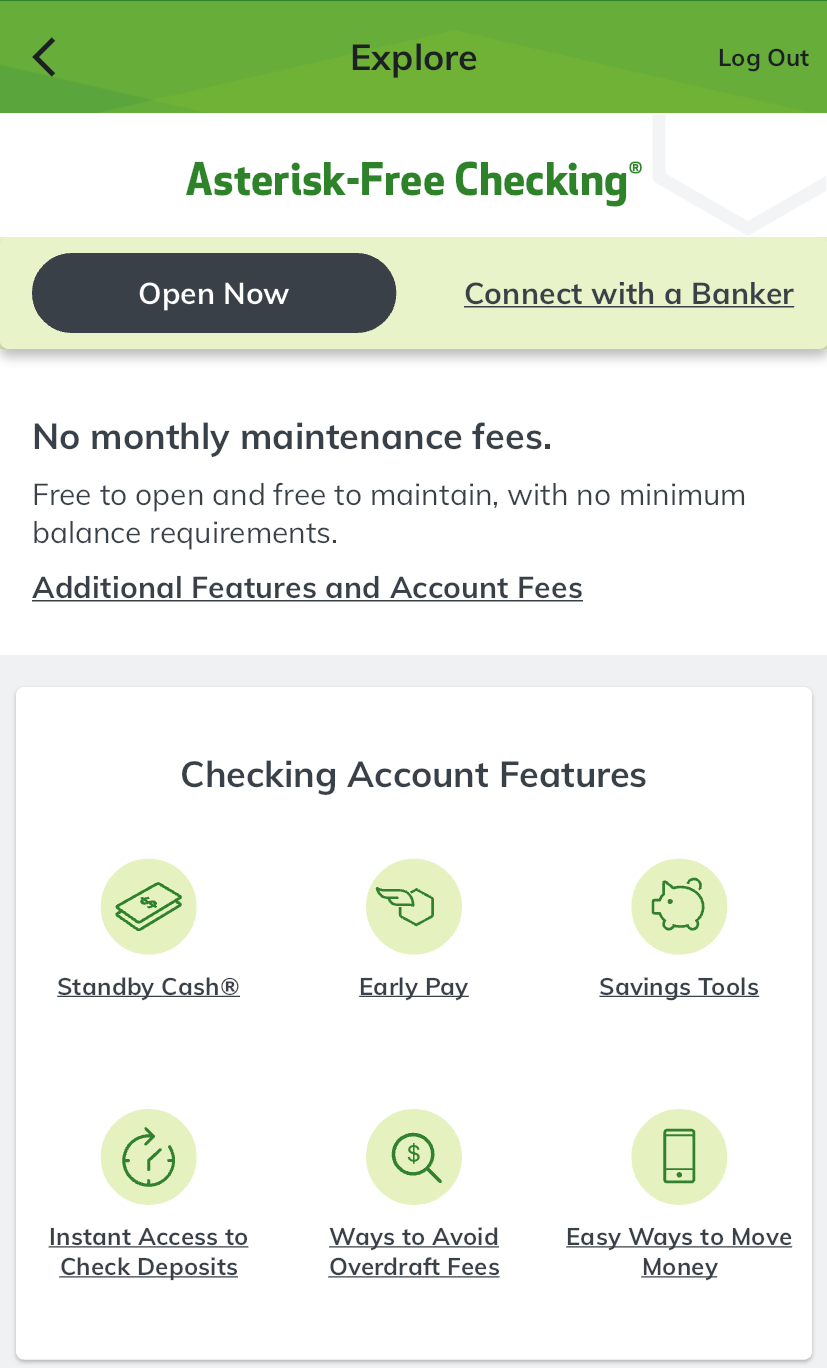

Huntington Bank's checking accounts include Asterisk-Free Checking, which is a no-frills account with no monthly fees.

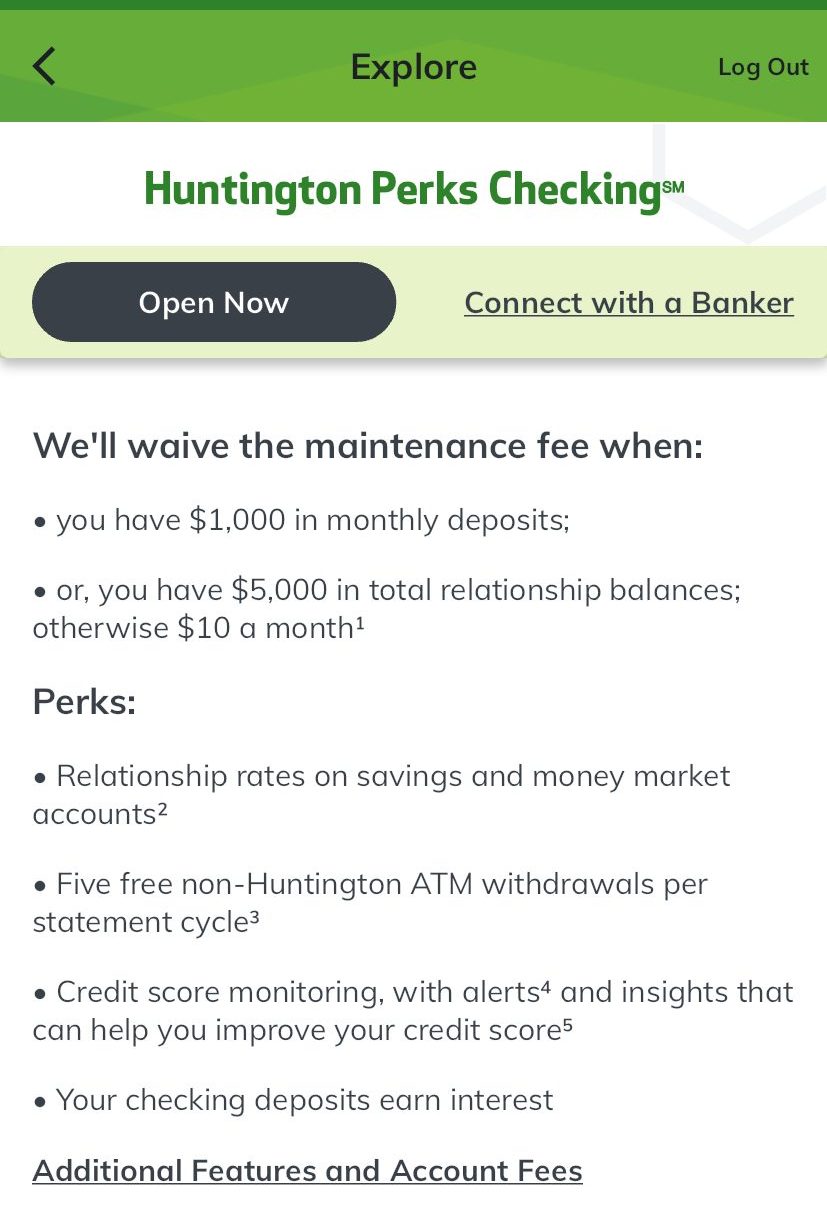

The Huntington Platinum Perks Checking and Huntington Perks Checking accounts offer tiered interest rates and various perks, but carry monthly maintenance fees (that can be waived in a couple of ways).

Huntington Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Huntington Asterisk-Free | $0 | N/A |

Huntington Perks Checking | $10 | $5,000 |

Huntington Platinum Perks | $25 | $25,000 |

Huntington SmartInvest | $0 | $100,000 |

-

Features

Huntington Bank offers a range of perks across its checking accounts, enhancing the overall banking experience for customers. For the Platinum Perks account, these include discounts on mortgages and home equity loans, identity monitoring services add an extra layer of security and unlimited free checks, and waived ATMs fees contribute to cost savings.

Additional perks of all accounts encompass modern banking conveniences such as Zelle for easy money transfers, Early Pay for quicker access to funds, and comprehensive online and mobile banking services.

Huntington Account | Main Features |

|---|---|

Huntington Platinum Perks | Mortgage discounts, unlimited free checks and ATMs fees |

Huntington Perks Checking | 5 free non-Huntington withdrawals, interest bearing, Relationship rates |

Asterisk-Free Checking

| Zelle, Early Pay, mobile banking, $50 Safety Zone and 24-Hour Grace |

Huntington SmartInvest

| Credit Score & Identity Monitoring, speical rates, investing, unlimited free checks and ATMs fees |

Fifth Third Bank's checking accounts offer a range of benefits designed to cater to various financial needs. The basic accounts provide customers with unlimited check writing, round-the-clock access to mobile and online banking, Early Pay options for quicker access to paycheck and more.

For those opting for premium checking, the advantages extend to better loan rates and the added security of Fifth Third Identity Alert.

Fifth Third Bank Account | Main Features |

|---|---|

Fifth Third Momentum Checking | Unlimited check writing, 24/7 mobile and online banking, Early Pay |

Fifth Third Preferred Checking | Better loan rates, Fifth Third Identity Alert |

Fifth Third Student Checking | Debit card, unlimited check writing, online bill pay |

Fifth Third Express Banking | Check cashing and deposits, tools to build credit, Debit Card. |

Fifth Third ABLE Checking | Debit card, unlimited check writing, no overdraft or non-sufficient funds fees |

Fifth Third Military Checking | Special VA home loan rates, 10 free non-Fifth Third ATM transactions per month |

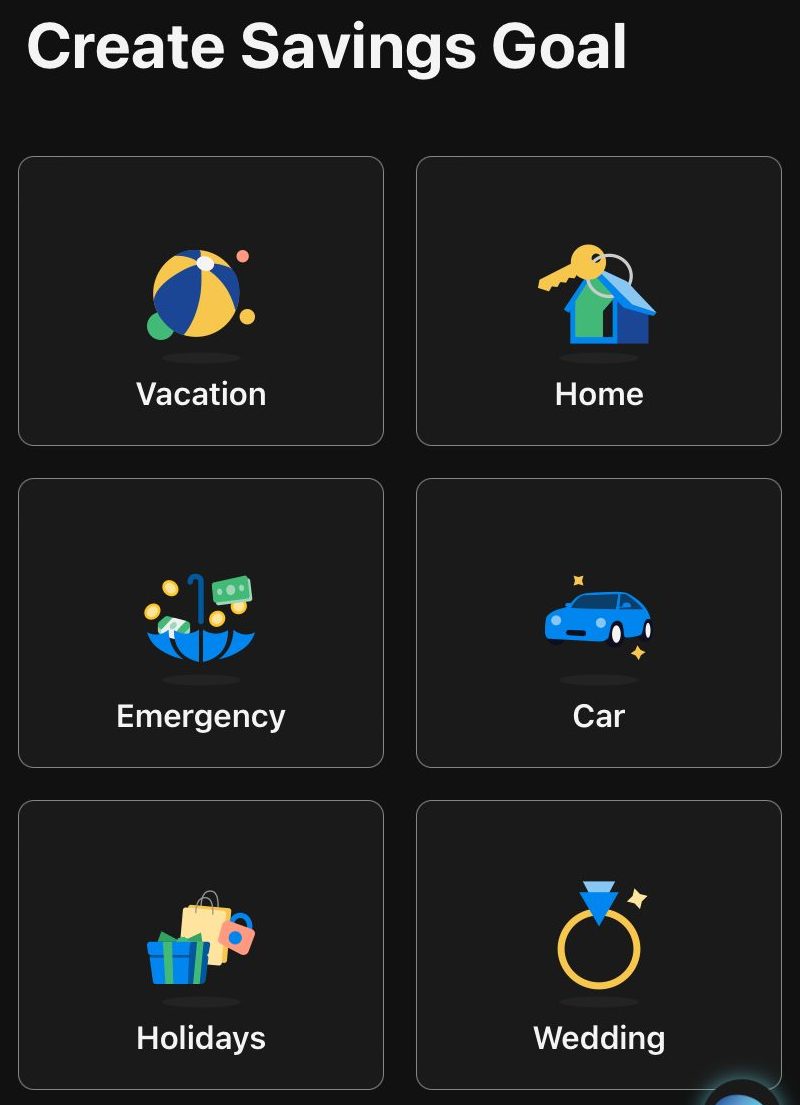

Savings Accounts

Huntington Bank is our winner when it comes to savings accounts. While both banks offer low savings rates, their money market account can earn you a decent yield.

Both U.S. Bank and Huntington Bank provides a savings account, but the rate is very low. Yet, the Relationship Money Market Account from Huntington stands out, offering a more attractive interest rate along with various perks (MMA is not available through U.S. Bank).

Customers can earn at least Up to 4.49% APY on balances exceeding $25,000, and they receive special relationship rates if they have a Perks Checking or Platinum Perks Checking account.

Fifth Third also offers a money market account, but the rates are low, similar to its savings account.

Huntington Bank Savings | Huntington Money Market | Fifth Third Savings | |

|---|---|---|---|

Savings Rate | 0.01% – 0.06% | Up to 4.49% | 0.01% |

Minimum Deposit | $0 | $25,000 | $0 |

Fees | $10

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $2,500

| $25

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $25,000

| $5

The monthly service charge for Fifth Third savings accounts is waived if you meet any of the following criteria: having a Fifth Third checking account, having all savings account owners listed on the Fifth Third checking account, maintaining an average monthly balance of $500 or more, having an account owner under 18 years old, or being enrolled in Fifth Third Military Banking.

|

Certificate Of Deposits (CDs)

When it comes to CDs, both banks offer similar options. Similar to other brick-and-mortar banks, if you want to get a high rate, there are “promotional” terms.

While Fifth Third Bank offers more options, its minimum deposit is higher compared to Huntington.

-

Fifth Third CD Rates

Fifth Third Bank CDs | |

|---|---|

5 Month | 5.20% |

7 Month | 4.40% |

12 Month | 4.20% |

Minimum Deposit | $5,000 |

-

Huntington CD Rates

Term | Huntington Bank CD Rates |

|---|---|

7 Month | 5.13% |

11 Month | 4.34% |

Minimum Deposit | $1,000 |

Credit Cards

Both banks offer cards for different purposes, and there is no real difference between them. Overall, the selection is quite limited compared to the big banks, the rewards are basic, and there are no premium cards.

Fifth Third Bank offers four credit cards for three types of customers: those looking to cash back, those who want to transfer their balance or finance a big purchase with low intro APR, or those who need to build credit with a secured card.

Card | Rewards | Bonus | Annual Fee |

| Fifth Third 1.67% Cash Back

| 1.67%

Unlimited 1.67% cash back with every purchase | N/A | $0 |

|---|---|---|---|---|

| Fifth Third Low Intro Rate | 1%

Unlimited 1% cash back on every purchase | 0% Intro APR: 21 months on purchases and balance transfers | $0 |

| Fifth Third Preferred Cash Back (Exclusively for Fifth Third Preferred Banking Clients) | 2%

unlimited 2% cash back with every purchase | N/A | $0 |

| Fifth Third Secured Card | N/A | N/A | $24 |

Huntington Bank offers a selection of credit cards with features like cash back rewards and low APRs.

Card | Rewards | Bonus | Annual Fee |

| Huntington Cashback Credit Card

| 1x – 3x

3x reward points (3% cash back) when you use your credit card to make a purchase in your category of choice, up to $2,000 in spend per quarter, 1x on all other purchases | N/A | $0 |

|---|---|---|---|---|

| Huntington Voice Rewards Credit Card | 1x – 3x

3x reward points (3% cash back) when you use your credit card to make a purchase in your category of choice, up to $2,000 in spend per quarter, 1x on all other purchases | N/A | $0 |

| Huntington Voice Credit Card | N/A | N/A | $0 |

| The Ohio State Voice Credit Card | $100

$100 when you spend $1,000 within the first 60 days after account opening. For the Cashback Card, you will receive $100 cash bonus, which can be redeemed for a $100 statement credit or direct deposit. For the rewards card, you will receive 10,000 bonus points which can be redeemed for a $100 statement credit or direct deposit. For the lower rate card, you will receive a $100 statement credit | N/A | $0 |

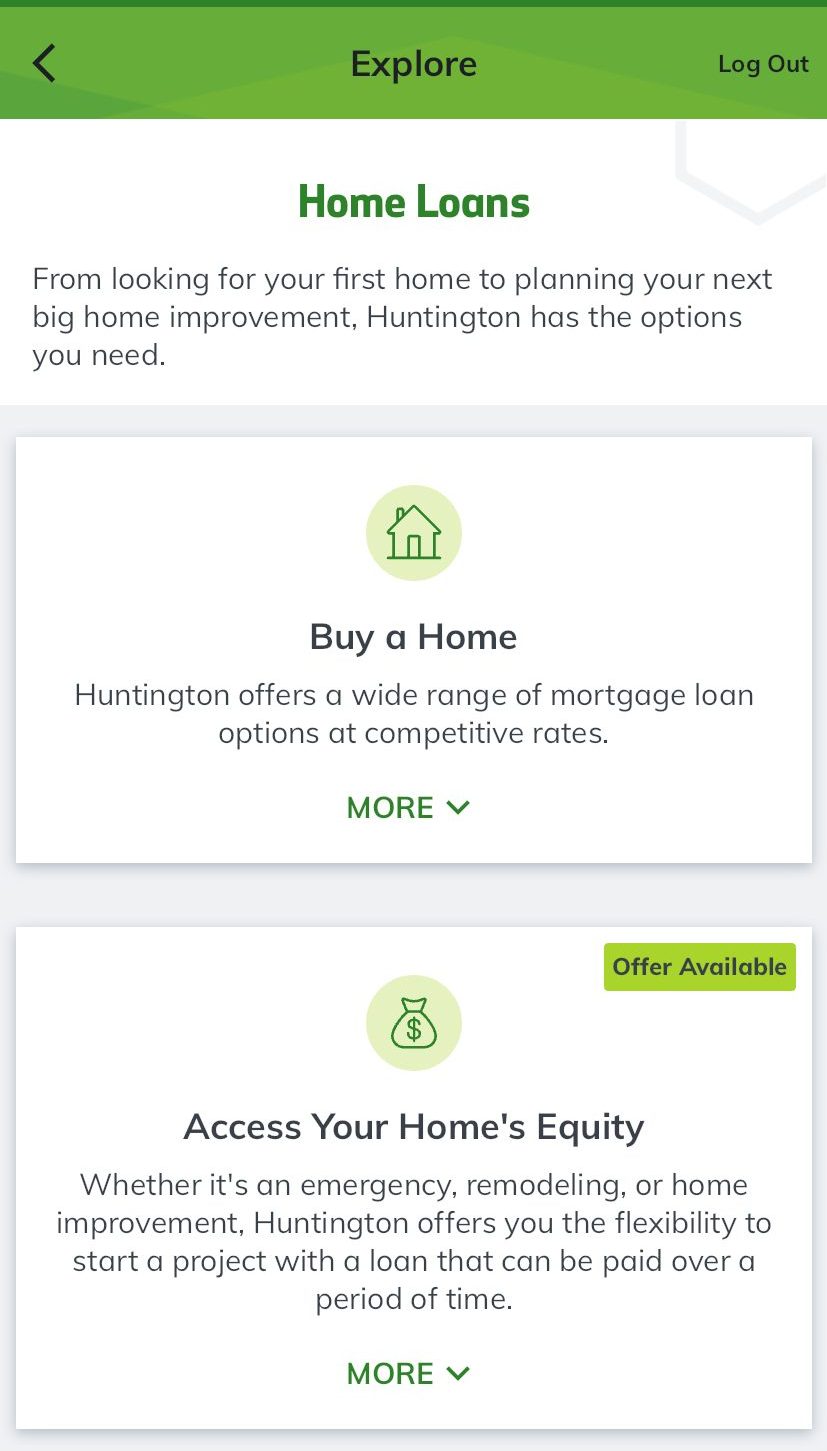

Mortgage And Loans

There is no clear winner when it comes to options for borrowers as both banks offer the same types of lending options.

Both Huntington and Fifth Third Bank provide mortgages for homebuyers, mortgage refinancing, and home equity loans. The banks also offer personal loans and car financing for both new and used vehicles.

Which Bank Is Our Winner?

Overall, there is no significant difference between the banks which offer similar banking products. Huntington may be a better option for savers due to its money market account.

Yet, choosing between them requires considering your needs—like banking services, overdraft support, ATM convenience, and location proximity. Different factors matter to different people, so take your time to evaluate what's essential for you before making a decision.

Compare Fifth Third Versus Other Banks

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why: Bank of America vs. Fifth Third Bank

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

Overall, we like Fifth Third a bit more than Truist bank, mainly due to the various checking options. Truist is better in credit cards.

PNC Bank and Fifth Third Bank are two big players when it comes to brick-and-mortar banking. Let's compare them and see which is our winner: PNC Bank vs. Fifth Third Bank

Our winner is U.S. Bank as it offers better package banking than Fifth Bank, but there are cases when Fifth Bank wins. Here's our comparison: U.S. Bank vs. Fifth Third Bank

Top Offers From Our Partners

![]()

Top Offers From Our Partners

![]()

Our Methodology for Comparing Banks

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.

Compare Huntington Versus Other Banks

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

There is no clear winner when comparing Huntington and U.S. Bank , but if we have to pick one – Huntington is our first choice. Here's why: U.S. Bank vs. Huntington Bank

PNC is our winner in this competition with a better banking package than Huntington Bank. But there are more things to consider: PNC Bank vs. Huntington Bank